Author: KarenZ, Foresight News

With the strong rise of Ethereum, user expectations for the Linea airdrop have also increased.

As a zkEVM Rollup incubated by Consensys, Linea released a declaration stating "Linea is Ethereum" before its Token Generation Event (TGE), announcing its tokenomics and several Ethereum-priority key decisions. This is not just a simple preheating; it represents a paradigm revolution about how L2 can feed back into L1.

Linea clearly states that every decision in its architecture, including the Gas mechanism, tokenomics, and governance, is dedicated to returning value to the Ethereum mainnet.

Linea is attempting to prove that L2 can not only scale Ethereum but should also become a catalyst for its value growth.

Ethereum Priority

On the Linea network, ETH is used as the exclusive method for Gas payments.

ETH Deflationary Mechanism and LINEA Value Capture

20% of the net revenue from each transaction's Gas fees (paid in ETH, after deducting L1 costs) will be burned, while the remaining 80% will be used to burn LINEA tokens, with both deflationary curves taking effect simultaneously. This design establishes a direct economic link between network usage and the accumulation of ETH and LINEA value, making ETH in Linea's network design not just a Gas fee but a core asset that can generate returns and has deflationary properties, while further reinforcing LINEA's deflationary characteristics through the burning of LINEA tokens.

- Native ETH Staking—Improving Capital Efficiency

Users bridging their ETH to Linea will be automatically staked, generating staking rewards that will be distributed to liquidity providers (LPs), thus powering Linea's DeFi ecosystem. Linea LPs will accumulate native returns based on the earnings from Linea DeFi activities.

LINEA Token Utility and Economics

Linea Token Utility

- LINEA is not a Gas token.

- LINEA currently does not have on-chain governance rights, and the protocol can operate without a DAO. Linea states that this governance structure avoids the pitfalls of token-based voting while still providing a credible collaborative model for ecosystem oversight.

- 80% of the net ETH revenue on the Linea network (defined as L2 fees after L1 costs) will be used to purchase and burn LINEA.

- LINEA is used to fund builders, users, liquidity providers, and Ethereum public goods.

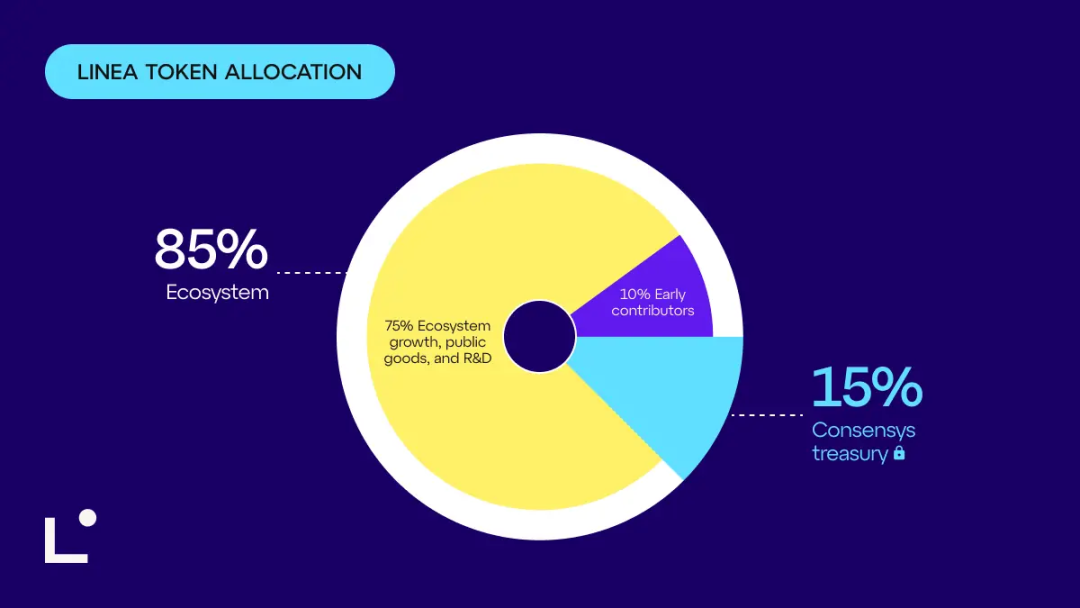

Token Economics: 85% Allocated to the Ecosystem

The total supply of Linea tokens is 72,009,990,000, equivalent to 1000 times the initial circulating supply of ETH.

85% of the LINEA token supply is allocated to the ecosystem, with 10% allocated to early users (9%) and contributors (1%); 75% is dedicated to ecosystem development, public goods funding, and Ethereum research through the Ethereum Ecosystem Fund (managed by the Linea Consortium). The remaining 15% is held by Consensys, with a complete lock-up period of 5 years. During the lock-up period, these tokens can be deployed within the ecosystem, such as for liquidity or staking funds. LINEA tokens have not yet been allocated or sold to any employees or investors.

Regarding the 9% allocated to early users, it will be airdropped and fully unlocked at TGE. A snapshot has been completed, and witch filtering has been done. Airdrop eligibility is assessed based on a series of activity-based metrics, including LXP and on-chain metrics, aimed at recognizing genuine usage and meaningful ecosystem participation.

At TGE, approximately 22% of the token supply (15.8 billion LINEA) will be in circulation, which includes airdrops for early contributors, ecosystem activation plans, and liquidity supply allocations. All other categories of tokens will remain locked or gradually unlocked.

Establishment of the Linea Consortium: Handing the Ecosystem Fund to Those Who Understand Ethereum Best

The Linea Consortium is a committee composed of several Ethereum-native organizations, with initial members including Consensys, Eigen Labs, ENS, Status, and Sharplink Gaming, responsible for managing the distribution of most LINEA tokens. More members are expected to join the Linea Consortium in the future. Builders and the Ethereum community will receive direct support to create public goods, build transformative applications, conduct research, and fundamentally strengthen the protocol stack.

The ecosystem fund will be established as a non-profit entity headquartered in the United States, which will apply for non-profit status.

A portion of the ecosystem fund is specifically allocated for recent ecosystem activation, including support for liquidity supply, exchange readiness, strategic partnerships, future airdrops, and early builder participation. The remaining majority of the funds will support the long-term development of the Ethereum ecosystem and public goods. Funds will be distributed according to a decreasing release schedule over 10 years. Initially, the release amount will increase to accelerate adoption, and later it will decrease to maintain sustainability.

It is expected that about 25% of the fund will be used to support the ecosystem's launch in the first 12-18 months, with the remaining 50% gradually released over 10 years. These funds will be used to finance protocol research and development, shared infrastructure, open-source tools, and establish strategic partnerships with developers aligned with the goals.

Why is Linea's initiative to push value back to L1 significant?

In the past, L2 has often been criticized for "siphoning" from L1. Now, Linea has reversed this situation with a dual deflationary engine, a native staking bridge, and an economic model:

- ETH is no longer just Gas but a direct beneficiary of L2 network revenue;

- ETH has become a core asset that can generate returns on Linea, and its deflationary properties have been strengthened. Liquidity remains in L2 but continuously pumps value back to L1 through burning and staking;

- The community fund feeds back into public goods, with long-term R&D and short-term incentives no longer in opposition.

Linea's ETH burning and automatic staking mechanism directly enhance ETH's deflationary nature and productivity, preventing Layer 2 from becoming a "vampire" of Ethereum's value and instead becoming a positive cycle within its economic model.

Additionally, the allocation of 85% of tokens to the community and ecosystem far exceeds the incentive ratios of most L2 projects, reflecting a commitment to decentralized governance and long-term building.

While other L2s are still competing on TPS, Linea has brought the battlefield back to ETH itself. For users waiting for airdrops, this is not only a potential wealth effect but also a vote for "Ethereum orthodoxy."

What makes Linea unique is that it is not just a technical scaling solution but also attempts to feed back the success of Layer 2 into Ethereum itself through economic design. In an era where L2 competition is becoming increasingly homogeneous, this "Ethereum priority" value proposition may become a key differentiating advantage.

More importantly, the initial members of the Linea Consortium include not only Consensys, the Ethereum domain service provider ENS, and the pioneer of the re-staking track EigenLayer, but also the Ethereum treasury company Sharplink Gaming (currently holding 438,200 ETH), and the wallet and messaging as well as L2 infrastructure provider Status (currently holding 18,100 ETH).

This also reassures community users that the ETH liquidity from Sharplink Gaming and an increasing number of Ethereum treasury companies will flow into Linea, with the community speculating that most liquidity may flow into Etherex.

Furthermore, leveraging Consensys's resources and reputation, Linea could become a bridge between traditional finance and the Ethereum DeFi ecosystem, accelerating mass adoption. Consensys's background (MetaMask has over 100 million monthly active users, Infura serves multiple banks) also gives Linea a unique advantage. Linea states that it has gained the trust of global financial platforms, including Mastercard, Visa, JPMorgan, and several sovereign banks, and has seamlessly integrated with leading DeFi protocols, custodians, and tokenization platforms.

According to DefiLlama data, as of now, Linea's cross-chain Total Value Locked (TVL) is around $500 million, with the ecosystem's DeFi TVL at around $160 million. The TVL scale is far from the mature L2 level, and there is still a significant gap to mass adoption.

The success or failure of this experiment will redefine the market's perception of L2 value—it should not just be a pipeline for transaction execution but should serve as a value-added layer of the Ethereum economic system, proving that L2 can become an amplifier of Ethereum's value rather than a diverter. If successful, this model could become the standard for future L2s, promoting the long-term prosperity of the Ethereum ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。