Article editing time: January 26, 2026, 18:30. All opinions do not constitute any investment advice! For learning and communication purposes only.

Self-discipline hides infinite possibilities in life, and its depth also measures the height of life. Every step of deep cultivation has its own echo; the more disciplined one is, the further they go. I am Fuzhu, deeply analyzing mainstream coin trends, breaking down market logic with professional accumulation, and outputting pragmatic trading ideas.

Market Overview

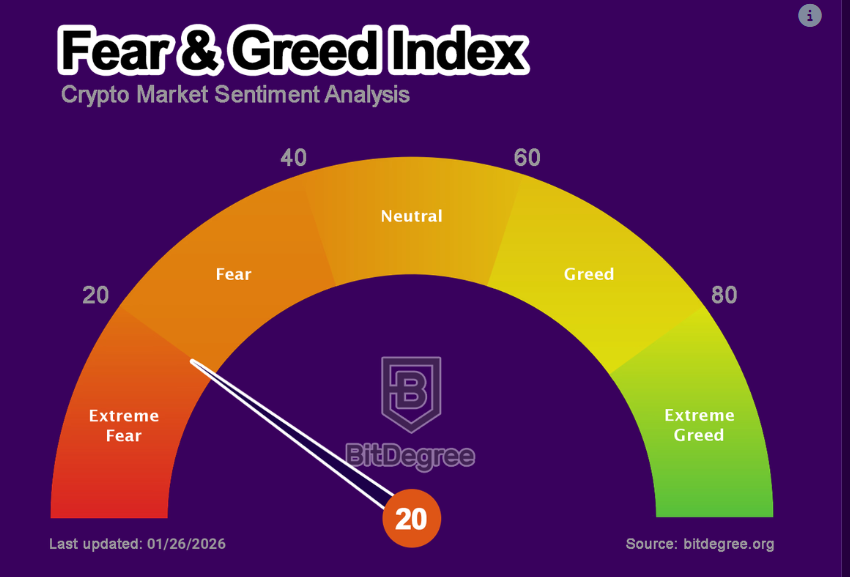

Today, the cryptocurrency market is generally showing a volatile downward trend. A slight rebound was influenced by the weakness of the US dollar, but the total market value has shrunk by about 5% over the past week, currently around $3.05 trillion, with a 24-hour trading volume of about $120 billion. Bitcoin fell to around $86,000 in the early session, then rebounded to a high of around $88,400, with a 24-hour decline of about 2.87%. Ethereum (ETH) performed even weaker, down 4.61%, currently consolidating around $2,900. Market sentiment leans towards fear, with altcoins like Solana and XRP following the overall market decline, but some AI-related coins (like FET) have seen slight increases. BTC dominance is about 57%, and ETH's share is about 12%.

Fundamentals

BTC fundamentals are under pressure but remain optimistic in the long term. The increasing economic risks in the US have led to a short-term crash, with leveraged liquidations exceeding $500 million. Institutional demand is strong; although ETF inflows have slowed, there was a net inflow of about $166 million in the past week, and the supply from long-term holders is increasing. Miners are turning to AI applications for new growth points, but the weak dollar and inflation expectations suppress risk appetite.

Policy Aspects

Today, fears of shutdowns by the US government and tensions between the US and Canada have turned the situation upside down! The risk of shutdowns has triggered a broad risk aversion, causing the cryptocurrency market value to evaporate by billions, with traders fleeing to gold. Although the weak dollar has boosted cryptocurrencies, overall demand remains weak.

This week, volatility may increase due to economic events, but regulatory clarity is accelerating: the CLARITY Act promotes banks entering crypto, and the GENIUS Act addresses stablecoin regulations. Short-term fears of shutdowns dominate, while mid-term regulatory improvements act as a catalyst—crypto is moving from "wilderness" to "mainstream fortress"!

Technical Analysis

BTC is currently consolidating around $88,000. It touched a low of around $86,000 in the early session, then rebounded to around $88,400 before pulling back again. After breaking below the $89,000 level, it has turned into a resistance level. Technically, if it cannot return above the $89,000-$90,000 range, it is likely to test $86,000 again. Key support is around $85,000. ETH is consolidating around $2,900; in the short term, we need to see if it can effectively hold above $2,900. If it can, it will challenge the $3,000 level; otherwise, a drop to $2,600 is still possible.

In terms of operations, consider short positions for BTC around $89,000 and long positions around $85,000. For ETH, consider short positions around $2,950 and long positions around $2,700. (Remember to control contract positions within 10% and set stop-losses.)

Disclaimer: The above content is personal opinion, and strategies are for reference only, not as investment basis. Any risks taken are at your own discretion.

Friendly Reminder: The above content is created by the public account: Fuzhu Zhiyuan. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。