Original Author: shaunda devens

Original Translation: Saoirse, Foresight News

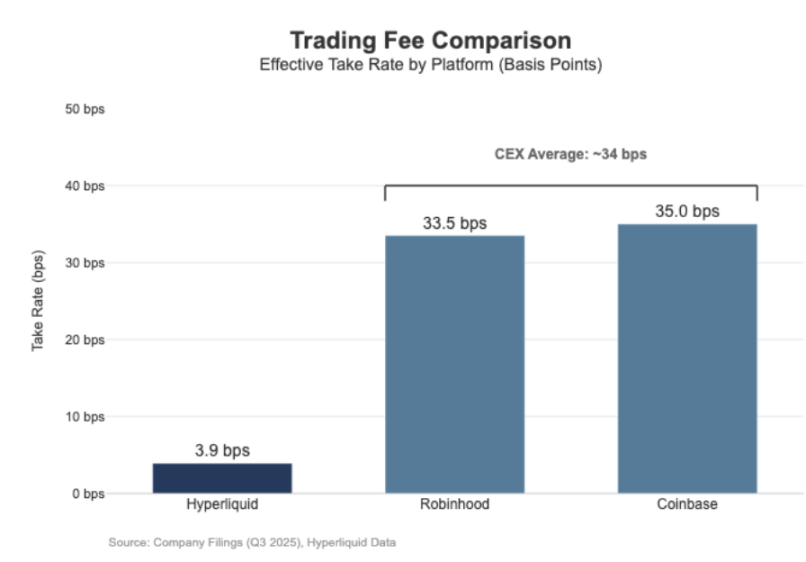

The liquidation scale of Hyperliquid's perpetual contracts has reached Nasdaq levels, but its economic benefits have not matched this scale. In the past 30 days, the platform has liquidated perpetual contracts with a nominal value of $205.6 billion (annualized scale of $617 billion), but the fee income was only $80.3 million, with a fee rate of about 3.9 basis points.

Its profit model is similar to a "wholesale trading venue."

In contrast, Coinbase reported a trading volume of $295 billion in Q3 2025, with trading revenue reaching $1.046 billion, implying a fee rate of 35.5 basis points. Robinhood exhibited a similar "retail profit model" in its cryptocurrency business: $80 billion in nominal cryptocurrency trading volume generated $26.8 million in cryptocurrency trading revenue, with an implied fee rate of 33.5 basis points; meanwhile, the platform's nominal stock trading volume in Q3 2025 was $647 billion.

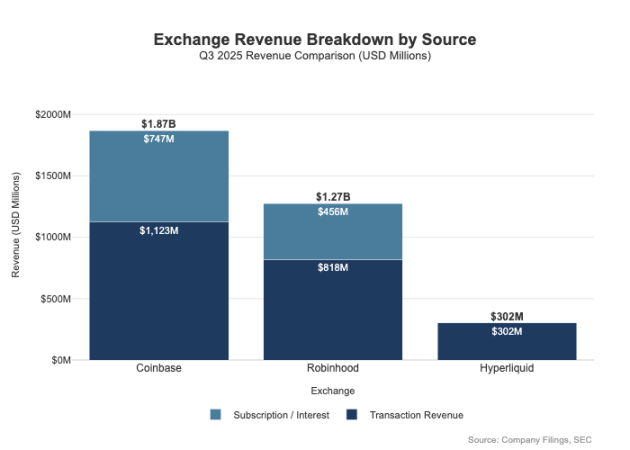

The gap between the two is not only reflected in the fee rates — retail platforms have more diversified profit channels. In Q3 2025, Robinhood's trading-related revenue was $730 million, in addition to $456 million in net interest income and $88 million in other income (mainly from Gold subscription services). In contrast, Hyperliquid still heavily relies on trading fees, and at the protocol level, its fee rates structurally remain at single-digit basis points.

This difference is essentially due to "different positioning": Coinbase and Robinhood belong to "brokerage/distribution-type enterprises," profiting through balance sheets and subscription services; while Hyperliquid is closer to the "exchange level." In traditional market structures, profit pools are distributed at these two levels.

The Distinction Between Brokerage and Exchange Models

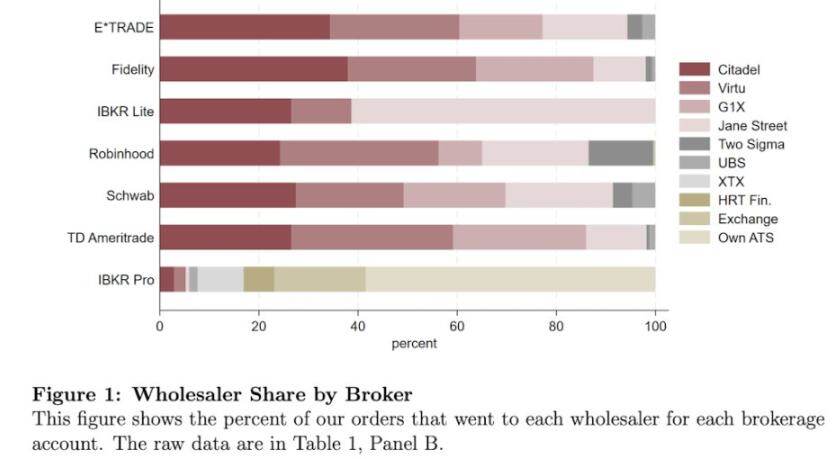

The core difference in traditional finance (TradFi) lies in the separation of the "distribution end" and the "market end." Retail platforms like Robinhood and Coinbase are positioned at the "distribution layer," occupying high-margin areas; exchanges like Nasdaq are at the "market layer" — at this level, pricing power is structurally limited, and competition in the trade execution segment gradually trends towards a "commoditized economic model" (i.e., profit margins are significantly compressed).

1. Broker-Dealer = Distribution + Client Balance Sheet

Broker-dealers control client relationships. Most users do not connect directly to Nasdaq but enter the market through brokers: brokers are responsible for account opening, asset custody, margin/risk management, customer support, and tax document processing, then route orders to specific trading venues. This "ownership of client relationships" brings profit opportunities beyond trading:

- Related to fund balances: cash concentration spreads, margin financing interest, securities lending income;

- Service packaging: subscription services, bundled products, debit card services/consulting services;

- Order routing economics: brokers control trading flow and can embed payment sharing or revenue-sharing mechanisms in the routing chain.

This is the core reason why brokers can profit beyond trading venues: profit pools concentrate at the "distribution end" and "fund balance end."

2. Exchange = Order Matching + Rule System + Infrastructure, Fee Rates Subject to Upper Limits

Exchanges are responsible for operating trading venues, with core functions including order matching, setting market rules, ensuring deterministic execution, and providing trading connectivity. Their profit sources include:

- Trading fees (in high liquidity products, fees are continuously driven down by competition);

- Rebates/liquidity incentive programs (to attract liquidity, exchanges often need to return most public fees to market makers);

- Market data services, trading connectivity/server hosting services;

- Listing services and index licensing fees.

Robinhood's order routing model clearly reflects this structure: the broker (Robinhood Securities) controls users and routes orders to third-party market centers, sharing the revenue from the routing segment along the chain. The "distribution layer" is the high-margin segment — it controls user acquisition and develops diverse profit channels around trade execution (such as payment for order flow, financing business, securities lending, subscription services).

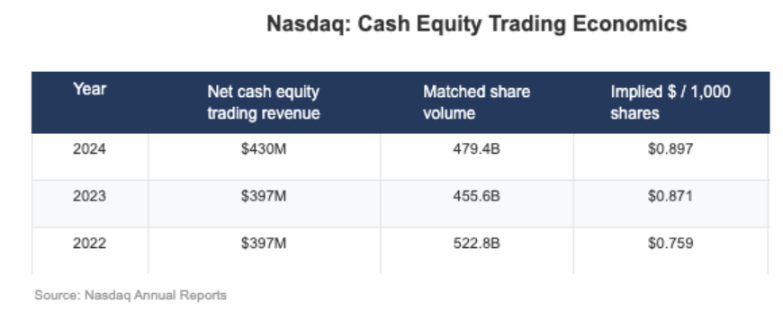

Nasdaq, on the other hand, belongs to the "low-margin layer": its core products are "commoditized trade execution" and "order queue access rights," with pricing power constrained by three mechanisms — to attract liquidity, it must return fees to market makers, regulatory caps on access fees, and high elasticity in order routing (users can easily switch to other platforms).

From Nasdaq's disclosed data, its stock business's "implied net cash yield" is only at the level of $0.001 per share (i.e., one-thousandth of a dollar/share).

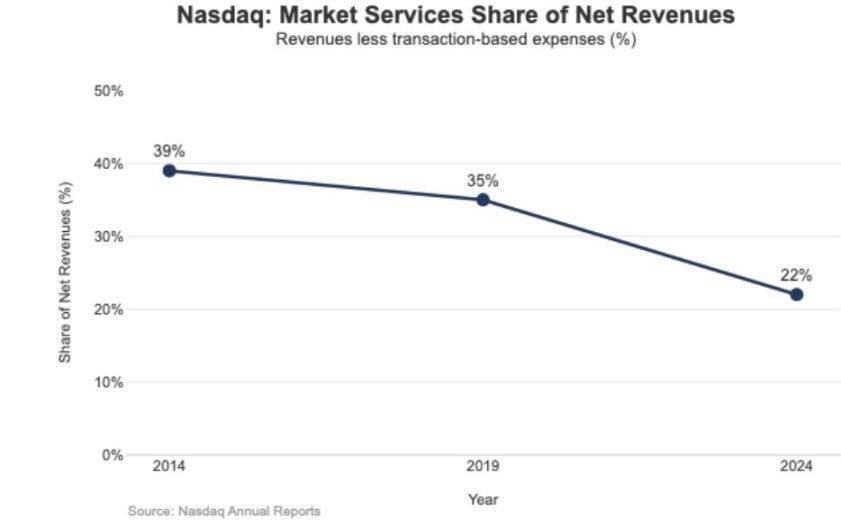

The strategic impact of low margins is also reflected in Nasdaq's revenue structure: in 2024, "market services" revenue was $1.02 billion, accounting for only 22% of total revenue of $4.649 billion; this proportion was 39.4% in 2014 and 35% in 2019 — this trend indicates that Nasdaq is gradually shifting from "reliance on market trading execution business" to "more sustainable software/data business."

Positioning "Market Layer" Hyperliquid

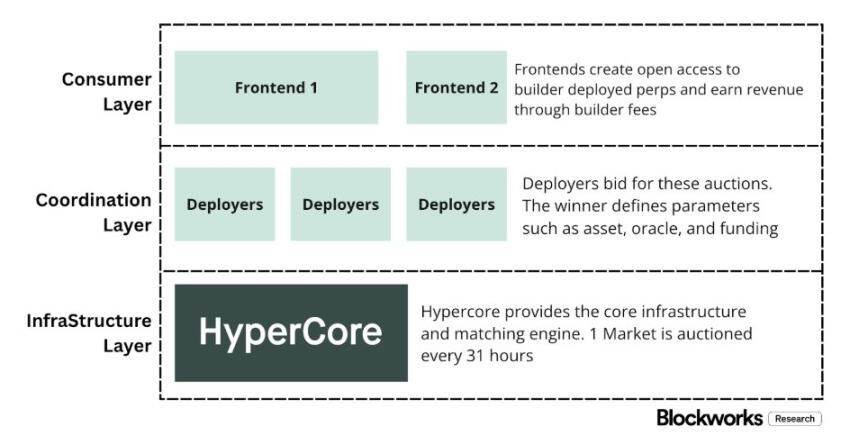

Hyperliquid's actual fee rate of 4 basis points aligns with its strategy of "actively choosing market layer positioning." The platform is building a "on-chain Nasdaq": through high-throughput order matching, margin calculation, and clearing technology stack (HyperCore), adopting a "market maker/taker" pricing model and providing market maker rebates — its core optimization direction is "trade execution quality" and "liquidity sharing," rather than "retail user profitability."

This positioning is reflected in two "quasi-traditional finance" separation designs, which most cryptocurrency trading platforms have not adopted:

1. Unlicensed Broker/Distribution Layer (Builder Codes)

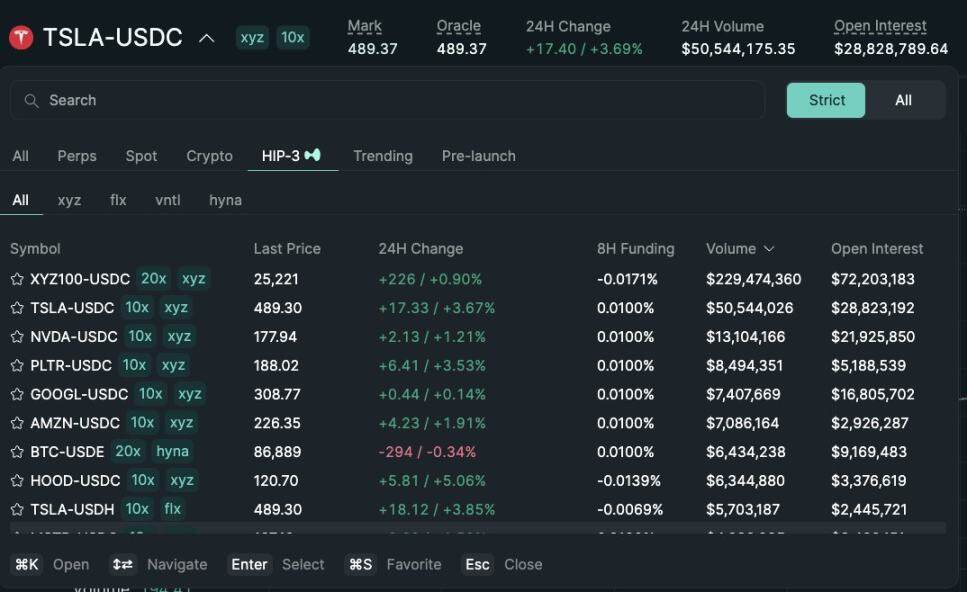

"Builder Codes" allow third-party interfaces to connect to the core trading venue and set their own fee standards. Among them, the upper limit for third-party fees on perpetual contracts is 0.1% (10 basis points), and for spot trading, it is 1%, with fees adjustable per order — this design creates a "distribution competitive market," rather than a "single app monopoly."

2. Unlicensed Listing/Product Layer (HIP-3)

In traditional finance, exchanges control listing permissions and product creation rights; however, HIP-3 externalizes this function: developers can deploy perpetual contracts based on the HyperCore technology stack and API, defining and operating trading markets independently. From an economic perspective, HIP-3 formally establishes a "revenue-sharing mechanism between trading venues and product providers" — deployers of spot and HIP-3 perpetual contracts can receive 50% of the trading fees for the deployed assets.

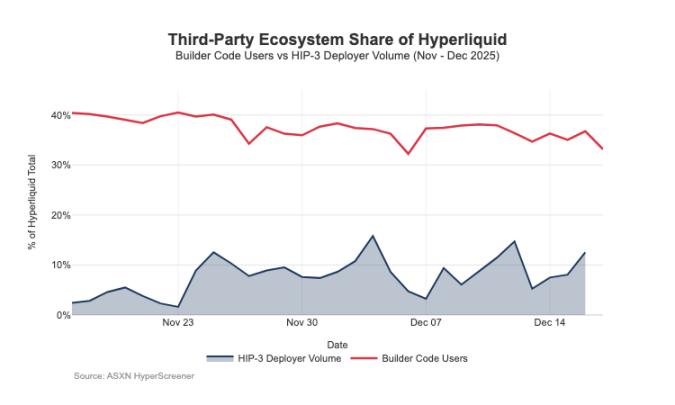

"Builder Codes" have achieved effectiveness at the distribution end: as of mid-December, about 1/3 of users traded through third-party front ends rather than the official interface.

However, this structure also brings foreseeable pressure on the trading venue's fee income:

- Pricing compression: multiple front ends share the same back-end liquidity, competition forces "overall costs" to be minimized; and fees can be adjusted per order, further pushing pricing towards the bottom line;

- Loss of profit channels: front ends control user account opening, service packaging, subscriptions, and trading processes, occupying the high-margin space of the "broker layer," while Hyperliquid retains only the low-margin income of the "trading venue layer";

- Strategic routing risk: if front ends develop into "cross-platform order routers," Hyperliquid will be forced into "wholesale execution competition" — needing to maintain trading flow through fee reductions or increased rebates.

Through HIP-3 and Builder Codes, Hyperliquid has actively chosen a "low-margin market layer" positioning while allowing a "high-margin broker layer" to form above it. If front ends continue to expand, they will gradually control "user-side pricing," "user retention channels," and "routing discourse power," which will create structural pressure on Hyperliquid's fee rates in the long run.

Defending Distribution Rights, Expanding Non-Exchange Profit Pools

The core risk facing Hyperliquid is the "commoditization trap": if third-party front ends can continuously attract users at prices lower than the official interface and ultimately achieve "cross-platform routing," the platform will be forced to shift to a "wholesale execution economic model" (i.e., profit margins continuously narrowing).

From recent design adjustments, Hyperliquid is attempting to avoid this outcome while broadening its revenue sources, no longer limited to trading fees.

1. Distribution Defense: Maintaining Economic Competitiveness of the Official Interface

Previously, Hyperliquid proposed that "staking HYPE tokens could enjoy up to a 40% fee discount" — this design would have structurally allowed third-party front ends to have "lower prices than the official interface." After canceling this proposal, external distribution channels lost the direct subsidy of "pricing below the official interface." Meanwhile, HIP-3 markets were initially only accessible through "developer distribution" and were not displayed on the official front end; currently, these markets have been included in the official front end's "strict listing." This series of actions conveys a clear signal: Hyperliquid retains the unlicensed characteristics at the "developer layer," but is unwilling to compromise on "core distribution rights."

2. Stablecoin USDH: Shifting from "Trading Profit" to "Capital Pool Profit"

The core purpose of launching USDH is to reclaim the "stablecoin reserve income" that was originally flowing out. According to the public mechanism, reserve income is distributed 50% to Hyperliquid and 50% for the development of the USDH ecosystem. Additionally, the design of "USDH trading market enjoying fee discounts" further reinforces this logic: Hyperliquid is willing to sacrifice "single transaction profit compression" in exchange for "larger scale and more stable capital pool profit" — essentially adding a "pension-like income stream," whose growth can rely on the "monetary base" (rather than solely depending on trading volume).

3. Composite Margin: Introducing "Institutional Broker-style Financing Economy"

The "composite margin" mechanism unifies the margin calculation for spot and perpetual contracts, allowing for risk exposure hedging while introducing a "native lending cycle." Hyperliquid will charge "10% of borrower interest" — this design gradually links the protocol's economic model to "leverage usage" and "interest rates," making it closer to the profit logic of "broker/dealer" rather than a pure exchange model.

Pathway for Hyperliquid Towards a Broker Economic Model

Hyperliquid's trading throughput has reached "mainstream trading venue levels," but its profit model remains at the "market layer": nominal trading volume is large, but the actual fee rate is only in single-digit basis points. The structural gap with Coinbase and Robinhood is significant: retail platforms are at the "broker layer," controlling user relationships and fund balances, achieving high margins through diverse profit pools such as "financing, idle funds, and subscriptions"; pure trading venues focus on "trade execution as the core product," and due to liquidity competition and routing elasticity, "trade execution" inevitably trends towards commoditization, with profit margins continuously compressed — Nasdaq is a typical example of this constraint in traditional finance.

In its early stages, Hyperliquid closely aligned with the "trading venue prototype": by separating "distribution (Builder Codes)" and "product creation (HIP-3)," it rapidly promoted ecosystem expansion and market coverage. However, the cost of this structure is "economic spillover": if third-party front ends control "comprehensive pricing" and "cross-platform routing rights," Hyperliquid will face the risk of "becoming a wholesale channel, clearing trading flow at low margins."

However, recent actions indicate that the platform is consciously shifting towards "defending distribution rights" and "broadening revenue structure" (no longer relying on trading fees). For example, it has stopped subsidizing "external front-end low-price competition," incorporated HIP-3 markets into the official front end, and added "balance sheet-style profit pools." The launch of USDH is a typical case of incorporating "reserve income" into the ecosystem (including 50% sharing and fee discounts); composite margin introduces "financing economy" by "charging 10% borrower interest."

Currently, Hyperliquid is gradually moving towards a "hybrid model": based on "trade execution channels," it overlays "distribution defense" and "capital pool-driven profit pools." This transformation reduces the risk of "falling into a wholesale low-margin trap" while aligning with a "broker-style income structure" without abandoning the "core advantages of unified execution and clearing."

Looking ahead to 2026, the core question facing Hyperliquid is: how to transition to a "broker-style economy" without breaking the "outsourcing-friendly model"? USDH is the most direct test case — currently, its supply is about $100 million, indicating that if the platform does not control "distribution rights," the expansion speed of "outsourced issuance" will be very slow. A more obvious alternative should be the "default settings of the official interface," such as automatically converting about $4 billion of USDC base funds into native stablecoins (similar to Binance's automatic conversion of USDC into BUSD).

If Hyperliquid wishes to obtain a "broker-level profit pool," it must take "broker-style actions": strengthen control, deepen the integration of self-operated products with the official interface, and clarify boundaries with ecosystem teams (to avoid internal friction over "distribution rights" and "fund balances").

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。