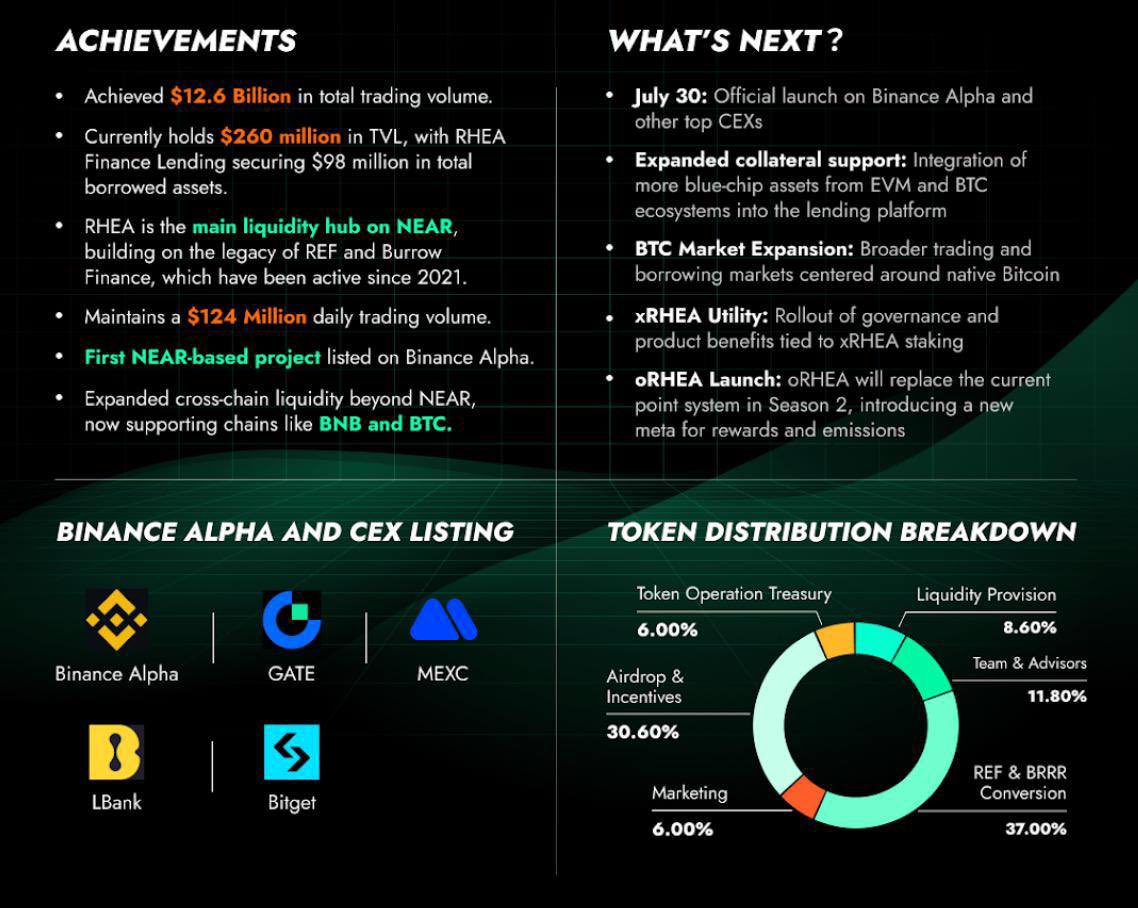

🧐 NEAR's beloved project is coming to the rankings|RHEA @rhea_finance is about to have its TGE, and all the highlights are here——

$RHEA is about to launch, with the TGE set for July 30, alongside Binance Alpha and several other CEXs.

As NEAR's beloved project is issuing tokens, I think this is a typical "you may not buy, but you can't miss watching" project.

Several core points:

1️⃣ NEAR's flagship DeFi stack——

Upon careful study, I found that this is essentially a new form after the merger of Ref + Burrow, right? RHEA = Ref (NEAR's largest DEX) + Burrow (largest lending) merged and upgraded.

It turns out that NEAR's DeFi core layer has now been integrated into one platform:

1) DEX supports CLMM + ALMM (similar to Uniswap V3 + Meteora);

2) Lending supports margin trading;

3) Supports cross-chain bridge aggregation, nBTC liquidity, and native BNB access;

4) Next, it will launch xRHEA staking + oRHEA buyback model;

To be honest, DeFi across major chains is extremely competitive right now, but a platform with "unified liquidity + lending + AI yield strategies," RHEA is one of the most complete projects I have seen so far;

2️⃣ TVL and trading volume data are impressive——

Current data:

TVL ~$260M (of which lending is $98M);

Daily average trading volume $120M+;

30-day cumulative trading volume $2.4B+;

Supported assets come from EVM, BTC ecosystem, and NEAR itself;

Comparing several on-chain DEXs:

Radiant FDV ~$40M, TVL $57M, Vol/TVL = 0.16

Cetus (Sui) FDV ~$105M, TVL ~$95M, Vol/TVL = 2.2

RHEA: TVL $260M, Vol/TVL ≈ 1.0, product completeness far exceeds competitors.

If RHEA's pricing FDV is in the $100–150M range, I believe it is reasonably undervalued, and the market is likely to experience FOMO.

3️⃣ Token model design is long-term oriented, with a relatively restrained release rhythm——

Total supply: 1 billion tokens

Lock-up period: 3 years

Initial release at TGE is only 0–21%, with almost no release for the team;

Here’s a highlight to pay attention to: the token model, stake to get xRHEA, then distribute oRHEA, and buy back to become RHEA, binding protocol income + buyback mechanism to long-term holders, forming an incentive closed loop;

37%: Old users (Ref + Burrow) conversion;

30.6%: Incentives + airdrops (oRHEA will replace old points in the new season);

💡 Summary——

The data speaks for itself, RHEA has already become one of the most heavily invested infrastructures in the NEAR ecosystem, and it is also the first NEAR project to launch on Binance Alpha. Currently, several exchanges including BITGET, GATE, and MEXC have already made announcements for the launch, with the TGE scheduled for July 30, which should be a good opportunity.

In one sentence: This is NEAR's true "DeFi operator," with a clear long-term route and clear short-term trading opportunities, let's watch this launch!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。