Author: Nikka / WolfDAO (X: @10xWolfdao)

Market Status and Core Turning Point

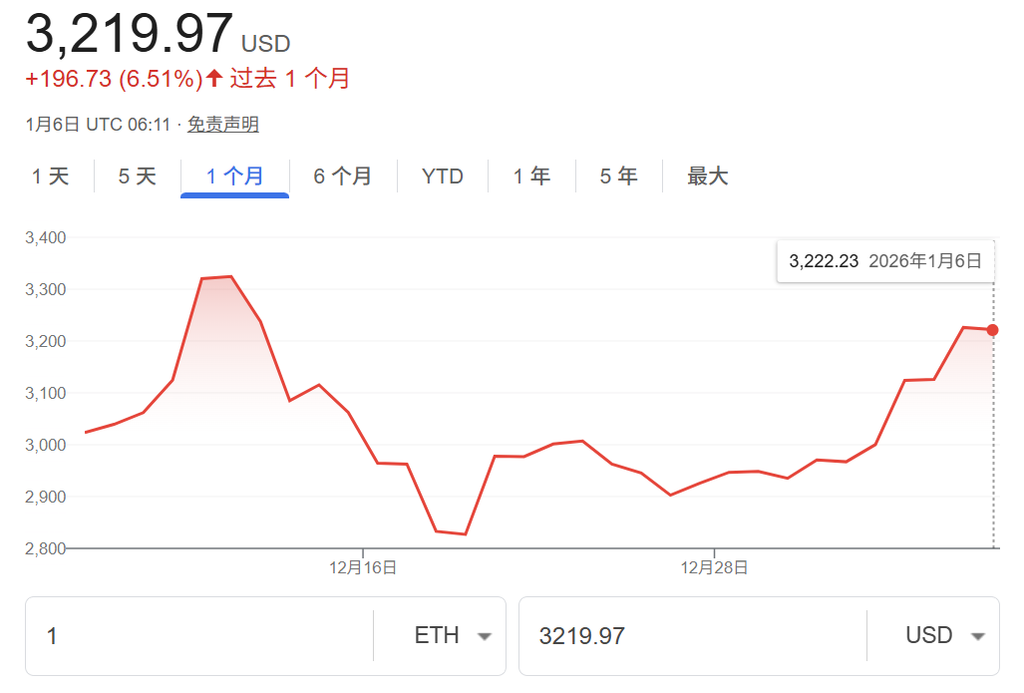

As we enter 2026, the total market capitalization of the crypto market has returned to over $3 trillion, with Bitcoin's dominance briefly dipping below 60%, sparking discussions about an "altcoin season." Ethereum is at a critical turning point. In the short term, it has surpassed $3,200, achieving a significant rebound from the lows at the end of 2025. Although it is still 34% away from the September 2025 high of $4,700, several early signals indicate that ETH may be brewing a structural rally.

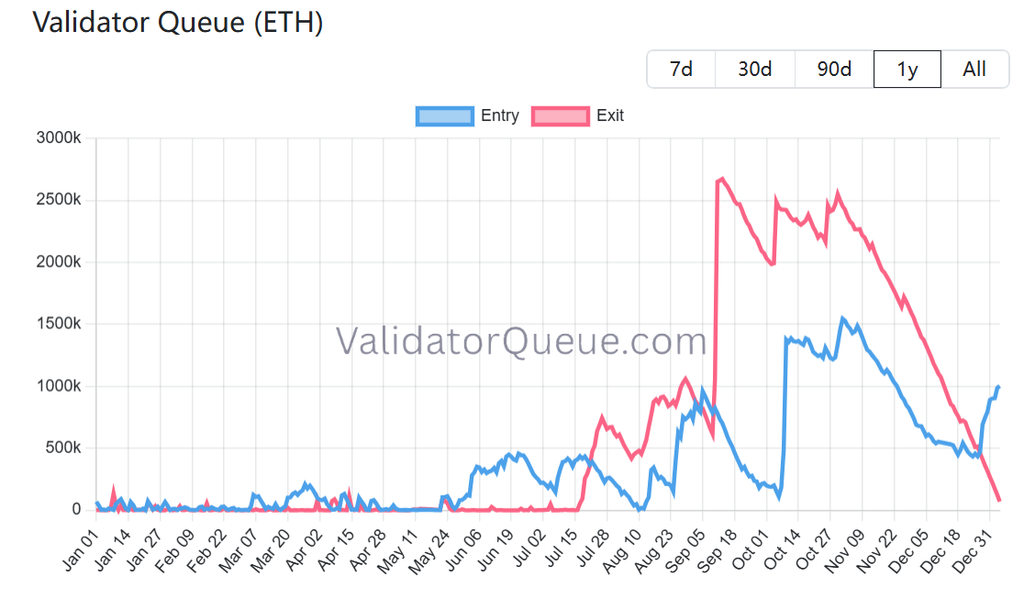

1. Staking Queue Reversal: Significant Reduction in Selling Pressure

The most important catalyst for 2026 comes from the dramatic reversal of the staking queue. For the first time since July 2025, a "shift in offense and defense" has occurred, marking a change in investor confidence from retreating to locking in.

Specifically, when ETH prices surged to around $4,700 in mid-September 2025, a total of 2.66 million ETH chose to exit staking, creating sustained selling pressure for several months. After three and a half months of digestion, only about 80,000 ETH remain waiting to exit, indicating that the source of selling pressure has essentially been eliminated. Meanwhile, the ETH waiting to enter staking has surged to 900,000 to 1 million, an increase of about 120% from 410,000 at the end of December. This number is 15 times that of the exit queue, causing the validator activation wait time to extend to 17 days.

Currently, the total amount of ETH staked has reached 35.5 million, accounting for 28.91% of the circulating supply, with an annualized yield maintained at 3-3.5%. Historical data shows that when the entry queue significantly outpaces the exit queue, it often signals a price increase. This supply lock-up will significantly reduce the liquid ETH in the market, combined with whales continuously buying over $3.1 billion since July 2025, forming a strong foundation for upward movement.

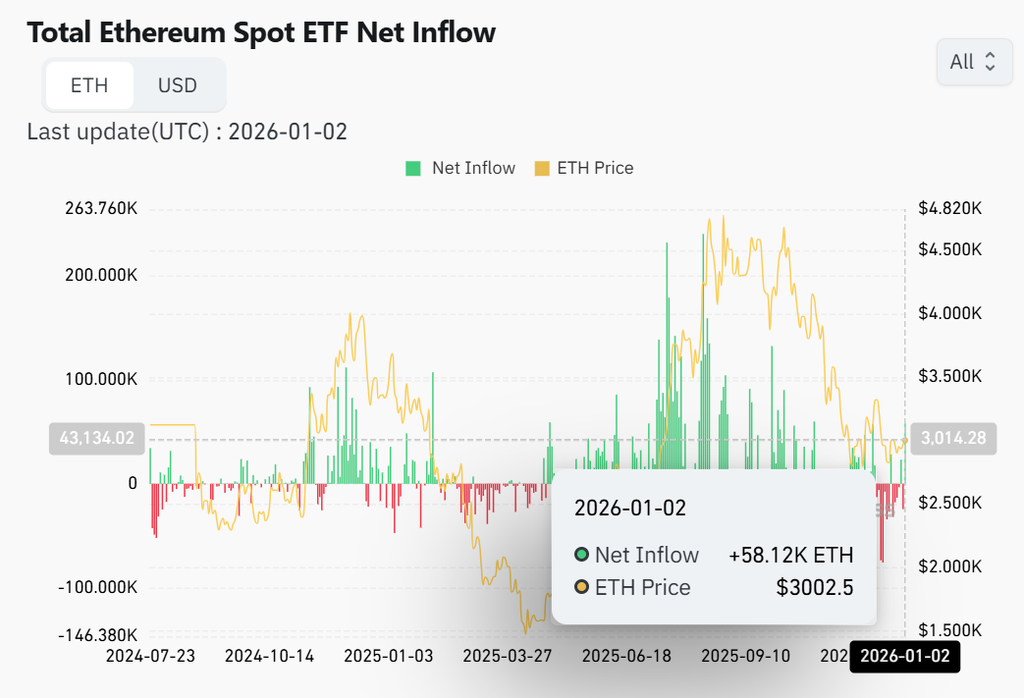

2. Institutional Involvement: From Passive Holding to Active Participation

If the staking reversal is a signal from the supply side, then the frenzy of institutional entry is the core driving force from the demand side. The world's largest Ethereum treasury company, BitMine Immersion Technologies, is rewriting the rules of the game. The company holds over 4.11 million ETH, accounting for 3.41% of the total supply, but more importantly, it is shifting from "passive holding" to "active earning."

In the last eight days, BitMine has staked over 590,000 ETH, worth over $1.8 billion. On January 3 alone, it staked 82,560 ETH, valued at approximately $259 million. The company plans to stake 5% of Ethereum's total supply through its own validator network, MAVAN, in the first quarter, expecting an annualized yield of $374 million. This aggressive action not only boosts the staking queue but also caused BMNR's stock price to soar by 14%.

The broader institutional trend is equally noteworthy. ETH spot ETFs saw cumulative inflows of over $9.6 billion in 2025, with a historical total inflow exceeding $125 billion. At the start of 2026, a single day saw net inflows reach $1.74 billion. BlackRock's ETHA fund holds about 3 million ETH, valued at nearly $9 billion. Institutions like Coinbase and Grayscale predict that 2026 will enter the "institutional era," with more ETP products and on-chain vaults doubling asset management scales.

Meanwhile, on-chain large holders accumulated addresses that bought over 10 million ETH in 2025, setting a historical high. These data collectively point to one fact: institutions no longer view ETH as a purely speculative asset but as an infrastructure asset with yield.

3. Technological Updates: Evolving into a Global Settlement Layer

2025 was a significant year for Ethereum technology. The Pectra and Fusaka upgrades laid a solid foundation for further breakthroughs in 2026. This is not just a simple performance optimization but a strategic transformation—turning Ethereum into a high-throughput, low-cost global settlement layer.

The Pectra upgrade was completed in the first half of 2025, with a core breakthrough being EIP-7251, which raised the validator staking limit from 32 ETH to 2048 ETH, greatly facilitating large-scale staking by institutions while increasing blob capacity, optimizing the validator mechanism, and reducing network congestion. This cleared technical barriers for aggressive staking actions by institutions like BitMine.

More critically is the Fusaka upgrade. Launched in December 2025, this upgrade introduced PeerDAS (peer-to-peer data availability sampling), fundamentally changing the way Layer 2 data is stored. Full nodes no longer need to download all blob data, theoretically supporting an increase in blob capacity by more than eight times, with Layer 2 fees expected to decrease by 40-90% in 2026. EIP-7892 allows for future dynamic adjustments to blob parameters without the need for hard forks, ensuring long-term scalability.

The roadmap extends into 2026 with even more aggressive plans. The upcoming Glamsterdam upgrade is expected to introduce Verkle Trees, enshrined proposer-builder separation (ePBS), and block-level access lists, pushing Layer 1 TPS to exceed 12,000+ and strengthening MEV extraction mechanisms, significantly enhancing network efficiency and revenue capture capabilities. These technological advancements are not just theoretical—smart contract deployment and invocation have both reached historical highs, with on-chain activity at unprecedented levels.

4. RWA Monopoly: Monopolists of a Trillion-Dollar Opportunity

Ethereum's dominance in the tokenization of real-world assets is becoming the strongest narrative engine for 2026. This is not just a self-congratulatory moment within the crypto circle, but a vote of confidence from traditional financial institutions with real capital.

According to the latest statistics from RWA.xyz, the TVL of tokenized assets on the Ethereum chain has reached $12.5 billion, with a market share of 65.5%, far exceeding BNB Chain's $2 billion and Solana and Arbitrum's less than $1 billion each. Wall Street giants like BlackRock and JPMorgan have massively tokenized government bonds, private credit, and fund products on-chain. The RWA market grew over 212% in 2025, surpassing $12.5 billion, while institutional research shows that 76% of asset management companies plan to invest in tokenized assets by 2026.

Institutions predict that the RWA market will achieve more than tenfold expansion in 2026. As the most mature and secure settlement layer, Ethereum will capture the vast majority of value from this trillion-dollar opportunity. The clarification of regulatory frameworks—especially the CLARITY Act and stablecoin legislation expected to be implemented in the first half of the year—will further accelerate this process.

The stablecoin sector is also heavily skewed. Ethereum supports over $62 billion in circulation, accounting for over 62%, and holds a 68% share in DeFi TVL. Institutional-level scenarios such as B2B payments and cross-border settlements are rapidly migrating on-chain, with an Artemis report indicating steady growth in Ethereum stablecoin B2B payment volumes between 2024 and 2025. This is not speculative capital but the real demand of the实体经济.

Conclusion

With the combined forces of supply, demand, and technology, Ethereum is highly likely to achieve a narrative flip from "follower" to "leader" in 2026. This will be a structurally driven bull market led by institutions, rather than a speculative frenzy driven by retail sentiment.

For the E-Guardians who have endured hardships over the past few years, 2026 may be the year of waiting for rewards. However, possibility rather than inevitability, patience and rationality remain essential in this harsh market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。