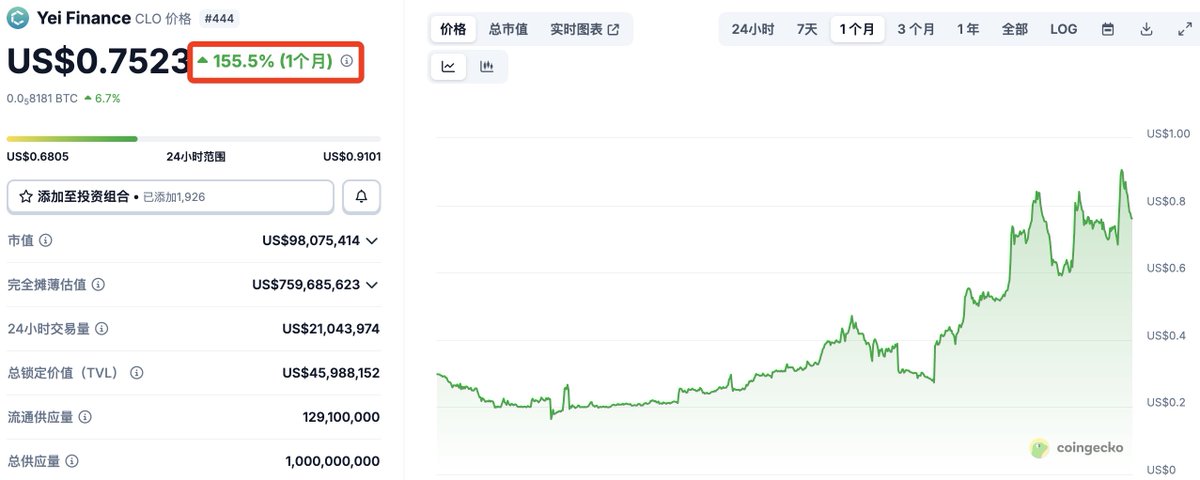

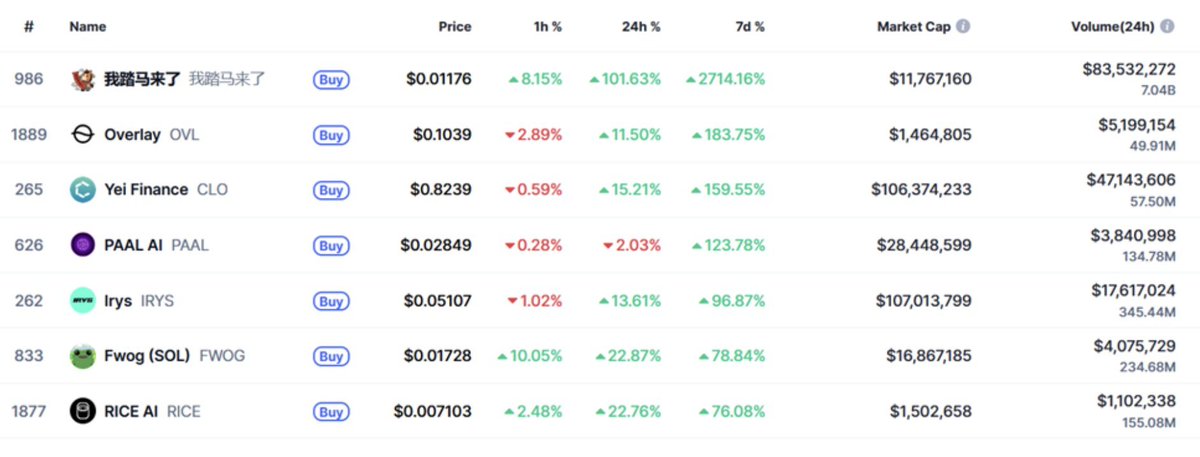

Recently, I have been researching #SEI and its ecological projects. Currently, in the #SEI ecosystem, @YeiFinance (token $CLO) ranks second in TVL and has climbed to third place in the growth chart over the past week, just behind "I'm coming." Today, let's talk about this project, and at the end, I'll share a potential big opportunity in the #SEI ecosystem! 🧐

Many people only see #Yei as a lending protocol, thinking it is just a replica of Aave or Compound. However, if you take a closer look at the data, you will find that the cumulative trading volume of YeiSwap + YeiBridge has already surpassed $685 million. This indicates that users are not just depositing money to earn interest; they are genuinely utilizing its swapping and cross-chain functionalities. Such real usage scenarios are often a hallmark of a protocol's vitality.

If we compare the entire DeFi on the #SEI chain to a city, then TVL is the "economic total" of this city. Currently, the total value of this city is approximately $180 million. Yei Finance itself accounts for $45 million of that, meaning that for every $4, about $1 is being borrowed, lent, stored, or swapped in Yei, making it one of the important supports of the ecosystem.

It is worth exploring why Yei has achieved such results on #SEI, which is closely related to #SEI's super performance and underlying advantages:

🟡 Parallel processing: While others are still queuing to package transactions, Yei has already processed a whole batch;

🟡 Low fees + high throughput: Small, high-frequency operations are not painful; arbitrage, cross-chain, and flash swaps can all be easily managed;

🟡 Native integration: It is not "grafted" on; it is specifically designed from the code level for #SEI.

This kind of DeFi project that is natively bound to #SEI is worth noting and paying attention to. When a protocol becomes the infrastructure of the ecosystem, its token is no longer just a speculative target but a capture of ecological value, and $CLO is a typical representative. At the same time, currently, the #SEI TVL leader, @TakaraLend, as a native lending protocol, is also worth noting. It is currently in the phase of earning points, which could be a potential big opportunity, and it is not crowded at all! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。