As 2025 winds down, Deribit—now a subsidiary of Coinbase—is preparing for its largest options expiry on record, with more than half of its total open interest rolling off on December 26. The event has become the defining market moment of the holiday week.

Deribit Chief Commercial Officer Jean-David Pequignot said the scale of the expiry reflects how far the market has evolved. “With a record-shattering $28.5 billion in notional value set to expire on December 26, this event represents more than 50% of the total open interest (OI) in options at Deribit,” he said, calling it the culmination of a year shaped by institutional participation rather than speculative excess.

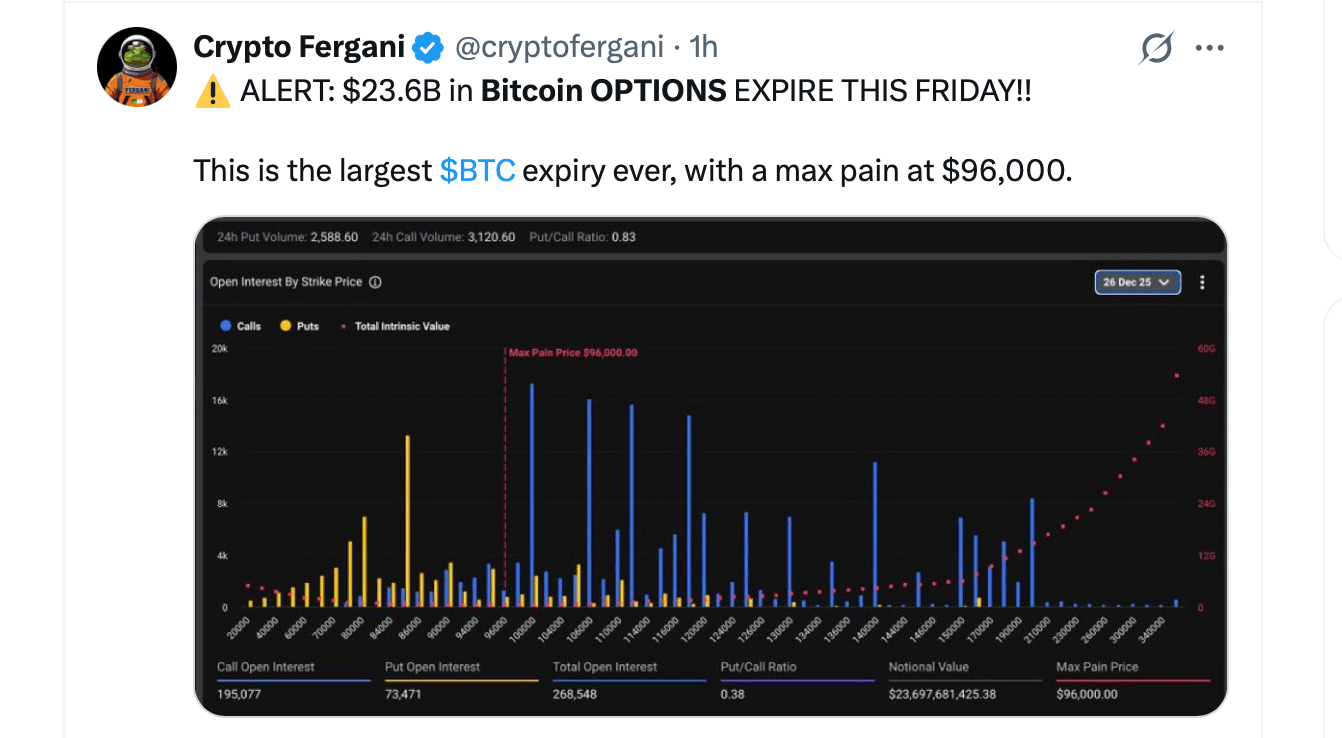

Friday’s bitcoin options expiry has been the talk of the town on social media as people have been hyping up the main event.

The year-end expiry includes roughly $24.3 billion in bitcoin ( BTC) options and about $4 billion in ethereum ( ETH) contracts—nearly double last year’s December expiry. Yet volatility remains muted, Pequignot emphasized that with bitcoin’s DVOL Index hovering near 45, it is signaling a relatively controlled market despite thinning holiday liquidity.

Bitcoin traded at $87,981 as of 3:30 p.m. EST on Monday, Dec. 22, positioning the spot price below the $96,000 “max pain” level for the expiry. The put-to-call ratio sits at 0.37, while a sizable $1.2 billion open interest cluster at the $85,000 strike could act as a short-term price magnet. Pequignot noted that the options skew has softened after late November and early December strength.

“The market has repriced the skew lower after a rally in late November and early December. 1-week and 1-month Put-Call skews remain in positive territory above 3%, down from 8-9% a few weeks ago,” Pequignot explained.

“This skew highlights a divergence: while the mid-term bias is call-heavy, targeting $100k-$125k via calls (spreads), the immediate demand for protective puts is expensive,” the Deribit exec added, highlighting a tension between bullish medium-term positioning and cautious year-end hedging.

Call-side positioning suggests heavy resistance near $100,000 to $102,000, where large option concentrations could cap any late-season rally unless volume meaningfully accelerates.

Traders have also been rolling defensive positions forward, shifting December downside puts into January structures. According to Pequignot, this reflects a market clearing risk ahead of key January catalysts, including the Federal Reserve’s late-January policy decision and an MSCI ruling tied to digital asset treasury (DAT) exposure.

Also read: Blackrock’s 2025 Investment Themes Put Bitcoin and IBIT Front and Center

There are 36 days on the calendar until the next Fed meeting and an 80% chance the central bank will not change the federal funds rate, according to CME’s Fedwatch tool. By Friday, the Boxing Day expiry is expected to reset positioning across the board—and it has already become the talk of the town on the social media platform X.

“Something big will happen on Friday this week,” one person wrote on X, adding, “If you have any money in crypto, you SHOULD NOT ignore this.”

Whether the expiry delivers fireworks or a quieter reset, the sheer scale of this Boxing Day event points to how derivatives now sit at the heart of crypto price discovery, with institutional positioning—not retail hype—calling the shots as markets head into 2026 and traders brace for a January packed with macro and index-driven catalysts.

- What is expiring at Deribit this week?

More than $28.5 billion in bitcoin and ether options are set to expire on Dec. 26. - Why does the $96,000 level matter for bitcoin?

It represents the max pain price where the most options expire worthless. - Is volatility expected to spike after the expiry?

Volatility remains moderate so far, but positioning could shift sharply post-expiry. - What comes next for crypto markets in January?

Traders are watching the Federal Reserve’s Jan. 28 decision and MSCI index-related developments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。