Original Title: DTCC Isn't Tokenizing Shares, Here is What's Actually Changing

Original Author: @ingalvarezsol

Translated by: Peggy, BlockBeats

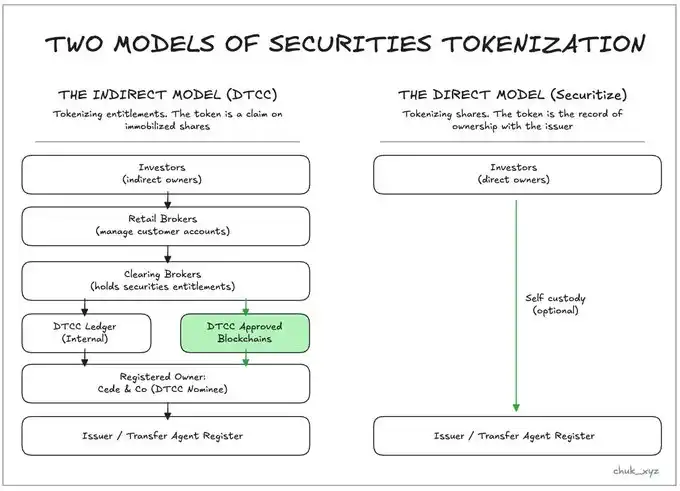

Editor's Note: The "tokenization" promoted by DTCC is not about putting stocks on the blockchain, but rather a digital upgrade of security entitlements, with the core goal of enhancing the efficiency and settlement capabilities of the existing market system. Alongside this, there is a more radical path that tokenizes stock ownership itself, reshaping self-custody and on-chain composability.

The two models are not in opposition; rather, they serve different purposes: stable scaling and functional innovation. This article attempts to clarify this distinction and points out that the real change lies not in who replaces whom, but in investors beginning to have the right to choose different ownership models.

The full text is as follows:

Introduction: Tokenization, but not the kind you think

The Depository Trust & Clearing Corporation (DTCC) has received a no-action letter from the U.S. Securities and Exchange Commission (SEC), allowing it to begin tokenizing its own securities infrastructure. This is a significant upgrade to the "underlying pipeline" of the U.S. capital markets: DTCC holds approximately $99 trillion in securities assets and supports trading volumes in the hundreds of trillions annually.

However, the market reaction surrounding this news reveals a clear gap between expectations and reality. What is being tokenized is not "stocks," but security entitlements, and this difference determines the nature of almost all subsequent issues.

Currently, discussions around "tokenized securities" do not indicate a single future arriving in its entirety, but rather two different models emerging simultaneously at different levels: one that transforms the way securities are held and circulated within the existing indirect holding system; the other fundamentally reshapes what it means to "hold a share of stock."

Note: For ease of expression, the following text will not distinguish between DTCC's subsidiary DTC (Depository Trust Company) and its parent company DTCC.

How today's securities ownership actually works

In the U.S. public markets, investors do not directly hold stocks with the listed companies. Stock ownership is placed within a chain of multiple intermediaries.

At the bottom level is the issuer's shareholder register, typically maintained by a transfer agent. For almost all listed stocks, this register usually records only one name: Cede & Co., the designated nominee holder by DTCC. This is done to avoid the issuer having to maintain millions of individual shareholder records.

One level up is DTCC itself. It "freezes" the physical circulation of these stocks through centralized custody. DTCC's direct participants are called clearing brokers, who represent retail brokers facing end customers and are responsible for custody and settlement clearing. What DTCC records in the system is: how many stocks each participant "is entitled to."

At the top level is the investor themselves. Investors do not hold specific, distinguishable stocks but rather hold a legally protected security entitlement—this is their claim of rights relative to the broker; the broker, in turn, holds corresponding entitlements down in the DTCC system through clearing brokers.

What is being tokenized this time are these "entitlements" within the DTCC system, not the stocks themselves.

This upgrade can indeed enhance system efficiency, but it cannot resolve the fundamental limitations posed by the multi-layered intermediary structure.

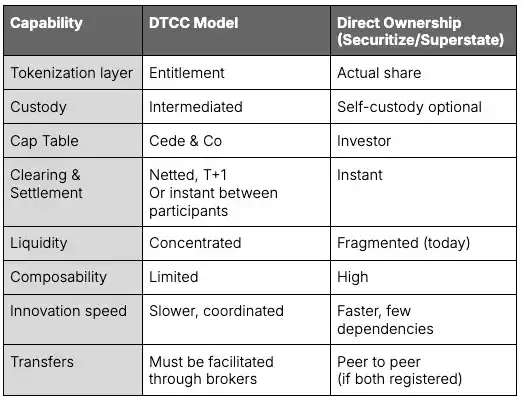

DTCC tokenizes "claims of rights," while the direct model tokenizes "the stocks themselves." Both are referred to as "tokenization," but they address completely different issues.

Why upgrade?

The U.S. securities system itself is quite robust, but its structure still has obvious limitations. Settlement relies on time-delayed processes that are restricted by working hours; corporate actions (such as dividends and stock splits) and reconciliations are still primarily completed through batch processing messages rather than shared states. Because ownership is nested within a complex network of intermediaries—each layer having its own pace of technological upgrades—real-time workflows are nearly impossible to achieve without simultaneous support from all levels, and DTCC is the key "gatekeeper" in this system.

These design choices also bring about capital occupation issues. Longer settlement cycles require tens of billions of dollars in margin to manage risks between the transaction and final settlement. These optimization solutions were originally designed for an old world where "capital transfer is slow and costly."

If the settlement cycle can be shortened, or if instant settlement can be achieved for voluntary participants, the required capital scale will significantly decrease, costs will drop, and market competition will intensify.

Some of the efficiency improvements can be achieved by upgrading existing infrastructure; however, others—especially those involving direct ownership and faster innovation iterations—require a completely new model.

Tokenizing the existing system (DTCC model)

In the DTCC path, the underlying securities remain in centralized custody and continue to be registered under Cede & Co. What changes is the expression of entitlement records: these "entitlements," which originally existed only in proprietary ledgers, are given a "digital twin" token that exists on an approved blockchain.

This is important because it achieves a modernization upgrade without disrupting the existing market structure. DTCC can introduce 24/7 entitlement transfers among participating institutions, reduce reconciliation costs, and gradually promote these entitlements towards faster collateral liquidity and automated workflows, while still retaining the efficiency advantages of centralized systems like net settlement.

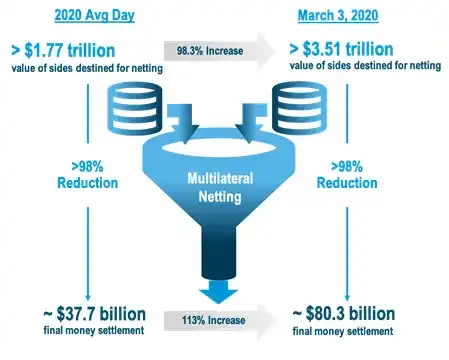

Multilateral netting can compress total trading activities worth trillions into a final settlement amount of only a few hundred billion. This efficiency constitutes the core of today's market structure, even as new ownership models gradually emerge.

However, the boundaries of this system are intentionally set. These tokens do not make holders direct shareholders of the company. They remain as licensed, revocable claims of rights, existing within the same legal framework: they cannot become freely composable collateral in DeFi, cannot bypass DTC's participating institutions, and will not change the issuer's shareholder register.

In short, this approach optimizes our existing system while fully retaining the existing intermediary structure and its efficiency advantages.

Tokenizing "ownership itself" (direct model)

The second model begins precisely where the DTCC model cannot reach: it tokenizes the stocks themselves. Ownership is directly recorded on the issuer's shareholder register and maintained by the transfer agent. When tokens are transferred, the registered shareholders change accordingly, and Cede & Co. is no longer part of the ownership chain.

This unlocks a range of capabilities that are structurally impossible under the DTCC model: self-custody, direct relationships between investors and issuers, peer-to-peer transfers, and programmability and composability combined with on-chain financial infrastructure—including collateral, lending, and many new financial structures yet to be invented.

This model is not just theoretical. Shareholders of Galaxy Digital can already tokenize their equity through Superstate and hold it on-chain, directly reflected in the issuer's equity structure. By early 2026, Securitize will also provide similar capabilities, introducing 24/7 trading supported by compliant brokerage systems.

Of course, the trade-offs of this model are also real. Once detached from the indirect holding system, liquidity will tend to fragment, and the efficiency of multilateral netting will disappear; services like margin and lending will need to be redesigned; operational risks will shift more to the holders themselves rather than the intermediaries.

But it is precisely the agency brought by direct ownership that allows investors to actively choose whether to accept these trade-offs rather than passively inherit them. Within the DTCC framework, this choice space is almost nonexistent—because any innovation regarding "entitlements" must sequentially pass through layers of governance, operations, and regulation.

There are key differences between these two models. The DTCC model is much more compatible and scalable with the existing system, while the direct ownership model opens up greater space for innovations like self-custody.

Why they are (temporarily) not competing visions

The DTCC model and the direct ownership model are not competing routes; they address different issues.

DTCC's path is an upgrade to the existing indirect holding system, retaining core advantages such as net settlement, concentrated liquidity, and systemic stability. It is aimed at institutional participants that require scalable operations, settlement certainty, and regulatory continuity.

The direct ownership model meets another type of demand: self-custody, programmable assets, and on-chain composability. It serves investors and issuers who wish to gain entirely new functionalities, not just a "more efficient pipeline."

Even if direct ownership may reshape market structures in the future, this transition will inevitably be a multi-year process that requires simultaneous advancement in technology, regulation, and liquidity migration; it cannot happen quickly. The pace of advancing clearing rules, issuer behavior, participant readiness, and global interoperability is far slower than the technology itself.

Therefore, a more realistic prospect is coexistence: on one side, modernization upgrades of infrastructure; on the other, innovations in ownership. Today, neither side can replace the other in fulfilling its mission.

What this means for different market participants

These two tokenization paths have different impacts on market participants at various levels.

Retail Investors

For retail users, the DTCC upgrade is almost imperceptible. Retail brokers have already shielded users from most frictions (such as fractional shares, instant purchasing power, weekend trading), and these experiences will still be provided by brokers.

What truly brings change is the direct ownership model: self-custody, peer-to-peer transfers, instant settlement, and the possibility of using stocks as on-chain collateral. Today, stock trading has begun to appear through some platforms and wallets, but most implementations still rely on "wrapping/mapping" forms. In the future, these tokens may directly become real stocks on the register, rather than synthetic layers.

Institutional Investors

Institutions will be the biggest beneficiaries of DTCC's tokenization. Their operations heavily rely on collateral flow, securities lending, ETF fund flows, and multi-party reconciliations—areas where tokenized "entitlements" can significantly reduce operational costs and increase speed.

Direct ownership is more attractive to some institutions, especially opportunistic trading firms seeking programmable collateral and settlement advantages. However, due to liquidity fragmentation, broader adoption will gradually unfold from the market's periphery.

Brokers and Clearing Institutions

Brokers are at the center of the transformation. Under the DTCC model, their role is further strengthened, but innovation will gravitate towards them: clearing brokers that adopt tokenized entitlements first can differentiate themselves, while vertically integrated institutions can directly build new products.

In the direct ownership model, brokers are not "removed" but reshaped. Licensing and compliance remain necessary, but a batch of native on-chain intermediaries will emerge to compete with traditional institutions for users who value the characteristics of direct ownership.

Conclusion: The Real Winner is "Choice"

The future of tokenized securities does not lie in one model prevailing over the other, but in how the two models evolve in parallel and connect with each other.

Entitlement tokenization will continue to modernize the core of public markets; direct ownership will grow in the margins where programmability, self-custody, and new financial structures are more valued. The transition between the two will become increasingly smooth.

The ultimate result is a broader market interface: existing tracks will be faster and cheaper, while new tracks will emerge to support behaviors that the existing system cannot accommodate. Both paths will produce winners and losers, but as long as the path of direct ownership exists, investors will be the ultimate winners—gaining better infrastructure through competition and having the right to freely choose between different models.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。