Growing stress signals are flashing across bitcoin markets as selling pressure broadens and momentum deteriorates. Cryptoquant, a blockchain analytics firm, shared an analysis on Jan. 23, 2026, warning that synchronized shifts in demand and investor behavior are undermining price stability.

The analysis examines bitcoin’s advance from roughly $90,000 toward $97,500 before upside traction faded, then interprets that move through multiple on-chain and exchange-based charts. The analysis states:

“All four indicators are currently showing a bearish convergence. US institutional demand is weak, overall demand is negative, and both Dolphins and Whales are in a distribution (selling) phase.”

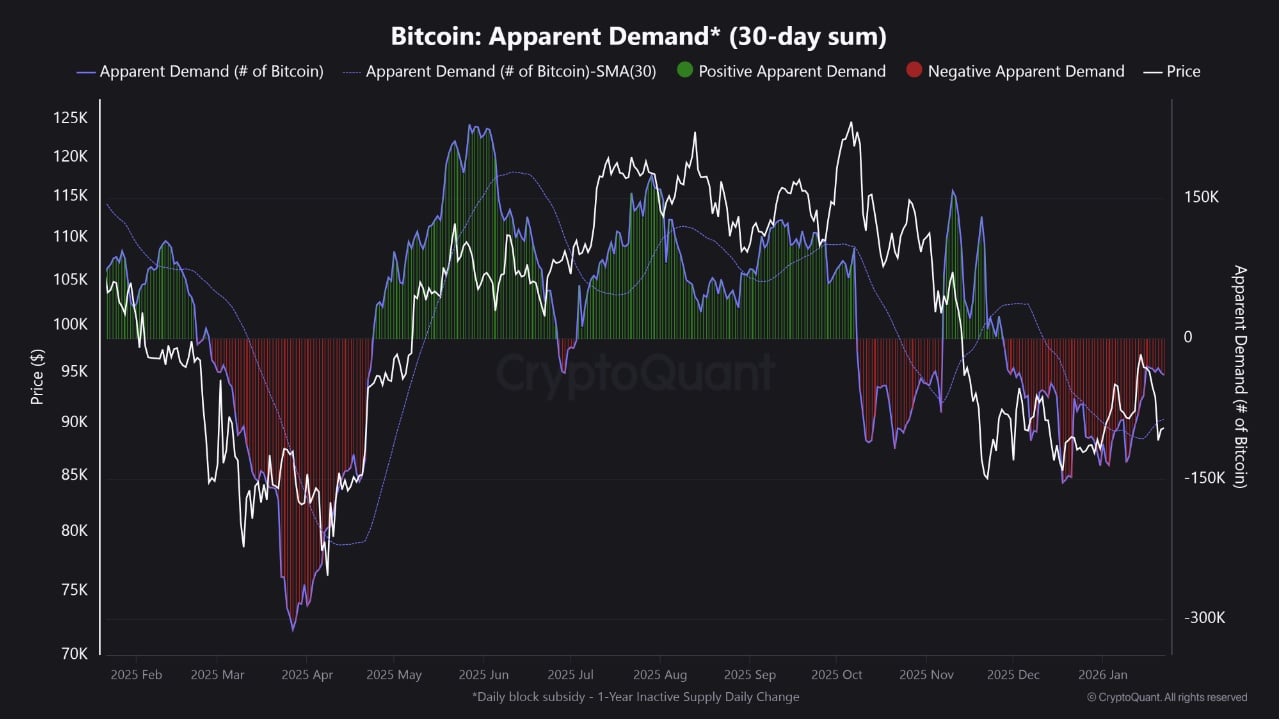

Apparent Demand, calculated on a 30-day sum basis, marks a decisive transition from the positive-demand regime that dominated mid-2025 into a sustained negative phase by January 2026. The visual data indicate that long-term holders are releasing supply at a rate exceeding new buyer absorption, a condition that historically weighs on price action beyond short-lived pullbacks.

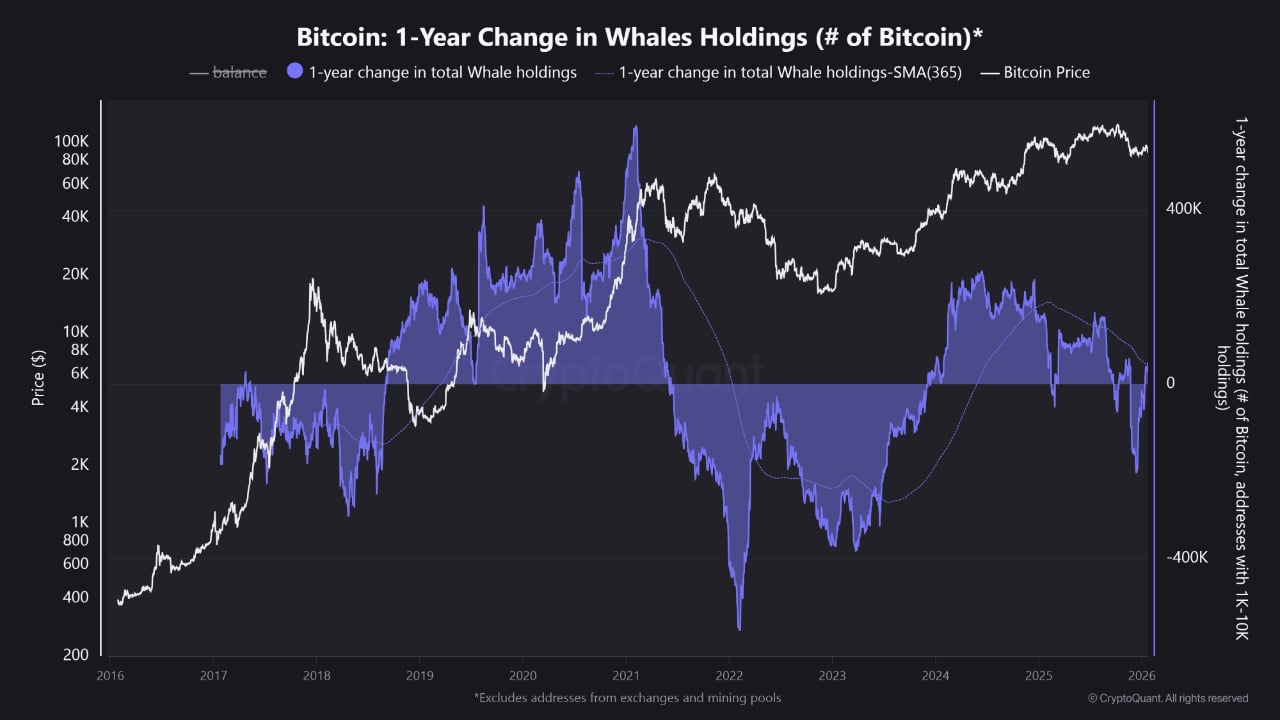

Supporting that conclusion, a separate chart tracking the one-year change in whale holdings, defined as large addresses holding thousands of bitcoin, shows that after persistent accumulation throughout 2024 and early 2025, the indicator compressed sharply and slipped into negative territory, a pattern often associated with late-cycle distribution by dominant market participants.

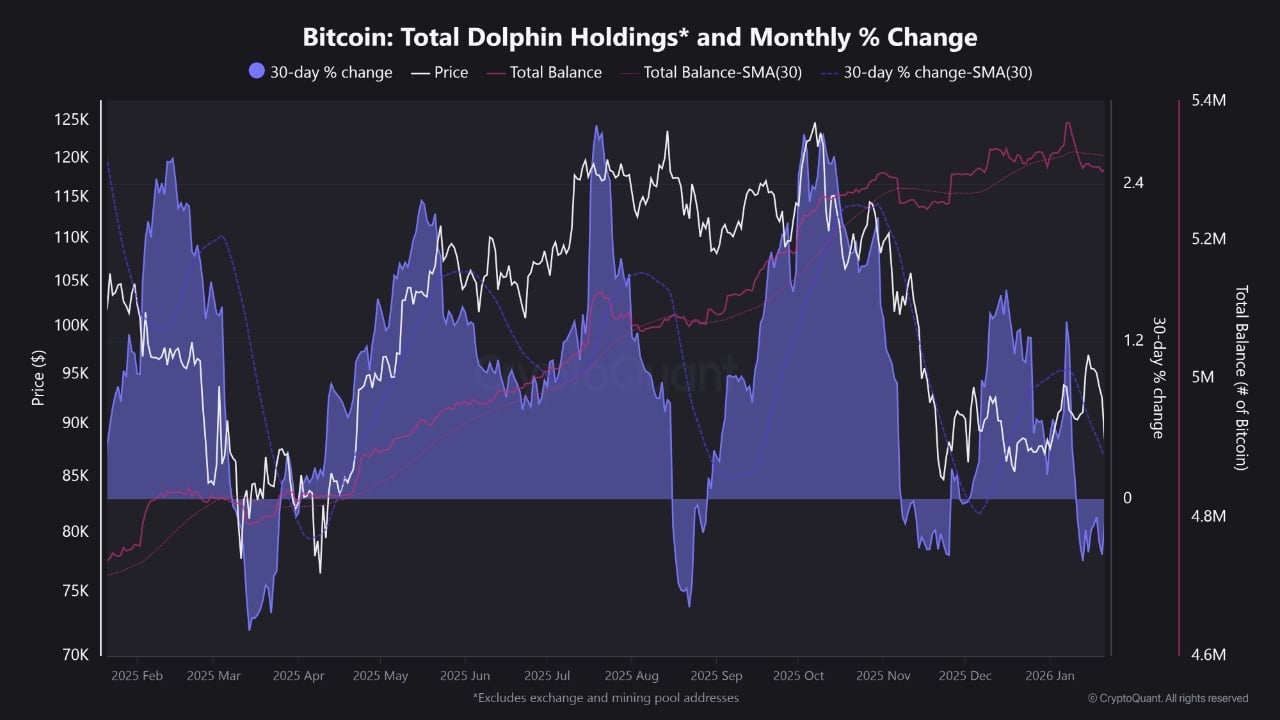

Medium-to-large investors show a similar behavioral shift, as the chart detailing total dolphin holdings and monthly percentage change reveals the 30-day growth metric turning negative following aggressive accumulation during the 2025 rally.

Read more: Bitcoin at $1M Isn’t a Dream —Ark’s Math Says the Market Is Dangerously Late

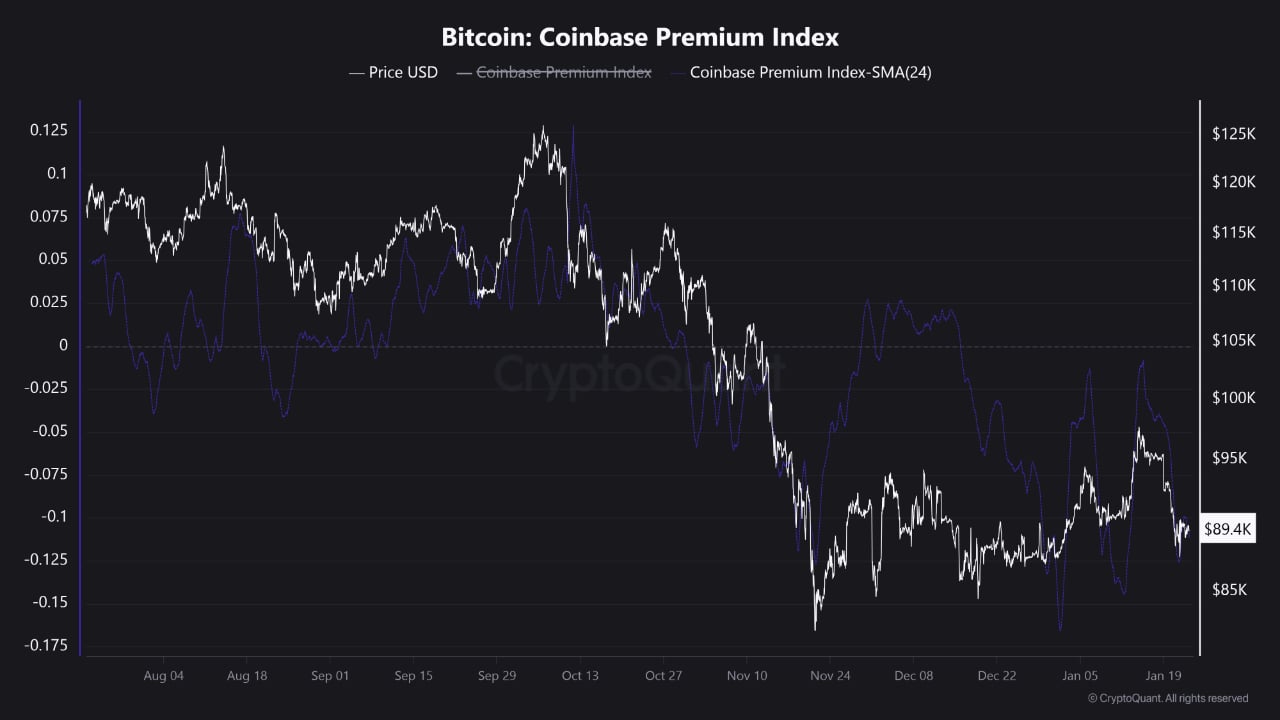

Market structure data from exchanges intensifies the cautionary tone. The Coinbase Premium Index remained deeply negative as bitcoin drifted toward $89,400, suggesting comparatively weaker appetite from U.S.-based traders and institutions than from global counterparts. Historically, extended periods of negative premiums have aligned with reduced risk-taking from domestic capital pools.

Together, these signals portray a market digesting excess supply amid declining marginal demand. While such conditions have often preceded prolonged consolidation rather than immediate collapse, they underscore a fragile near-term setup. Over longer horizons, bitcoin’s capped supply, expanding global liquidity access, and continued integration into investment vehicles have previously provided a foundation for renewed accumulation once distribution pressure subsides.

- What is driving the current bearish convergence in bitcoin markets?

On-chain data show negative apparent demand alongside whale and dolphin distribution, signaling selling pressure outweighing new buyer absorption. - Why is Cryptoquant warning about long-term holder behavior?

Long-term holders are releasing bitcoin at a pace that historically suppresses price momentum beyond short-term pullbacks. - What does a negative Coinbase Premium Index indicate for bitcoin?

It reflects weaker demand from U.S.-based traders and institutions compared with global markets. - Do bearish on-chain signals mean a bitcoin crash is imminent?

Historically, similar conditions have led to extended consolidation rather than immediate sharp declines.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。