Author: Web3 Xiao Lu

By 2025, people will have fully recognized the transformative potential of blockchain and stablecoins, as well as their potential power in the monetary field. It can be said that we already have a tokenized blueprint that allows assets to achieve permissionless access globally and supports peer-to-peer transfers.

Since stablecoins—the tokenized form of fiat currency—can operate efficiently in the real world, what about the tokenized form of stocks?

In the stock market, the current pain points are particularly prominent: the existing stock securities market is fragmented by region, cumbersome, and slow. Almost every region has its own Central Securities Depository (CSD)—the US has DTCC, Europe has Euroclear and Clearstream, and Asia has many more. Transferring stocks from one CSD to another through brokers can take days or even weeks. Similarly, there are many frictions in the corresponding fund settlement for securities.

How can we replicate the success of stablecoins in the currency space to the broader stock securities field? How can we use blockchain to break the liquidity islands of various trading venues?

To answer these questions, I am honored to discuss with Hedy Wang, the founder of Blockstreet, to explore observations about this market and attempt to answer unresolved questions, while delving into the innovative solutions Blockstreet brings to this outdated and massive stock securities market.

Hedy Wang is the founder & CEO of Blockstreet. After graduating in computer science from Harvard, she built risk systems serving 40 million users at Capital One and managed quantitative asset portfolios at Wall Street hedge funds like Point72/Cubist, deeply constructing trading, clearing, and market structure models. Blockstreet is building the most critical underlying infrastructure on-chain: a unified liquidity layer across issuers and chains, aiming to become the "next-generation DTCC" in the era of global asset tokenization.

(blockstreet.money)

1. What is Tokenization & Tokenized Stocks?

Here is a statement from the CTO of the US Depository Trust & Clearing Corporation (DTCC):

Tokenization is the representation of asset value on the blockchain; a token is a piece of smart contract data that reflects ownership of the underlying asset; a wallet is an account for storing tokens, allowing users to hold, trade, and transfer related assets/tokens.

This is quite similar to brokerage accounts in the stock market, but the revolutionary difference lies in the efficiency of the circulation of these tokenized assets and values on the blockchain—global T+0 settlement. In financial markets, time is money! At the same time, traditional financial infrastructure also has many frictional reconciliation costs regarding ownership, all of which blockchain can solve. In addition, financial innovation in traditional finance will further develop.

(https://www.dtcc.com/digital-assets/tokenization))

Tokenized stocks (we will narrowly define this within the scope of "on-chain US stocks") are digital tokens that map traditional stocks (such as one share of Apple, Tesla, or the S&P 500 ETF) to the blockchain on a 1:1 basis. They are held by licensed custodians off-chain, issuing a corresponding number of tokens on-chain, allowing holders to receive dividends, capital gains, and other economic rights, but typically do not grant shareholder rights.

They can be freely transferred, staked, and lent 24/7 in on-chain wallets, DEXs, or any DeFi protocols that support the token standard, breaking geographical and trading hour restrictions without the need to open a traditional US stock account.

Currently, the on-chain US stock market has formed two major camps: "physically backed" and "synthetic assets."

The physically backed camp prioritizes compliance: Switzerland's Backed Finance has issued over 60 tokens such as bTSLA and bNVDA, which can be directly exchanged on 1inch; Kraken has partnered with Fidelity Custody to open trading of popular stock tokens like Apple and Tesla to non-US users; Ondo Finance has launched the Global Market series on its own Ondo Chain, planning to cover US stocks, ETFs, and bonds. EU users can also use Robinhood EU's Arbitrum L2 network to hold over 200 on-chain US stock tokens and receive dividends in real-time.

On the other hand, the synthetic assets camp focuses on flexible leverage: Bybit offers 78 US stocks as USDT margin CFDs, with no physical stocks but supporting 20x long and short; Coinbase is also in talks with the SEC to launch spot and contracts on Ethereum or Base chain, which is highly anticipated but not yet realized.

A significant trend is that we have already seen the US SEC allow DTCC to attempt stock tokenization. As the regulatory framework gradually clarifies, tokenized securities are moving from "trial" to "mainstream," providing global investors with a next-generation capital market channel that has lower barriers and higher liquidity.

According to Tiger Research, the current market size of tokenized stocks is $500 million, but if only 1% of stocks globally are tokenized, the market size could reach $13.4 trillion by 2030. This represents a potential growth of 2,680 times, driven by the dual enhancement of regulatory clarity and infrastructure maturity in 2025.

2. Blockstreet's Ecological Positioning—Unified On-Chain Liquidity

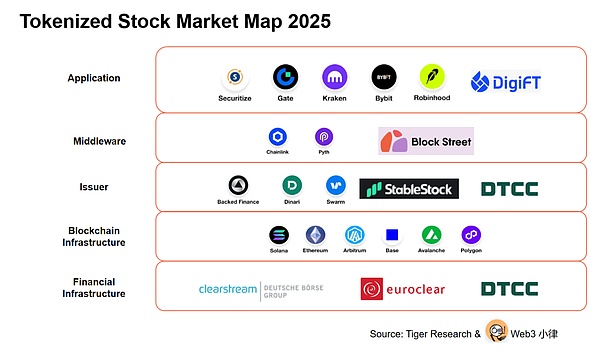

(Tokenized Stock Market Map: How Tokenized Stock is Reshaping Global Finance)

Web3 Xiao Lu Will:

From the perspective of the on-chain US stock ecosystem, the entire stack can be roughly divided into: 1) the underlying traditional financial settlement layer & blockchain settlement layer (L1/L2); 2) issuers of on-chain US stocks; 3) middleware (oracles, liquidity, compliance, etc.); 4) the core trading scenarios; 5) and the DeFi layer above trading.

While the various layers seem interoperable, in reality, they are extremely limited. Although it seems that everyone is trading Coinbase's stock on-chain, the token standards for Coinbase stock on each trading venue are likely different, and what users hold may just be an IOU certificate, leading to the formation of isolated islands at each trading venue, making liquidity difficult to interconnect. This results in users' intuitive feelings: a single trading venue lacks liquidity, has low trading volume, high slippage, and high fees. This is the current state of the on-chain US stock market.

So for Blockstreet, how do you view the current market situation, and how do you plan to solve these problems?

Blockstreet Hedy:

Blockstreet's positioning is as the infrastructure for the RWA ecosystem—a unified liquidity layer for tokenized assets. We believe that in the asset tokenization track, what is truly scarce is not the assets themselves, but the infrastructure that can connect all assets and all upstream and downstream participants, with its core role being to unify market liquidity.

As we mentioned earlier, issuers are still fragmented (different token standards, different ecological layouts, etc.), and this has not changed. One of the core reasons for this fragmentation is our lack of a clear global regulatory framework to define how to issue assets. Regulations in various regions mostly provide a possibility. As a result, project parties are scrambling for pilot opportunities to quickly launch assets.

Therefore, we believe that the underlying reason for the current unsatisfactory market trading volume is that liquidity is physically fragmented, divided among different issuers and different trading scenarios. This is akin to the lack of interoperability in traditional stock markets around the world.

It is precisely because of the lack of a unified on-chain liquidity infrastructure that the market experience is poor, real use cases are scarce, and no institutions dare to enter the market in large volumes.

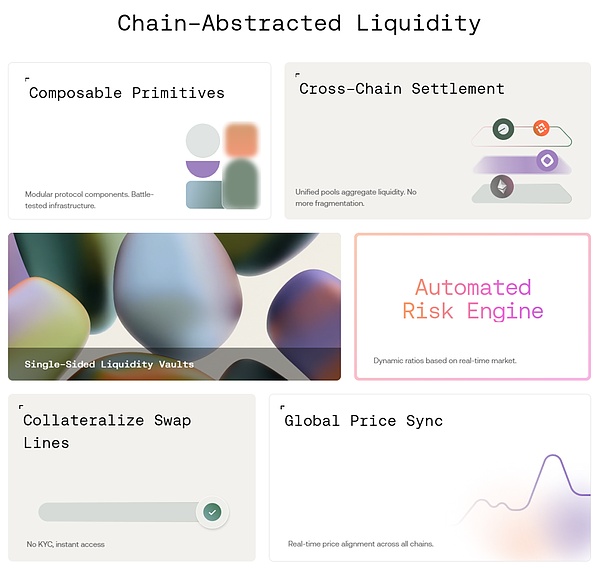

(blockstreet.money)

Blockstreet's vision today is to solve the problem of unified on-chain liquidity, and even further bridge it to off-chain, connecting to the traditional brokerage system, thus achieving overall optimization at the trading level. Breaking this down logically:

The first step is to connect directly to the supply side. We connect with issuers rather than collecting liquidity on-chain through a permissionless method. Only by directly integrating the issuer's "Inventory" into a unified liquidity pool can we lock in the source chips.

The second step is to connect directly to the demand side. We connect with global market makers and institutional order books with one click. These market makers act like "movers," and they need a unified liquidity pool to trade efficiently. Making the same pool the "loading dock" for all market makers will significantly reduce slippage and deepen liquidity.

The third step is to connect directly to traditional finance. We connect with brokers and OTC desks to achieve a time-based closed loop (24×7) and a scenario-based closed loop (on-chain and off-chain, with full participation from different parties), ultimately forming a healthy and complete tokenized stock market.

Ultimately, the RWA market will no longer be a group of "crippled" entities going their separate ways, but a cohesive liquidity network: issuers focus on assets, market makers focus on depth, and users only see one quote, seamlessly switching between on-chain and off-chain.

3. Reaching the Market with RWA DEX

Web3 Xiao Lu Will:

From my understanding, Blockstreet is actually building a Liquidity Engine, connecting on-chain assets from issuers with off-chain assets from traditional finance on the left hand, and connecting market-making funds and various trading venues on the right hand to unify on-chain liquidity.

We now see that CEX has already launched a portion of on-chain US stocks, continuing the trading logic of CEX and respecting the product forms of the crypto space. On the other hand, some fintech companies' consumer apps, which are platforms for trading US stocks, are also opening up trading for crypto assets. From Blockstreet's positioning, where do you think Blockstreet's product direction will be in the future? Will it be embedded within them?

Blockstreet Hedy:

We believe that the market's direction, whether in terms of the product forms in the crypto space or the development trends of various parties, has formed an "unwritten" consensus: CEX has reached its peak. Although trading volume is still concentrated on leading platforms, from the perspective of user growth, the addition of new users has slowed down. Therefore, CEX must start building some DEX-like products to allow users to trade in a more permissionless manner or provide more flexible, self-custody trading models that better meet the core needs of crypto users.

On the other hand, CEX is now facing an awkward situation: as markets like the US gradually advance compliance, many fintech companies are also eyeing the listing and trading of mainstream tokens. For example, in the US, a typical case is Robinhood, where retail investors can now trade crypto assets directly. We won't delve into whether they truly hold assets or have custody mechanisms behind the scenes, but from the user's perspective, retail investors only care about "where it's convenient for me to buy." Additionally, the launch of financial products like ETFs has further diluted the traffic of crypto exchanges.

Therefore, the focus returns to the core we discussed earlier: we believe that DEX is still an important direction for the future product forms in the crypto space. The CEX track has become very difficult to "roll out" a new leading platform.

(blockstreet.money)

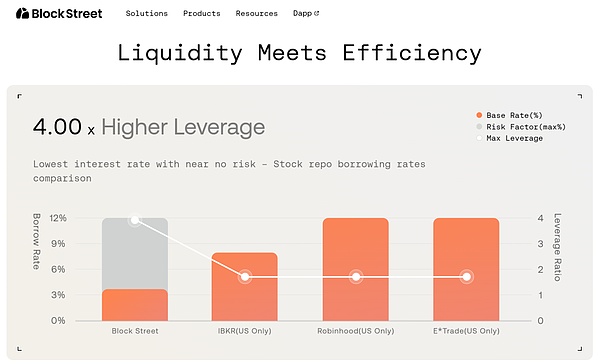

The biggest pain point in the current tokenized stock market lacking liquidity appears to be "insufficient exchange depth," but the root cause still lies on the supply side: issuers are acting independently, with inconsistent standards, and there is no native mechanism to aggregate fragmented order pools into continuous depth. Therefore, our DEX aims to act as a "pipeline" to facilitate liquidity across issuers and chains.

If DEX is more user-friendly for crypto-native users, then we are undoubtedly their ideal platform. These native crypto users remain very loyal; they are accustomed to self-custody and jumping between different ecosystems to explore early incentives—this is a familiar play for crypto OGs. Many market makers (MM) and issuers can also reach more traditional scenarios through us.

However, we believe that for crypto to truly grow, it must rely on further openness from fintech. They need to provide more opportunities for listing and distributing tokenized assets.

From Blockstreet's product positioning, we define ourselves as "Infrastructure" because we hope that more fintech companies will open interfaces, allowing us to provide the underlying on-chain and off-chain services for them. They can then focus on front-end user experience, enabling users to trade on-chain US stocks and even more tokenized RWA assets in the future—these assets do not necessarily have to be "on-chain US stocks," as traditional fintech has already done a lot in stock-like assets.

As for whether the final trading interface will be operated by Blockstreet itself, we are not exclusive. As long as liquidity is sufficient, we are willing to provide our infrastructure: whether it is co-building an RWA DEX with large CEXs or collaborating with DeFi and wallet middleware, all options are on the table. However, the current real trading volume has not yet surged, so RWA DEX does not need to be established all at once; we still need to deepen the underlying liquidity, connect with issuers, and increase institutional participation.

The overall strategy is: first, to run a closed loop for "on-chain US stocks," ensuring that secondary US trading has depth, users, and stories on-chain; then, to vertically delve into asset categories like Pre-IPO, private bonds, and real estate, while horizontally expanding into DeFi applications, with a rhythm of "easier first, then harder."

4. The Real Demand for Investing in On-Chain US Stocks

Web3 Xiao Lu Will:

From our observations, the current real demand for purchasing on-chain US stocks primarily comes from two types of people:

One type is those who cannot open US stock accounts, such as individuals in regions with insufficient financial infrastructure in Africa, Asia, and Latin America.

The other type is those who want to avoid taxes by purchasing on-chain US stocks.

Just like my previous experience buying CRCL on CEX, the liquidity during US stock market hours is decent, but once the weekend hits, the so-called 24/7 trading becomes ineffective, and liquidity nearly dries up. Therefore, we genuinely need a liquidity infrastructure like Blockstreet to unify various issuers, trading venues, and market makers to form our ideal 24/7, all-weather, high-liquidity on-chain US stock trading market, which we are very much looking forward to.

Blockstreet Hedy:

Indeed, for the vast majority of ordinary investors, buying a token of Apple stock and purchasing an actual Apple stock through a brokerage are almost indistinguishable in terms of experience, returns, and risks, yet they have to bear additional costs such as on-chain slippage, wallet interactions, and compliance uncertainties. Without additional returns, this becomes the most fatal shortcoming. The lack of a wealth effect, combined with the recent lackluster performance of US stocks, has caused even crypto-native users to shift their attention back to high-beta crypto assets; even if they stay on-chain, they will only choose a few star stocks with global consensus, while other "random" US companies lack brand appeal, and retail investors will not buy them blindly.

At the same time, investors in developed economies can easily allocate US stocks or US stock funds through local brokerages, Alipay, Futu, etc., without needing to go through on-chain channels; users in smaller countries may have demand, but their payment capabilities, financial literacy, and understanding of US stocks are limited, contributing only sporadic trading volume. The dual existence of educational costs and alternative channels means that the "user pain points" of tokenized securities remain more at the trial level for crypto enthusiasts rather than the rigid demand of a broad base of investors.

Only when US stocks re-enter a strong upward trajectory, bringing significant profit effects, can the "wait-and-see" demand that is "buyable or not" be transformed into new accounts and trading volume on-chain, similar to the pandemic bull market; before that, the market still needs to solve the issues of standard unification and depth aggregation on the supply side and patiently await the next round of demand explosion driven by wealth effects.

This is precisely the direction we at Blockstreet are striving for before the market explodes. To envision the future ideal on-chain US stock market, I summarize it into three points:

First, liquidity must rival TradFi, with market depth, spreads, and settlement speeds able to engage in dialogue with NASDAQ, and a sufficiently rich asset class that makes inclusive finance no longer just a slogan;

Second, the three elements of value, risk, and return must be clearly priced, rather than just watching price fluctuations, which will force the entire crypto space to pay more attention to fundamentals and sustainability, allowing long-term capital to dare to enter and settle;

Third, new variables such as AI and the Internet of Things continuously inject innovative products and narratives, ultimately leading to "everything can be on-chain," with capital markets genuinely moving a portion on-chain, forming assets and projects with lifecycles of 5–10 years or even longer, rather than the crypto space's transient "Launch & Leave."

5. What Else Can On-Chain US Stocks Do Besides Trading?

Web3 Xiao Lu Will:

Despite currently seeing some shortcomings in on-chain US stocks, we still observe teams like Blockstreet actively laying out and improving the pain points, such as connecting liquidity through infrastructure like Aqua and subsequently reaching the end-user through CEX and DEX. So how can we go further?

We have already seen tokenized money market and bond fund products go on-chain, which can be applied to collateralized lending, margin trading, off-chain settlement, on-chain savings accounts, leveraged strategies, and other models. So, besides trading attributes, what innovative scenarios can on-chain US stock assets create with the DeFi ecosystem?

In fact, we also see that Blockstreet is about to launch the stock lending product Everst.

(blockstreet.money)

Blockstreet Hedy:

A. Lending Scenarios

The core pain point of lending business still returns to the phrase "liquidity fragmentation." Once tokenized chips are locked, if users want to borrow stablecoins, the price difference and slippage losses are significant; coupled with the fact that the crypto market has not yet achieved true 24/7 trading, it can only manage about 24/5 effective trading hours, leading to a sharp decline in price and experience after US stock market hours. In the event of a black swan scenario, fluctuations of five to ten percentage points are commonplace, and if liquidation is triggered at that time, the platform's own inventory may also suffer losses, making the risk uncontrollable.

The market's maturity and clearing infrastructure are still insufficient to support large-scale on-chain stock token lending. Aave remains inactive, waiting for the track to truly explode; early small projects attempting P2P stock lending have only a few billion dollars in total value locked (TVL), with a low input-output ratio, making it difficult to form a leading effect.

Therefore, we first focus on "unified on-chain US stock/RWA liquidity," with lending being just one of the subsequent scenarios; the ultimate goal is to first solve liquidity fragmentation and then build a more robust trading and lending market on that foundation. Partners or Blockstreet itself can extend lending functions on this liquidity layer, but the rhythm still needs to "wait for the wind to come."

Returning to the pain points of RWA itself, we find that "making it possible for users to buy" is just the first step; more crucial is "what users can do after they buy." If there is just one more on-chain channel but it can only hold or sell like traditional brokerages, then it does not break out of the alternative framework of fintech and cannot stimulate the original vitality of the crypto world.

B. Staking Incentives

We recently discussed new ideas with some listed companies: tokens should not just be a mapping of stocks but should become the key to unlocking shareholder rights, business scenarios, and subsequent product issuance. For example, holding a token of a certain energy company's stock could simultaneously grant access to airdrops or discounts on future on-chain renewable energy projects; holding tokens of AI concept stocks could enjoy VIP rates when renting GPUs on-chain. These additional utilities do not necessarily have to be provided directly by large enterprises but can be designed by the crypto ecosystem formed around that token, as long as on-chain data is verifiable and permissions are programmable, allowing for the packaging of "special channels" that traditional shareholders cannot enjoy, creating additional benefits exclusive to buying RWA.

Moving one step further, we have the native staking and governance rights in the crypto space. In traditional finance, lending out Nvidia stocks to earn interest requires multiple intermediaries, resulting in slow settlements and high thresholds; on-chain, however, one can stake instantly through smart contracts, earn immediate returns, and participate in DAO voting to influence the operational decisions of companies or asset pools. This "composability" is a continuation of the ICO era's narrative of "shareholders as contributors." The liquidity layer that Blockstreet aims to create is designed to allow these utilities to be realized and converted at any time, rather than being locked on a single platform or chain.

6. Liquidity is the Core of Tokenized Products

Web3 Xiao Lu Will:

Let’s return to the core of tokenized products—liquidity. In fact, we see that there are various liquidity demands in the current market.

The first type is distribution liquidity based on tokenized financial products like money market funds and bond funds. After the primary issuance of a single product, secondary distribution requires enough buyers (liquidity) to absorb it, meeting investors' needs for asset preservation and appreciation. Blockchain undoubtedly opens up global distribution avenues for these tokenized financial products. Additionally, to achieve T+0 real-time settlement for some tokenized products, market makers may need to provide liquidity to bridge the traditional T+3 redemption period.

The second type is trading liquidity for products like on-chain US stocks. Hedy has already explained the logic of liquidity for on-chain US stocks very clearly.

The third type lies in the private market, which is between on-chain US stocks and tokenized money market and bond funds, such as the private equity Pre-IPO market. They require both distribution liquidity and trading liquidity.

The fourth type is the DeFi liquidity demand that arises after assets are tokenized and combined with on-chain DeFi, such as the Everst product launched by Blockstreet, which meets users' needs for stock staking and lending.

Blockstreet Hedy:

I agree. For money market and bond fund products, some project teams have cleverly packaged their products as "stablecoin-like/yield-bearing stablecoin" products rather than selling them as "tokenized funds." The advantage of stablecoins in the crypto space is that funds circulate quickly, and people are willing to hold, use, and transfer them—this is a clever packaging for distribution, but behind it lies a traditional financial asset with higher yields and slower redemptions.

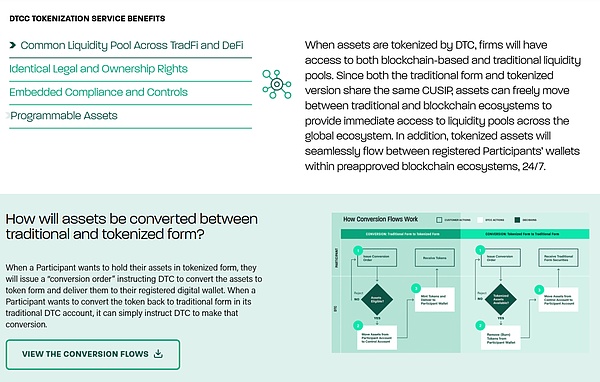

DTCC has provided a top-down tokenization standard, whether on-chain or off-chain, which will be a more fundamental Chain Agnostic or customized institutional service. This indicates that more assets will be compliant and go on-chain, especially those with good liquidity in the US. There is no doubt that Wall Street institutions and listed companies will trust the system of NASDAQ and DTCC more.

However, in the future, the composability of assets after going on-chain and the liquidity on-chain still need to be built. If these large amounts of capital enter the market, more infrastructure like this on-chain liquidity layer, Transfer Agents, and ATS will be needed to truly complete the final downstream distribution step, and Blockstreet is working on this important step.

(https://www.dtcc.com/digital-assets/tokenization))

Blockstreet's positioning is to first create the most liquid and highest consensus secondary market for US stocks—specifically, the NASDAQ stocks that everyone is familiar with—first establishing on-chain depth and cross-ecosystem exchanges. But further down, the asset lineage will naturally extend: on one end are fixed assets like real estate; on the other end are private assets, including PE equity, private bonds, and the Pre-IPO equity that many people are discussing today.

Pre-IPO sits in the middle of the "liquidity spectrum": it is more flexible than real estate but lacks the constant quotes and market makers that secondary US stocks have. We believe it will be the next category to be concentrated on after "secondary market tokenization," and we have already engaged with several US-based issuers who are preparing to package original VC equity into SPVs and issue them on-chain while building a matching trading platform.

In the Pre-IPO space, liquidity remains the number one challenge. Secondary US stocks at least have existing market makers and arbitrageurs; as long as we establish the on-chain routing well, slippage can be reduced. Pre-IPO itself has a long lock-up period and lacks continuous quotes, and the traditional world does not have deep order books to "transport." More challenging is valuation—each round of VC investment has different prices and terms, and some information may not be publicly available. Which round and which price should be used as the anchor value for the on-chain token? This is a question that issuers must answer during both the subscription and trading phases. Some have attempted to use prediction markets to "discover prices" for unlisted equity, such as predicting OpenAI's valuation, but this approach still seems forced. In contrast, leading unicorns, due to high media coverage and potential buying interest, are more likely to form fair prices in the market; however, for mid-tier or lower-tier unlisted companies, pricing is inherently vague, and after tokenization, they can easily fall into the trap of "having a price but no market."

It is foreseeable that once leading projects like ByteDance and OpenAI start, strong buyer demand will "bid" a market price, and the pricing problem will be resolved; however, for Pre-IPO targets with average recognition and wide valuation ranges, how to organize the shares held by different VCs and the prices from different rounds into an acceptable fair value on-chain remains a core challenge for the industry.

7. Final Thoughts

Blockstreet Hedy:

The true significance of assets going on-chain does not lie in the act of "going on-chain" itself, but in how to build underlying liquidity and subsequent underwriting systems—this is the core logic for attracting quality assets. Just as NASDAQ and the New York Stock Exchange attract global issuers and investors with deep liquidity and mature underwriting capabilities, the imaginative space of the on-chain world also depends on whether it can provide a more convenient trading experience that surpasses traditional infrastructure, rather than merely asset digitization.

Although there are currently many issuers, Wall Street generally believes that the industry is still in its early stages. The real topic for next year will shift to building underwriting and trading systems, with listed companies focusing more on how to optimize trading processes and truly unleash the potential of blockchain as the next-generation financial super gateway.

This process essentially involves building blockchain on top of the existing financial hegemony system, rather than starting from scratch. The dollar's hegemony has established traditional finance, and now stablecoins have built a global on-chain payment network that surpasses SWIFT. The payment aspect has been settled; the next step must be to introduce real-world assets, providing underlying yields and trading attributes, deeply binding on-chain finance with traditional finance.

Most native cryptocurrencies, aside from BTC and ETH, have failed to establish substantial links with the real world. To establish a new financial order, incremental changes must be made at the top of the existing pyramid, rather than attempting a fantastical reconstruction. Wall Street's core advantage lies in siphoning global capital, and the future challenge will be: as on-chain funds become important participants, how to maintain their attractiveness? This year, BTC's yield has stabilized, indicating that relying solely on the returns of crypto assets is insufficient for long-term capital retention; it is essential to introduce the robust yield logic of traditional finance.

Ultimately, we must return to the original intention of blockchain—financial inclusion and global connectivity. The on-chain virtual world needs the empowerment of real-world scenarios, with payment and finance as the two pillars. The essence of finance is to achieve efficient circulation of value, and the introduction of RWA is key to rooting this circulation system in reality, truly enabling the global on-chain financial market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。