Just over three years ago, on Dec. 14, 2022, Bitcoin developer Casey Rodarmor introduced the Ordinals protocol, and the first Ordinal inscription (1) was minted on the Bitcoin blockchain two days later. In the opening months of 2023, interest in Ordinal inscriptions accelerated rapidly, drawing growing attention across the crypto ecosystem.

In simple terms, a Bitcoin Ordinal inscription places arbitrary data—such as images or text—directly onto an individual satoshi, Bitcoin’s smallest unit, by using the witness field of a Taproot transaction. Ordinal theory assigns each satoshi a distinct serial number based on its mining order, allowing data to be affixed onchain without modifying Bitcoin’s protocol and giving rise to what are known as digital artifacts.

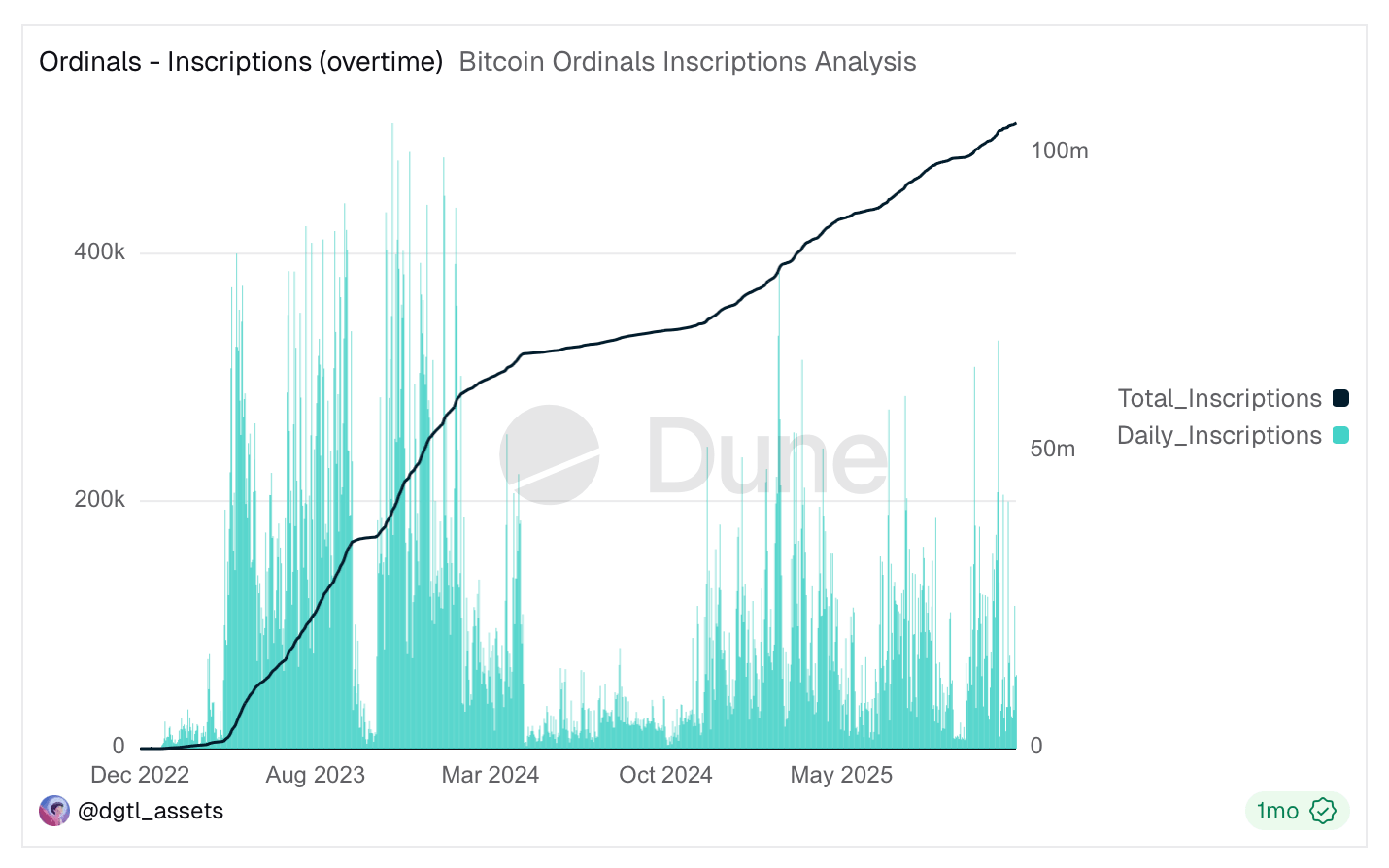

Arbitrary data can take many forms, including plain text, images, code, and applications. By September 2024, the chain accounted for 75 million inscriptions, and it later pushed past the 100 million mark in the first week of November 2025. At press time, ordinals.com indicates there are more than 117 million inscriptions as of the second week of January 2026. The number crossed tapped 117 million officially on Thursday, Jan. 15, 2026, according to ord.io and ordinals.com stats.

Dune stats from the user @dgtl_assets show more than a 10% discrepancy between numbers from ordinals.com and ord.io.

Parsing data from Dune.com, which carries an estimated 10.3% undercount, suggests bitcoin miners have collected roughly $646 million in inscription fees, keeping that gap in mind. The bulk of those fees, measured by the 7,092 bitcoin gathered from inscriptions, was generated around the fourth Bitcoin halving and in the period leading up to it. Since then, miners have seen relatively little revenue from inscribers compared with earlier periods.

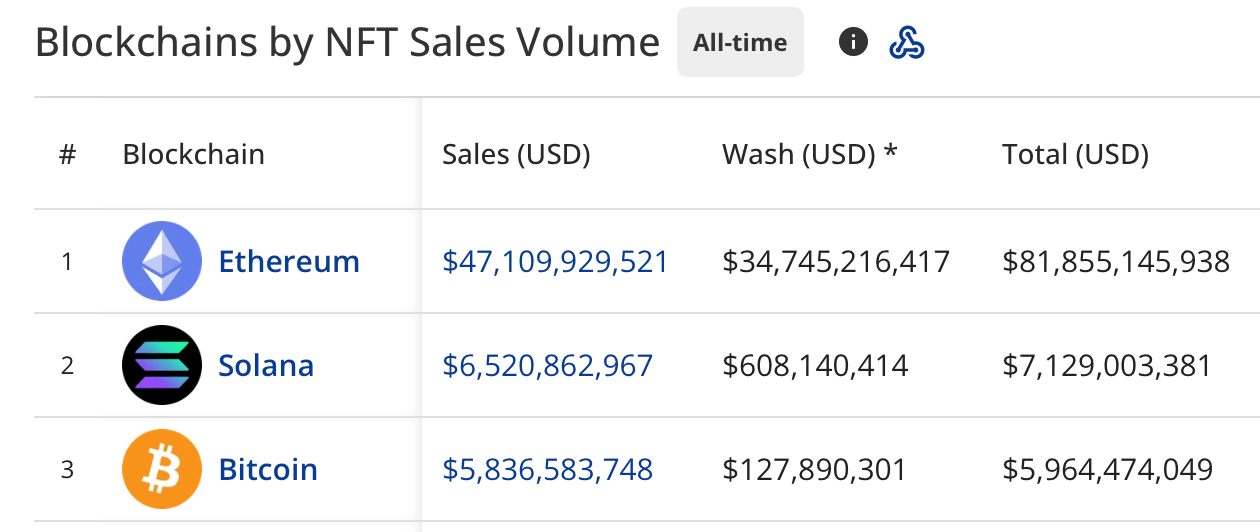

From a sales perspective, Bitcoin has climbed past several blockchains that moved large volumes of NFTs well before it, back when the NFT frenzy of 2020–2021 was at its peak. Bitcoin now sits in third place with $5.8 billion in total sales, according to cryptoslam.io data. Only Ethereum and Solana rank higher, and Bitcoin would need roughly $688 billion more in sales to overtake Solana—assuming, of course, that Solana’s figures remained static.

NFT sales data from cryptoslam.io on Jan. 15, 2026.

Bitcoin sits comfortably ahead of Ronin, the network behind Axie Infinity NFTs, which has recorded $4.3 billion in NFT sales. That figure also exceeds Polygon’s $2.2 billion in digital collectible sales and Flow’s $1.73 billion total. Over the past seven days, cryptoslam.io stats show Bitcoin ranked third by sales with $6.9 million, while on a monthly basis it moved into second place with $62 million after posting an 88% month-over-month gain.

Even so, it is hard to ignore how marginal NFTs have become in the broader crypto conversation. Outside of niche circles, digital collectibles are no longer a daily talking point, and retail interest that once powered the 2020–2021 boom has largely drifted elsewhere. Against that backdrop, Bitcoin’s NFT numbers read less like a cultural revival and more like a quiet accounting milestone—evidence that activity persists even as hype has faded and attention has shifted to other corners of the market.

Also read: Ripple Locks RLUSD Into LMAX’s $8.2 Trillion Trading Engine

That contrast may be the most telling takeaway. Bitcoin’s ascent into the upper tier of NFT sales has unfolded without fanfare, celebrity drops, or retail frenzy, driven instead by ordinals and a steady, if narrower, base of users. Whether that foundation proves durable or remains a historical footnote will depend less on sales tallies and more on whether NFTs regain relevance beyond specialized communities—or remain a subdued sideshow while Bitcoin continues to dominate the crypto narrative for entirely different reasons.

- What is driving Bitcoin’s NFT growth over the last few years?

Bitcoin’s NFT activity is being fueled by Ordinal inscriptions, which embed data directly onto satoshis without altering Bitcoin’s core protocol. - How much have Bitcoin NFTs generated in total sales?

Bitcoin NFTs have recorded about $5.8 billion in cumulative sales, ranking the network third behind Ethereum and Solana. - How many Ordinal inscriptions exist on Bitcoin today?

The Bitcoin blockchain hosts more than 117 million Ordinal inscriptions as of mid-January 2026. - Are Bitcoin NFTs still profitable for miners?

Inscription fees added meaningful revenue before and around the fourth halving, but contributions have since tapered massively compared with earlier peaks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。