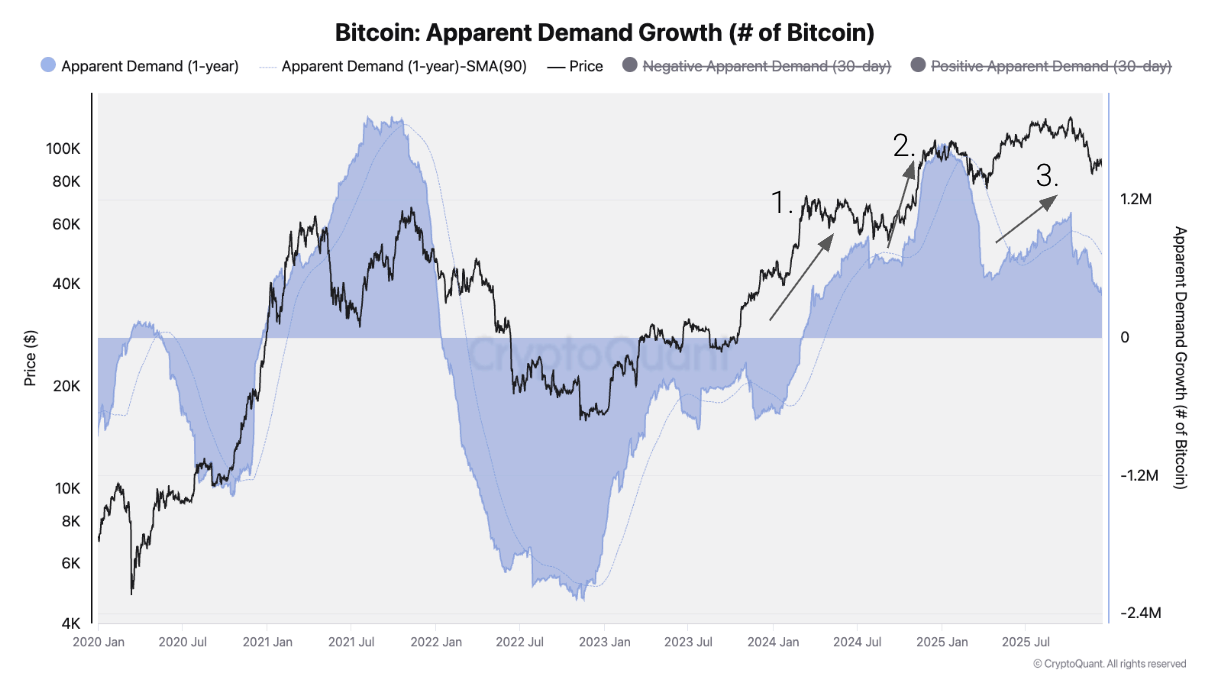

Cryptoquant’s latest report argues that most of this cycle’s incremental bitcoin demand is already in the rearview mirror, with growth slipping below its long-term trend since early October.

According to researchers, three major spot-driven demand waves — the U.S. spot exchange-traded fund (ETF) launch, President Trump’s election win, and the bitcoin treasury company boom — have largely played out, removing a critical pillar of price support.

Source: Cryptoquant report.

Data from cryptoquant.com shows institutional behavior has flipped from accumulation to distribution. Analysts note that U.S. spot bitcoin ETFs became net sellers in the fourth quarter, shedding roughly 24,000 BTC after adding more than 200,000 BTC during the same period last year. That reversal, Cryptoquant researchers say, marks a sharp contrast from the accumulation-heavy phase that defined late 2024.

Large holders appear to be following the same script. The analytical company’s data shows addresses holding between 100 and 1,000 BTC — a cohort dominated by ETFs and treasury companies — are now growing below trend. Cryptoquant researchers point out that a similar slowdown emerged in late 2021, just ahead of the 2022 bear market.

Derivatives markets are also flashing caution. According to the report, perpetual futures funding rates have fallen to their lowest level since December 2023. Cryptoquant researchers say declining funding rates typically reflect fading appetite for leveraged long exposure, a pattern more common in bear markets than bullish regimes.

Also read: Milestone: Bitso Processes Stablecoin Payments for Over $80B in Latam

Price structure has followed the demand lower. The analysis highlights bitcoin’s break below its 365-day moving average, a long-term level that has historically separated bull markets from bear markets. In past cycles, Cryptoquant researchers note, sustained trading below this level tended to coincide with broader market weakness.

Looking ahead, Cryptoquant market strategists estimate downside risk may be relatively contained. Based on realized price models from cryptoquant.com metrics, historical bear market bottoms have clustered near the realized price, now around $56,000. That would imply a roughly 55% drawdown from the peak — potentially the shallowest bear market decline on record — with interim support near $70,000.

- What is Cryptoquant saying about bitcoin’s market cycle?

Cryptoquant researchers say bitcoin has entered a demand-driven bear market phase. - Why does Cryptoquant focus on demand instead of halvings?

Cryptoquant data shows demand expansions and contractions drive cycle shifts more than supply events. - What role do ETFs play in the current bitcoin outlook?

Cryptoquant reports U.S. spot bitcoin ETFs turned into net sellers in Q4. - Where could bitcoin find downside support, according to Cryptoquant?

Cryptoquant identifies a realized price near $56,000 as a historical bear market reference.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。