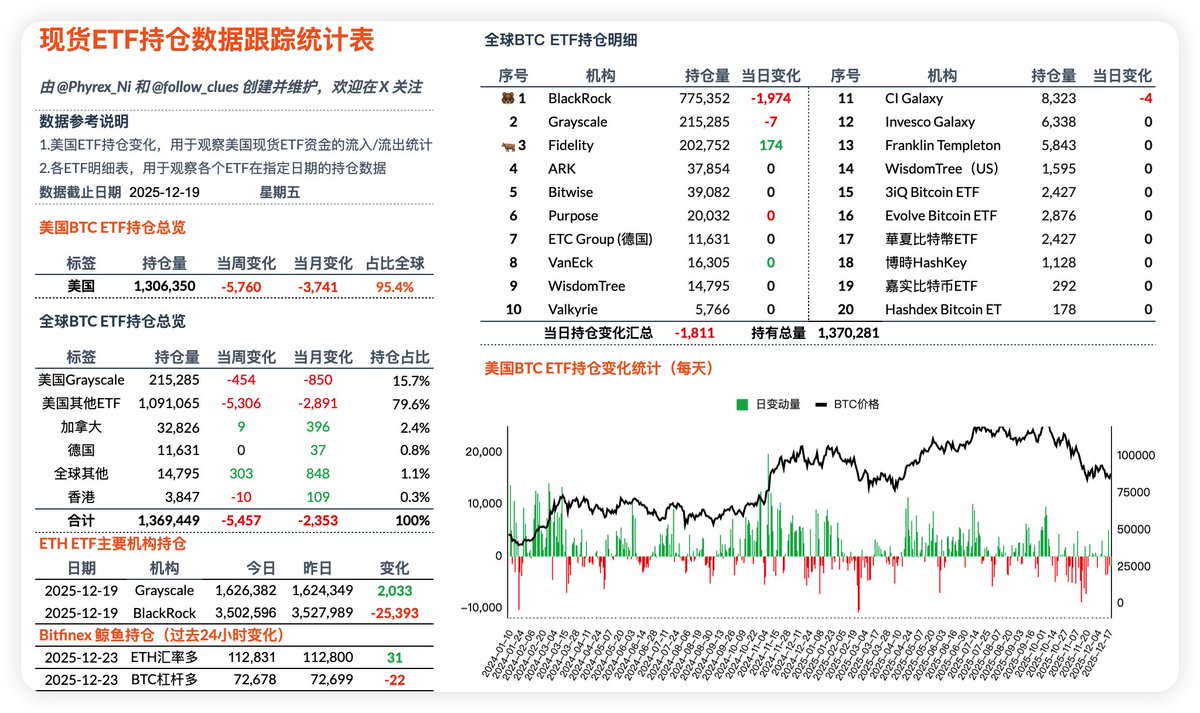

On Friday, the $BTC spot ETF data continued to remain lukewarm. Although there wasn't much net outflow, nearly 2,000 Bitcoins continued to flow out from BlackRock investors. Recently, I've looked at a lot of ETF data; $IBIT, although it has seen significant inflows this year, still shows negative returns up to now.

I calculated that this year, the highest institutional holdings of the U.S. spot ETF reached 1.362 million BTC, and by Friday, it was down to 1.306 million BTC, a total decrease of 56,000 BTC over more than two months, most of which were reductions by BlackRock investors, likely reallocating to U.S. stocks.

In contrast, other institutions have seen very little reduction. In the past 101 weeks, U.S. investors had a net outflow of over 5,700 BTC, while in the 100th week, the data still showed a net inflow of 3,100 BTC. The sentiment among traditional investors seems to be gradually deteriorating. However, the impact on spot prices is very minimal.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。