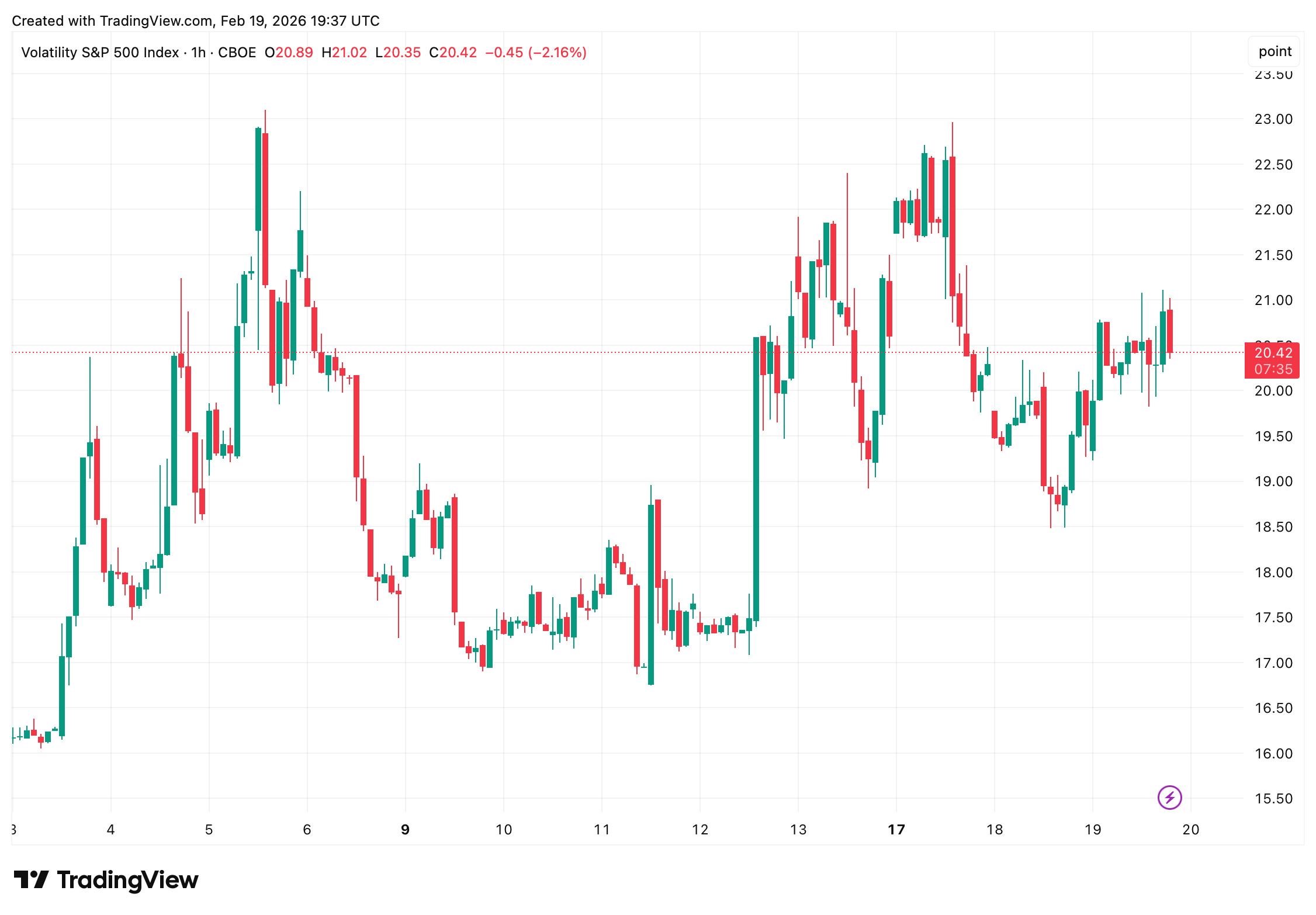

As of 3:30 p.m. EST on Feb. 19, just before Wall Street’s close, the Dow Jones Industrial Average stood at 49,349, down 314 points, or 0.63%. The S&P 500 fell 28 points, or 0.41%, to 6,853, while the Nasdaq Composite declined 107 points, or 0.47%, to 22,646. The CBOE Volatility Index rose about 4% to 20.41, reflecting increased uncertainty heading into the close.

Cboe’s VIX on Feb. 19, 2026.

The pullback follows Wednesday’s rally, when artificial intelligence-linked optimism lifted technology shares and drove the S&P 500 up 0.6% and the Nasdaq 0.8%. Market breadth was mixed during that session, with fewer than two-thirds of Dow components finishing higher.

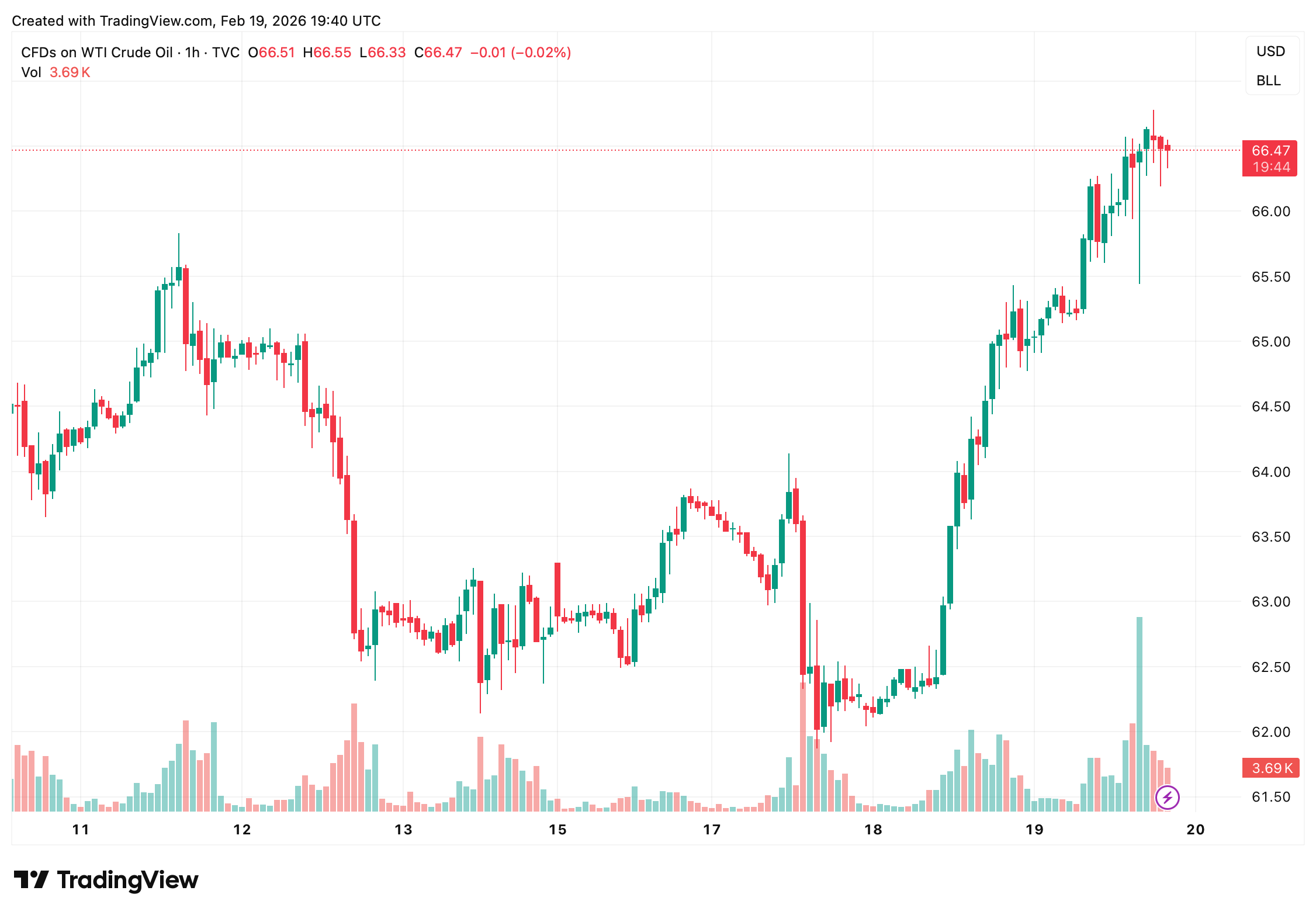

Energy markets were a central driver on Thursday. U.S. crude oil climbed more than 2% to about $66.52 per barrel, reaching a six-month high amid reports that President Donald Trump could decide within 10 days on potential military action tied to escalating U.S.-Iran tensions. The move supported energy stocks but dampened broader risk appetite.

Barrel of U.S. crude on Feb. 19, 2026.

Corporate earnings also shaped trading. Walmart reported better-than-expected fourth-quarter results but issued full-year adjusted earnings guidance of $2.75 to $2.85 per share, below the $2.96 consensus estimate. Shares edged lower. Deere rose more than 11% after topping profit expectations, citing improving demand in construction and smaller agricultural equipment segments.

Economic data continued to signal resilience. January manufacturing output rose 0.7%, while housing starts increased 6.2%. Initial jobless claims came in at 223,000. However, minutes from the Federal Reserve’s January meeting indicated officials remain open to additional rate increases if inflation fails to moderate.

The 10-year Treasury yield held near 4.07%, while the U.S. dollar index rose 0.2% to 97.90. Futures markets currently price in two quarter-point rate cuts in 2026, though stronger data could alter that outlook.

Attention now turns to Friday’s Personal Consumption Expenditures report, the Fed’s preferred inflation gauge. Core PCE is expected to rise 3% year over year, reinforcing expectations that policy easing may proceed gradually.

After-hours earnings from Booking, Block, Intuit and Rivian are expected to influence technology, travel and consumer-related shares. Broader themes, including AI investment trends and pending Supreme Court decisions on tariffs, add additional variables for investors.

With geopolitical risk elevated and inflation data pending, markets appear positioned for continued volatility into the week’s close.

- Why are U.S. stocks lower on Feb. 19, 2026?

Stocks are modestly down due to rising oil prices, geopolitical tensions, and caution ahead of key inflation data. - What is the Dow Jones level in late trading?

The Dow Jones Industrial Average was at 49,349, down 314 points, as of 2:30 p.m. EST. - What is core PCE expected to show?

Core Personal Consumption Expenditures inflation is forecast at 3% year-over-year. - How are oil prices affecting markets?

Crude oil above $66 per barrel is supporting energy stocks but weighing on broader risk sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。