At the beginning of 2026, the cryptocurrency market welcomed a strong start. Bitcoin briefly broke through $96,000 on January 14, reaching a two-month high, and then stabilized above $95,000. This breakthrough ended Bitcoin's more than a month-long consolidation phase, marking the potential establishment of a new upward trend.

1. Breakthrough Market: Data and Technical Resonance

The momentum of this round of rising prices is strong and validated by multiple data points.

● Price and Market Performance: As of January 14, Bitcoin's year-to-date increase had reached 8.9%. During trading on January 14, Bitcoin peaked at $97,694, the highest intraday price since it hit the $100,000 mark on November 14, 2025. This rise also successfully broke the previous range of $92,000 to $94,000.

● Broad Market Participation: The rise was not solely a Bitcoin phenomenon. Ethereum (ETH), as the second-largest cryptocurrency, also saw a significant increase, with a rise of up to 6%. The total market capitalization of the entire cryptocurrency market was pushed higher, breaking $3.3 trillion.

● Key Technical Signals: A key bullish signal for this breakthrough is that Bitcoin's price successfully rose above the 100-day moving average. For traders who follow chart analysis, this is often seen as a positive technical indicator for future price increases.

2. Macroeconomic Tailwind: Slowing Inflation and Interest Rate Expectations

Bitcoin's strong rebound is closely related to the recent favorable macroeconomic environment. The market's expectations for a shift in the Federal Reserve's monetary policy have become the core driving force behind the rise in risk asset prices.

● Inflation Data Meets Expectations: The Consumer Price Index (CPI) for December 2025 in the U.S. showed that overall inflation rose by 2.7% year-on-year, in line with market expectations. This "tepid" report alleviated market concerns about a resurgence of inflation and weakened the rationale for the Federal Reserve to take more aggressive rate hikes.

● Strengthened Rate Cut Expectations: The stability of inflation data has reinforced market expectations that the Federal Reserve will begin to cut rates in mid-2026. The market even predicts that the final federal funds rate may trend down towards the range of 3.0% to 3.9%. A lower interest rate environment means increased liquidity in the financial system, which is generally favorable for risk assets, including cryptocurrencies.

● Overall Risk Sentiment Rebounds: This optimistic macro sentiment is not limited to the cryptocurrency market. The U.S. stock market also showed an upward trend during the same period, indicating that this round of rising crypto assets is part of a broader global risk appetite recovery, rather than an isolated event.

3. Institutional Return: Massive Inflows into ETFs

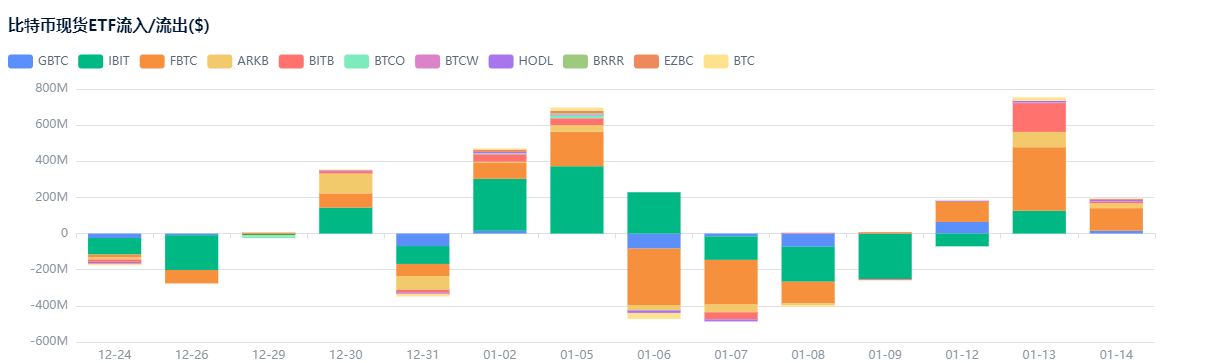

While the macro environment provided a "tailwind," it was the significant return of institutional funds that directly ignited the market and pushed prices through key resistance levels. Among these, the flow of funds into spot Bitcoin exchange-traded funds (ETFs) is seen as an accurate barometer of institutional movements.

Record Single-Day Inflows: On January 13, the U.S. spot Bitcoin ETF recorded a net inflow of $753.7 million, the largest single-day net inflow since October 2025. This data strongly reversed the outflow trend caused by portfolio rebalancing and tax planning at the end of 2025, showing that institutional investors are reallocating cryptocurrency assets.

Performance of Major ETF Products:

● Fidelity FBTC: Leading the market with a single-day net inflow of $351 million.

● Bitwise BITB: Net inflow of $159 million.

● BlackRock IBIT: Net inflow of $126 million.

Ethereum ETFs Also Favored: The expansion of institutional interest is also reflected in Ethereum, with five Ethereum-focused ETF products receiving a net inflow of $130 million on the same day.

4. Market Liquidation: Shorts Suffer Heavy Losses

Strong buying pressure pushed prices to break through quickly, forcing many short traders betting on price declines to close their positions, creating a typical "short squeeze" that further amplified the price increase.

● Massive Short Position Liquidation: Within 24 hours after Bitcoin broke through $96,000, the market liquidated over $290 million in Bitcoin short positions. In contrast, the liquidation amount for long positions was only about $24 million.

● Market-Wide Liquidation Wave: Expanding the scope to the entire cryptocurrency market, the total liquidation of short positions during the same period approached $700 million. Such a large-scale liquidation cleared a significant amount of bearish leverage from the market, easing the burden for healthy price increases in the future.

5. Major Holdings: Strategy's Unrealized Gains Exceed $10 Billion

Among the many institutions pouring into Bitcoin, the publicly traded company Strategy (NASDAQ: MSTR) is undoubtedly the most prominent representative. Its aggressive and sustained Bitcoin holding strategy has yielded astonishing paper returns in the current market.

● Holdings and Unrealized Gains: According to Binance market data, as of January 11, 2026, Strategy held a total of 687,410 Bitcoins, valued at approximately $51.8 billion, with an average purchase price of about $75,353. As Bitcoin's price broke through $95,000, Strategy's holdings achieved an unrealized gain rate of 26.3%, corresponding to an unrealized profit of approximately $13.63 billion.

● Industry Leader: Strategy has long been regarded as one of the largest institutional investors in Bitcoin. Some analysts point out that its buying behavior is closely related to Bitcoin's price movements, making it one of the main buyers at specific price levels.

6. Institutionalization Wave: From Trend to Norm

The case of Strategy is not an isolated one; it reflects a deepening wave of "Bitcoin institutionalization" that is taking place. More and more traditional industry giants are incorporating Bitcoin into their balance sheets.

Active Allocation by Public Companies:

In addition to Strategy, many publicly traded companies worldwide have publicly disclosed their Bitcoin investments:

● Participation of Nations and Sovereign Funds: Another important dimension of institutionalization is the involvement of sovereign entities. For example, the government of El Salvador holds 6,133 BTC, while the U.S. government holds nearly 200,000 BTC. Sovereign wealth funds like Norway's have also begun testing allocations to Bitcoin.

● Future Massive Predictions: A joint research report released by cryptocurrency asset management firms Bitwise and UTXO Management in 2025 predicts that by the end of 2026, institutions (including public companies, ETFs, sovereign wealth funds, and nations) are expected to hold over 4.2 million Bitcoins, accounting for about 20% of Bitcoin's total supply. The report estimates that the total institutional funds flowing into Bitcoin will exceed $420 billion over the two years of 2025 and 2026.

7. Future Outlook: Consensus and Risks Coexist

In the face of the current hot market, analysts have both optimistic views and warnings about potential risks regarding Bitcoin's future path.

● Short-Term Target Levels: Charlie Sherry, CFO of BTC Markets, pointed out that if Bitcoin's price can remain stable above the $96,000 to $97,000 range, it will pave the way for further attempts to breach the $100,000 mark. Justin d‘Anethan, research director at Arctic Digital, proposed the narrative of "catching up to gold," suggesting that Bitcoin may receive more capital allocation in the mid-term.

● Long-Term Supply Contradictions: One of the core logics supporting a long-term bullish view is the supply-demand relationship. Bitcoin's supply growth continues to slow due to its halving mechanism. In contrast, as mentioned earlier, if the massive institutional demand materializes, it will create significant supply shortage pressure, which could become the fundamental driving force for long-term price increases.

Risks Not to Be Ignored:

Macroeconomic Changes: If U.S. inflation data rises again beyond expectations, it could lead the Federal Reserve to delay or reduce rate cuts, putting pressure on all risk assets.

Regulatory Uncertainty: Although recent regulatory signals have been positive, the regulatory framework for cryptocurrencies, especially products like ETFs, is still evolving globally, leading to uncertainty.

Market Volatility: The inherent high volatility of cryptocurrencies has not changed. Large institutions' concentrated buying and selling behavior may exacerbate short-term market volatility. Additionally, if Bitcoin struggles to break through key resistance levels (such as $98,000-$100,000), it may experience short-term consolidation or pullback.

In summary, Bitcoin's rise at the beginning of 2026 was jointly driven by favorable macro conditions from moderate inflation data, substantial institutional fund inflows through ETFs, and technical pushes from significant short liquidations. The massive unrealized gains represented by companies like Strategy are the most tangible results of this "institutionalization" revolution. Although there are still bumps ahead, Bitcoin is writing a new chapter in its journey of value discovery, deeply involving traditional financial forces.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。