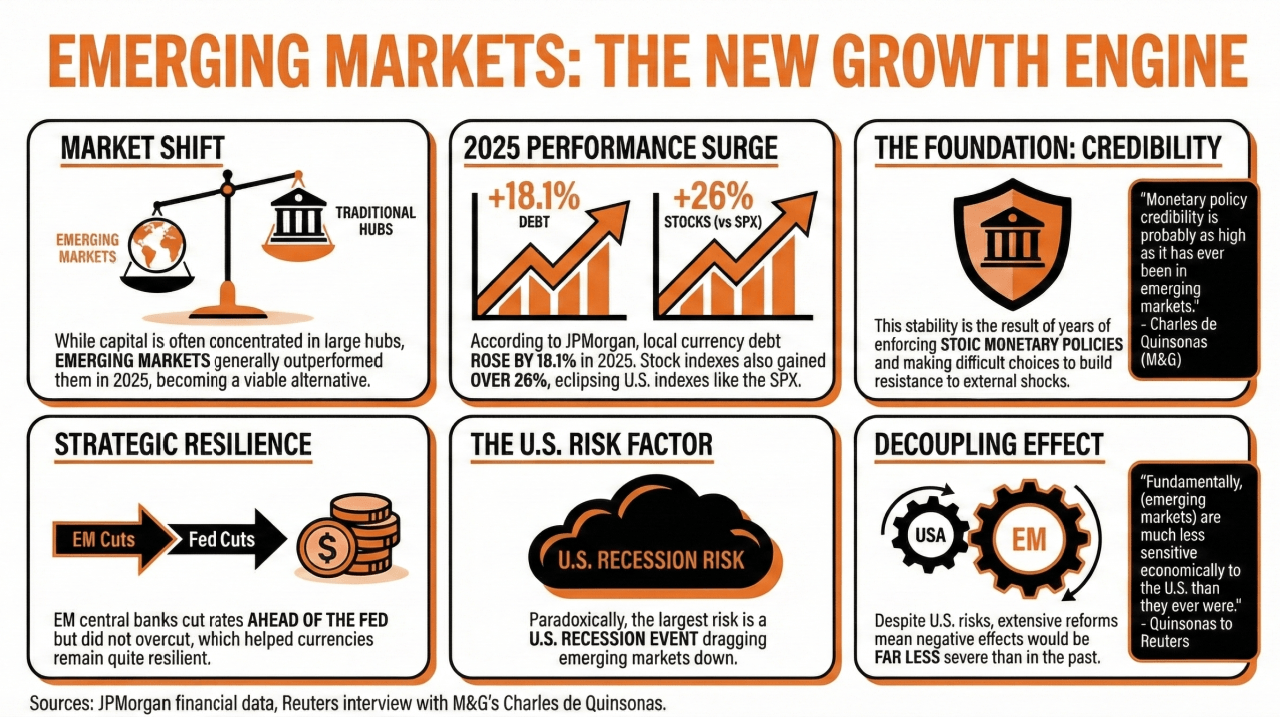

While most investment capital is concentrated in large financial market hubs, emerging markets have outperformed them thus year, becoming a viable alternative to their safer counterparts.

According to JPMorgan, local currency debt rose by 18.1% in 2025, while stock indexes also showed healthy gains of over 26%, eclipsing even U.S. indexes, such as the SPX.

Analysts claim that this newfound prosperity and stability come after years of difficult choices and enforcing stoic monetary policies that have made them resistant to external shocks.

In this sense, Charles de Quinsonas, head of emerging market debt at M&G, stated:

When it comes to monetary policy, credibility is probably as high as it has ever been in emerging markets. They cut, actually ahead of the Fed as well, but they haven’t overcut, which has helped currencies to remain quite resilient.

Paradoxically, the largest risk for these markets is the U.S., as they can be dragged out if there is a recession event. Nonetheless, even in this scenario, the effects would be far less negative than they would have been before due to the extensive reforms performed.

“Fundamentally, (emerging markets) are much less sensitive economically to the U.S. than they ever were,” Quinsonas told Reuters.

Read more: Report: Blockchain and Crypto VC Investments Grew Almost Tenfold During 2021 in Latam

Alternative markets can offer different investment options from the traditional investment hubs, serving as a diversification tool for investors hedging their large bets on large markets.

The rise of these markets as credible alternatives this year is attracting attention, as there is a general positive sentiment toward them. According to David Hauner, head of global emerging markets fixed income strategy at BofA Global Research, no customer contacted had a negative sentiment regarding capital allocation in emerging markets.

While strong results tend to attract more capital, emerging markets still present several limitations that keep investors out. Nonetheless, 2026 might be the year of the emerging market investment boom for all the reasons mentioned.

- How have emerging markets performed compared to traditional financial hubs?

Emerging markets have consistently outperformed larger financial hubs, with local currency debt increasing by 18.1% and stock indexes gaining over 26% in 2025. - What factors have contributed to the stability of emerging markets?

Years of tough choices and robust monetary policies have enhanced the credibility of emerging markets, making them resilient to external shocks. - What risk do emerging markets face from the U.S. economy?

The largest risk is a potential recession in the U.S., but emerging markets have become significantly less sensitive to U.S. economic fluctuations than in the past. - Why are investors showing interest in emerging markets for the future?

Emerging markets are seen as diversification tools offering viable alternatives to traditional investments, with no negative sentiment reported in capital allocation decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。