Original | Odaily Planet Daily (@OdailyChina)

On January 9, the venture capital giant Andreessen Horowitz (a16z), which is extremely active in the cryptocurrency market, announced the completion of a new fundraising of $15 billion, the largest fundraising since the establishment of the institution, accounting for more than 18% of the total venture capital in the United States in 2025.

In the relatively short official announcement, a16z mentioned cryptocurrency twice, with the most critical statement being, “Our mission is to ensure that America wins the technological competition of the next 100 years, starting with winning the key architectures of the future—artificial intelligence and cryptocurrency technology,” indicating that a16z, now well-funded, will continue to lay out in the cryptocurrency market.

Six Major Directions Breakdown

According to a16z's plan, this round of funding will be allocated to six major directions, with the American Dynamism fund receiving $1.176 billion, the App fund receiving $1.7 billion, the Bio + Health fund receiving $700 million, the Infrastructure fund receiving $1.7 billion, the Growth fund receiving $6.75 billion, and the Other Venture Strategies fund receiving $3 billion.

Although a16z did not explicitly plan a dedicated cryptocurrency fund in this fundraising, these six major directions actually have significant intersections with cryptocurrency.

First is the American Dynamism fund, which is a direction a16z has been promoting in recent years with a clear “political” color. Its core goal is to use venture capital to rebuild America's “hard power” and national competitiveness. This fund will primarily invest in aerospace, defense, public safety, education, housing, supply chain, industry, and manufacturing—objectively, the intersection of this fund with cryptocurrency is not large.

Next is the App fund, one of a16z's most traditional and VC-like funds, with a core goal of focusing on application-layer products that can be directly used by users. This fund will mainly invest in consumer internet products, AI applications, creator tools, social products, content services, games, fintech, and Web3 applications, etc.—this is also the direction where a16z's cryptocurrency narrative is most easily realized.

Then there is the Bio + Health fund, which represents a long-term bet by a16z “beyond pure technology,” aiming to transform life sciences and healthcare systems using software, data, and engineering thinking. The main investment areas of this fund include biotechnology, drug development platforms, gene editing, synthetic biology, medical data and AI diagnostics, medical infrastructure software, etc.—this part has little direct intersection with cryptocurrency, but DeSci is expected to become a potential crossover point.

The Infrastructure fund focuses on infrastructure, with a core goal of providing irreplaceable technological foundations for the next generation of applications and platforms. The main investment areas of this fund include cloud computing and distributed systems, AI infrastructure, data platforms, developer tools, network protocols, and blockchain underlying protocols (L1, L2, other tools)—this is another core battlefield for a16z in the cryptocurrency field, aside from the App fund.

The Growth fund primarily invests in post-Series C and Pre-IPO stages, with a core goal not to seek new opportunities but to amplify returns by supporting already validated winners. This fund mainly invests in mature tech companies, AI platforms, fintech unicorns, and established Web3 infrastructure or applications—information from a16z's official website indicates that Coinbase, Kalshi, and others are clearly categorized here.

The Other Venture Strategies fund is relatively special; it does not have a single theme but is more like a flexible “tactical fund pool,” usually used for special structured transactions, cross-fund collaborative investments, testing in emerging fields, secondary market opportunities, regional or thematic experimental funds, etc.—this fund has little direct intersection with cryptocurrency, but it cannot be ruled out that temporary associations may occur at special junctures, such as responsive actions during certain policy windows.

Looking at the six proposed layout directions of this $15 billion fund, the App fund, Infrastructure fund, and Growth fund will be the main blood transfusion channels for a16z into the primary cryptocurrency market. Among them, the App fund and Infrastructure fund will focus more on the application layer and protocol layer projects native to the cryptocurrency market, while the Growth fund will focus more on platform services like exchanges and prediction markets, with a tendency to invest in leading players that have already shown positional advantages.

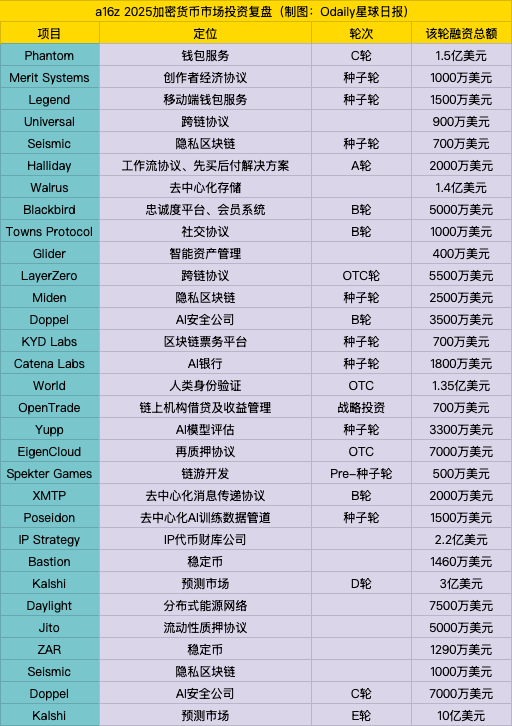

2025, a16z's Investment Review

According to incomplete statistics from Odaily Planet Daily, a16z made a total of 31 investments in the broader cryptocurrency field over the past year, including two investments in prediction market Kalshi, AI security company Doppel, and privacy blockchain Seismic—especially Kalshi, where a16z first co-led a $300 million Series D funding round with Sequoia in October, with a valuation of $5 billion; then in November, it participated in the company's $1 billion Series E funding round at a valuation of $11 billion—this is also a16z's largest bet in the cryptocurrency field last year.

From the statistics in the above chart, aside from the heavy investment in prediction markets, wallet services, privacy blockchains, stablecoins, and the intersection of AI and cryptocurrency are a16z's key focus areas for 2025, and these subfields can be categorized under the blockchain underlying protocols and tools covered by the Infrastructure fund, as well as the fintech and AI applications covered by the App fund.

2026, a16z Made This Prediction

On New Year's Day 2026, a16z Crypto officially published a New Year outlook article. In the article, a16z mentioned 17 potential advancements that excite them for 2026, which may contain the institution's focus directions for future layouts.

These 17 potential advancements are:

- Privacy will become the most important moat in the cryptocurrency field;

- Prediction markets will become larger, broader, and smarter;

- Thinking about the tokenization of real-world assets and stablecoins in a more “crypto-native” way;

- Trading is just a transit station for cryptocurrency business, not the endpoint;

- From “Know Your Customer” (KYC) to “Know Your Agent”;

- Better and smarter stablecoin deposit and withdrawal channels;

- Stablecoins will initiate an upgrade cycle for bank ledgers and create new payment scenarios;

- The future of instant communication will not only be quantum-resistant but also decentralized;

- Moving from “code is law” to “regulation is law”;

- Cryptographic technology is providing a new type of foundational primitive that can transcend the use of blockchain itself;

- We can now use AI to perform substantive research tasks;

- “Invisible taxation” in the open internet;

- The rise of Staked Media;

- “Secrets-as-a-Service”;

- Wealth management for everyone;

- The internet is becoming a bank;

- When the legal framework finally matches the technological framework, the full potential of blockchain will be unleashed.

Among these 17 potential advancements, some explicitly mention specific business models, including the areas a16z has already focused on, such as privacy, prediction markets, stablecoins, and AI, and a16z also directly provides optimization paths for related models, such as the need for smarter stablecoin deposit and withdrawal solutions.

At the same time, another part of the potential advancements belongs to the imagination of future conditions, such as the internet eventually becoming a bank, but how these imaginations should be realized is not clearly answered by a16z—this question needs to be left to entrepreneurs who can bring innovative solutions, and they are precisely the targets a16z wants to find with this $15 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。