Momentum accelerated across crypto exchange-traded funds (ETFs) as fresh capital poured back into the market. What began as a tentative recovery earlier in the week turned into a decisive surge, led by a powerful return of demand for bitcoin exposure and reinforced by steady inflows across major altcoin products.

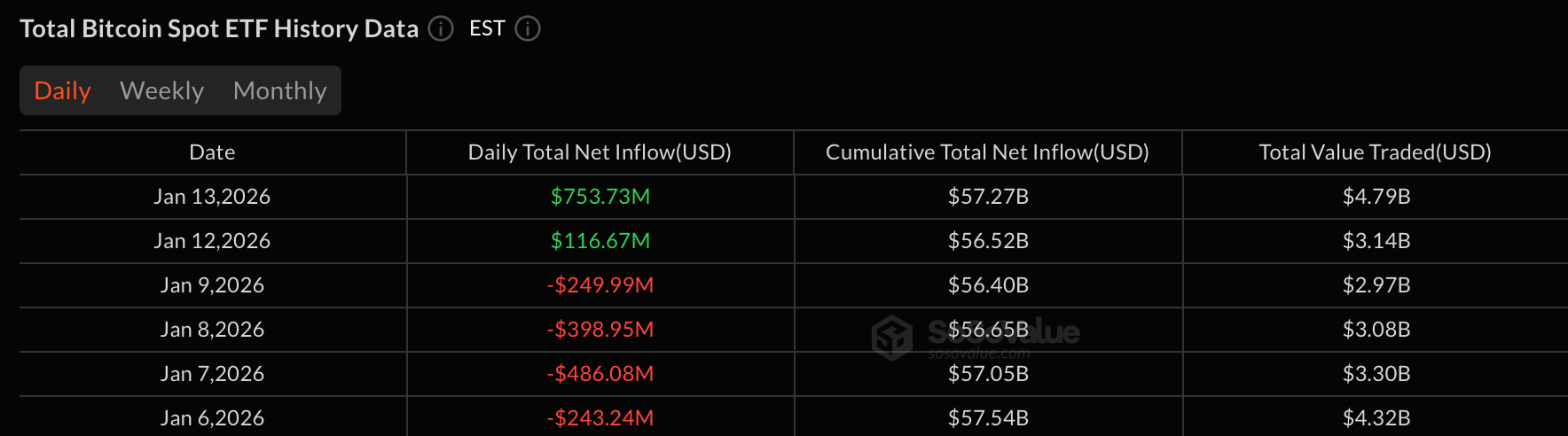

Bitcoin ETFs dominated the session with a $753.73 million net inflow, marking the category’s largest daily intake so far in 2026. The buying was broad and decisive. Fidelity’s FBTC led the charge with $351.36 million, followed by Bitwise’s BITB at $159.42 million and Blackrock’s IBIT with $126.27 million.

Ark & 21Shares’ ARKB added $84.88 million, while Grayscale’s Bitcoin Mini Trust saw $18.80 million in new capital. Smaller but notable entries came from Vaneck’s HODL ($10 million) and a rare inflow into Wisdomtree’s BTCW ($2.99 million). No outflows were recorded across the complex. Total value traded climbed to $4.79 billion, pushing net assets sharply higher to $123 billion.

Successive days of inflows for bitcoin ETFs worth over $850 million.

Ether ETFs also extended their recovery with a $129.99 million inflow, spread evenly across five funds. Blackrock’s ETHA topped the list with $53.31 million, while Grayscale’s Ether Mini Trust attracted $35.42 million. Bitwise’s ETHW added $22.96 million, Fidelity’s FETH brought in $14.38 million, and Grayscale’s ETHE rounded out the gains with $3.93 million. Trading activity reached $1.53 billion, with net assets holding firm at $19.62 billion.

XRP ETFs maintained their positive run, logging a $12.98 million inflow. Grayscale’s GXRP led with $7.86 million, while Canary’s XRPC and Bitwise’s XRP added $2.73 million and $2.39 million, respectively. Total value traded stood at $30.90 million, lifting net assets to $1.54 billion.

Read more: Crypto ETFs Turn Green as Bitcoin Rebounds With $117 Million Inflow

Solana ETFs closed green for a second straight session as well, posting a $5.91 million inflow driven entirely by Fidelity’s FSOL. Trading volume reached $41.82 million, and net assets advanced to $1.18 billion.

Taken together, Tuesday’s action reflected a decisive shift in sentiment. Bitcoin’s explosive inflow set the tone, ether confirmed follow-through demand, while XRP and solana ETFs continued to attract steady allocations. The result was a rare across-the-board green day that reinforced the market’s growing confidence heading deeper into January.

- Why did bitcoin ETFs see their biggest inflow of 2026?

Strong institutional demand drove $753 million into bitcoin ETFs, marking the largest daily inflow of the year. - How did ether ETFs perform during the rally?

Ether ETFs added nearly $130 million as buying interest spread across multiple major funds. - Did XRP and solana ETFs also attract capital?

Yes, both XRP and solana ETFs recorded fresh inflows, extending their recent positive momentum. - What does the all-green session signal for crypto markets?

The synchronized gains point to a sharp rebound in investor confidence across digital asset ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。