Written by: Joe Zhou, Foresight News

"It seems that Vitalik has undergone some subtle changes after a year."

This was the first thought that crossed my mind after finishing my second interview with him in Chiang Mai.

Memory flashes back to the end of 2024. Our first conversation took place in a closed and quiet indoor space on Nimmanhaemin Road in Chiang Mai. At that time, he was filled with excitement about innovations in the Web3 application layer. We talked for a full 90 minutes, covering topics from Farcaster to Polymarket, and then to Solana and Base.

This time, the date has shifted to the end of January 2026, and the scene has changed to a completely open space.

That afternoon, Vitalik casually strolled from the "Four Seas Community" to the "Co-living space of the 706 Community." On the second-floor balcony, he was sitting alone on a swing, swaying contentedly, exuding a relaxed vibe that felt just like any ordinary community member here. I took a seat beside him and, with the swing swaying back and forth, threw a series of questions his way.

Around us were community members busy with their own activities. There was no strict security, nor any deliberate show. Before long, seeing us chatting, a few curious friends from the 706 Community naturally gathered around, sitting on the ground like a group of college students chatting on a campus lawn.

In the subsequent conversation, I was surprised to find that his thought process had undergone substantial iteration over the past year.

Whether it was Web3 social, prediction markets, or AI, his perspectives had become sharper and more specific. He dissected his observations on leading projects like Polymarket, Farcaster, UMA, Chainlink, MetaDAO, and Base, and shared his latest insights on Ethereum's role in the AI era, decentralized stablecoins, and RWA without reservation.

Of course, there were also many things that remained unchanged.

He still has no fixed residence, never staying in one city for more than two months; he still has no bodyguards and queues with us, a large group, in the cafeteria for a buffet; he still holds immense enthusiasm for decentralized communities, tirelessly moving between various hubs in Chiang Mai.

As the conversation wrapped up and night fell, the swing came to a stop. As usual, he dashed off to the street before it got completely dark, calling a ride-share car to leave alone.

Outside that multi-billion-dollar decentralized kingdom, he continues to defend his freedom as an "ordinary person."

Below is my latest conversation with Vitalik. The latter part of the content also includes selected questions from other members of the 706 Community present at the scene.

Image: Vitalik at the 706 Community in Chiang Mai

Vitalik's Reflections in Chiang Mai: Technological Maturity, Why Applications Are Lost

Joe Zhou: A year ago, on the eve of Devcon, I invited you for an exclusive interview titled "Vitalik, Forty-Two Days in Chiang Mai." A year later, we meet again here. What new feelings has this return to Chiang Mai brought to your personal mindset?

Vitalik: I've seen some communities thriving, like the Four Seas Community, which has undergone many different changes. There are many activities, many people, and one crucial point—they haven't become boring.

Joe Zhou: Environment and time often reshape thoughts. A year later, I'm curious about how your thinking paradigm regarding core issues in Crypto has changed. Where does your attention anchor now?

Vitalik: The biggest shift is that I've seen a significant disconnect between technology and application.

In the past year, Ethereum has made tremendous progress in scaling technology. Our gas limit has increased from 30 million to 60 million, and this year's goal is to push for 300 million. This includes the successful implementation of zkEVM and significant improvements in infrastructure experiences like wallets—one could say that the development on the technical level has been very successful.

However, in contrast, I've seen many concerns at the application level. Looking back five or ten years, the community had a very diverse and grand vision for the entire ecosystem. At that time, everyone was hopeful, thinking about creating DAOs and various decentralized applications that could genuinely change the way society collaborates, like a "decentralized Uber." However, I feel that too many people seem to have forgotten these original intentions.

Crypto has succeeded in finance but has lost its way in governance, such as the flaws in the current DAO "token voting" mechanism. The recent explosion of Memecoins is a typical example; in early 2025, even Trump personally launched a meme coin. But I think when he greedily issued a second token, MELANIA, his first coin, TRUMP, had already declared its death.

Joe Zhou: Last year, we had an in-depth discussion about SocialFi applications like Farcaster. A year later, from your current perspective, how do you evaluate their development?

Vitalik: SocialFi is currently in a rather awkward stage. The biggest structural dilemma of SocialFi is that if you tie social and financial incentives too closely, financial incentives often backfire and overwhelm social incentives.

When users come not to access quality content but to make money, they will start generating a lot of junk information to maximize their profits. This is a dangerous signal—because the financial attributes are destroying the essence of social interaction.

I like the model of Substack. If you look at the top ten authors on Substack, they are all very thoughtful and content-rich. But if you look at the top ten on some Crypto SocialFi platforms, they are often just about gaming the system or hype. The difference is that Substack has done curation and community building. They work hard to find authors they believe are of high quality and help them move to their platform, rather than just providing a token issuance tool. This is something Crypto entrepreneurs need to learn.

Joe Zhou: This seems to explain Farcaster's recent transformation—why they are no longer fixated on pure social but have turned to wallets?

Vitalik: Yes. They haven't found a way to scale it up. They are not satisfied with creating a "small but beautiful" product; they desire to have millions or even hundreds of millions of users. In their current path, they believe that the wallet track is more likely to achieve this scale of mass adoption than pure social.

Joe Zhou: A few years ago, there was a general consensus in the industry that the application layer was about to experience a "big explosion," but that hasn't happened. Looking back four years, did you also hold the same optimistic expectations?

Vitalik: Yes, I did think that. At that time, my thought was that the applications hadn't taken off because the core bottleneck was the limitations of the underlying technology—like insufficient scalability, slow speeds, and poor user experience.

But by 2025, at least on L2 (Layer 2 networks), these hard technical barriers have basically been resolved. However, the awkward thing is that we still haven't seen good applications emerge on a large scale. The only track that can be called an explosion in 2025 is prediction markets, but frankly, even they have exposed significant problems.

Joe Zhou: What do you mean by the "problems" you mentioned?

Vitalik: If you look at discussions on Twitter, Polymarket is currently most focused on bets like "Which team will win next week?" or "Will the Bitcoin price go up or down in an hour?" I think in the long run, these short-term bets don't have much social significance. Theoretically, prediction markets as a tool are successful (because they can operate), but we need more meaningful applications.

I think some mechanisms with long-term incentives would be better. For example, Robin Hanson's concept of Futarchy (prediction market governance) is very interesting to me. In traditional governance, people usually vote for candidates (president, legislators) or vote on measures (like "Should we repair this road?"). But Robin Hanson's governance idea is that people only vote to decide "goals" (like: we want GDP growth, or we want to reduce unemployment), and then use prediction markets to determine "means." Traders in the market will use real money to "buy" the most accurate data. Currently, MetaDAO is making related attempts.

Behind Earning $70,000: Vitalik's "Anti-Frenzy" Strategy and Oracle Concerns

Joe Zhou: Do you still use Polymarket? I remember you were using it quite frequently last year.

Vitalik: Yes, I made $70,000 on Polymarket last year.

Joe Zhou: What was your principal?

Vitalik: $440,000.

Joe Zhou: Many people lose money; how did you earn?

Vitalik: My method is simple: I look for markets that are in a "frenzy mode" and bet that "crazy things won't happen." For example, there was a market betting on "Will Trump win the Nobel Peace Prize?" Or some markets predicting that the dollar will go to zero next year during extreme panic. When market sentiment enters this irrational "frenzy mode," I bet against it, which usually makes money.

Joe Zhou: What specific areas do you generally focus on in Polymarket? Crypto? Politics? Entertainment? Economics?

Vitalik: There’s politics and technology. If you want to make money, you need to go to those prediction markets where people are caught up in relatively crazy and irrational predictions; that's when you can make money.

Joe Zhou: As the founder of Ethereum, do you have insider information? During the war in Venezuela, netizens found that someone seemed to have insider information. Have you encountered similar situations?

Vitalik: Here, I want to mention a noteworthy case regarding the vulnerabilities of Oracles. There was a prediction market about the battlefield in Ukraine, betting on "Will the Russian army control a certain city?" The contract defined the standard for "control" as whether they controlled the most important train station in that city. The data source (Oracle) was anchored to ISW (Institute for the Study of War) Twitter and maps.

An incident occurred: an employee of ISW may have made a mistake or intentionally compromised their company's system, causing their maps to suddenly update to show that the Russian army had taken control of the train station. This led to something that everyone thought had only a 5% probability (almost impossible) suddenly becoming 100% in the prediction market. Although ISW retracted the update the next day, the money may have already been paid out.

This reveals a significant problem: the current data sources for Oracles (such as Web2 news sites and Twitter) have very low security standards. They never considered that a piece of information they released could determine the ownership of $1 million on-chain.

Joe Zhou: This indeed sounds like a very crazy situation. You just pointed out some issues with Oracles; how should we address them?

Vitalik: Currently, there are two main approaches to solving the Oracle problem.

The first approach is a centralized model, which simply means trusting a company, like Bloomberg, to provide you with accurate information.

The second approach is Token Voting, which is a decentralized model. The logic is to let holders of governance tokens vote to determine "what is the truth." UMA is a representative of this model. (Note: UMA is a decentralized Oracle protocol on Ethereum that relies on token holders voting to adjudicate the authenticity of data.)

However, recently, trust in UMA has been declining. People believe it has a game-theory flaw: if a whale decides to collude to manipulate the voting results, ordinary people find it hard to fight back. Because in this mechanism, even if you vote for the truth, as long as you stand against the majority, the system will declare you the loser, and you will lose money. This forces everyone to follow the whales in voting rather than following the truth.

I believe a trustworthy Oracle is very important. Because currently, any DeFi application requires an Oracle. If you want to create Real World related applications (like putting real estate on-chain or predicting real elections), you need an Oracle. In the DeFi industry, people generally choose to trust Chainlink. However, Chainlink's mechanism is also quite complex and relatively centralized.

I have always hoped that in the future we can find a better solution.

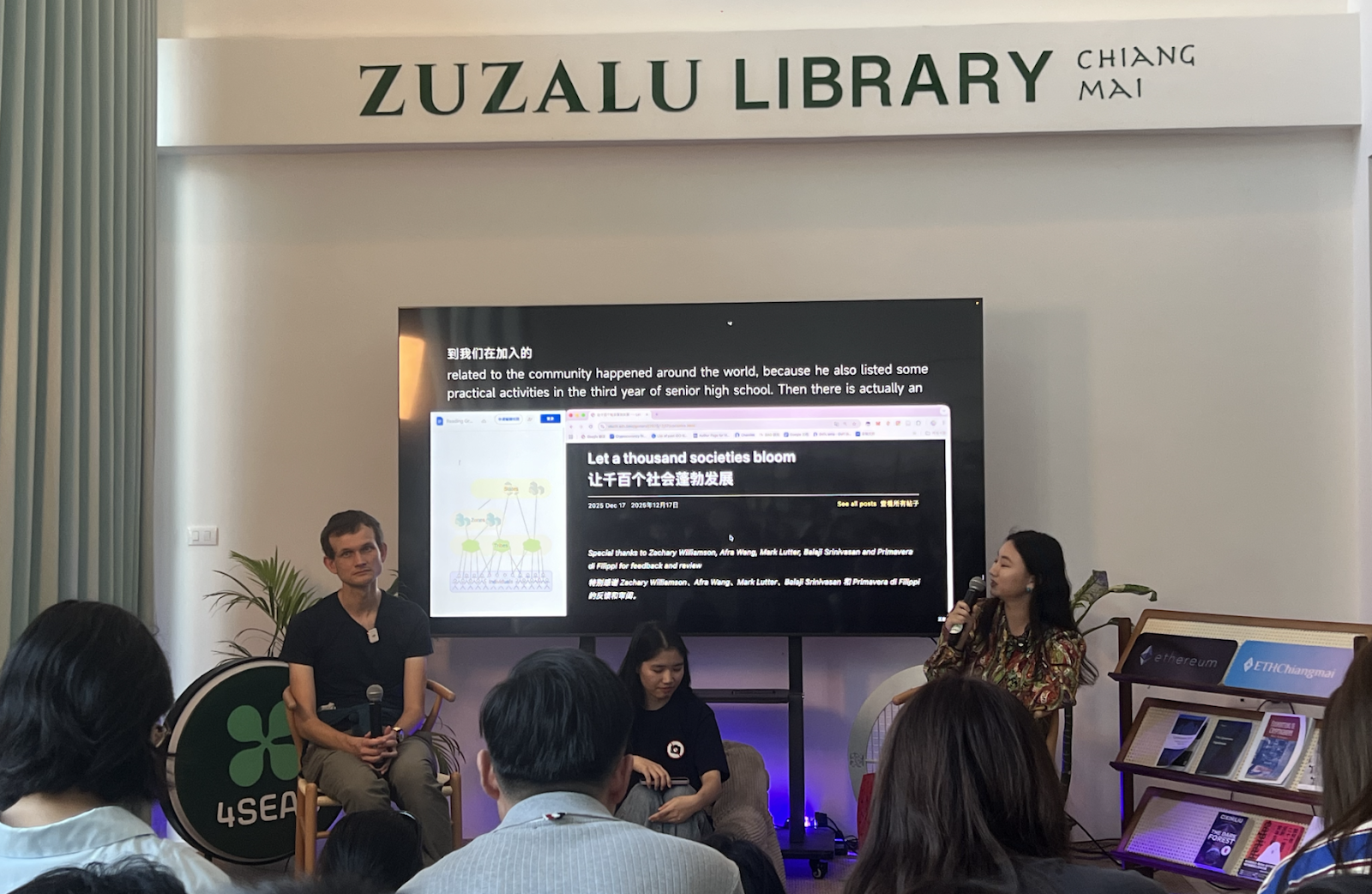

Image: Vitalik sharing at a reading session in the Four Seas Community in Chiang Mai

Ethereum's Survival Path in the AI Era

Joe Zhou: I want to discuss a hot topic right now: AI. Over the past year, the market has had boundless expectations for the combination of AI and Crypto, but the atmosphere now seems to have turned into a collective confusion. In this new era of AI, what role do you think Ethereum plays?

Vitalik: At its core, Ethereum is a decentralized world computer. Its core attribute is "permissionless"—whether human, company, or AI agent, everyone has equal access rights. This means that AI can hold assets, trade, and even participate in DAO governance on Ethereum. From this perspective, Ethereum is already prepared.

Joe Zhou: But the confusion lies in: where are the specific points of integration? How do we bring these two grand concepts to fruition?

Vitalik: First, we need to be wary of a thinking trap: do not combine just for the sake of combining.

For example, even in the AI era, our underlying TCP/IP protocol (Internet protocol) does not need to be restructured because of the emergence of AI. The same goes for blockchain—as a foundational trust protocol, it may not need to undergo dramatic changes.

However, if we look for intersections between AI and Crypto at the application layer, I believe there are indeed several directions worth paying attention to.

1: AI Bank Accounts. AI cannot open accounts at traditional banks. If an AI agent needs funds to perform tasks, Crypto is its only option.

2: Prediction Markets. AI can participate as a trader in predictions, providing more accurate information.

3: Content Authenticity: Using blockchain to prove whether content is human-created or AI-generated.

Joe Zhou: There’s a popular term now called "Vibe Coding" (referring to coding easily with AI assistance without pursuing details). Do you still write code yourself?

Vitalik: Sometimes. I still maintain the habit of writing code myself. My coding work mainly falls into two categories:

The first category is practical scripts, writing small programs for personal use, mainly to improve my productivity.

The second category is research validation. When I am researching some complex cryptographic algorithms, I will write an implementation myself (usually in Python) to validate my mathematical ideas through code.

Joe Zhou: Do you use any of the popular AI programming tools on the market now? For example, Claude, Gemini, or Manus? Which one do you personally prefer?

Vitalik: Actually, I am not tied to any specific tool. I mainly use OpenRouter. It is an aggregation platform through which I can access all models. For coding, I still use some mainstream ones, like ChatGPT, DeepSeek, and Gemini.

Vitalik's Dialogue with the 706 Community: On Motivation, Original Intent, and Ideals

(The following content is organized from a joint interview between Joe Zhou and members of the 706 Community with Vitalik)

706 Community: What is your current motivation for doing things?

Vitalik: My motivation mainly comes from three levels, or three senses of urgency.

First, to avoid the "apocalyptic scenario" for Crypto. What I worry about most for the future is that the entire industry ultimately devolves into a 100% speculative place, with only speculation and no applications. If that happens, once everyone gets bored, this industry will die in boredom. To avoid this outcome, we must build real value—create better DAOs, develop truly decentralized applications that penetrate various industries, and foster a more open DeFi.

Second, to improve Ethereum's technology. Frankly speaking, the current Ethereum technology is still not good enough. Although L2 (Layer 2 networks) have solved the scalability issue, they are still mostly highly centralized. We need to make L2 more extreme and decentralized, allowing the application experience to truly catch up with Web2.

Third, if we fail in Crypto, the future technological world is likely to be completely dominated by Centralized AI, which would be a very dangerous future. Crypto is our defense against this trend of digital totalitarianism, maintaining diversity and freedom in the technological world.

706 Community: This is a hypothetical question: if you could abandon all of Ethereum's historical baggage and redesign it on a blank slate, what would you do?

Vitalik: Frankly speaking, the technical roadmap wouldn't change much. Because no matter how many times we start over, Ethereum's core goal remains unchanged: to be a decentralized application platform.

Looking back before the birth of blockchain, the most successful decentralized network was actually BitTorrent. It was great, but it lacked a key component: a global shared database (Global Shared State). So on BitTorrent, you can share files, but you cannot create a currency, cannot secure assets, and cannot run a DAO. Without a "state," you cannot record "who owns what."

So if I were to redesign it to fill this gap, the platform must have two core features: the first is scalability. Without high scalability, the on-chain costs are too high, limiting it to only high-net-worth DeFi transactions, and mass applications cannot run at all. The second is speed. Only with sufficient speed can we provide a usable user experience.

706 Community: As an ETH holder, I want to ask a sharp question: what do you think is the biggest risk ETH currently faces that is most overlooked by the outside world?

Vitalik: Frankly speaking, I am not too worried about technical risks at the moment.

What truly concerns me is the application layer. The so-called "failure scenario" is not a network outage or a hack, but rather—everyone indeed develops thousands of applications, but when looking back, finds that none of them have real social significance. If we have the strongest decentralized technology but only use it to create a bunch of toys or casinos, that is the biggest risk.

706 Community: Looking ahead 5 to 10 years, what do you think Ethereum's role will be?

Vitalik: I hope it will serve as a core hub for all decentralized applications, not only serving finance but also penetrating various industries.

Its core value lies in "true ownership." Here, if you own something, it truly belongs to you. In the traditional world, you are always subject to some big company—they have the power to shut you down, change the rules, and charge you arbitrary fees. We need to change this status quo. This change is not limited to finance; it is also extremely important in social interactions, identity verification, and other areas.

Therefore, the primary prerequisite for Ethereum's success is that our technology (scalability, experience) must be strong enough to genuinely support these applications and become their solid foundation.

706 Community: Will the development of AI and quantum computers pose a 51% attack on Ethereum?

Vitalik: I don't think so. We need to clarify the concept: the essence of a 51% attack is an attack on the consensus and coordination mechanism of PoS (Proof of Stake) systems—this requires controlling 51% of the funds in the network, not computational power.

Quantum computing mainly threatens cryptographic signatures, not consensus mechanisms; and for AI, I believe it is not a threat but rather can provide assistance. For example, AI can help us with formal verification, discovering code vulnerabilities, thereby making Ethereum more secure.

706 Community Member: Are you keeping an eye on Hyperliquid?

Vitalik: Actually, not too much.

706 Community: You just mentioned wanting to see more applications emerge; what type of applications do you most hope developers will build?

Vitalik: The first is decentralized social (DeSoc). Current social media has huge problems. Although most people dislike Twitter (X), the awkwardness is that we lack a sufficiently good alternative. Users are locked into platforms, with no freedom to "move." We need to build a truly user-owned, portable social network.

The second is "smarter" DAOs. DAOs are still a very valuable concept, but we need to be smarter than we are now. It can't just be about issuing a token and holding a vote. Developers need to think more deeply: what are the specific goals of this organization? What governance structure best matches this goal? We need to conduct more experiments and do things differently than before.

Third, it would be better if we had more decentralized stablecoins.

706 Community: Decentralized stablecoins refer to those pegged to fiat currencies, right?

Vitalik: The most interesting part is here—if we can achieve "de-pegging from fiat," that would be true innovation.

Joe Zhou: If it's not pegged to fiat, then what is it pegged to?

Vitalik: Pegged to real-world value. For example, pegging to the CPI (Consumer Price Index) so that the money you hold is always worth a certain amount of bread; or pegging to energy prices. That is true "stability."

Joe Zhou: This logic sounds very much like Facebook's former Libra project (a basket of currencies).

Vitalik: Indeed. I think the idea behind Libra was good, but the execution went off track. They turned a vision of decentralized currency into a Zuckerberg-controlled corporate version. Due to Facebook's poor privacy record, people instinctively felt fear. So we need to create a similar but decentralized version.

Joe Zhou: Recently, have you been doing any interesting "personal experiments" in your life or technology usage?

Vitalik: (pauses for a moment) I am trying to completely detach from X's official client. Now I mainly use decentralized aggregation protocols like Firefly to publish and browse content.

706 Community: What is your ideal Web3 social product?

Vitalik: It doesn't necessarily need to have features that Twitter doesn't have; it doesn't have to have new financial-related features, but it needs to have higher quality than Twitter. The most important question is not what features it has, but who the users on this platform are.

706 Community: Most ordinary users currently don't care about "data sovereignty," which may also be why Web3 social has struggled to take off. At this stage, where do you think the breakthrough lies?

Vitalik: To be honest, I don't know yet.

The author would like to thank Qiuqiu and other members of the 706 Community for their help with this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。