Has the ancient giant whale's 80,000 $BTC been sold off? Let's look at the data.

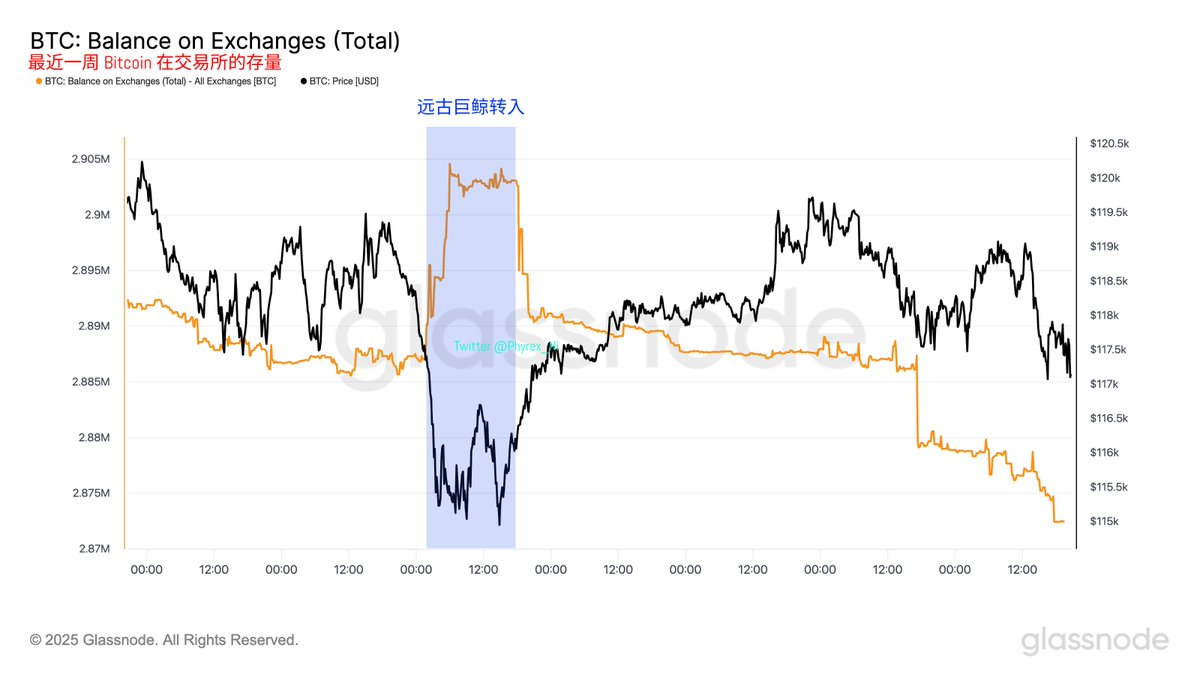

Last week, the main factor affecting Bitcoin's price was the selling by the ancient giant whale. Unlike the previous two weeks, the 80,000 BTC from the ancient giant whale was indeed sold through Galaxy last week, and it is clear that a portion of the BTC was transferred to four exchanges: Binance, OKX, Bybit, and Coinbase.

As of now, although the price has mostly recovered and the market has digested this whale sell-off, on-chain data indicates that there are still new ancient whales stirring. While only a few hundred BTC have moved recently, some unfriendly data can still be seen from the exchange inventory data.

From the overall exchange inventory data, it does show that the BTC transferred to exchanges, whether from ancient whales or not, has not only been digested but is also continuously decreasing, indicating that investor buying sentiment remains strong. The ancient whale's sell-off appears to have been absorbed by the market, and the reduction in exchange inventory has lowered the risk of a market crash.

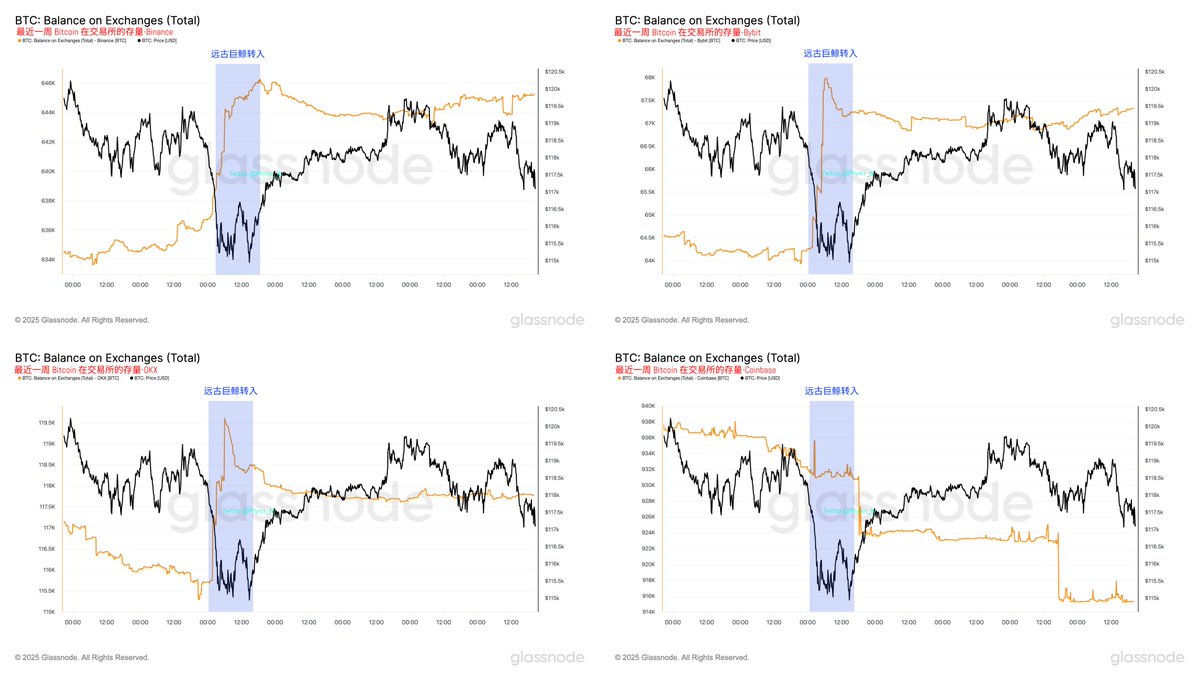

However, looking at more detailed data, the situation is not so optimistic. As mentioned earlier, part of this whale's sales was executed through Binance, OKX, Bybit, and Coinbase. Although the total exchange inventory is indeed decreasing, a closer look at these four exchanges reveals that, except for Coinbase, the BTC inventory at the other three exchanges does not show a significant downward trend. Currently, it is estimated that about 24,000 BTC entered the exchanges during the ancient whale's movement.

Binance had the highest inflow, with about 12,000 BTC, and currently has over 10,000 BTC still held there. OKX saw an inflow of about 4,000 BTC, with less than 3,000 BTC remaining. Bybit had an inflow of around 3,000 BTC, with about 3,000 BTC still remaining, while Coinbase received less than 5,000 BTC, which has not only been fully digested but has also seen a large amount of BTC withdrawn from the exchange.

Therefore, we can see that there are actually over 15,000 "extra" BTC still residing in the exchanges, which have not been digested. These three exchanges still have the potential for sell-offs, indicating that compared to non-U.S. dominant exchanges, Coinbase, which primarily serves U.S. investors, is currently the leader in purchasing power. U.S. investors and those in U.S. time zones remain the main force in buying.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。