The crypto economy saw its total market capitalization drop below $3 trillion late on Dec. 15, driven by a sharp decline in bitcoin ( BTC) to $85,140, its lowest point since the beginning of December. Even the announcement of a large BTC acquisition—approximately 10,600 coins—by Michael Saylor’s Strategy on Monday was insufficient to reignite the desperately needed bullish sentiment.

Read more: Saylor Buys Nearly $1B Worth of Bitcoin, Then It Plunges 4%

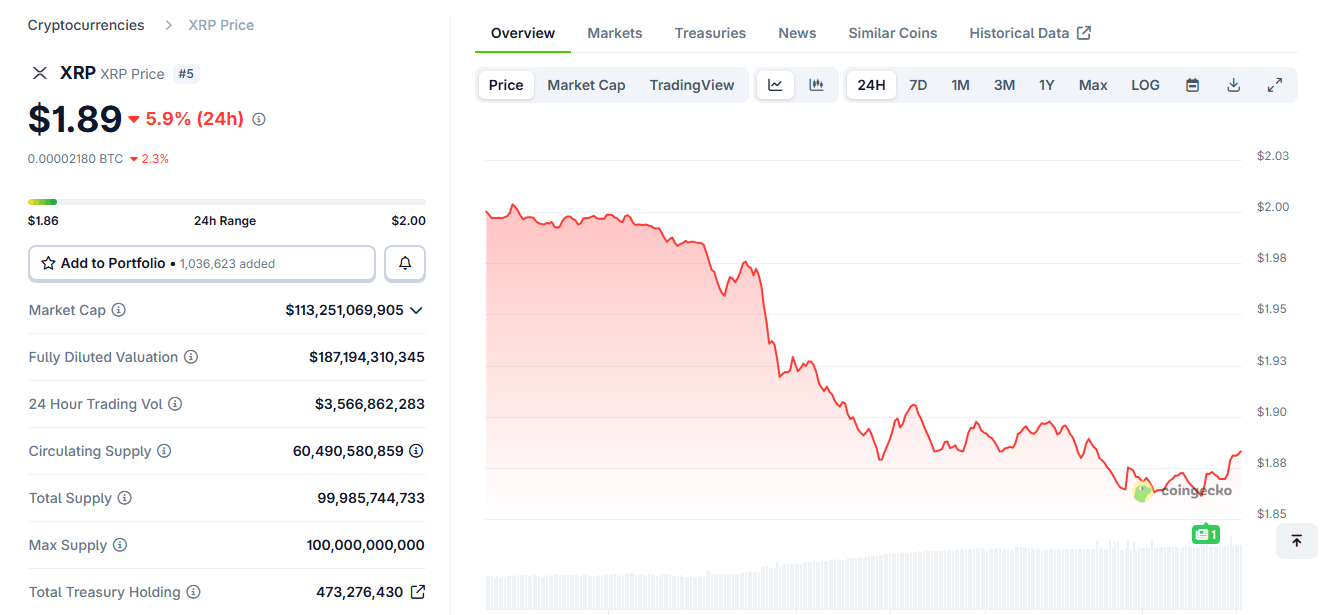

While BTC was down by around 4.5% in 24 hours, the sell-off severely impacted high-cap altcoins, with many seeing declines of 6% or more. XRP was among the hardest hit, cratering by 6.5% to $1.85, its lowest price since Nov. 21. This decline pushed XRP’s market capitalization just under $112 billion, allowing BNB to solidify its position as the number four digital asset.

XRP’s latest tumble deepened its losses to 16.6% over the last 30 days and nearly 50% since its July 18 peak of $3.66. At the time of writing (12:30 a.m. Dec. 16), nearly all gains made since the April 9 low had evaporated. Coinglass data confirmed the intensity of the selling pressure, showing that XRP’s sharp decline triggered the liquidation of $15 million in leveraged long positions, vastly outweighing the mere $235,000 in short bets liquidated.

The altcoin’s downtrend has persisted despite positive institutional indicators; recently launched spot XRP exchange-traded funds (ETFs) have seen sustained inflows, absorbing over $400 million in XRP value since Nov. 14. This suggests the short-term price action is being dominated by technical selling and macroeconomic risk-off sentiment rather than fundamental demand.

Despite the fear, one analyst views the market movement as a necessary technical correction. “Testing support is a GOOD thing and keeps us moving,” noted market analyst TARA on X.

TARA’s sentiment posits that this current pressure is essential to flush out “weak hands” and establish a solid base. She asserts that if XRP successfully holds the $1.88 line and avoids setting a new low, the market will be primed for a significant upward move. This potential rebound is being compared to similar BTC price action, where holding key support often precedes a strong breakout.

The consensus in broader market analysis is that the range of $1.80 to $2.00 represents a critical long-term support zone. Holding this macro support is now the main requirement for any meaningful bullish revival attempt.

Bullish Scenario: If XRP holds the $1.88 support and breaks above local resistance zones (recently cited around $1.93 to $2.05), the technical structure flips strongly bullish, potentially leading to a rapid surge in price.

Bearish Scenario: A decisive break and close below this macro support zone, particularly below $1.80, could signal a deeper decline, potentially testing the next major support zone around $1.73.

- Why did the crypto market drop below $3 trillion? A sharp bitcoin sell‑off pulled the entire market lower, dragging major altcoins with it.

- Why was XRP hit harder than other assets? Heavy technical selling and liquidations pushed XRP to its lowest level in weeks despite strong ETF inflows.

- What price levels matter most for XRP now? Analysts view the $1.80–$2.00 zone as critical long‑term support for any bullish recovery.

- What are the bullish and bearish scenarios from here? Holding $1.88 could spark a rebound, while losing $1.80 risks a deeper slide toward $1.73.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。