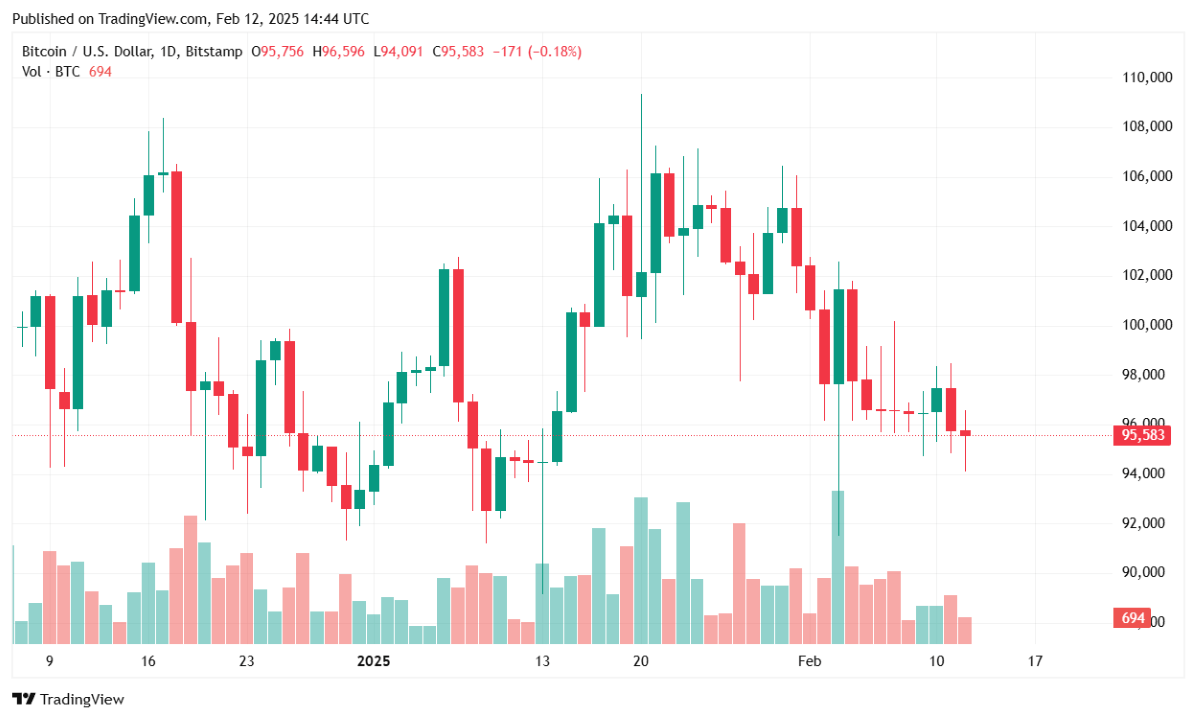

Bitcoin (BTC) is struggling to maintain momentum, trading at $95,580.74 at the time of reporting. The leading cryptocurrency has declined 1.55% in the past 24 hours and is down 3.55% over the past week, as macroeconomic concerns weigh on risk assets. Over the past 24 hours, BTC has fluctuated within a range of $94,101.20 to $97,298.13 as traders react to mounting economic uncertainty.

(BTC Price / Trading View)

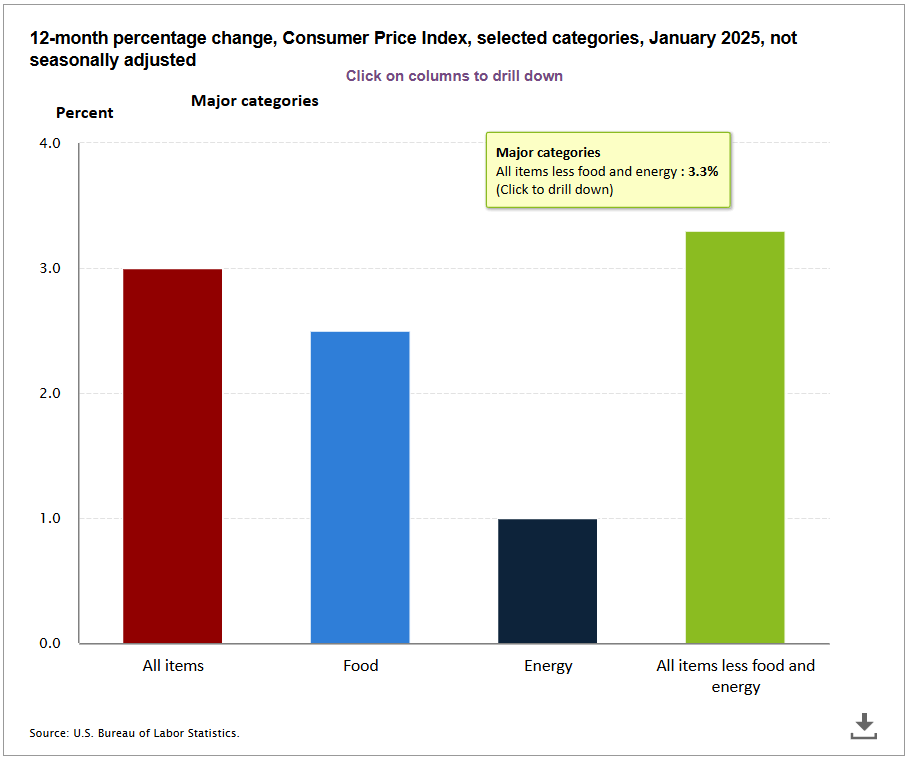

Macroeconomic headwinds are influencing BTC’s price action, with higher-than-expected January Consumer Price Index (CPI) data. Inflation rose 0.5% month-over-month, driven by rising shelter, insurance, medical care, and airline fares. Core inflation came in at 3.3% year-over-year, reinforcing concerns that inflationary pressures remain persistent.

(Consumer Price Index 2-12-2025 / U.S. Bureau of Labor Statistics)

The higher inflation data triggered a sell-off in traditional markets, with Dow futures dropping nearly 400 points, while Treasury yields spiked as investors braced for prolonged high interest rates. The data has raised doubts about the Federal Reserve’s timeline for potential rate cuts, adding uncertainty to financial markets, including crypto.

Bitcoin’s 24-hour trading volume jumped 38% to $43.48 billion, possibly due to a temporary sell-off. The asset’s market capitalization fell 1.84% to $1.88 trillion, signaling reduced investor confidence as risk-off sentiment prevails.

Despite BTC’s price decline, bitcoin dominance has risen 3.18% over the past 24 hours, now standing at 60.4%. This suggests that investors are continuing to consolidate into bitcoin as other digital assets face heavier losses amid market uncertainty.

BTC futures open interest edged up 0.97% to $60.46 billion, suggesting that traders are positioning for potential price moves. However, liquidation data reveals continued volatility, with $71.91 million in liquidations over the past 24 hours. Notably, long liquidations accounted for $59.03 million, significantly outpacing short liquidations at $12.88 million, indicating that bullish traders have been caught off guard by BTC’s recent price pullback.

Bitcoin faces a challenging near-term outlook, with inflation concerns and shifting Fed policy expectations adding pressure to risk assets. The key resistance level remains $97,500, with BTC needing a strong break above $98,000 to regain bullish momentum. On the downside, if selling pressure continues, BTC could test the $94,000 support zone, with a break below this level potentially opening the door to further declines toward $92,500.

Investors will closely monitor macroeconomic developments, particularly Fed policy signals, as BTC continues to trade within a fragile market environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。