Top Is Almost In: Market Strategist Warns of Steep Gold and Silver Pullback

Speaking with David Lin on The David Lin Report (TDLR), Chris Vermeulen, chief market strategist at thetechnicaltraders.com, said precious metals are entering a classic late-cycle phase marked by extreme momentum, crowded positioning and rising investor euphoria.

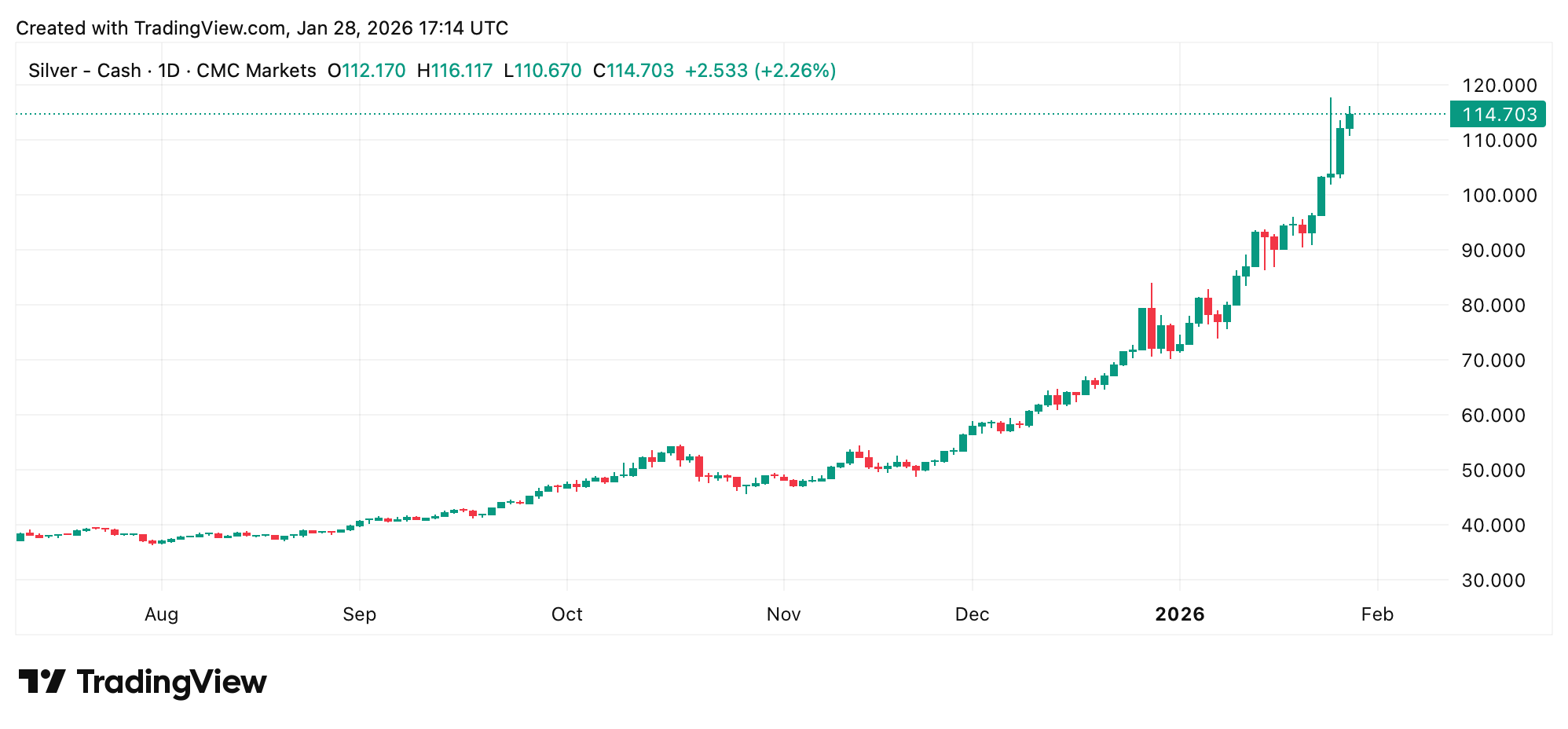

Vermeulen said silver, which recently pushed above the psychologically important $100 level, appears to be in a “feeding frenzy” that could drive prices toward $120 to $140 before the rally exhausts itself. Gold, while slower moving, may also break decisively well above $5,000 per ounce in the near term as capital rotates out of weakening equity markets. As of Jan. 28, 2026, an ounce of gold has already tapped $5,315, and silver came awfully close to reaching $120 on Jan. 26.

Gold prices at 12:14 p.m. EST on Wednesday.

However, Vermeulen cautioned that these final upside moves often precede violent reversals. Drawing comparisons to prior market stress events in 2008, 2020 and 2022, Vermeulen said precious metals initially benefit from equity selloffs but tend to fall sharply once fear, margin calls, and forced liquidation take hold. In past cycles, gold dropped more than 30% while silver and platinum fell over 60%.

Silver prices at 12:14 p.m. EST on Wednesday.

Vermeulen argued that today’s setup is becoming increasingly crowded. He pointed to the surge in mining stocks—some of which have tripled in a year—as a sign that speculative enthusiasm may be peaking. He also flagged the emergence of leveraged mining exchange-traded products as a late-cycle warning signal historically associated with market tops.

Beyond metals, Vermeulen expressed growing concern about the broader economy and equity markets. He said artificial intelligence (AI)–linked stocks, particularly the so-called “Magnificent Seven,” appear to be forming topping patterns after massive capital inflows over the past year. Financing for data centers is already tightening, and momentum in the AI trade has slowed, Vermeulen remarked.

Chris Vermeulen, chief market strategist at thetechnicaltraders.com, speaking with David Lin from The David Lin Report.

If major equity indices roll over, Vermeulen expects an initial wave of capital to flow into precious metals, potentially fueling one last upside burst. But if stocks fail to stabilize and continue lower, he warned that metals would likely follow as investors sell anything with liquidity.

Vermeulen said his firm has shifted into a defensive posture, raising cash levels to roughly 30% of portfolios and exiting technology-heavy positions such as the Nasdaq-tracking QQQ. He emphasized that this move was recent and not a long-standing bearish stance, noting that his strategy follows trends rather than predicting tops.

On interest rates, Vermeulen highlighted technical signals suggesting the U.S. 10-year Treasury yield could eventually climb toward a massive 8.3%, a move he said would place severe strain on government debt and global bond markets. While he stressed that such an outcome is not guaranteed, he said the charts point to mounting structural stress.

Vermeulen was also cautious on bitcoin (BTC), which he described as vulnerable to sharp downside moves if equities weaken. He said bitcoin’s mass-psychology dynamics often lead to swift selloffs once momentum turns, making it riskier than gold during periods of market stress.

Also read: Tom Lee: Gold and Silver FOMO Is Setting up Next Crypto Rotation

When asked to choose between gold and bitcoin in 2026, Vermeulen said he favors gold due to its lower volatility and established role during financial uncertainty, even though he remains bullish on gold’s long-term trajectory well beyond current price levels.

Despite his caution, Vermeulen said he does not believe the metals rally has fully ended. Instead, he framed the current moment as a decision point, urging investors to scale out gradually rather than attempt to time an exact top. “At some point,” he said, “you just have to be happy with the gain.”

FAQ ❓

- Is the gold rally over?

Not yet, but Chris Vermeulen believes gold may be entering its final upside phase before a major correction. - How big could the correction be?

Vermeulen warned gold and silver could fall between 30% and 60% once the rally peaks. - Why is silver riskier than gold?

Silver’s smaller market size and parabolic momentum make it more vulnerable to sharp reversals. - What about bitcoin?

Vermeulen said bitcoin could drop sharply if equities weaken, citing its history of fast, sentiment-driven selloffs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。