Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Shutting down the old fund to make way for a bigger game?

As Asymmetric's Liquid Alpha Fund was forced to hit the "shutdown" button due to strategy failure and low market volatility, Joe McCann was waiting for his "rebirth from the ashes."

According to Unchained, McCann will become the CEO of a new Sol treasury company that plans to raise $1.5 billion. If successful, the company will become the largest Sol treasury company in the market.

The Final Chapter of the Liquid Alpha Fund

Joe McCann has a diverse background spanning Wall Street and Silicon Valley, with over 24 years of experience. He previously founded NodeSource, an enterprise service platform for Node.js. Currently, he leads the crypto asset management company Asymmetric.

The Liquid Alpha Fund is regarded as Asymmetric's "flagship product," focusing on volatility arbitrage and employing fundamental analysis, event-driven strategies, and macroeconomic tactics. In a high-volatility market environment, the fund has received multiple performance awards from BarclayHedge.

However, by 2025, the fund's strategy began to fail.

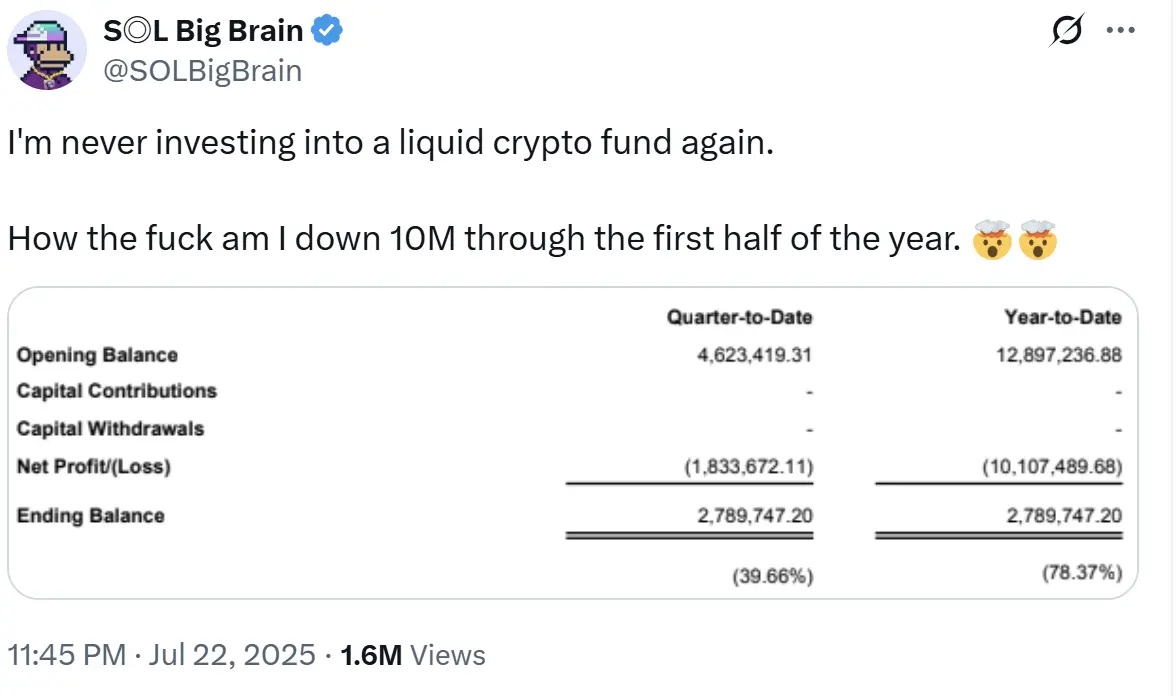

On July 22, well-known Solana supporter @BigbrainSOL posted on X platform stating, "I will never invest in liquidity crypto funds again," revealing a loss of $10 million in the first half of the year and a 78% reduction in his portfolio.

The market widely speculated that he was referring to Asymmetric's Liquid Alpha Fund, with some netizens joking, "James Wynn is actually a substitute for Joe McCann."

As public opinion heated up, on July 24, Asymmetric founder Joe McCann responded on social media, stating that the Liquid Alpha Fund had performed poorly this year, and the strategy could no longer create value for LPs, announcing that the fund would fully exit liquidity trading strategies.

Shutting down the Liquid Alpha Fund may be a strategic "self-mutilation for survival." But almost simultaneously, it was revealed that Joe McCann would become the CEO of a new Solana treasury strategic company named Accelerate.

Joe McCann's New Move: Aiming for the Largest Solana Treasury Company

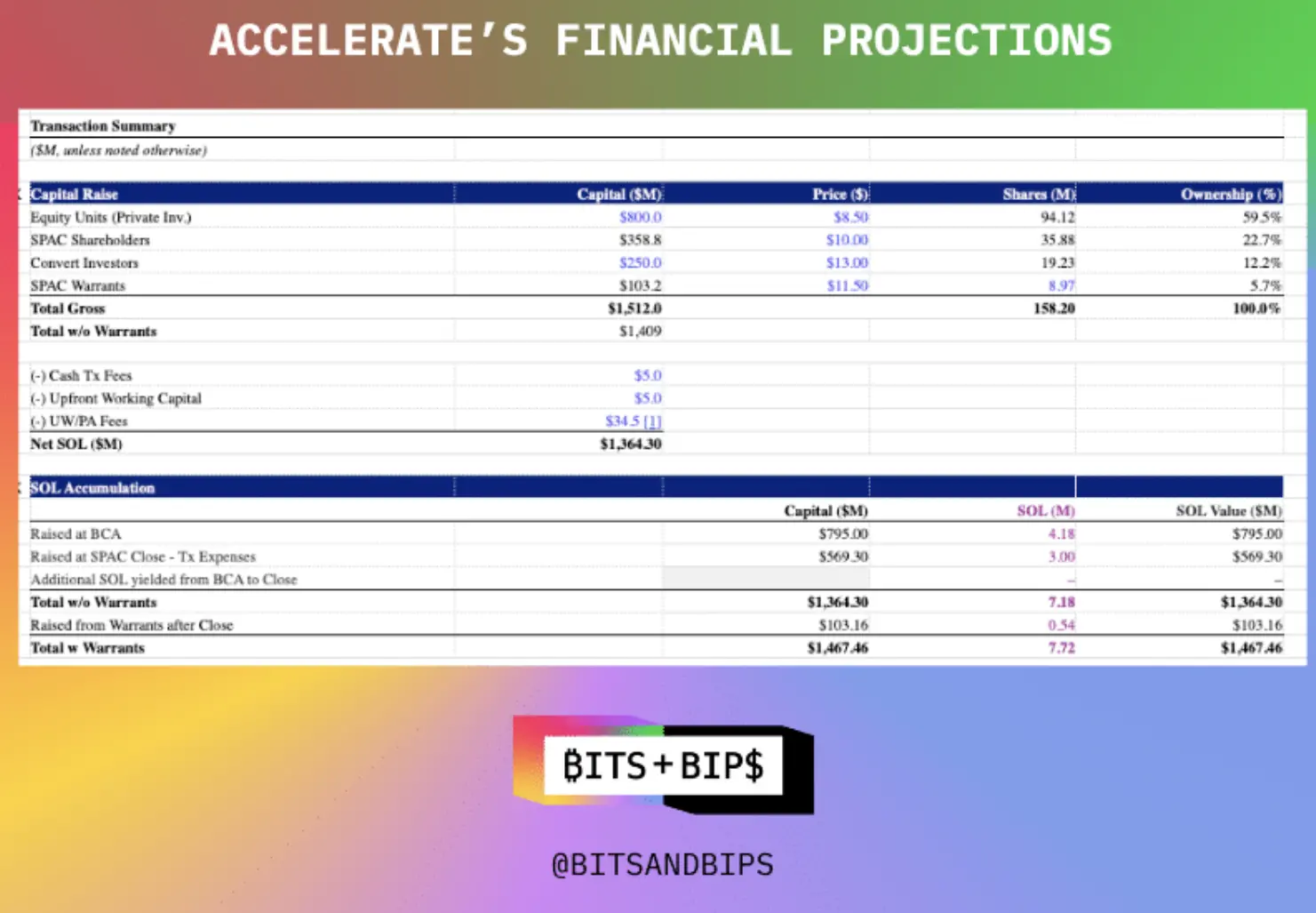

Accelerate is planning to go public through a SPAC merger with the shell company Gores X Holding. According to investor presentation materials and financial models obtained by Unchained, this fundraising round could reach as high as $1.51 billion, which includes:

- $800 million PIPE (Private Investment in Public Equity);

- $358.8 million SPAC trust funds;

- $250 million convertible bonds;

- $103.2 million SPAC warrant financing.

Image source: Unchained

If this round of financing is successful, Accelerate will surpass Upexi, which currently holds nearly 1.9 million SOL, becoming the largest SOL treasury strategic company by holdings. Based on the current price of $186 per SOL, Accelerate plans to use $1.36 billion to purchase approximately 7.32 million SOL after deducting related fees and costs.

It is worth noting that the core management team's shares in Accelerate will be locked for six months, but PIPE investors can immediately circulate their shares once registered with the SEC. Previously, several PIPE model companies, including Upexi, experienced significant stock price declines after the lock-up period ended.

As of now, it is unclear how much Accelerate has actually raised, but informed investors have revealed that "a considerable amount has already been raised." The transaction is expected to be completed by the end of 2025.

The "Coin Stock" Track: A New Battleground for Crypto VCs

The end of Liquid Alpha and the emergence of Accelerate seem more like a break and reconstruction in a cycle switch.

This year, the crypto VC industry has faced overall pressure. According to a report by RootData, as of June 5, the death rate of VC-supported projects exceeded 20.8%, with the highest reaching 61%. Projects from GBV Capital, Spark Digital Capital, HTX Ventures, and LD Capital all had death rates exceeding 30%. In April, the well-known investment firm ABCDE also announced a pause on new project investments, hitting the "pause button."

The "coin stock" track has become a new arena for capital competition, with several investment institutions making waves in the trend of crypto reserves in listed companies:

- Pantera: Invested in Twenty One Capital, DeFi Development Corp, SharpLink Gaming, BitMine, StablecoinX, etc.;

- Galaxy Digital: Involved in SharpLink, BitMine, GameSquare, GameStop, AMC, Bit Digital, TLGY Acquisition Corp, ReserveOne, etc.;

- ParaFi Capital: Invested in SharpLink Gaming, ProCap Financial, MEI Pharma, etc.

In contrast, Joe McCann's bet on the Solana treasury strategic company Accelerate appears to be a timely choice.

By shutting down the old fund, Joe McCann turns to the hottest narrative track of the moment. In this new round of competition in crypto capital, can Accelerate ignite market enthusiasm? Can Joe McCann turn the tide with this move?

Recommended Reading:

Pantera Capital, which has survived for twelve years, makes bold moves in the coin stock frenzy

RootData: The death rate of VC-supported projects exceeds 20.8%, with the highest reaching 61%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。