Ark Investment Management has released its Big Ideas 2026 report outlining long-term views on disruptive technologies and digital assets. The publication explains how bitcoin’s potential value is constructed through market sizing and adoption assumptions rather than a stated price target. The framework positions bitcoin valuation as a calculated outcome of demand scenarios and fixed supply.

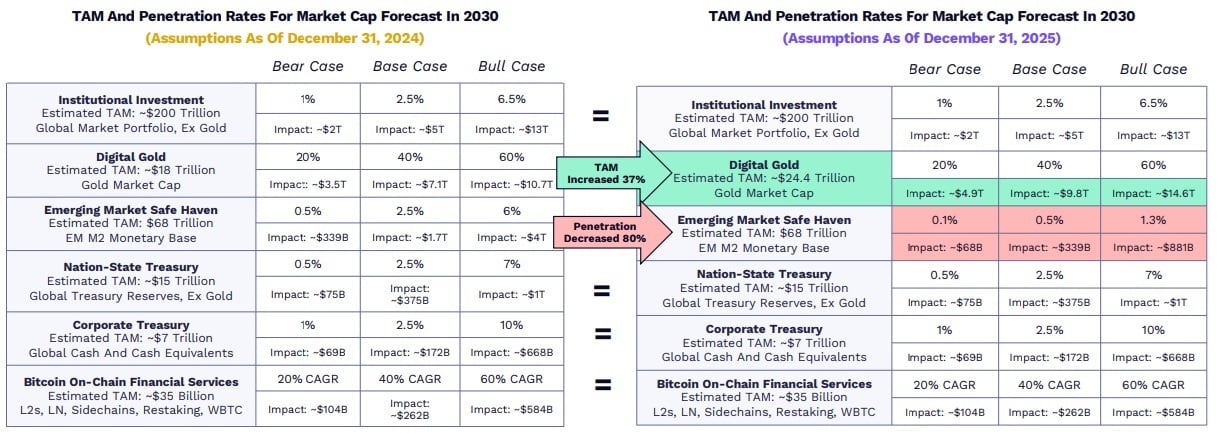

The central chart supporting Ark’s bitcoin outlook models total market capitalization under bear, base, and bull cases. In the base case, institutional investment contributes about $5 trillion, based on 2.5% penetration of a $200 trillion global market portfolio excluding gold. Digital gold adds roughly $9.8 trillion, assuming bitcoin captures 40% of a $24.4 trillion gold market. Additional components include $339 billion from emerging market safe-haven demand, $375 billion from nation-state treasuries, $172 billion from corporate treasuries, and approximately $262 billion from bitcoin on-chain financial services modeled to grow at a 40% compound annual growth rate.

Ark Invest’s total addressable market (TAM) and penetration rates for the 2030 market cap forecast for bitcoin.

Using that math, a $16 trillion market cap implies a bitcoin price near $760,000. Applying the same calculation to the bear case, where the total value is about $8 trillion, results in an implied price of around $380,000. In the bull case, where higher penetration assumptions push market capitalization beyond $25 trillion, the implied price exceeds $1.2 million per bitcoin. As presented, the chart shows that bitcoin valuation in the report is an output of adoption rates and supply constraints rather than a standalone forecast.

Read more: Bitcoin’s Path to $1.5M: Ark Invest’s Ultra-Bullish BTC Roadmap

That valuation range aligns with commentary from Ark founder and CEO Cathie Wood, who explained her firm’s revised long-term bull case for bitcoin in November. Wood said Ark had lowered its 2030 price target to $1.2 million from $1.5 million, attributing the $300,000 reduction to the faster-than-expected rise of stablecoins. The executive detailed:

“So our bullish forecast out there is $1.5 million by 2030. Given what’s happening to stablecoins, which are serving emerging markets in a way that we thought bitcoin would, I think we could take maybe $300,000 off of that bullish case just for stablecoins.”

Wood explained that stablecoins are increasingly displacing bitcoin in global payments and remittances, particularly in emerging markets where users favor the price stability of digital dollars over bitcoin’s volatility. Despite the adjustment, she remains firmly bullish, arguing that bitcoin’s core value proposition as digital gold continues to strengthen. She has emphasized that bitcoin’s mathematical scarcity and decentralized structure underpin its role as a global store of value and a strategic diversification asset for institutional portfolios, even as transactional use cases migrate to stablecoins.

- Why does Ark argue that current bitcoin prices are the real outlier?

Ark’s framework shows that when bitcoin is valued using adoption-driven market sizing and fixed supply, today’s prices appear low relative to long-term demand scenarios. - How does Ark’s framework arrive at a potential $1M+ bitcoin valuation?

The model aggregates demand from institutions, digital gold substitution, nation-states, corporates, emerging markets, and on-chain financial services to derive market caps exceeding $25 trillion in the bull case. - What assumptions matter most for investors in Ark’s bitcoin outlook?

Institutional portfolio penetration, bitcoin’s share of the gold market, and adoption by sovereign and corporate treasuries are the largest drivers of upside valuation. - Why did Cathie Wood lower Ark’s bitcoin bull case despite remaining bullish?

Ark reduced its 2030 bull target to about $1.2 million due to stablecoins capturing more payments and remittance use, while maintaining bitcoin’s long-term role as digital gold.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。