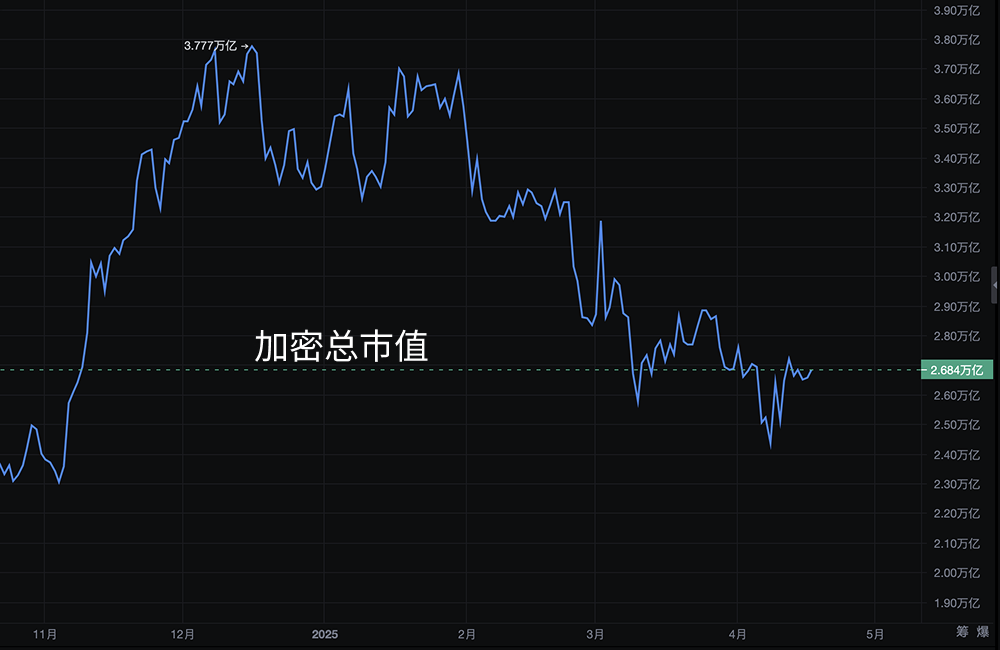

According to the "Q1 2025 Crypto Industry Report" released by CoinGecko, the cryptocurrency market experienced a significant correction in the first quarter of 2025, with a total market capitalization decline of 18.6%, falling from a peak of $3.8 trillion at the beginning of the year to $2.8 trillion. The market reached its annual peak on January 18 but subsequently continued to decline due to cooling investor sentiment and increased market volatility. The average daily trading volume also dropped significantly by 27.3%, down to $146 billion, reflecting a noticeable decrease in market activity.

Bitcoin's Dominance Rises to 59.1%

In the midst of the market downturn, Bitcoin (BTC) demonstrated relative resilience, with its market dominance rising from 54.5% at the end of 2024 to 59.1% (as of the end of the first quarter), reaching a new high since 2021. The report noted that Bitcoin's price hit an all-time high of $106,182 on January 22 but subsequently fell back, ending the quarter at $82,514, a decline of 11.8%. Nevertheless, Bitcoin's performance still outperformed most other crypto assets. In contrast, gold performed strongly in this quarter, rising by 18% to become the best asset class, while the Nasdaq and S&P 500 indices fell by 10.3% and 4.4%, respectively.

Ethereum Plummets, Erasing All Gains from 2024

Ethereum (ETH) faced a severe setback this quarter, with its price plummeting from $3,336 to $1,805, a staggering decline of 45.3%, erasing all gains from 2024, and its market dominance fell to 7.9%, the lowest level since 2019. Trading volume also shrank, with the average daily trading volume dropping from $30 billion in the previous quarter to $24.4 billion. The report analyzed that market confidence in Ethereum was dragged down by price volatility and the sluggish decentralized finance (DeFi) ecosystem.

Meme Coin Craze Fades, Pump.fun Activity Plummets

The meme coin market experienced a rollercoaster ride this quarter. The TRUMP and MELANIA meme coins, launched before Trump's presidency, sparked a craze, driving the daily token deployment on the Pump.fun platform to a historic high of 72,000. However, the LIBRA token promoted by Argentine President Milei collapsed due to a developer "rug pull" incident, with its market cap plummeting from $4.6 billion to $221 million, severely impacting market confidence. The daily token deployment on Pump.fun subsequently plummeted by 56.3% to 31,000, reflecting the rapid retreat of the meme coin craze.

Centralized Exchange Trading Volume Declines, Binance Remains Leader

The spot trading volume on centralized exchanges (CEX) reached $5.4 trillion this quarter, a decrease of 16.3% from the previous quarter. Binance continued to lead with a 40.7% market share, but its trading volume in March fell from $1 trillion in December of last year to $588.7 billion. HTX was the only platform among the top ten exchanges to achieve growth, with a trading volume increase of 11.4%. In contrast, Upbit's trading volume plummeted by 34%, and Bybit saw a sharp decline of 52.4% due to a hacking incident in February.

Solana Leads Decentralized Exchanges, DeFi Total Value Locked Plummets

In the decentralized exchange (DEX) sector, Solana continued its strong performance from the end of 2024, capturing 39.6% of the market share, with January trading volume accounting for 52%, a historic high. However, as the meme coin craze faded, Ethereum regained the top spot in DEX trading volume in March, with a market share of 30.1%. Meanwhile, the total value locked (TVL) in DeFi decreased by 27.5%, from $177.4 billion to $128.6 billion. Ethereum's TVL share fell from 63.5% to 56.6%, while Solana and Base's TVL also declined by 23.5% and 15.3%, respectively, due to falling token prices. Notably, the newly launched Berachain quickly attracted $5.2 billion in TVL after its launch on February 6, becoming the sixth-largest DeFi network.

Market Outlook: Cautious Sentiment Prevails

CoinGecko's report indicates that the crypto market in Q1 2025 rapidly cooled after a brief frenzy at the beginning of the year, with Bitcoin's solid position and the fleeting meme coin craze being the highlights of the quarter. Despite the overall market downturn, Solana's continued strength in the DEX space and Berachain's rapid rise injected some new vitality into the industry. The report advises investors to pay attention to subsequent market dynamics, especially potential rebound opportunities in the DeFi and meme coin sectors.

For a more detailed analysis: 2025 Q1 Crypto Industry Report

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。