Written by: Dogan, Cyber Fund Researcher

Translated by: Shaw Golden Finance

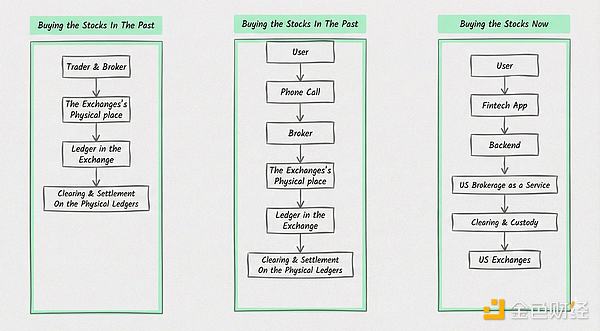

The U.S. securities exchanges manage approximately $69 trillion in assets, providing investors and traders with access to financial markets. However, this system has not always operated at the speed and efficiency we see today. In the past, trading relied on phones, paper ledgers, and many manual operations. To understand where we are today, it is necessary to briefly review the evolution of trading.

Evolution of U.S. Securities Exchanges

In the early days, information was difficult to disseminate widely, so trading could only occur in physical locations, namely stock exchanges. With advancements in communication technology, trading was no longer confined to trading floors but began to occur via phone between brokers.

However, by the 1960s, this system still primarily relied on manual operations. Brokerage firms' back offices were overwhelmed with paper documents, and settlement was slow and error-prone. This fragility led to the back-office crisis from 1967 to 1970, when trading volumes far exceeded the industry's processing capacity. This crisis ultimately led to the establishment of the Depository Trust Company (DTC), which later merged with the National Securities Clearing Corporation (NSCC) to form the Depository Trust & Clearing Corporation (DTCC), the infrastructure that supports today's U.S. stock market.

The fundamental issue is simple: No centralized institution could manage counterparty risk on a large scale. During times of market stress, panic and forced liquidations led to broker failures. The DTCC emerged as a central clearing layer, effectively acting as a system risk manager and guarantor.

With the rise of the internet, exchanges gradually became internet-native enterprises, and a new layer emerged in the market structure: fintech applications and Brokerage-as-a-Service providers. These platforms significantly lowered the barriers to entry into the U.S. stock market, allowing brokers and consumer applications to provide global market access via APIs.

Today, U.S. stocks are traded globally through this technological platform, and the application scope continues to expand. This trend has given rise to several unicorn companies, including Robinhood, Revolut, Midas (which provides U.S. stock trading services for Turkish users), GetBaraka (focused on the UAE market), and more.

It is important to clarify that the DTCC's clients are brokers, not end users, and this situation is unlikely to change. The reason is simple: the DTCC does not process millions of transactions in real-time. Instead, it receives executed trades from brokers, nets them, and ultimately processes the resulting debts. This design allows the system to operate efficiently in a large-scale market environment. Even for highly optimized databases, directly processing millions of transactions per second is impractical.

Why is this point so important when discussing tokenized stocks rather than the history of exchanges? Because putting stocks directly on the blockchain does not automatically solve the core issues of market structure.

The existence of the DTCC is to address one of the most critical issues in the stock market: counterparty risk. Most current tokenized stock models still carry counterparty risk, just in a different form. While there are many on-chain price discovery mechanisms, none are specifically designed for stocks operating within regulated market blocks.

Additionally, there are fundamental pressures on the licensing mechanism. Stocks are not apolitical assets, but permissionless blockchains are essentially neutral (or at least strive to be). Allowing U.S. stocks to circulate freely in a completely permissionless system could conflict with sanctions and regulatory requirements. On the other hand, placing tokenized stocks under a permissioned mechanism can transform the blockchain into a more efficient ledger, which is useful but significantly incompatible with existing decentralized finance (DeFi) liquidity and composability.

Types of Tokenized Stocks and Their Pros and Cons

1. Perpetual Exchanges

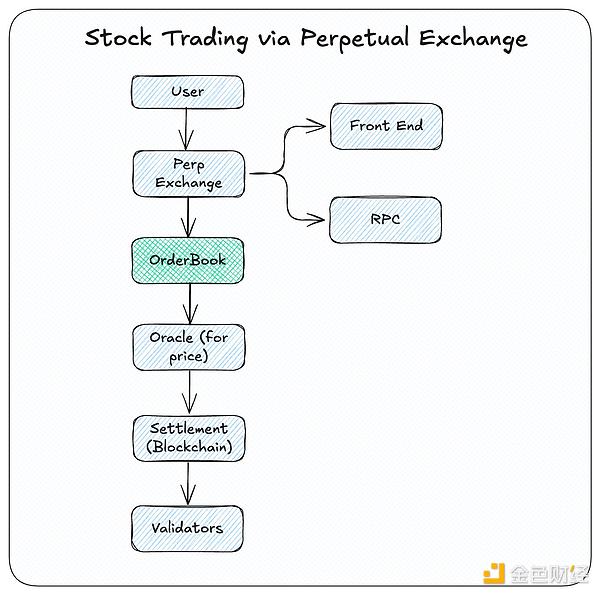

In 2017, Bitfinex launched a new financial instrument: perpetual futures. This innovation enabled 24/7 leveraged trading without relying on the traditional financial system. This is primarily due to the fact that cryptocurrencies are the only global financial market that never closes.

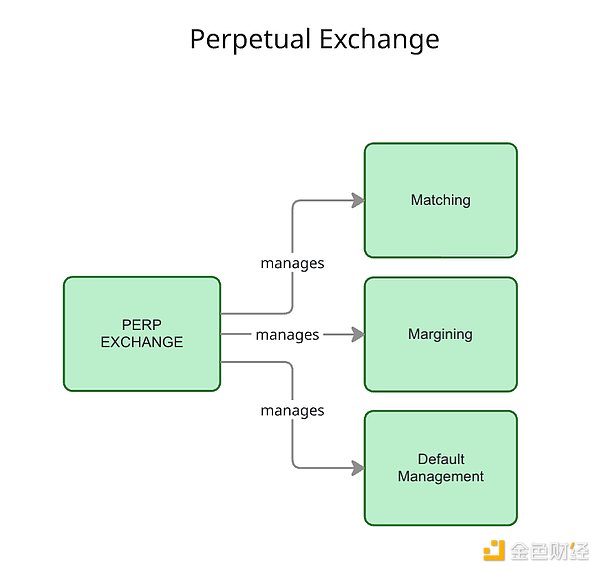

Perpetual futures contracts (referred to as "perpetual contracts") are trading venues where users can buy and sell perpetual contracts that track the price of underlying assets without an expiration date. Traders can establish long or short positions by providing margin, thus gaining leveraged exposure to price fluctuations. To keep the contract price aligned with the spot market, exchanges employ a funding rate mechanism, which periodically facilitates capital flow between long and short positions. Positions are continuously marked to market, and when margin requirements are no longer met, automatic liquidations are triggered. Risk management is achieved through margin rules, liquidation mechanisms, and insurance mechanisms, rather than through expiration settlements.

From a macro perspective, exchanges utilize a synthetic price discovery mechanism introduced by perpetual contracts, allowing any asset to be traded 24/7.

The core value of perpetual contracts lies in their ability to allow any trader to gain leveraged price exposure to assets. However, as you might expect, perpetual contracts are not backed by actual stocks. Therefore, they do not pay dividends, do not confer ownership, and are more susceptible to price manipulation.

This makes the perpetual contract market easier to launch compared to other methods, but it also means they can only provide synthetic exposure, have limited legal protections, and do not grant direct claims to the underlying equity.

2. Traditional Tokenization Platforms (Current Existing Platforms)

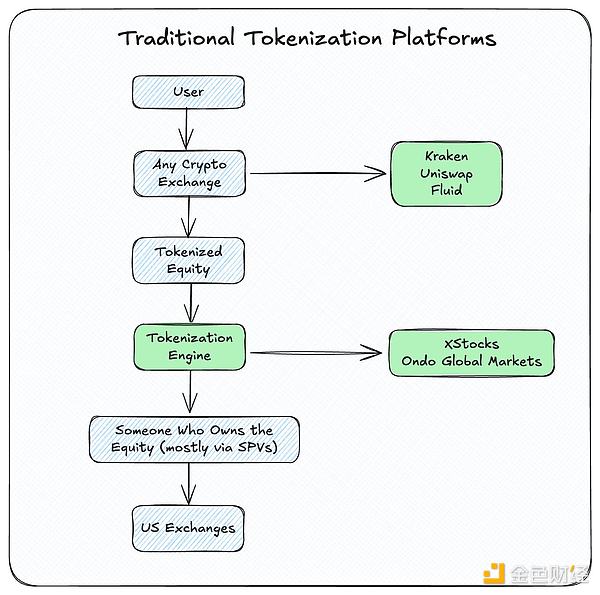

In general, tokenization refers to converting assets into standardized digital representations, or tokens, to facilitate storage, transfer, and processing within a system. In the cryptocurrency space, we already have an increasingly rich array of such tokenized products. These products include stablecoins (tokenized dollars), tokenized deposits (e.g., JPM Coin), and tokenized credit (e.g., syrupUSD). Additionally, there are tokenized equity products, such as Ondo Global Markets and Backed Finance's xStocks, which have secured millions of dollars in equity and facilitated millions of dollars in trading volume.

These platforms typically tokenize their controlled equity through special purpose vehicles (SPVs) or similar issuance structures, allowing more people to access these assets. In some cases, they also tokenize exchange-traded funds (ETFs) that track underlying equities. This model often operates under regulatory frameworks or is offshore, frequently navigating regulatory gray areas.

The main issue with this approach is the lack of a clear legal framework to protect users. Token holders typically do not enjoy enforceable rights such as dividends, voting rights, or direct ownership of the underlying shares. Instead, they only receive economic benefits, similar to stock trading conducted through perpetual exchanges.

While this model introduces legal and counterparty risks, it also brings significant benefits. Token holders can trade 24/7 and, where applicable, can integrate these assets into DeFi protocols, achieving composability that traditional stock markets cannot.

An interesting detail is that almost all tokenized stocks use Alpaca as their broker. Therefore, compared to traditional processes, traditional tokenization merely adds a step and increases complexity.

3. Direct Tokenization Platforms

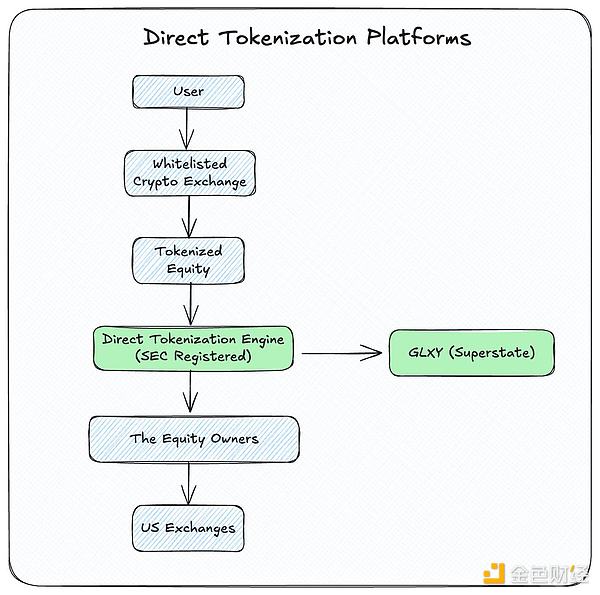

So far, we have discussed "tokenization through wrapping." However, it is also possible to directly tokenize ordinary stocks while retaining the same legal rights as stocks purchased on U.S. exchanges. How is this achieved?

Currently, there are few such examples, but the most well-known is the tokenization of GLXY through Superstate. This is feasible because Superstate is a registered transfer agent with the U.S. Securities and Exchange Commission (SEC). Any GLXY shareholder can collaborate with Superstate to transfer their shares onto the blockchain. In this model, Superstate acts as a bridge between the public blockchain and the DTCC system.

Nevertheless, compared to wrapping-based tokenization, the application of on-chain tokenization remains very limited. This is primarily because this model requires both shareholders and issuing companies to actively integrate with platforms like Superstate. Currently, GLXY has only about 80 on-chain holders, accounting for approximately 0.0075% of total outstanding shares.

The key advantage of this method is that token holders retain full shareholder rights, including dividends, voting rights, and other benefits associated with direct equity ownership. While this is a significant legal advancement, scaling this model to the trillions of dollars in stock remains a massive challenge.

From a broader perspective, the reason fintech platforms capable of trading U.S. stocks have become mainstream is not that they only offer a few assets, but because they support nearly all listed U.S. stocks. Broad coverage, rather than limited choices, is the true driving force behind their popularity.

Therefore, direct tokenization is promising and is one of the hottest solutions emerging in the market recently; however, it is a one-to-one model that requires teams to invest significant business development efforts. A strong team may be able to create a good product, but I still do not see a network effect that can transfer all equities onto the blockchain.

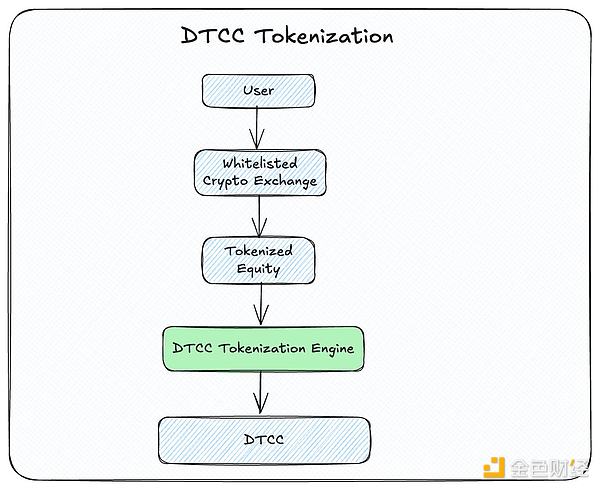

4. DTCC is Tokenizing Stocks

DTCC is responsible for the custody, net settlement, clearing, and counterparty risk management of U.S. stock trading. It is a nonprofit organization, but it can also be profitable. If the DTCC tokenizes the stocks it holds in custody, it would undoubtedly be the ideal development direction for the U.S. digital asset market.

Two weeks ago, the DTCC announced plans to tokenize the stocks it holds in custody. This is a significant advancement that seemingly addresses the debate over tokenized stocks in the U.S. market. However, let’s take a closer look at what was actually announced.

This vision means that in the future, stocks, mutual funds, fixed income products, and other financial instruments can be transferred on-chain on demand, at least in a tokenized form. This functionality adopts a voluntary participation model, and assets will not be forcibly migrated. However, the DTCC is building infrastructure aimed at enabling participants to convert securities into tokenized formats and vice versa in as little as 15 minutes.

The system allows clients to use decentralized finance strategies or 24/7 settlement channels while maintaining a connection to traditional market liquidity. Tokenized assets will retain all existing ownership, legal protections, and bankruptcy treatment.

DTCC's Global Head of Digital Assets and Managing Director Nadine Chakar stated, "We will not dictate which wallet or blockchain clients should use. Everything we do is to meet their needs."

They essentially stated that they would tokenize the equity in custody and inject it into the existing system. However, I am not as optimistic as others for a simple reason:

Look at how long it took Galaxy to tokenize its own stock. They released a lengthy report detailing the legal implications and operational methods of tokenization, even though this was just "their" own stock being tokenized.

If the DTCC becomes the counterparty for tokenized transactions, they will need to handle all anti-money laundering and "know your customer" (AML/KYC) processes for millions of clients. When the scale reaches such a size, it will become extremely complex.

This would make the DTCC more vertical, effectively turning it into a "broker," which seems unrealistic to me.

Do not think they will allow unrestricted access to U.S. financial assets. There is a reason for the existence of sanctions. The U.S. is one of the superpowers, and they will not let go easily.

What does the future hold?

I believe the future will see the emergence of on-chain native brokers similar to Interactive Brokers (IBKR) or Alpaca, but built specifically for cryptocurrencies. Some platforms already support USDC deposits, but their activities have largely stopped there and have not truly expanded to on-chain. (Even Alpaca has supported the existing traditional tokenized stock infrastructure.)

In this model, the system can operate exchanges using order books or other price discovery mechanisms, settle trades on-chain, and retain ownership through existing market infrastructure. To achieve this, brokers need to integrate with institutions like the SEC and DTCC. The DTCC can facilitate one-to-one tokenization or a 24/7 operational settlement layer, while blockchain-native infrastructure handles custody, composability, and programmability.

This would enable brokers to operate natively on-chain while leveraging the rapidly growing new on-chain banks and their financial ecosystem.

Nevertheless, the complexity of infrastructure and legal frameworks remains the biggest challenge that needs to be addressed. This is precisely why I am writing this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。