As the largest liquid staking protocol on Hyperliquid, Kinetiq has over $700 million in TVL (primarily from the liquid staking token kHYPE), making it a key infrastructure layer in the HyperCore and HyperEVM ecosystems. Based on Hyperliquid's HIP-3 protocol, Kinetiq has pioneered the "Exchange-as-a-Service" business model through its Launch platform. The flagship DEX product Markets, built through Launch, is the first HIP-3 exchange and is expected to go live on January 12, supporting perpetual contract trading for assets such as BABA, crude oil index, energy index, Russell 2000 index, and bond index.

BlockBeats interviewed Kinetiq founder Omnia. The interview covered their transition from LST protocol to "exchange curation platform," the competitive landscape of HIP-3 exchanges, and strategies for attracting institutional capital. We also discussed the utility of the newly launched $KNTQ token and how Kinetiq designs mechanisms to align incentives among builders, traders, and stakers.

Full interview:

Belief in Hyperliquid

BlockBeats: Let's start from the beginning. You mentioned in a tweet that your journey into Hyperliquid began in May 2023 when you listened to a podcast featuring Jeff. What specific "alpha" or insights from that podcast ignited your belief? What made you so confident in fully committing to building within Hyperliquid even before it became widely recognized?

Kinetiq: Yes, that podcast is called "Flirting with Models," and Jeff was a guest, which led us to discover Hyperliquid. It was a very insightful podcast that clearly showcased Jeff's high level of intelligence. The topic of Hyperliquid mainly appeared in the latter half of the podcast. What was most appealing was that this perpetual contract DEX is built on its own chain. We have extensive experience in deeply using and understanding these protocols over the past few years, and Hyperliquid's construction on its own chain piqued our interest greatly; the rest is history.

BlockBeats: Speaking of the broader ecosystem, Hyperliquid is facing fierce competition from emerging Perp DEXs like Lighter and Extended. As a core infrastructure builder, how do you view these challenges? What do you believe is Hyperliquid's core moat to ensure its long-term leadership?

Kinetiq: We firmly believe that Hyperliquid's moat is durable for the following reasons:

The network effects between market makers and takers on Hyperliquid have been proven, and even after the genesis airdrop, Hyperliquid has maintained strong data across all time periods. While other Perp DEXs that have not yet undergone TGE have caused some very short-term market share erosion, we want to point out that once these competing challengers undergo TGE, Hyperliquid's market share has healthily recovered.

We believe that the core team's focus on optimizing core infrastructure + core product is the right approach. This allows the core team to concentrate on ensuring that Hyperliquid's technology can scale to multiples of its current capacity while allowing other teams to build products on top of it, helping to shift the burden of business development from the core team to the community.

Jeff, Iliens, and the team have proven to be world-class in execution and integrity, and we believe this gives ecosystem participants (traders, market makers, builders) a high level of comfort, making us willing to participate long-term. There is no other ecosystem in the crypto space that deserves this level of effort and commitment.

Markets and the HIP-3 Ecosystem

BlockBeats: Kinetiq is preparing to deploy the first decentralized exchange "Markets" through the Launch platform. Why is it so important for Kinetiq to build its own HIP-3 DEX "reference implementation"? Is the goal of Markets to compete directly with other projects deployed through Launch, or is it more of a showcase and guiding model for the ecosystem?

Additionally, how do you think Markets will differentiate itself from other HIP-3 exchanges like trade.xyz and Felix? Considering it is directly supported by the Kinetiq team, what unique advantages does Markets bring?

Kinetiq: Kinetiq has always viewed HIP-3 as a key upgrade for Hyperliquid, transforming HyperCore from a product into a platform. HyperCore has demonstrated unprecedented commercialization potential, and the addition of HIP-3 now brings productization potential. Therefore, Kinetiq has always hoped to leverage HIP-3 to expand our core business beyond liquid staking, which sets us apart in all LST protocols and even in the exchange space. This includes Launch and Markets, both of which benefit from the distribution capabilities Kinetiq has established for kHYPE.

We do not see Markets as direct competition with other HIP-3 products. In our view, most DEXs have their unique advantages in terms of unique asset selection or unique collateral options. Markets aims to be a general-purpose HIP-3 DEX covering traditional asset classes. We plan to differentiate ourselves in the following ways:

- Asset selection: We will bring the most sought-after assets into the perpetual contract framework and pay close attention to the details of oracle construction.

- Top-tier liquidity.

- Top-tier UI/UX and user guidance.

- Cost competitiveness: Using USDH as collateral, benefiting from discounts on Aligned Quote Assets.

BlockBeats: A key challenge of the HIP-3 model is the risk of liquidity fragmentation. As more exchanges launch the same stock perpetual contracts, how does Kinetiq plan to address this issue? Will the Launch platform provide direct support for the exchanges it helps deploy, such as shared liquidity solutions or market maker resources?

Kinetiq: First, we maintain a list of potential listing codes, and a key metric we track is the potential taker trading volume. We do our utmost to ensure that every code listed on Markets has strong taker demand, which naturally incentivizes market makers to conduct business on Markets.

Secondly, a certain degree of liquidity fragmentation is inevitable. Whenever we list a trading asset, we are always committed to making it the authoritative trading code among all HIP-3 products tracking the same underlying asset. Regarding liquidity issues, we have strong relationships with market makers who have expressed their intention to provide strong liquidity on Markets.

Stock Perpetual Contracts and Institutional Capital

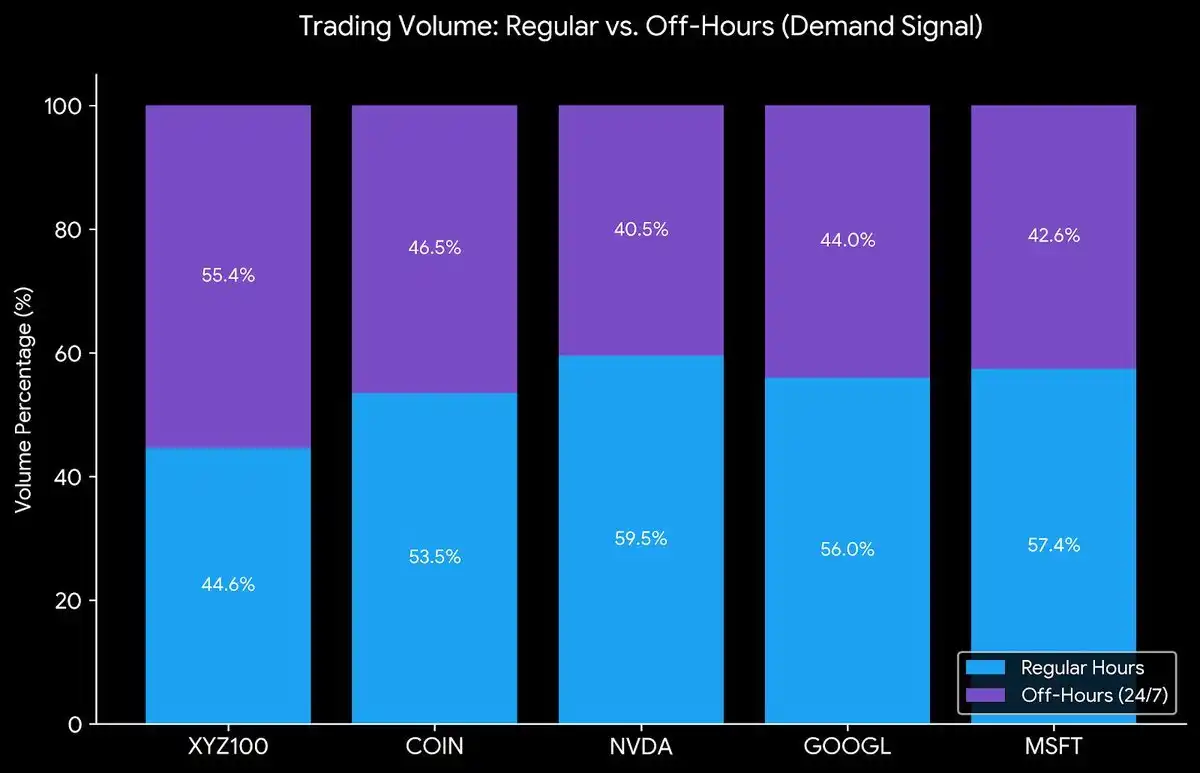

BlockBeats: Kinetiq co-founder Magnus's analysis of 24/7 trading of stock perpetual contracts shows that 30-55% of trading volume occurs outside traditional market hours, which is a strong validation. Beyond crypto-native traders, do you think this is enough to attract the interest and capital of traditional finance players? What key obstacles need to be overcome to achieve this?

Kinetiq: We believe that as a leveraged tool, perpetual contracts are better than options because they are products with Delta equal to 1, and returns are based on price, unlike options that require consideration of technical factors such as volatility and time decay. This will be a key differentiating factor in winning retail trading volume in the future.

We also believe we have observed early interest from institutions in RWA perpetual contracts, as they see blockchain as a more efficient distribution channel for RWA assets (spot and perpetual contracts). Their main considerations are liquidity depth and oracle construction. The latter is extremely important because if oracle construction and backtesting are not done properly, there may be multiple opportunities for arbitrage and malicious attacks. Therefore, oracle construction is a key task for the launch of Markets.

For both retail and institutional capital, the key obstacles to overcome are the fear of the on-chain environment and the lack of proper education. Therefore, Markets is committed to simplifying as many on-chain operational aspects as possible at the UX level to make it as friendly as possible to traditional finance.

BlockBeats: You partnered with Hyperion DeFi to launch iHYPE, a permissioned fund pool that complies with KYC/KYB standards. Why is it crucial for a decentralized protocol like Kinetiq to have a dedicated institutional channel? Do you see iHYPE as the main bridge for traditional financial capital to enter the Hyperliquid ecosystem?

Kinetiq: Hyperliquid has achieved tremendous success in a short time, not only in token price but also in fundamental performance and profitability. Its unique position lies in the fact that it is a project that traditional finance can easily evaluate from a fundamental perspective. Therefore, Kinetiq's argument is that compared to other projects, HYPE's DAT and ETF have a much higher potential for good performance. These DATs and ETFs will ultimately require a compliant staking solution to generate more returns for their shareholders. We are confident that iHYPE is that preferred tool.

BlockBeats: You also partnered with Native Markets to support $USDH. Why is a native stablecoin so crucial for the success of the perpetual contract market on HyperCore? How does the Kinetiq ecosystem plan to support and accelerate the adoption of USDH?

Kinetiq: Kinetiq has chosen USDH as collateral for Markets and as the primary pairing asset for our governance token KNTQ. We have also built workflows to simplify the process of exchanging USDC for USDH on Markets, allowing users to seamlessly enter Markets and use USDH.

Business Model and Token Empowerment

BlockBeats: The Launch model relies on crowdfunding a margin of 500,000 HYPE, which may attract yield-seeking "mercenary capital." How do you ensure that the incentives of these crowdfunders align with the long-term growth vision of the builders? What mechanisms are in place to prevent capital flight after the initial mining period ends?

Kinetiq: Launch aims to achieve a win-win for deployers and stakers. Project teams will be able to guarantee that at least 500,000 HYPE is staked, with the staking period determined by them at the start of fundraising. After the initial period expires, they can seek to renew with the community to maintain continued staking, even replacing part of the community stake with their own funds. This provides them with a flexible solution to gain community support and ownership at the outset while overcoming any issues related to the redemption of staked tokens.

We also encourage project teams to align with stakers through a hybrid approach of token and revenue sharing. Again, the fact that Markets launched before any Launch project validates the Launch model and demonstrates some market standards regarding revenue sharing.

BlockBeats: Markets allocates 10% of its revenue to kmHYPE holders, with 90% used for growth. What is the long-term vision behind this ratio? As the ecosystem matures, might we see a shift where KNTQ stakers (sKNTQ holders) begin to capture a portion of fees directly from all exchanges deployed through Launch?

Kinetiq: KNTQ is at the very center of the Kinetiq protocol, enjoying priority across all Kinetiq business lines, so value is directed from all Kinetiq business lines to KNTQ holders through sKNTQ. We recently announced how sKNTQ accumulates value from various aspects of the Kinetiq protocol, including programmatic KNTQ buybacks utilizing all revenue sources and burning 100% of KNTQ trading fees on HyperCore. More details can be found in this article we posted on Twitter.

BlockBeats: Besides deploying exchanges, what other innovations do you foresee on the Launch platform? Is it possible that we will see it used to create novel financial products, structured products, or even non-financial applications utilizing the HIP-3 framework?

Kinetiq: Launch is envisioned as a permissionless LST infrastructure that enables deployers wanting to launch their customized DEX to leverage HIP-3 functionality. You can think of Launch as a combination of Shopify and Kickstarter, as it is a ready-made platform that allows for the creation of permissionless LSTs and the option to adopt HIP-3 features, allowing protocols to fully own their distribution channels without having to build independent staking protocols or LSTs from scratch, while also benefiting from Kinetiq's support in contract security, making it highly capital efficient compared to any possible alternatives. Financial products/structured products are likely to be built on kHYPE, as it has strong existing distribution channels among stakers and is well integrated within the Hyperliquid ecosystem.

BlockBeats: BlockBeats has a large and enthusiastic readership in the Chinese-speaking world, and many Chinese users are actively participating in the Hyperliquid ecosystem. What would you like to say to the builders, traders, and HYPE holders in this community? Are there plans for more direct interaction with the Chinese market in the future?

Kinetiq: First of all, we want to thank all the friends who support Hyperliquid and Kinetiq. Kinetiq is not just an LST project; we are a team of builders dedicated to developing high-quality products tailored to the needs of Hyperliquid. We place great emphasis on user experience, and everyone is welcome to provide feedback in our Discord. We also welcome other Hyperliquid builders to reach out to us to explore collaboration opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。