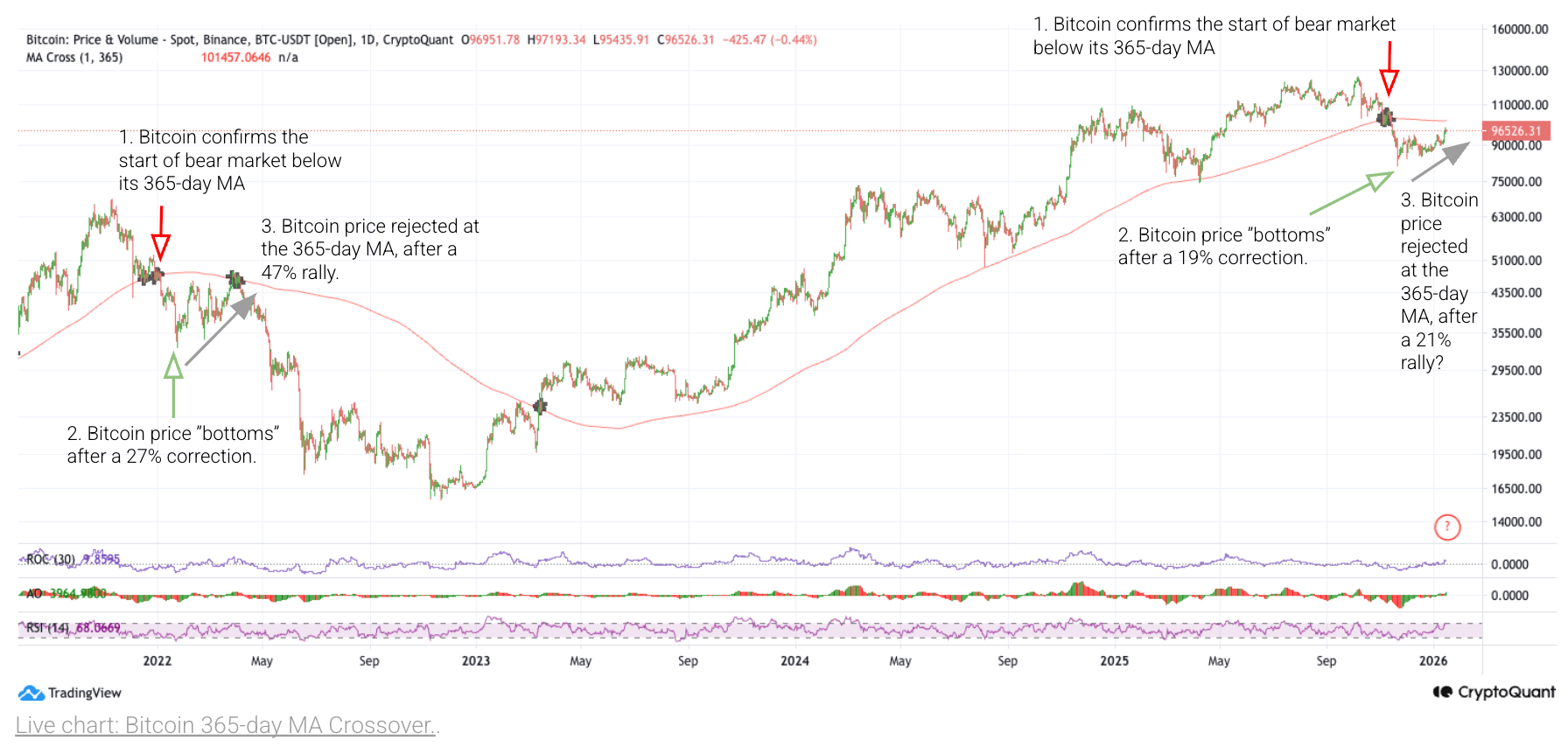

This week, Cryptoquant researchers note that bitcoin has climbed roughly 21% since Nov. 21, following a 19% decline that confirmed a bear market after the asset fell below its 365-day moving average.

According to the analytics firm, the latest price action closely resembles patterns observed during the 2022 downturn, when similar rallies failed near the same technical threshold. The report highlights that bitcoin is approaching, but has not reclaimed, the 365-day moving average, currently near $101,000.

The market strategists identify this level as a long-standing regime boundary, with past bear cycles repeatedly seeing price rejection near the same zone before renewed downside. Cryptoquant’s onchain analysis shows that demand conditions have improved slightly but remain weak.

The Coinbase Premium Index briefly turned positive, indicating marginal improvement in U.S.-based demand, though Cryptoquant researchers emphasize that these episodes have been short-lived. Spot bitcoin exchange-traded funds (ETFs) tracked by Cryptoquant paused net selling after offloading roughly 54,000 BTC in November.

Also read: Stablecoin Market Opens 2026 at a New $310B Record

However, the firm notes that recent ETF behavior does not yet reflect sustained accumulation consistent with lasting recoveries seen in prior cycles. According to Cryptoquant data, apparent spot demand has contracted by approximately 67,000 BTC over the past 30 days and has remained negative since late November.

ETF inflows in early 2026 totaled about 3,800 BTC, nearly unchanged from the same period last year. Researchers also highlight rising exchange inflows as a growing risk factor. Bitcoin transfers to exchanges reached a seven-day average of roughly 39,000 BTC, the highest level recorded since late November, a pattern historically linked to increased sell-side activity.

While Cryptoquant notes that the current trajectory does not have to repeat prior cycles exactly, unfortunately for well-wishers, its analysts conclude that both onchain and market data continue to support a bear market framework rather than a confirmed trend reversal.

- Is Cryptoquant calling this a bull market?

No, Cryptoquant states the data still supports a bear market structure. - Why is the 365-day moving average important?

Cryptoquant identifies it as a historical regime boundary for bitcoin price trends. - Are ETFs driving the rally?

Cryptoquant data shows ETFs have paused selling but are not accumulating meaningfully. - What risk does Cryptoquant see ahead?

Rising exchange inflows signal increasing sell-side pressure, according to Cryptoquant.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。