Prediction markets as of Jan. 25, 2026, offer a wide-angle look at where traders think bitcoin is headed next, even as the asset slips under the $87,000 level and prints an intraday low of $86,117 during Sunday trading.

Rather than one unified forecast, the data paints a layered picture: optimism dominates long-term bets, while near-term contracts show restraint, tight ranges, and little appetite for dramatic moves. In short, traders are hopeful, but not in a hurry.

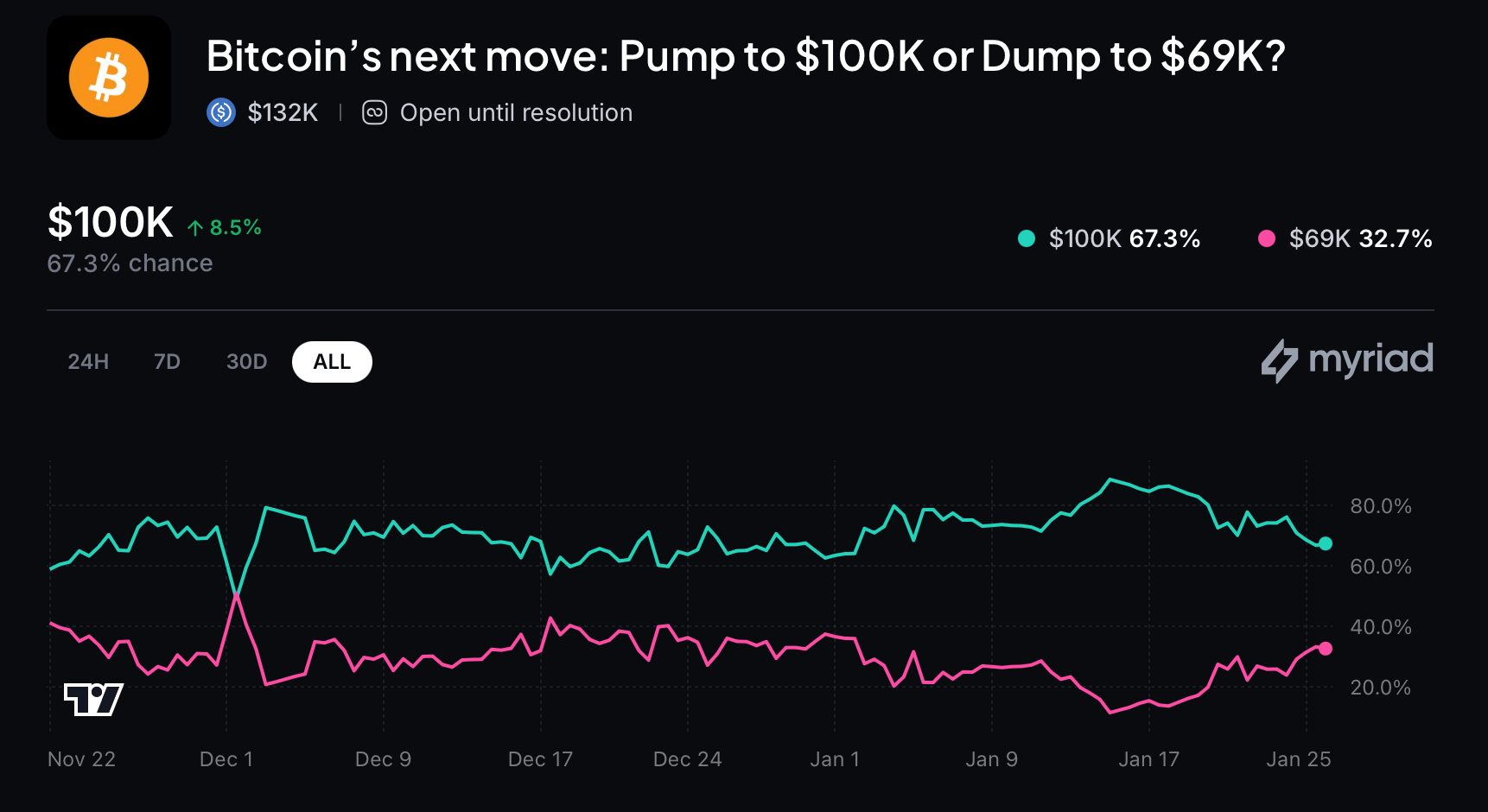

One of the clearest expressions of long-term confidence comes from a Myriad contract that asks a blunt question: Will Bitcoin hit $100,000 first, or fall to $69,000? At the time of observation, traders assigned a 67.3% probability to $100,000 and just 32.7% to $69,000, signaling a strong bullish skew. The market remains open-ended, resolving only when one of those levels is touched using Binance’s BTC/ USDT one-minute spot price.

That structure matters. Because there is no expiration date, the contract reflects directional conviction rather than timing. Traders may not expect fireworks this week or next, but they are clearly leaning toward higher prices eventually.

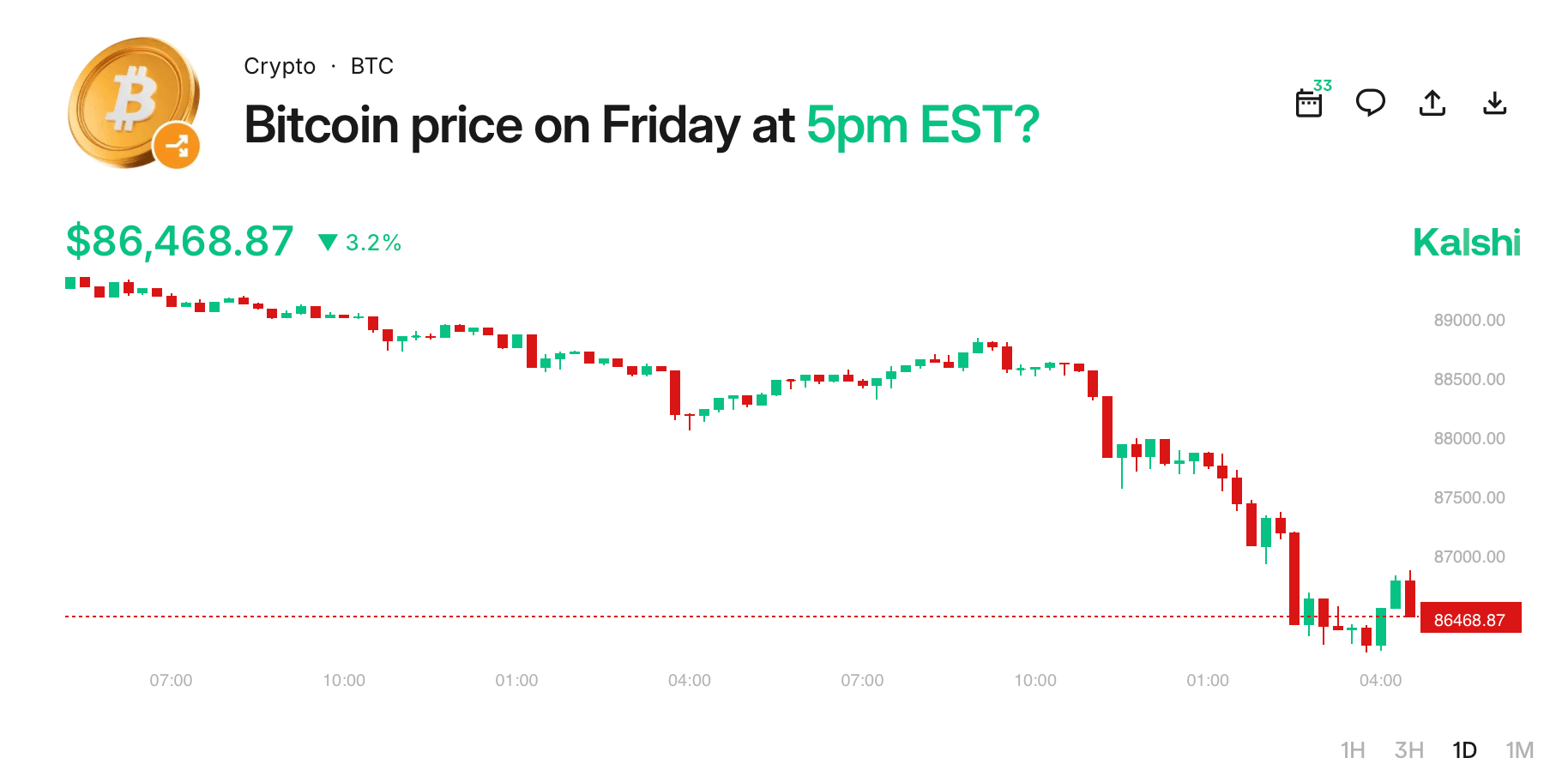

Shorter-dated markets, however, strike a noticeably different tone. A Kalshi contract tracking whether bitcoin will trade above $86,750 at 5 p.m. EST on Jan. 30 shows the market almost evenly split, with roughly a 53% probability assigned to the bullish outcome. With “Yes” trading near 54 cents and “No” around 50 cents, the contract effectively calls it a coin flip.

The reference price hovering just below the threshold points to how finely balanced sentiment is in the near term. Traders are not pricing panic, but they are not pricing confidence either. The message: bitcoin is close, but conviction is thin.

Polymarket’s short-dated noon ET Jan. 26 contract reinforces that sense of restraint. The highest probability outcome, at 43%, places bitcoin in the $86,000 to $88,000 range, followed by $84,000 to $86,000 at 25.8% and $88,000 to $90,000 at 20%. Together, those brackets suggest expectations for tight, rangebound trading.

Outlier scenarios barely register. Sub-$84,000 outcomes sit under 10%, while anything above $90,000 collectively carries less than 6% implied odds. With about $820,775 in volume, participation is healthy, but hardly euphoric, reinforcing the idea that traders see consolidation, not chaos.

A broader January-wide Polymarket contract, tracking the highest price bitcoin might hit during the month, offers perhaps the most sobering snapshot. The strongest probability centers around $85,000, with roughly 69% implied odds, while $80,000 sits near 15%. Above $100,000, probabilities fall off a cliff, with most higher targets priced at 1% or less.

Also read: Polymarket Launches Real‑Estate Prediction Markets Using Parcl’s Housing Indices

Despite that caution, the market has attracted more than $61 million in volume, suggesting strong collective agreement that January’s peak is likely capped below six figures. Big money, it seems, is betting on realism over bravado.

Taken together, the four markets sketch a consistent narrative. Traders believe in bitcoin’s long-term upside, but they see January as a month for digestion rather than liftoff. The crowd is patient, pragmatic, and allergic to drama.

For now, prediction markets are not calling for a breakdown or a breakout. They are calling for a grind, with bullish dreams parked just beyond the calendar page.

- What do prediction markets suggest about bitcoin’s near-term price?

They point to tight, rangebound trading in the mid-$80,000s rather than sharp moves. - Are traders still bullish on bitcoin long term?

Yes, longer-dated markets strongly favor bitcoin eventually reaching $100,000. - Is a major January rally likely, according to markets?

No, January-wide contracts show low odds for prices above six figures. - Do prediction markets expect a sharp crash?

Not really, as downside scenarios below the low-$80,000s carry relatively low probabilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。