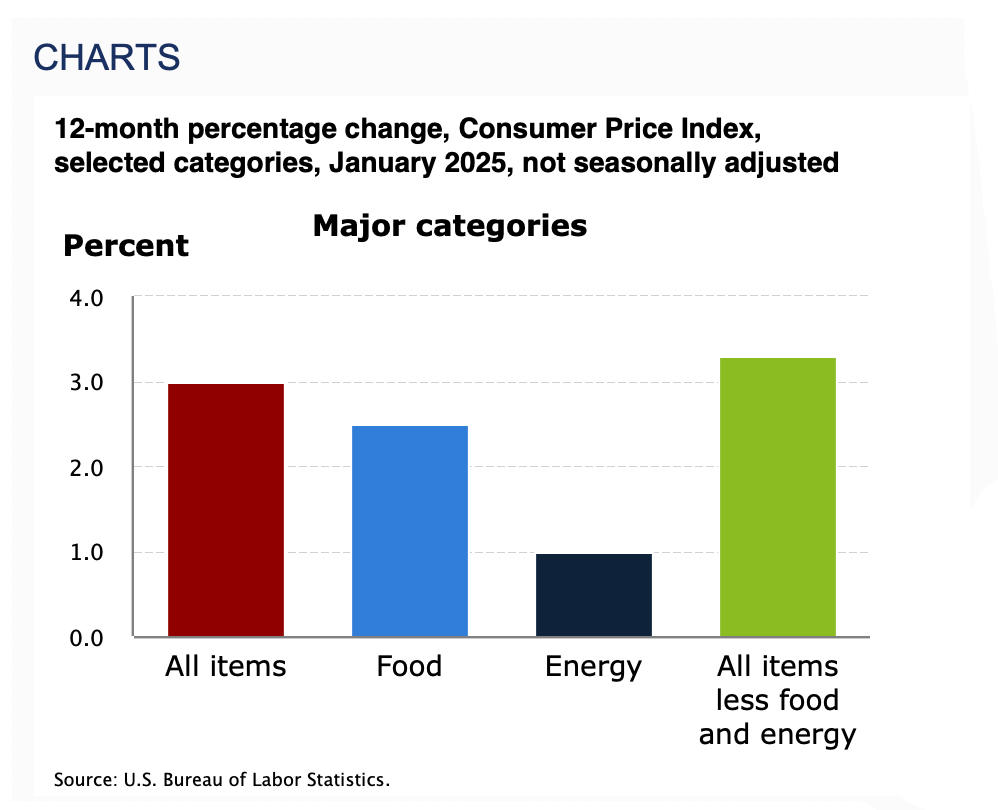

This incremental yet stubborn rise reflects the ongoing challenge of cooling price elevations across foundational consumer categories, defying expectations of swift stabilization. U.S. Bureau of Labor Statistics’ figures show January’s annual inflation rate settled at 3%, with the month-to-month increase from December marking the most rapid acceleration since Q4 2023.

Over his final 22 days in office, President Trump enacted a flurry of policy revisions, though economists caution that reversing the inflationary pressures entrenched during the Biden administration’s four-year tenure will demand sustained effort far beyond short-term adjustments. The chief economist at Fwdbonds cautions that the rising-price quagmire still lingers.

“The long national nightmare of inflation isn’t over yet for consumers, businesses, and investors,” Fwdbonds’ chief economist Chris Rupkey told CNN. “There could be some seasonality that pushes prices up at a faster clip in January, but today the news for [Federal Reserve] officials is all bad.”

In the wake of an unexpectedly high CPI, all major stock indices retreated, crypto markets contracted, and both gold and silver maintained elevated levels. Investment advisor Kevin Malone of Malone Wealth noted on Feb. 11 that the U.S. Federal Reserve’s Reverse Repo (RRP) Facility has reached its lowest point in 1,392 days, with a balance of $76.446 billion as of Feb. 11, 2025.

“The Federal Reserve’s Reverse Repo Facility hit their lowest inventory in 1,392 days, today. Do you know what’s coming?” Malone remarked on the social media platform X.

Numerous scenarios are conceivable, such as more constrained credit conditions in which U.S. banks may adopt greater caution in their lending practices. Additionally, if liquidity continues drying up, risk assets (like stocks, cryptos, and precious metals) might be impacted. The absence of surplus cash could likewise propel repo rates and other short-term funding costs upward. If financial conditions contract excessively, the Fed may be compelled to act—either by cutting rates sooner than anticipated or by hitting the money printer button.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。