After weeks defined by sharp reversals and uneven conviction, capital flows began to settle into a more constructive rhythm, with investors selectively adding exposure rather than rushing for the exits. Bitcoin and ether found renewed footing, while solana and XRP continued to attract steady interest, signaling a market that is no longer retreating but carefully recalibrating risk as year-end approaches.

Bitcoin ETFs: Capital Rotates Back In

Bitcoin spot ETFs recorded $286.60 million in net inflows for the week, marking a decisive shift after a choppy start. Blackrock’s IBIT was the clear anchor. Despite seeing outflows early in the week, strong additions later in the week lifted IBIT to a net weekly inflow of $214.10 million, reinforcing its role as the primary liquidity magnet.

Fidelity’s FBTC experienced the widest swings. Heavy redemptions early in the week were more than offset by a massive $198.85 million inflow on Tuesday, leaving FBTC with net inflows of $84.47 million for the period. Grayscale’s Bitcoin Mini Trust quietly stabilized with a $22.82 million inflow for the week, although its GBTC fund finished the week in the negative with a -$38.76 million exit.

Further additions for the week were seen on Bitwise’s BITB with a $24.66 million net inflow. Franklin’s EZBC and Invesco’s BTCO added $8.09 million and $6.50 million each for the week, while Wisdomtree’s BTCW added a modest $987K. The week wasn’t all green, though. Vaneck’s HODL saw a -$25.14 million exit, and Ark & 21Shares’ ARKB recorded a -$11.12 million loss.

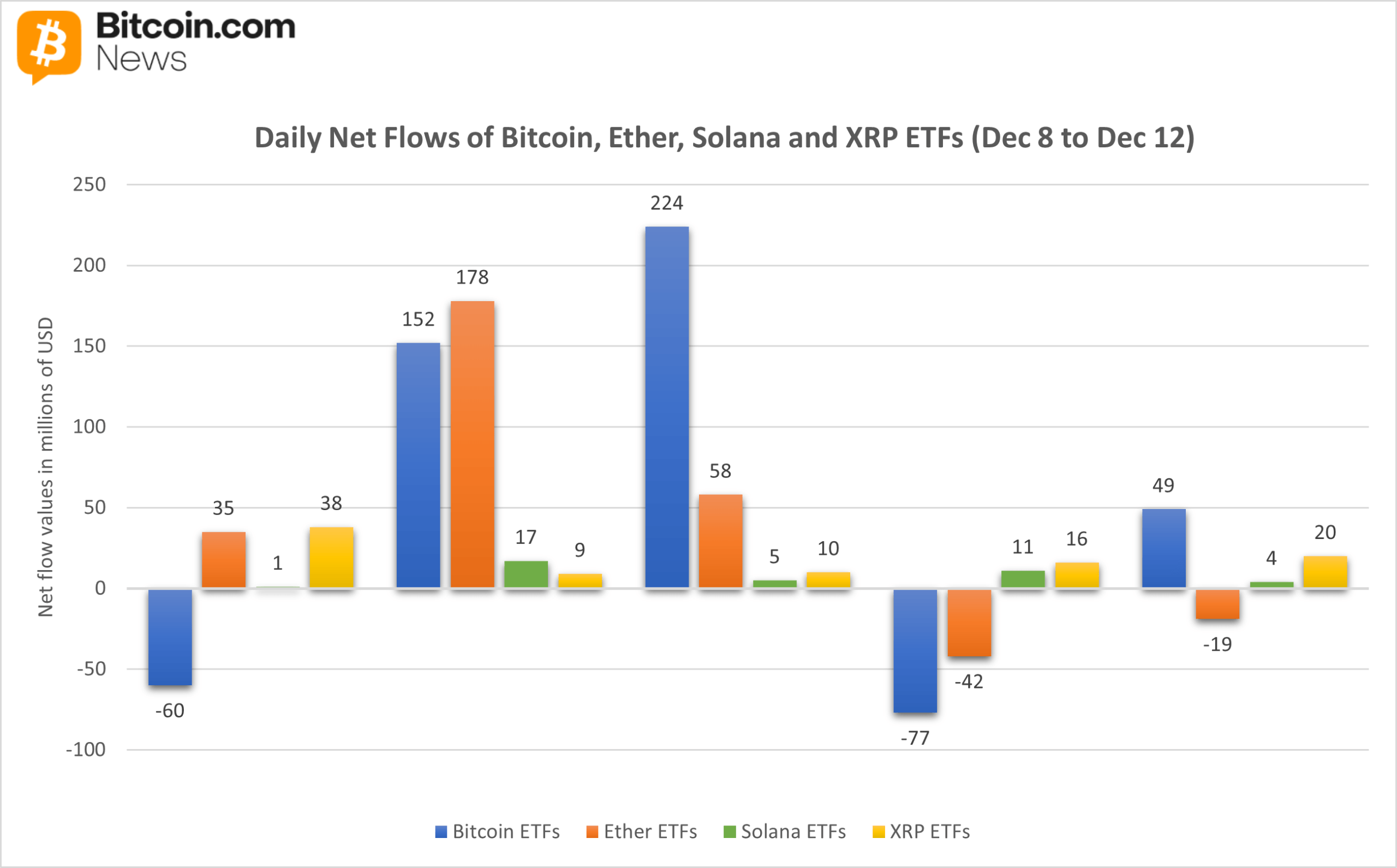

Daily breakdown for each crypto fund for the week of Dec.8-12.

Ether ETFs: Momentum Builds Gradually

Ether spot ETFs posted $208.94 million in net inflows, their strongest weekly showing in over the past three weeks. Blackrock’s ETHA led decisively, pulling in $138.65 million across the week, buoyed by consecutive strong inflow sessions.

Fidelity’s FETH ended the week in the green with $35.35 million, despite midweek redemptions. Grayscale’s Ether Mini Trust rebounded with $32.80 million, but its ETHE fund closed negative with -$34.17 million.

Bitwise’s ETHW, Vaneck’s ETHV, and 21Shares’ TETH all closed the week in the green with gains of $17.91 million, $14.64 million, and $3.75 million each.

Solana ETFs: Quiet Strength Across the Board

Solana spot ETFs delivered $37.20 million in net inflows, with none of the seven funds posting weekly outflows, a notable show of consistency. Bitwise’s BSOL remained the leader, accounting for $15.90 million of the weekly inflow, while Grayscale’s GSOL and Fidelity’s FSOL added $8.73 million and $8.40 million each.

Smaller but steady contributions came from Vaneck’s VSOL ($3.06 million) and Franklin’s SOEZ ($1.12 million), reinforcing Solana’s position as the most stable inflow story among major altcoin ETFs.

Read more: ETF Flows Recap: Red Week for Bitcoin and Ether, Green for Solana and XRP

XRP ETFs: Demand Holds Firm

XRP spot ETFs extended their winning streak with $93.57 million in weekly inflows. Franklin’s XRPZ led decisively, contributing $50.27 million, while Bitwise’s XRP ($25.44 million), Canary’s XRPC ($11.40 million), and Grayscale’s GXRP ($6.82 million) all recorded consistent daily additions. Five consecutive weeks of inflows now point to sustained institutional positioning in XRP-linked products.

The Dec. 8–12 week marked a clear stabilization phase for crypto ETFs. Bitcoin and ether reclaimed positive footing, solana maintained remarkable consistency, and XRP continued to build quiet momentum, setting a steadier tone heading deeper into December.

FAQ📈

- How did Bitcoin ETFs perform this week?

Bitcoin ETFs posted $286.6 million in weekly inflows, led by strong late-week demand for BlackRock’s IBIT. - Did Ether ETFs recover from recent volatility?

Yes, ether ETFs added $208.9 million, marking their strongest inflow week in nearly a month. - Which altcoin ETFs showed the most consistency?

Solana ETFs saw $37.2 million in inflows with no weekly outflows across all funds. - What is driving the continued demand for XRP ETFs?

XRP ETFs extended their streak to five straight positive weeks as institutional positioning builds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。