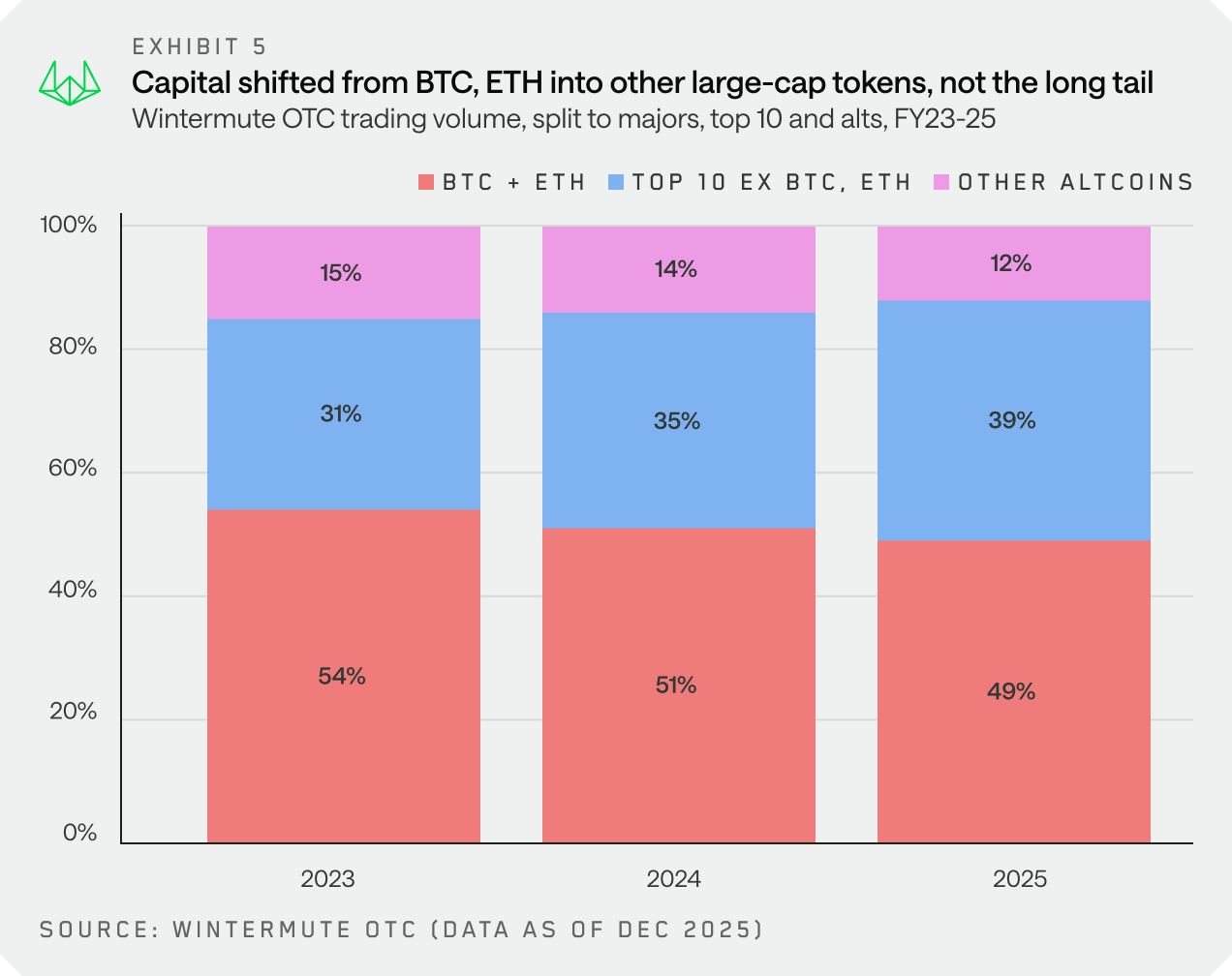

Crypto markets attracted fresh liquidity in 2025, but that capital did not spread evenly across the ecosystem. According to Wintermute’s Digital Asset OTC Markets 2025 report, inflows remained tightly concentrated in bitcoin, ether, and a small group of large-cap tokens, fundamentally altering how the market behaved.

The report, based on Wintermute’s proprietary over-the-counter flow data, shows that exchange-traded funds (ETFs) and digital asset trusts (DATs) became the primary entry points for capital. Their mandates naturally funneled money into BTC, ETH, and select majors, leaving little spillover for the broader altcoin market. As a result, the long-anticipated rotation into smaller tokens never materialized.

Altcoins felt the impact directly. Average altcoin rallies lasted roughly 20 days in 2025, down sharply from around 60 days in 2024. Popular narratives, including memecoin launchpads, perpetual DEXs, and AI-related tokens, rose quickly but faded just as fast as liquidity moved on.

Signs of market maturation also appeared in derivatives. Options activity surged, more than doubling year over year and increasing 2.5 times from the fourth quarter of 2024 to the fourth quarter of 2025. Usage shifted away from outright directional bets toward more systematic strategies such as yield generation, downside hedging, and covered calls.

Retail behavior further reinforced the concentration trend. Much of the speculative attention that previously flowed into crypto shifted to equities, particularly themes around AI, robotics, and quantum computing.

Regionally, positioning changed in phases rather than all at once. Asian investors sold during April’s tariff-driven volatility, European flows redistributed over the summer, and U.S. investors led net selling into year-end as the Federal Reserve signaled a more hawkish stance.

Read more: Bitcoin ETFs Surge With $754 Million Inflow as Crypto ETFs Register Broad Gains

The report argues that these dynamics point to a deeper shift. The traditional four-year crypto cycle appears to be weakening, replaced by a market driven by where liquidity enters and where investor attention concentrates. In 2025, concentration, not cycles, determined performance.

Looking ahead, Wintermute notes three factors that could alter the pattern in 2026: broader ETF and DAT mandates, a BTC and ETH rally creating a wealth effect, or a renewed shift in retail focus back to crypto.

- Where did most new crypto liquidity go in 2025?

Most capital flowed into bitcoin and ether via ETFs and trusts, leaving limited liquidity for altcoins. - Why did altcoin rallies fade faster in 2025?

Liquidity stayed concentrated in major assets, shortening altcoin rallies to about 20 days. - How did derivatives markets change last year?

Options activity surged as traders favored hedging and yield strategies over directional bets. - What does Wintermute expect could change this in 2026?

Broader ETF mandates, a BTC– ETH wealth effect, or renewed retail interest could spread liquidity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。