Family, the recent data on BTC has been quite contrasting! On one hand, funds are quietly retreating and observing, while on the other hand, large holders are secretly increasing their positions. It’s like a double act! Today, we will analyze these three key data sets to see what big moves the market is really planning.

First, let’s look at the first set of data — the U.S. spot BTC ETF, which saw a net outflow for four consecutive days last week, totaling over $1.3 billion! This is no small amount, mainly due to the two giants, BlackRock and Fidelity, selling off. They started reducing their positions on the 6th, which just happened to be the peak of the market rebound, clearly locking in profits and running away.

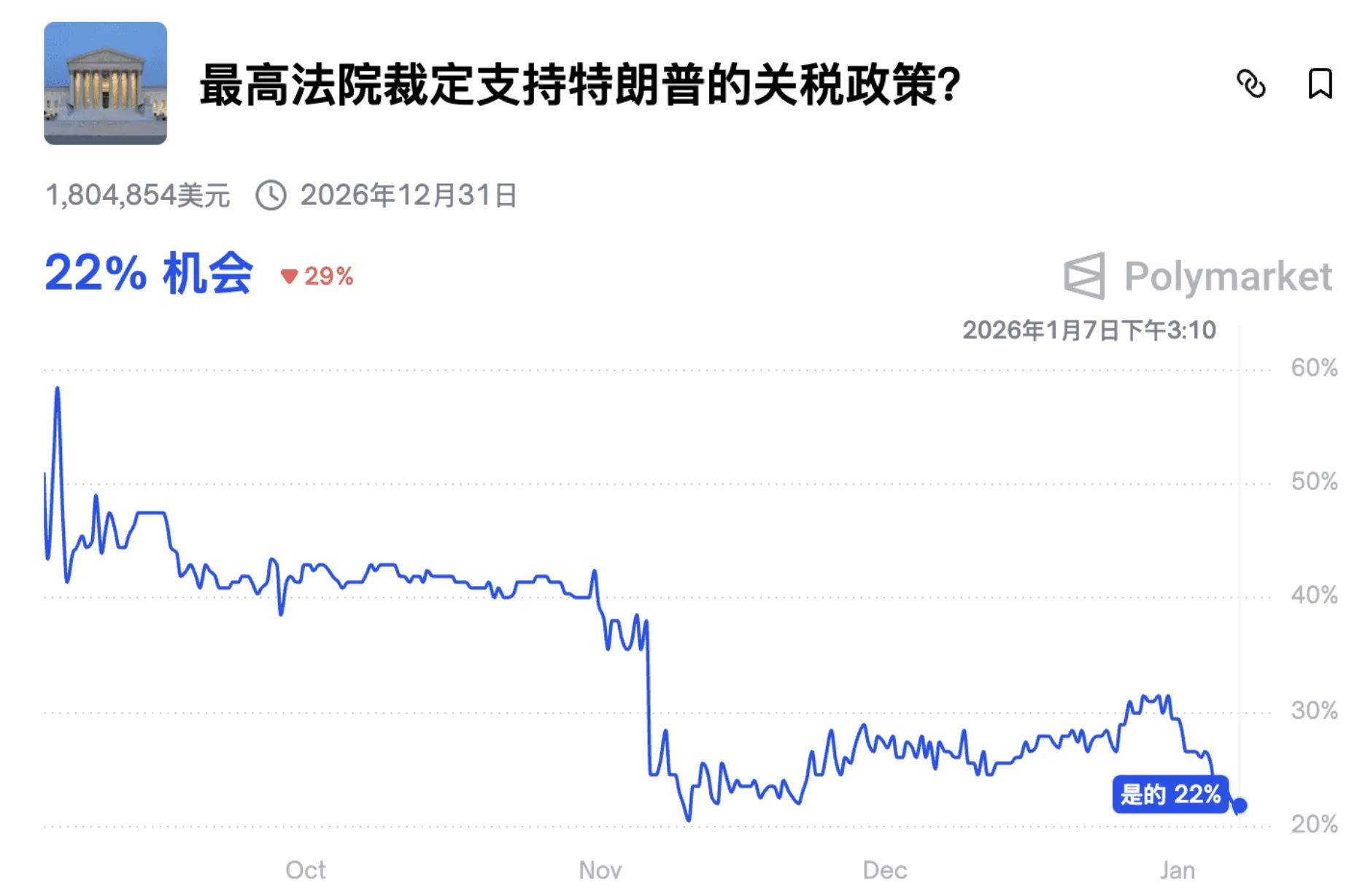

Why reduce positions? It’s understandable; last week, the Trump tariff ruling that was supposed to be released suddenly got postponed, with results only coming out on the 14th. Coupled with the disturbances from the non-farm payroll data, institutions didn’t want to take risks and decided to reduce their positions and observe instead. After all, being cautious is the most important thing.

Moreover, this isn’t a panic sell-off; it’s more about funds rotating, so there’s no need to panic! For those wanting to check the data, here’s the link: https://www.aicoin.com/zh-Hans/web3-etf/us-btc?lang=cn. You can directly go to the “Market - Comprehensive” page in the app to see it.

The second set of data is even more interesting — Coinbase’s BTC has been at a negative premium for several consecutive days! Simply put, the price of BTC in the U.S. market is actually lower than in the Asian market. This means that the recent market trend is actually being supported by funds from the Asian market, while large funds in the U.S. haven’t actively entered the market yet; they are just watching from the sidelines.

Want to know the exact price difference between the U.S. and Asian markets? Here’s a little trick: just create a custom indicator using the price difference between Coinbase BTC/USD and Binance BTC/USDT. Our AiCoin also has a membership feature for AI to write indicators, so you don’t have to code it yourself, which is super convenient.

The third set of data gives us a reassuring signal! Bitfinex is a place where international big players gather, and currently, the long positions in BTC there exceed the short positions by a whopping 71,600 BTC. This scale is almost on par with the levels before the bull market started in March-April last year. The big players are secretly positioning themselves; isn’t this signal clear enough?

When we string the data together, it becomes clear: on one hand, funds from the U.S. are retreating in the short term — ETF outflows + negative premium in the U.S. market, indicating they are still observing; on the other hand, the large long positions on Bitfinex are still firmly in favor, showing clear interest in BTC. Between this retreat and advance, the market’s “cleaning” hasn’t been completed yet, and funds are still in a tug-of-war. Once the cleaning is done, the direction will naturally become clear.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

This article only represents the author's personal views and does not reflect the stance or views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。