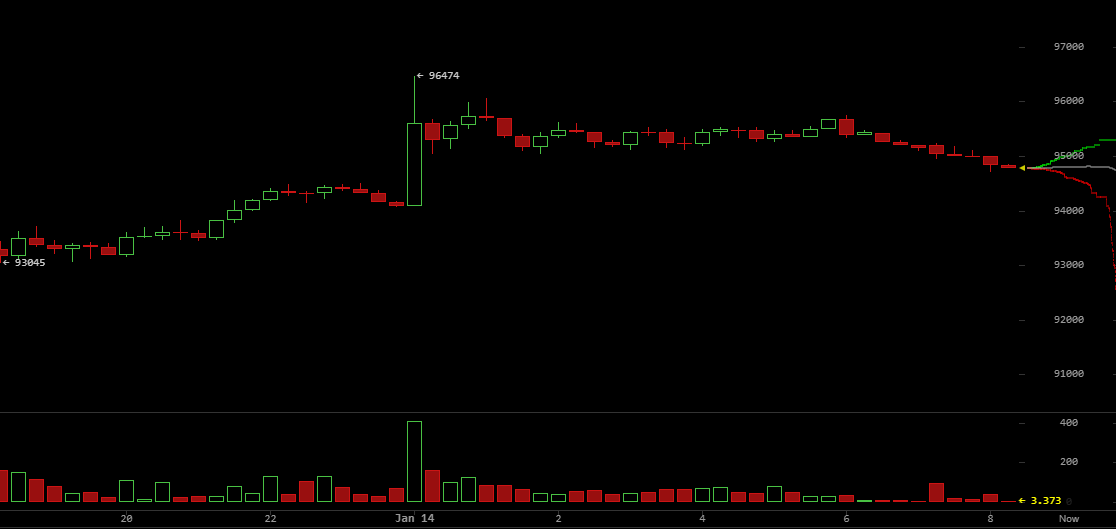

Bitcoin surged past the $96,000 mark late Jan. 13 as U.S. President Donald Trump renewed his attacks on Federal Reserve Chairman Jerome Powell. The cryptocurrency’s climb lifted its market capitalization past the $1.9 trillion mark and helped push the broader crypto economy’s market capitalization to $3.33 trillion.

The rally followed spot bitcoin exchange-traded funds (ETFs) recording a significant net inflow of $753.8 million on Jan. 12, which the data platform Lookonachain identified as the highest single-day net inflow since their 2024 launch. Among top funds, Blackrock’s IBIT posted a net inflow of $126.3 million, while Fidelity’s FBTC recorded $351.4 million.

At 12:30 a.m. EST, bitcoin was up nearly 5% from its Jan. 12 price of approximately $90,500, making it one of the top performers for the week so far. While the rally is fueled by rising institutional interest, it was initially triggered by the Trump administration’s subpoena against the Federal Reserve.

Read more: Bitcoin Surges Past $94,000 Following New CPI Data and Renewed ETF Inflows

In a speech in Detroit celebrating 4.3% GDP growth in the third quarter of 2025, the U.S. President railed against Powell, whom he accused of refusing to lower interest rates to match economic momentum. Some see the administration’s attempt to coerce the Fed as eroding the central bank’s independence. The renewed attacks and a Department of Justice subpoena prompted heads of several central banks to issue a statement in support of Powell and his team.

Meanwhile, the crypto economy’s unexpected climb triggered the liquidation of millions of dollars in short bets, with bitcoin accounting for the largest portion. According to Coinglass data, the surge above $96,000 caused the liquidation of more than $270 million in short bets in 24 hours, compared with nearly $24 million in liquidated longs. Overall, the crypto economy saw more than $590 million in short bets liquidated versus just under $90 million in long positions.

With the cryptocurrency now having breached the $95,000 resistance, market analysts believe bitcoin is closer to reclaiming the $100,000 psychological barrier.

- Why did bitcoin surge past $96K? It jumped after U.S. President Trump renewed attacks on Fed Chair Jerome Powell.

- What fueled the rally in crypto markets? Spot Bitcoin ETFs saw $753.8M in net inflows, the largest since their 2024 launch.

- How much was liquidated in short bets? Over $590M in shorts were wiped out, with bitcoin accounting for the biggest share.

- What’s next for bitcoin’s price? Analysts say breaching $95K resistance puts the $100K psychological barrier within reach.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。