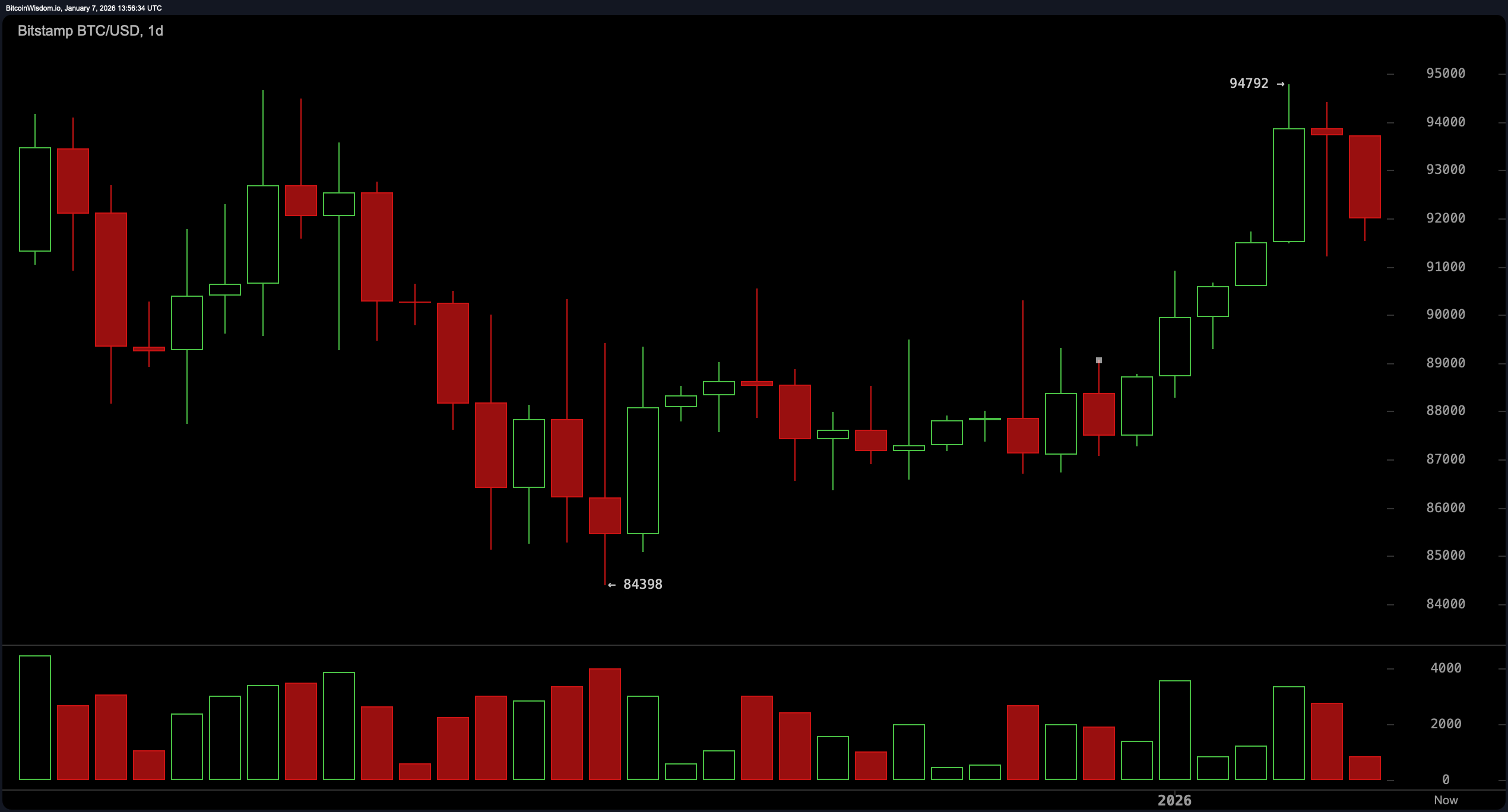

On the daily chart, bitcoin is exhibiting textbook exhaustion after a powerful surge from around $84,398 to a peak near $94,792. But those champagne corks popped a little too early — the celebratory rally met a cold shoulder at resistance near $94,000–$95,000. Recent large-bodied red candles, accompanied by high volume, hint at a distribution phase, possibly with institutional players discreetly slipping out the side door.

The 88,000–89,000 zone remains the neckline of interest, acting as a support shelf. Should price action wander back down there, it’ll be a critical area to monitor for a potential bounce — or a further stumble.

BTC/USD 1-day chart via Bitstamp on Jan. 7, 2026.

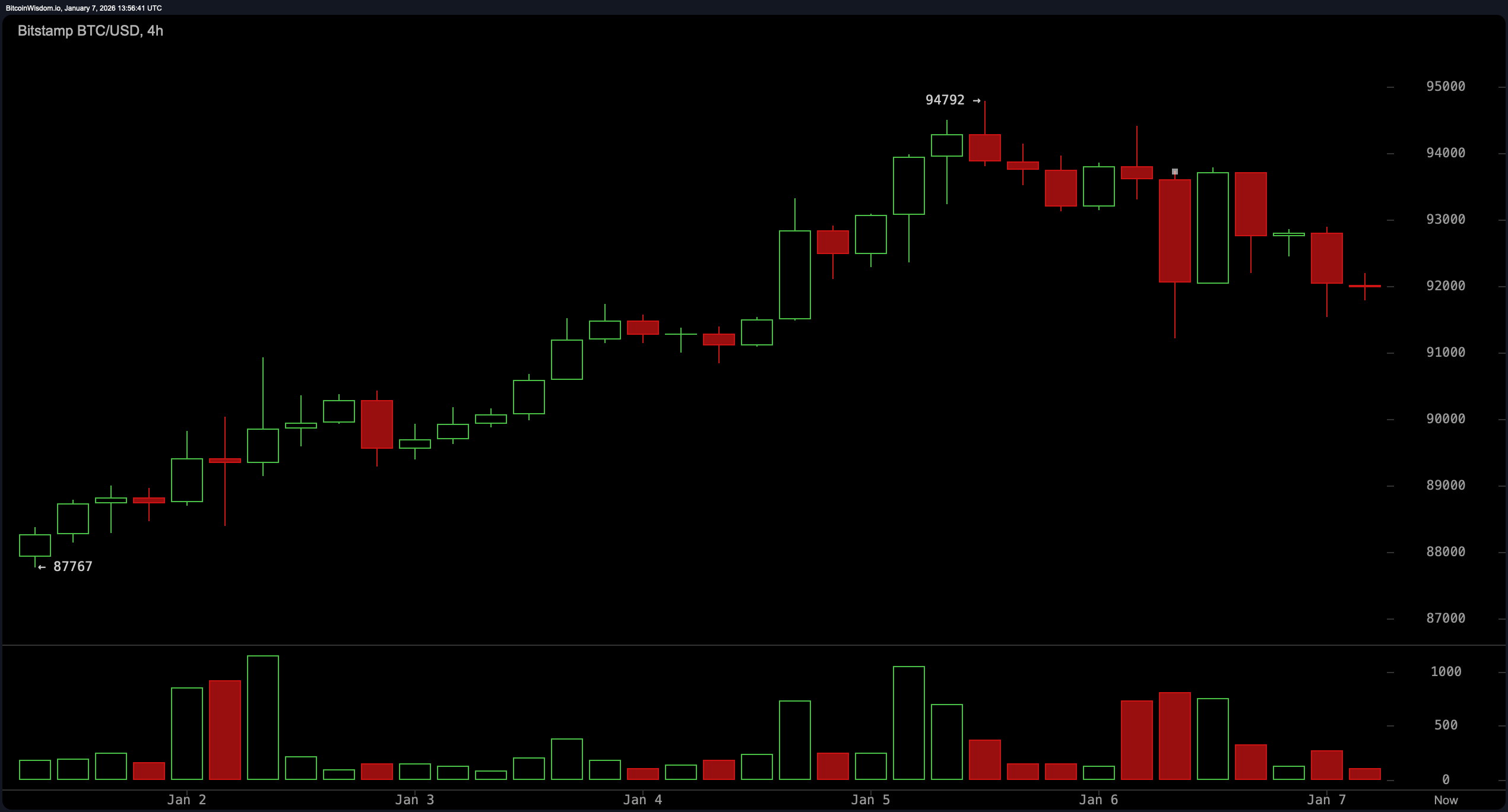

Zooming into the 4-hour chart, bitcoin isn’t exactly painting a picture of strength. Lower highs and lower lows are the name of the game, and it’s looking like the bears brought their A-game. After a harsh rejection at 94,792, the price has been sliding with red candles leading the charge. Volume has been rising — not the good kind — on selling pressure, putting the spotlight on the micro support zone around $91,800 to $92,000. Unless bulls stage a comeback rally with volume to back it, the next chapter might include a test of the 90,000 region.

BTC/USD 4-hour chart via Bitstamp on Jan. 7, 2026.

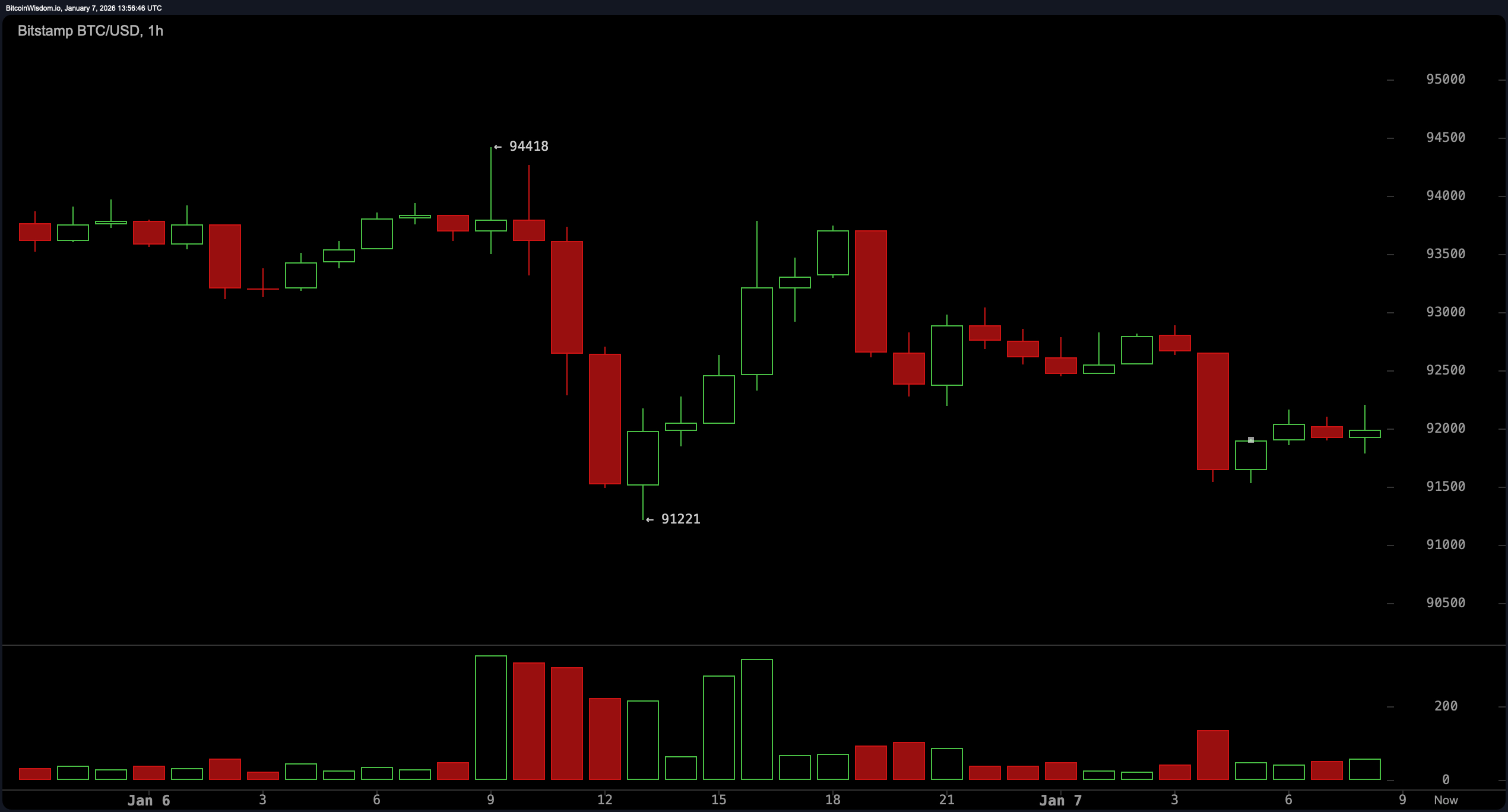

Over on the 1-hour chart, things are looking eerily calm — and not in a good way. Bitcoin is caught in a state of short-term consolidation, bouncing between 91,500 and 92,500 like it forgot which way it was headed. Each rebound is limper than the last, a classic signal that buying interest is fading faster than New Year’s resolutions. Sellers remain dominant, with every upward attempt sputtering out quickly. A break below 91,500 could usher in a test of the psychological 90,000 level, while reclaiming 93,000 might reignite some short-term optimism.

BTC/USD 1-hour chart via Bitstamp on Jan. 7, 2026.

From a technical indicator perspective, it’s a mixed bag with a dash of attitude. The relative strength index ( RSI) sits at 57 — neither hot nor cold, just Switzerland-neutral. The Stochastic oscillator is screaming overbought at 81, while the commodity channel index (CCI) echoes the same with a value of 142. Momentum is slipping, clocking in at 4,125 — yet another warning bell. The moving average convergence divergence ( MACD) is still flashing green with a level of 667, giving a faint glimmer of strength amid broader weakness.

Moving averages, though, are where bitcoin still manages to turn a few heads. On the short-term side, everything from the exponential moving average (EMA) and simple moving average (SMA) at 10, 20, 30, and 50 periods all favor continued upward momentum. But the longer-term 100 and 200-period averages — both EMA and SMA — are decisively in the opposite camp, suggesting a looming reckoning if bulls don’t reclaim higher ground. In sum, the short game might still be in play, but the long game is asking tough questions.

Bull Verdict:

If bitcoin can hold the line above the 91,800 threshold and bounce with meaningful volume, the bulls might just wrangle control of the wheel again. A push past 93,000 would signal that the uptrend isn’t ready to bow out — not yet, anyway.

Bear Verdict:

Should bitcoin fail to defend the 91,500 support zone, the bears will likely take the reins, with 90,000 — and possibly 88,000 — in their crosshairs. Momentum favors the downside, and unless something shifts fast, this party might be heading for a lights-out moment.

- What is the current bitcoin price range?

Bitcoin is trading between $91,926 and $92,022 as of January 7, 2026. - Where is bitcoin facing resistance?

Strong resistance is seen between $94,000 and $95,000. - What support level should traders watch?

Key support zones are at $91,500 and $88,000. - Is bitcoin’s trend bullish or bearish right now?

Momentum has turned bearish in the short term across multiple timeframes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。