In August 2023, the MakerDAO ecosystem lending protocol Spark offered an annual yield of 8% on $DAI. Subsequently, Sun entered in batches, accumulating an investment of 230,000 $stETH, which at its peak accounted for over 15% of Spark's deposit volume, forcing MakerDAO to urgently propose a reduction of the interest rate to 5%.

MakerDAO's original intention was to "subsidize" the usage rate of $DAI, but it almost turned into Sun Yuchen's Solo Yield.

In July 2025, Ethena played with a "coin-stock-bond" treasury strategy, rapidly raising the APY of $sUSDe to around 12%, with $ENA surging 20% in a single day.

As a treasury strategy originating from the BTC ecosystem, it brushed past the prominence of $SBET/$BMNR and ultimately landed on USDe.

Ethena once again leveraged the capital market, successfully creating a dual flywheel for $ENA and $USDe in both the on-chain market and the stock market.

Dual-Currency System Mass Exodus

USDT created stablecoins, USDC occupied users' compliance mindset, and USDe is a capital catcher.

Image caption: Ethena's path to capitalization. Image source: @zuoyeweb3

When the $ENA treasury strategy was launched, I instinctively thought it was a simple imitation of the current Strategy trend. However, upon careful review, Ethena is actually attempting to break the curse of the "dual-currency" system.

The curse is that on-chain stablecoin issuers must choose between the protocol token price and the stablecoin market share.

• Aave chose to empower $AAVE, resulting in a 83.4% increase in its price over three months, but the issuance of $GHO was only $300 million.

• MakerDAO evolved into Sky, with a 43.2% price increase over three months, and $USDS issuance of $7.5 billion.

• Ethena's token ENA saw a 94.2% price increase over three months, with $USDe issuance of $7.6 billion.

Adding to this is the collapse of the Luna-UST dual-token system, revealing that maintaining a balance between the two is incredibly difficult. The root cause is limited protocol revenue; directing it towards market share leads to unstable token prices, and vice versa.

In the entire stablecoin market, this is the barrier to entry established by USDT. USDT invented the stablecoin track and naturally does not need to worry, while Circle needs to share profits with partners but still does not share with USDC holders.

Ethena, through a bribery mechanism, shares ENA as a profit "option" with CEX partners, temporarily appeasing large holders, investors, and CEX, prioritizing the protection of USDe holders' dividend rights.

According to A1 Research's estimates, since its establishment, Ethena has shared approximately $400 million in profits with USDe holders in the form of sUSDe, breaking through the entry barriers set by USDT/USDC.

Ethena not only surpassed Sky in stablecoin market share (excluding the residual share of DAI) but also outperformed Aave in the performance of its main token project, which is not coincidental.

The rise in Ethena's ENA price is certainly influenced by the stimulation from Upbit, but Ethena is deeply transforming the value transmission method of the dual-currency system by introducing stock market treasury strategies.

Returning to the previous question, while prioritizing the protection of USDe's market share, the dividend rights of ENA still need to be realized. Ethena's choice is to imitate treasury strategies to launch StablecoinX but modify it.

• BTC treasury strategy, taking Strategy as an example, bets on the long-term upward trend of BTC prices, with a holding of 600,000 BTC acting as a catalyst for price increases, but it can also be hell during downturns.

• ETH treasury strategy, using Bitmine (BMNR) as an example, bets on eventually being able to buy 5% of the circulating share, becoming a new stock, following the paths of Sun Yuchen and Yi Lihua in the stock market, profiting from volatility trends.

• BNB/SOL/HYPE treasury strategies involve project foundations or single entities driving up stock prices to stimulate local currency growth. This is the most trend-following group, as these assets have not yet achieved market values similar to BTC/ETH.

ENA's treasury StablecoinX is different from the above. On the surface, it involves ENA on-chain entities investing and fundraising, spending $260 million to purchase 8% of the ENA circulating supply, stimulating ENA price increases through internal transfers.

The market reacted positively, with Ethena's TVL, USDe supply, and sUSDe APY all rising in response. However, note that sUSDe is essentially the protocol's liability, while ENA's sales revenue is the profit.

StablecoinX reduces ENA's circulating supply, stimulating sales growth in the secondary market, with communication costs being controllable, as Ethena can negotiate with investors Pantera, Dragonfly, and Wintermute.

Among them, Dragonfly is the lead investor in Ethena's seed round, and Wintermute is also a participant. Compared to new investments, this is more like accounting bookkeeping.

Ethena is taking the route of capital manipulation, successfully navigating the mass exodus of the dual-currency system, which should be the biggest stablecoin innovation after Luna-UST.

Real Adoption Has Yet to Occur

When false prosperity is shattered, those long-rooted elements will be exposed.

The new upward trend of ENA is one of the sources of project profits, and the holdings of USDe/sUSDe will also increase accordingly. At the very least, USDe now has the potential to become a truly application-oriented stablecoin.

ENA's treasury strategy imitates BNB/SOL/HYPE, raising yields to stimulate stablecoin adoption, allowing for profits from volatility trends, while the high control under the negotiation mechanism also alleviates selling pressure during downturns.

Capital operations can only stimulate coin prices. After stabilizing the growth flywheel of USDe and ENA, long-term development still requires the real application of USDe to cover market-making costs.

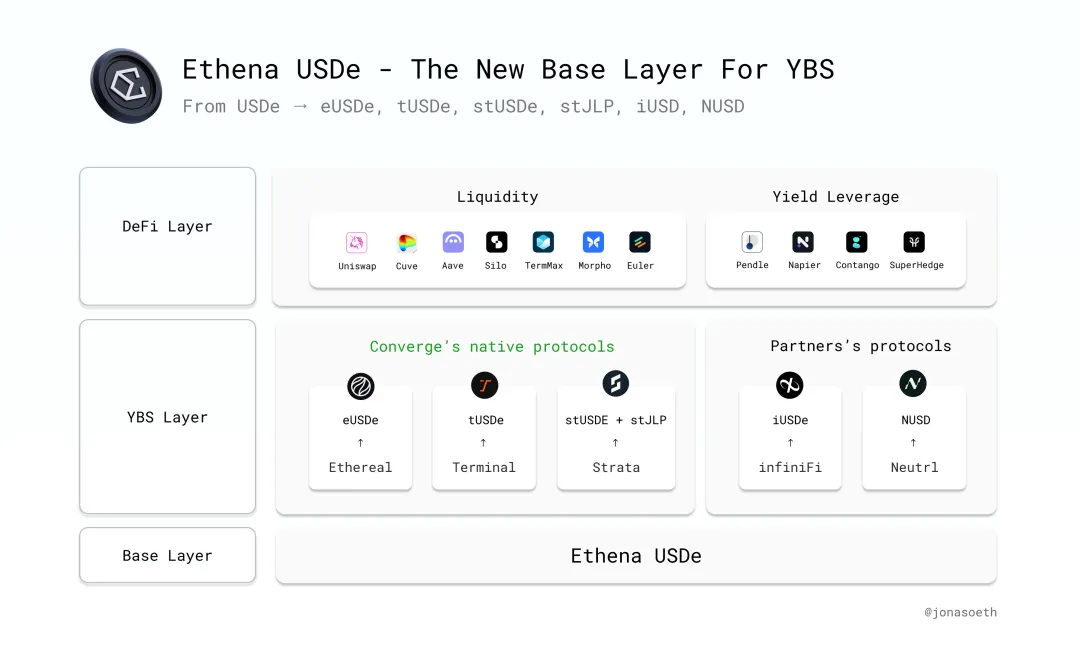

Image caption: Ethena's ecological expansion

Image source: @Jonasoeth

In this regard, Ethena has always walked on two legs, both on-chain and off-chain:

• On-chain: Ethena has long collaborated with Pendle to activate the on-chain interest rate market and is gradually cooperating with Hyperliquid, while also supporting Ethreal as a backup Perp DEX internally.

• Off-chain: Collaborating with BlackRock partner Securitize to issue the Converge EVM chain, targeting institutional adoption, and increasing the issuance of compliant stablecoin USDtb after the latest Genius Act with Anchorage Digital.

Additionally, Anchorage Digital and Galaxy Digital are both recently prominent institutions. In a sense, they represent the third wave of market-making forces after Jump Trading/Alameda Research, with the second wave being market makers like DWF/Wintermute, which will be detailed later.

Outside of the capital landscape on-chain and off-chain, real-world adoption remains lacking.

Compared to USDT and USDC, USDe/USDtb has only scratched the surface in cross-border payments, tokenized funds, and DEX/CEX pricing. The only commendable aspect is the collaboration with TON; however, cooperation with DeFi protocols is difficult to penetrate into every household.

If Ethena's goal is on-chain DeFi, then it has already been very successful. However, if it aims for off-chain institutional adoption and retail usage, it can only be said that the long march has just completed its first step.

Moreover, concerns about ENA have emerged, and the fee switch is also on the way. Remember that Ethena currently only shares profits with USDe holders? The fee switch requires ENA holders to share profits through sENA.

Ethena stabilizes USDe's survival space by exchanging ENA for CEX, and through treasury strategies, it stabilizes the interests of ENA large holders and investors. However, what is inevitable will eventually come; once ENA starts sharing protocol revenue, ENA will also become Ethena's debt rather than income.

Only by truly becoming a counterpart to USDT/USDC can ENA enter a real self-sustaining cycle. For now, it is still in a state of shifting and maneuvering, and pressure will never truly disappear.

Conclusion

Ethena's capital manipulation provides inspiration for more stablecoin and YBS (yield-bearing stablecoin) projects. Even compliant payment stablecoins under the Genius Act can still be linked to RWA for interest calculation.

Following Ethena, Resolv also announced the activation of the fee switch protocol, but it will not truly share profits with token holders for the time being. Ultimately, the premise for sharing protocol revenue is to have protocol revenue.

Uniswap has been cautious about the fee switch for years, with the core goal of maximizing protocol revenue between LPs and UNI holders. Currently, most YBS/stablecoin projects still lack sustainable revenue capabilities.

Capital stimulation is a pacemaker, while real adoption is the blood-producing protein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。