Introduction: From "Tool Stacking" to "Symphonic Ecosystem"

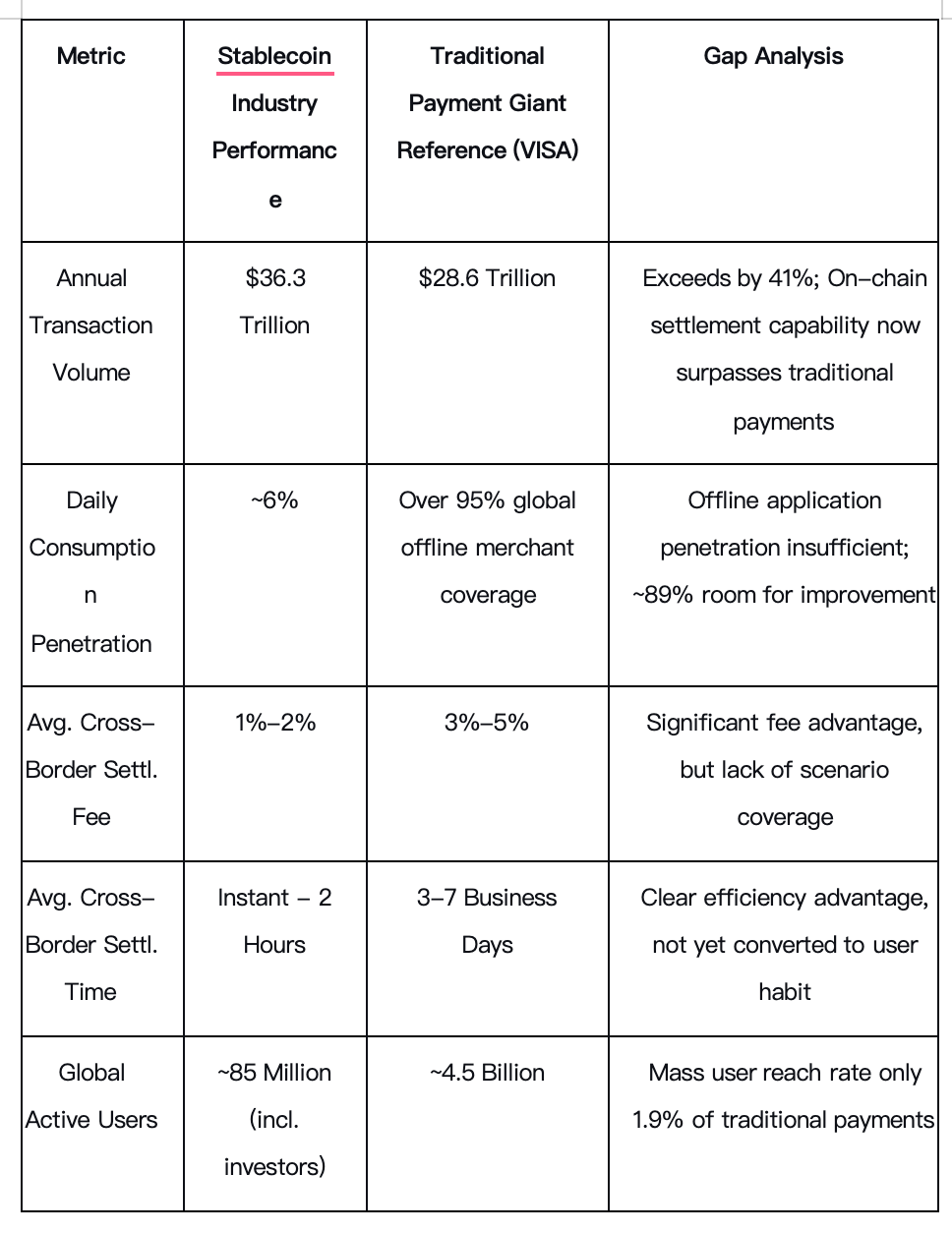

A paradoxical phenomenon has long existed in the crypto world: while the total market capitalization of stablecoins has exceeded $2.7 trillion, and the annual on-chain transaction volume of $36.3 trillion far surpasses the combined totals of VISA ($28.6T) and Mastercard ($22.1T), their penetration rate in daily consumption remains stagnant at around 6%. Why has this asset, hailed as the "go-to currency for the digital era," consistently failed to reach the everyday user?

The answer lies in the fragmentation of the ecosystem. Looking at the market, whether it's exchange-built payment tools or independent crypto payment gateways, most only offer "point-based" solutions. Users might trade and swap assets on Platform A, only to complete payments on Platform B, unable to seamlessly manage assets, daily spending, and value appreciation within a single system. Consequently, stablecoins have been confined to the small circle of trading and speculation, failing to unleash their true potential as circulating currency.

This is precisely where Solulu breaks through. As a platform aspiring to become a globally leading stablecoin infrastructure provider, it doesn't merely stack features. Instead, through an intricate "flywheel architecture," it weaves five core businesses into a self-driving, value-cycling micro-economic ecosystem. This article will delve deep, combining industry data and real-world cases, to dissect how Solulu transforms stablecoins from isolated "assets" into the "economic lifeblood" flowing freely within a vast system.

1. Industry Status: Stablecoin's "Scale Dilemma" and the Window for Breakthrough

To understand the value of Solulu's ecosystem, one must first grasp the core contradiction in the current stablecoin industry – "strong technical scale, weak practical application." The following data and charts clearly depict the industry landscape:

Core Data Comparison: Striking Contrast Between On-Chain Boom and Off-Chain Absence

Analyzing the data, the industry's core pain points and breakthrough opportunities can be summarized into three key conclusions:

1. Stablecoins' technical advantages (low fees, fast settlement) are proven, but lack a closed-loop scenario from "swap to spend".

2. Over 80% of industry transactions are concentrated in asset exchange and speculation, with genuine payment scenarios accounting for less than 20%.

3. The core barrier of traditional payment giants isn't technology, but "full-scenario coverage + user habits," which is precisely the key to breaking through in the stablecoin track.

2. Core Flywheel: Five Interlocking Business Engines Construct a Value Loop

Solulu's confidence stems from its five business engines not operating in silos but interlocking like precision gears, collectively driving the value cycle flywheel, forming the inseparable core power of the ecosystem.

2.1 Starting Point & Cornerstone: Multi-Stablecoin Exchange Center – The Core Liquidity Engine of the Ecosystem

Any economy's prosperity begins with the convergence of liquidity. Solulu's Multi-Stablecoin Exchange Center is precisely the ecosystem's core liquidity engine and traffic entry point. Its functional positioning is clear: support real-time exchange for over 100 stablecoins across 40+ public chains, completely solving the "island problem" of user assets being scattered across different chains.

Messari reports indicate that the average daily trading volume of stablecoins reached approximately $143 Billion in 2025, with the proportion of cross-chain transactions soaring from 18% in 2023 to 42%. Leveraging aggregation capabilities from major DEXs and smart routing technology, Solulu builds deep cross-chain liquidity pools, fundamentally ensuring low-slippage experiences for mainstream stablecoin swaps, aiming to become a core hub for massive stablecoin trading. Therefore, in the ecological closed loop, this advantage is the beginning of the entire story. Without this deep, cross-chain liquidity pool, subsequent payment and trade businesses would be like water without a source.

2.2 Key Bridge: Fiat On/Off-Ramp Services – The "Two-Way Gate" Connecting Virtual and Real

Holding stablecoins, how does one achieve free interchange with real-world wealth? Solulu's Fiat On/Off-Ramp services are this crucial bridge building trust. Its core function is providing seamless two-way, one-click conversion between stablecoins and global fiat currencies. Users can directly link bank accounts for easy deposits and withdrawals. It currently supports 28 major fiat currencies including USD, EUR, and GBP. Relying on compliant payment channels and fast clearing technology, the conversion-to-account efficiency is significantly improved, much faster than the industry average of 2-4 hours, providing users with efficient and convenient fund transfer, while also accurately addressing the key user pain point of "exit concerns."

2.3 Breaking Consumption Barriers: Solulu Digital Asset Card – The "Global Spending Terminal" for On-Chain Assets

After establishing confidence comes breaking through into spending scenarios. The Solulu Digital Asset Card is the ultimate tool for instantly converting on-chain assets into global purchasing power.

It seamlessly integrates with the global payment network, allowing users to swipe for payments at over 70 million merchants worldwide and withdraw cash from ATMs in 200+ countries and regions. The card supports automatic conversion; users need no manual operation to achieve real-time conversion from stablecoin to local fiat, with transaction fees lower than those of traditional cross-border credit cards.

The Solulu Digital Asset Card creates the most direct and highest-frequency value consumption scenario for stablecoins within the ecological loop. Through real-time conversion technology, the complexity of blockchain is completely abstracted away; users don't perceive the underlying conversion, only experiencing the ultimate convenience of "spending crypto."

2.4 Ecological Stickiness: Solulu Pay – The Social Bonding Agent Driving High-Frequency Engagement

Crypto payment tools are easily replaceable, but social habits integrated into daily life are the deepest moat – this is precisely the secret weapon Solulu Pay uses to enhance user stickiness. It integrates features like QR Code/NFC payments, social red packets, and group collections, can be described as a Web3 version of "Alipay + WeChat Pay," supporting instant multi-chain stablecoin payments, covering core scenarios like peer-to-peer transfers, holiday red packets, and offline payments. Furthermore, it utilizes content community fission and incentive mechanisms, reinforcing user binding by rewarding payment and sharing behaviors. Its core highlight lies in injecting social warmth into cold financial payments. This logic has been market-proven: WeChat Pay leads in transaction volume through social scenario embedding, while Web3 social wallets have increased user retention by 35% by simplifying operations. Solulu Pay accurately follows this pattern, transforming stablecoin payments from "low-frequency operations" to "high-frequency interactions," becoming the key lever for ecological stickiness.

2.5 Value Escalation: Web3 Cross-Border E-Commerce Caviar – The Key Move Targeting the Trillion-Dollar Settlement Gap

After conquering individual consumption, Solulu sets its sights on a stage with even greater imagination – cross-border trade worth trillions of dollars. The powerful alliance with Caviar, the premier Web3 e-commerce platform focusing on official brand authorizations, is the flagship embodiment of this strategy.

Traditional cross-border trade and luxury e-commerce have long been plagued by long settlement cycles (often days) and high handling fees (typically 3%-5%). According to cross-border payment industry research and World Bank data, the global cross-border trade settlement market amounts to tens of trillions of dollars, with about 40% of scenarios suffering from efficiency and cost gaps due to the high cost of traditional settlement. Stablecoins' characteristics of low fees and instant settlement perfectly address this issue. Solulu keenly captured this opportunity, partnering with Caviar, which focuses on luxury goods and IP collaborations, initiating this strategic demonstration project: They built a legal and transparent settlement environment through built-in KYB/compliance audit/invoicing and reconciliation systems; utilizing real-time clearing technology, they reduced the traditional multi-day settlement process to minutes, with costs significantly lower than traditional banking channels like SWIFT; and also achieved seamless integration with Web3 enterprises, cross-border e-commerce, and supply chain platforms.

Within the closed loop, this combination not only validates the efficiency and reliability of Solulu's underlying settlement network but also substantially expands the application of stablecoins from C-end consumption to enterprise-level large-value trade settlement, providing global commerce with a more efficient, economical, and trustworthy financial infrastructure.

2.6 The Summary of the Ecosystem Closed-loop

The five businesses collectively weave an inseparable network of value: users acquire assets from the Exchange Center, build trust through fiat on/off-ramps, travel the globe with the Solulu Card, interact socially within Solulu Pay, proceed to high-end consumption and commercial activities on Caviar, and finally achieve cross-border enterprise-level stablecoin settlement. Each link feeds traffic and value to the others, forming a self-reinforcing growth closed loop.

The sustainable operation of such an ecological closed loop hinges on two core cornerstones: compliance and trust — these are the fundamental pillars for the long-term development of any financial ecosystem targeting the mainstream market. Solulu has deeply grasped this industry essence and proactively pursued a forward-looking global compliance licensing strategy. The platform has not only secured the U.S. MSB (Money Services Business) license but is also actively applying for financial licenses in key markets, including New York State MTL, UAE VARA, and Canadian MSB. This comprehensive compliance framework not only solidifies the legal foundation for fiat currency issuance services but also clears the way for the global clearing of its digital asset cards.

3. Accelerant Fuel: How Incentives and Token Economics Empower the Five Businesses

A sophisticated ecosystem requires not only a solid skeleton but also lifeblood that drives the organism to operate at high speed. Solulu's token economic model is the "super fuel" that makes the aforementioned flywheel spin faster.

Regarding incentive synergy, users receive deep incentives when using the five businesses. Whether providing liquidity to increase tiers and obtain annual arbitrage multiples of up to 3.5x or more, or promoting the ecosystem to gain active yield acceleration bonuses, Solulu successfully transforms users from "users" to "ecological co-builders."

In terms of value capture and deflationary design, the SOLU token is the core vehicle. All taxes generated by the platform's businesses (e.g., withdrawal fees, transaction commissions) are used for monthly buybacks and burns of SOLU tokens on the open market, continuously strengthening the deflationary effect.

It is worth noting that this model, through exquisite economic incentives, greatly promotes user growth, stickiness construction, and network effects for the five businesses, serving as an indispensable acceleration catalyst for the entire Solulu ecosystem.

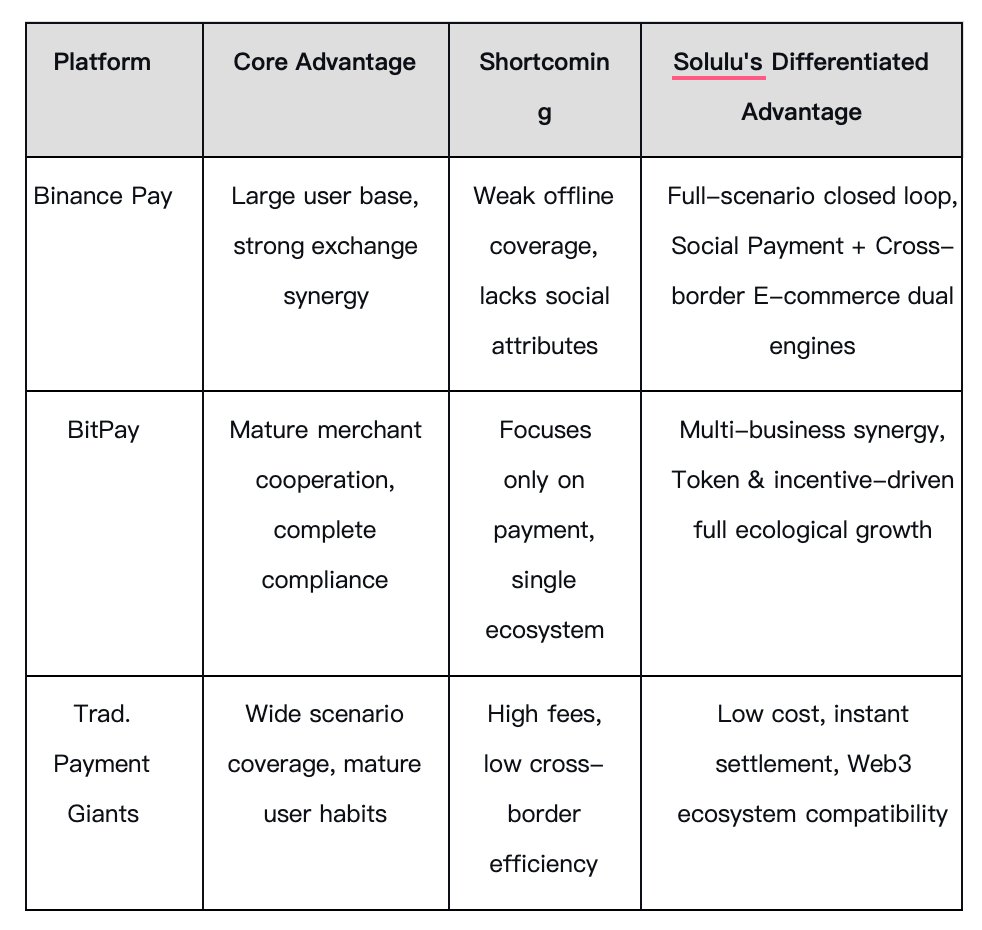

4. Industry Benchmarking and Future Outlook

Core Competitor Comparative Analysis: Competitors' Ecological Fragmentation vs. Solulu's Full-Stack Closed Loop

From the core competitor differences, Solulu's growth potential is clear: relying on its full-scenario closed-loop ecosystem and deflationary token economic model, it builds differentiated competitive barriers. Compared to the limitations of most platforms focusing on single functions, Solulu achieves business synergy across "Exchange-Payment-Social-E-commerce," not only filling the industry's functional fragmentation gap but also forming a dimensional advantage over traditional payment systems by leveraging stablecoins' inherent low-cost, high-efficiency advantages. This combination drives its growth flywheel to accelerate continuously – various business sectors within the ecosystem empower each other, users transform from mere users into ecological co-builders, further strengthening the ecosystem's vitality. In the long term, Solulu's development goal is not limited to being a functional aggregation platform or feature stack but aims to grow into the core infrastructure supporting large-scale stablecoin application, truly practicing its core mission of "making every value flow more stable, transparent, and usable," ultimately becoming the key bridge connecting traditional finance and the Web3 economy, promoting the formation and implementation of a stable value ecosystem.

Conclusion: Solulu — Evolving from Feature Development to Economic Architecture

Solulu's practice clearly validates its core proposition: it is through the systematic reconstruction of stablecoin infrastructure via the "Five Core Business Engines" that the industry has been opened up to a breakthrough. This brings a fundamental revelation to the entire track: competition in the second half has long transcended the contest of individual technologies or functions, evolving into the ultimate showdown of capabilities in overall ecological design and economic model construction.

Leveraging the closed-loop growth flywheel formed by the five engines, combined with diversified application scenarios, Solulu encapsulates technical complexity and underlying challenges at the infrastructure layer, delivering simplicity, seamless experience, and core value back to users. From personal daily payments to corporate cross-border settlements, from online social transfers to offline merchant collections—this new architecture built by the five business segments is exactly the bridge Solulu has constructed leading to a future of stable value. It has successfully driven stablecoins from "technically useful" to "user-friendly," and is steadily moving toward the ultimate vision of "omnipresent in daily life."

And this is the core power of "architecture"—it is not confined to solving individual pain points, but reshapes the underlying paradigm of value flow as a whole.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。