Bitgo Files Amended S-1

The amendment, filed Jan. 12, details an offering of 11.8 million shares of Class A common stock, including 11 million shares sold by the company and 821,595 shares offered by existing stockholders. Bitgo said it expects the IPO price to fall between $15 and $17 per share, though final terms have not been set.

Founded in 2013, Bitgo Holdings, Inc. positions itself as a digital asset infrastructure provider serving institutional clients. Its platform spans self-custody wallets, regulated custody, staking, liquidity services and infrastructure-as-a-service offerings used by exchanges, financial institutions, corporations and government entities.

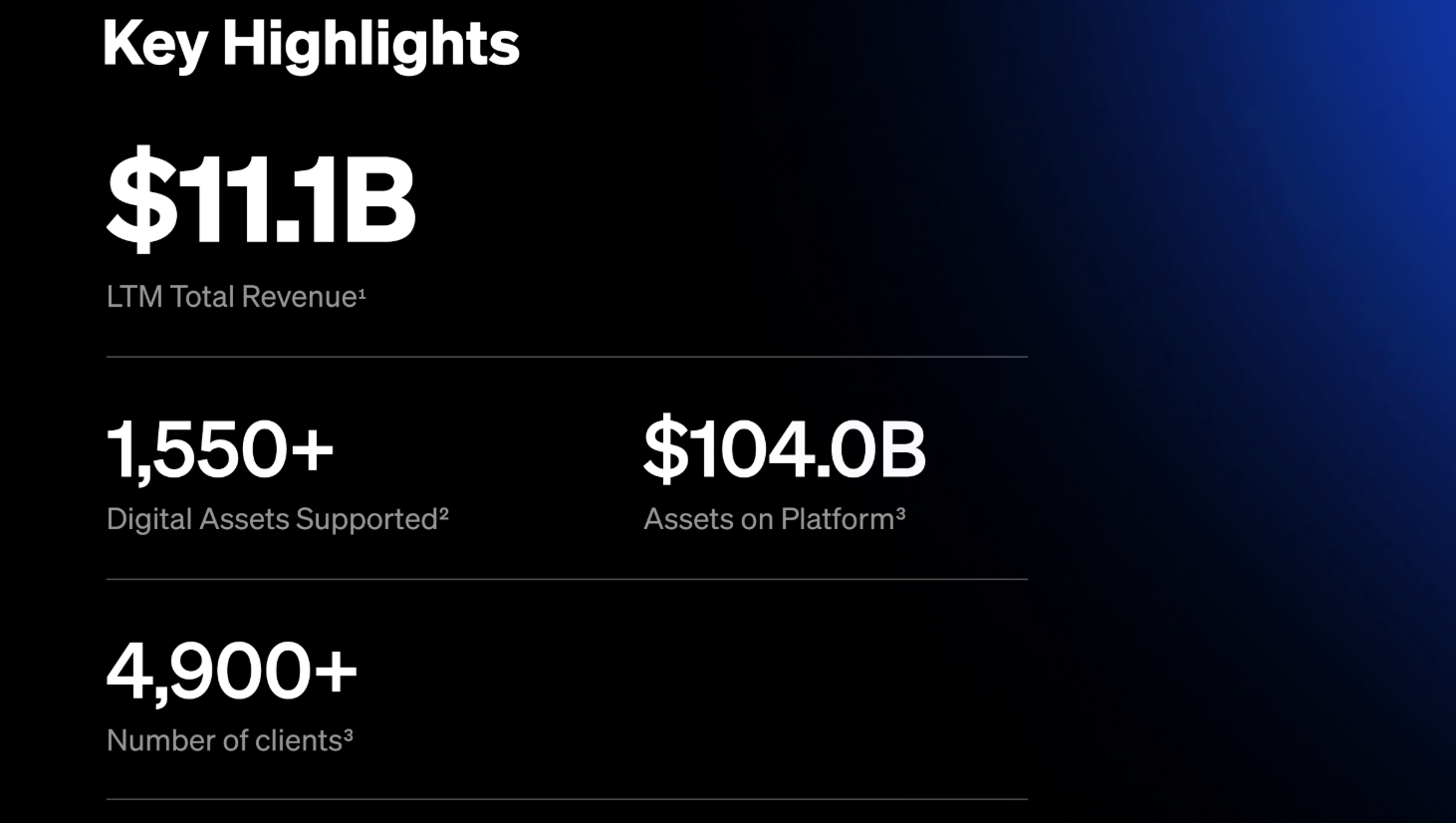

In the filing, Bitgo reported supporting more than 1,550 digital assets and safeguarding approximately $104 billion in assets on platform as of Sept. 30, 2025. The company said it served more than 5,100 clients and roughly 1.18 million users across more than 100 countries, reflecting its focus on large-scale institutional adoption rather than retail trading.

Source: Bitgo’s amended S-1 filing.

Financially, the filing shows a sharp increase in activity during 2025. Bitgo estimates total revenue for the year ended Dec. 31, 2025, in a range of $16.02 billion to $16.10 billion, up from $3.08 billion in 2024. Most of that revenue stems from digital asset sales activity conducted on a principal basis, with corresponding costs nearly matching revenue.

Despite thin operating margins, Bitgo expects to post a modest operating profit of between $3.2 million and $3.5 million for 2025, compared with an operating loss of nearly $7 million the prior year. Management attributed the improvement to increased trading volumes, a growing client base and the launch of new services.

Source: Bitgo’s amended S-1 filing.

One of those new lines is Stablecoin-as-a-Service, which generated an estimated $63 million to $67 million in revenue during 2025 after launching earlier in the year. The company also recorded staking revenue of roughly $367 million to $387 million, down from 2024 due to lower digital asset prices.

Governance, however, is likely to draw close attention from investors. Bitgo plans to maintain a dual-class share structure in which Class B shares carry 15 votes each, compared with one vote per Class A share. As a result, co-founder and CEO Michael Belshe would control more than half of the company’s voting power following the offering.

Because of this structure, Bitgo will qualify as a “controlled company” under New York Stock Exchange (NYSE) rules, allowing it to rely on certain governance exemptions. The company said it does not currently plan to use those exemptions, though it acknowledged it may do so in the future.

Also read: Saylor’s Strategy Stacks 13,627 More BTC as Bitcoin Hoard Nears 690K

The filing also highlights Bitgo’s regulatory posture. In December, its trust subsidiary received approval to convert into a federally regulated national trust bank under oversight from the Office of the Comptroller of the Currency (OCC), a move the company says strengthens its standing with institutional clients.

Bitgo will not receive proceeds from shares sold by existing stockholders, and it cautioned that the offering remains subject to market conditions and regulatory review. Still, the amended filing places the company firmly on the runway to public markets, complete with scale, ambition and a governance structure investors will have to weigh carefully.

FAQ ❓

- What is Bitgo planning?

Bitgo plans to go public through an initial public offering on the New York Stock Exchange under the ticker BTGO. - How much revenue did Bitgo report for 2025?

The company estimates total revenue between $16.02 billion and $16.10 billion for 2025. - Who controls voting power at Bitgo?

Co-founder Michael Belshe is expected to retain majority voting control through Class B shares.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。