The world is bustling, all for profit; the world is in turmoil, all for profit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to cryptocurrency enthusiasts. I welcome all crypto friends to follow and like, and I refuse any market smoke screens!

Yesterday, I posed a question in the private domain, and today’s article will provide an answer. In the current financial market, Lao Cui feels a sense of domestic business competition; the US dollar is rising, US bonds are rising, US stocks are rising, Japanese bonds are rising, Japanese stocks are rising, Korean stocks are rising, the CNY is appreciating, and Lao A is also rising. Gold, silver, heavy metals, and energy safe-haven assets are all rising; any financial market can make a profit. So who is actually losing? Is it the darkness before dawn, or the final madness of the financial market? According to textbook knowledge, the relationship between the US dollar and US dollar assets seems to always be contradictory; either the dollar rises and the stock market falls, or the stock market rises and the dollar falls. However, the current result has turned into both the dollar and dollar assets rising, which does not align with the theoretical knowledge we learned earlier. Why is this happening? And does Bitcoin belong to dollar assets or decentralized consensus assets? Where is the logic that allows both to rise?

To understand the fundamental reason, it is essential to clarify that the dollar's peg is often said to be the constant dollar of energy. In Lao Cui's understanding, this is correct but superficial, as currency is always tied to a country's military strength; these two should be linked. Before the tariffs began, the entire dollar exchange rate, if Lao Cui's memory serves correctly, was stable around 6.3-6.5, and is currently stable around 7. In the overall comparison, the dollar is appreciating, and so are US bonds. Many friends have been hearing the slogan of the dollar system collapsing for nearly decades; why is it now in an upward trend? This slogan is not wrong, and Lao Cui agrees, but the result has deviated. This requires looking at the holdings of US dollars and US bonds; in the previous dollar system, we occupied half of the market, with a peak holding of nearly 1.2-1.3 trillion.

Through long-term selling, nearly half has been offloaded, and who has taken over this portion that was sold and the portion that was newly issued? It is clear that more of the takeover is internal digestion, namely pensions and their domestic reserves, even the top ten market cap companies. The dollar and US bonds of stablecoin targets can be ignored; the overall market cap is not high, especially since USDT has nearly 100 tons of gold in reserve, so the cryptocurrency market's share is not large. From the perspective of holders, one can see that global de-dollarization is gradually being established, and the dollar market is actually contracting. This is also why it leads to turmoil in the landscape; for the Americans, waging war is certainly a fundamental national policy. Thus, there have been conflicts with Iran, Venezuela, and all major energy countries in the Middle East. Only by making the world see the military strength of the Americans again can the dollar regain its value.

Many friends are also brainwashed by the so-called Western civilization, seeing the US Supreme Court condemning Trump for starting wars, even thinking it will roll back the so-called illegal gains from the tariff war. They believe this is the direction of civilization and admire the Americans more. Lao Cui cannot understand; aren't these things just for show? Do you really think the money in your pocket will be returned to them? Even if it is returned, will Venezuela's oil be returned? Just a mutual performance internally can make you all proclaim the so-called civilized lighthouse shine again. Those who believe really need to check whether their investments are in a profitable state. When the world hegemon is challenged, it will certainly flex its muscles again, showing those challengers that it is still great, and this greatness is predicated on the sacrifices of other countries. After this war ends, take a look at the performance of the entire US stock market; has it not risen to a new level?

Whether it is yen assets or won assets, they are all backed by dollar assets. The turmoil in the world landscape is the primary factor causing the growth of heavy metals and energy sectors, while the growth of dollar assets is a reward for the winning side of the war. The growth of Lao A and CNY does not belong to the dollar system but is a push from the system. This cannot be explained too thoroughly; everyone just needs to remember one point: currently, in all markets, if there is even a hint of fatigue, a group of vultures will emerge to devour. The current situation is that no one dares to fall; falling will be devoured by capital. As Lao Cui mentioned, it depends on who can’t hold on first; once someone can’t hold on, it will lead to the next round of financial crisis. The outbreak of a financial crisis will certainly lead to military action; this state will not last. After understanding this series of logic, what is your view on Bitcoin? This requires you to see your own definition: does it belong to dollar assets or consensus assets?

The fundamental reason is that you can think about it: if stablecoins detach from the peg of US dollars and US bonds, will Bitcoin be affected? To put it bluntly, it will definitely be hit; if the Americans really decouple from the crypto world, Bitcoin's current price will at least be halved. For the crypto world, this round of bull market rise has benefited from Trump's support, and this support has also caused the crypto world to officially decouple from decentralization. Now, if you want to participate in the crypto world, the first step is KYC certification, and many major platforms have already integrated with the tax systems of most countries, meaning that in the future, you may really need to pay taxes on your profits. This tax point is not bad news; at least your funds can be protected, but this information leak is completely contrary to the theory of decentralization in the crypto world. Is the current crypto world really still the same as before it went public? From the perspective of the crypto world, Lao Cui hopes for the appreciation of dollar assets, but from other perspectives, the appreciation of dollar assets is built on the suffering of others.

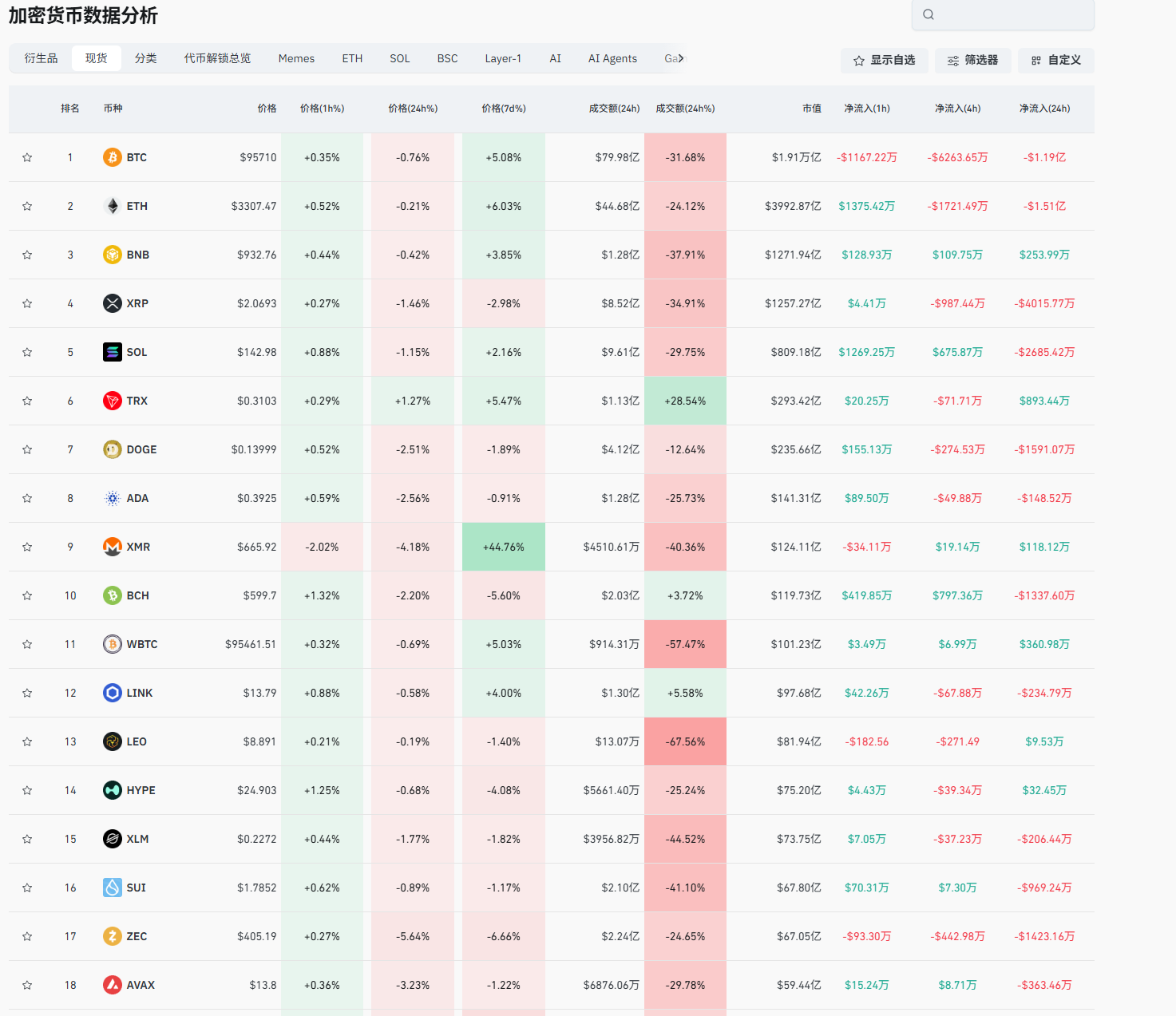

Lao Cui summarizes: Over the past 25 years, I have met many new friends, and the value system of the crypto world has led many friends to lack independent thinking ability. They often follow the trend; although the growth rate of the crypto world over the past 25 years has not been large, it has still maintained a growth cycle, allowing many friends to profit easily. It can be said that for a full two years, users who can hold on have even had Bitcoin below 30,000. Lao Cui is very clear that this is not personal ability or recognition of profit, but the trend that allows everyone to profit. Under the support of this environment, Lao Cui will instead focus more on risk issues. To put it bluntly, all markets at this stage have very serious bubbles. If it weren't serious, finance would not drive military participation. The continuous good news is certainly beneficial to us, but once the Americans are dragged into a long-term front, you need to be prepared to be cut. In 2026, you may not need to worry too much; energy, gold, and even the crypto world, combined with the commercial aviation sector and even the explosion of AI, will allow the US stock market to survive. Once we enter late 2026 and early 2027, you need to stay alert; 2027 is indeed likely to start raising interest rates, and the period before the rate hike is when the scythe swings down. Bitcoin still has room for growth; 2026 is still looking at the 13-15 range, and there will not be a new low in the short term; it will rise, so everyone can rest assured.

Original article created by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。