This is a re-evaluation of asset logic, rather than a cycle of macroeconomic easing.

Author: Dr. PR

The current market is generally focused on "when will interest rates be cut," but what is truly worth paying attention to is that the Federal Reserve maintaining high interest rates may actually be more beneficial for the long-term macro landscape of the U.S. stock and cryptocurrency markets. This perspective, although counterintuitive, points in the same direction when considering historical experience, fundamental structures, and the implicit easing driven by fiscal policy.

1. High Interest Rates ≠ Bear Market: History Tells Us That Structural Bull Markets Often Emerge in High Interest Rate Environments

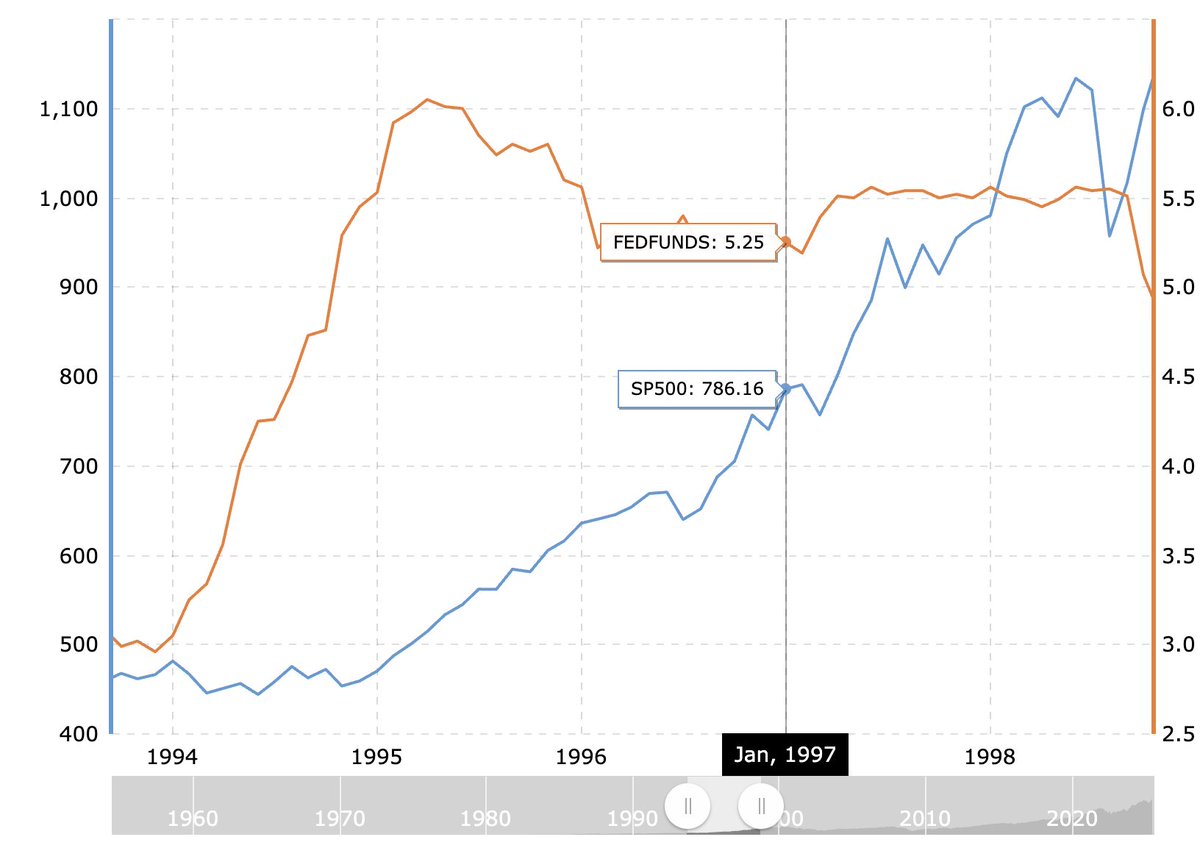

Federal Funds Rate vs. S&P 500 (approximately 1994–2000)

Taking the period from 1994 to 2000 as an example, the Federal Reserve raised the federal funds rate from about 3% to 6% in 1994. Following this rate hike cycle, the U.S. stock market experienced one of the strongest technology bull markets in history:

The S&P 500 index rose from about 470 points to a peak of 1500 points in 2000;

The NASDAQ achieved an annualized return of over 25% from 1995 to 2000, driving a substantial profit cycle before the "dot-com bubble";

Corporate profits, technological innovation, and return on investment became dominant factors, rather than monetary easing itself.

This means that as long as the economy does not experience a hard landing, high interest rates are not the culprit suppressing the stock market.

2. The Current "No Rate Cut" is Essentially a Vote of Confidence in the Economy

As of July 2025, the Federal Reserve's target federal funds rate range is 4.25%-4.50%. While there has not been a significant easing, importantly—there has also been no rate hike.

What this reflects is the reality that "a soft landing is being realized":

Core PCE inflation has decreased from a peak of 5.4% in 2022 to a range of 2.6%-2.7% by mid-2025;

GDP growth remains between 1.5%-3% annualized;

The unemployment rate is stable at 4.1%, with a resilient labor market;

The overall EPS expectation for U.S. stocks in 2025 is in the range of 250-265, indicating a recovery in profitability.

In other words, the essence of not cutting interest rates is that the Federal Reserve believes there is no need to intervene in the market because it is self-repairing.

3. True "Easing" is Being Driven by Fiscal Policy Rather Than Monetary Policy

Although nominal interest rates have remained unchanged, the overall macro liquidity structure in the U.S. has shifted towards "fiscal-led stimulus."

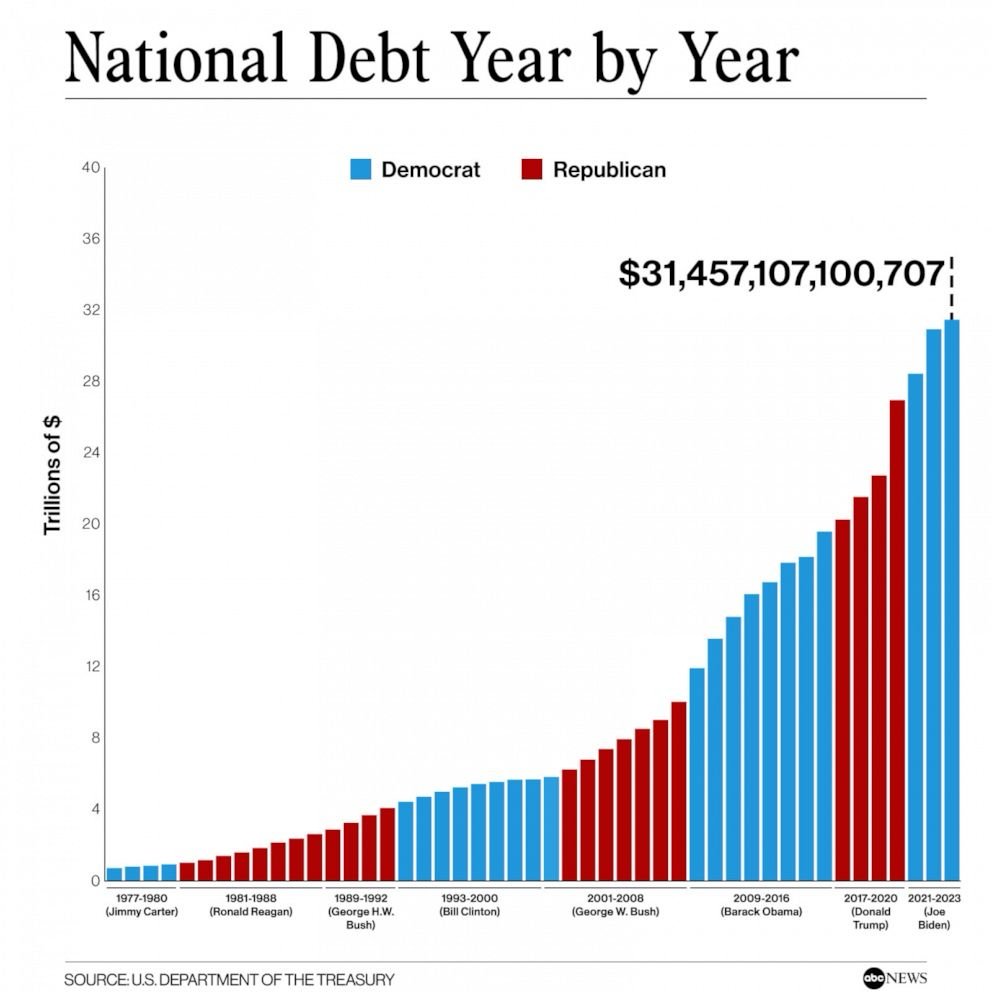

Trend of Annual Growth in U.S. Federal Debt

The fiscal deficit in the U.S. for 2024 is projected to exceed 6.4% of GDP, one of the highest since World War II;

As of July 2025, the total U.S. federal debt has surpassed $36.7 trillion;

The net issuance of U.S. Treasury bonds in Q3 2025 is expected to exceed $1 trillion;

The "Big Beautiful Bill" promoted by the Trump administration includes large-scale tax cuts and industry subsidies, expected to increase the fiscal deficit by about $3 trillion over the next 10 years.

Even if the Federal Reserve remains inactive, such fiscal spending constitutes a de facto "implicit easing."

4. High Interest Rates Purify Market Structure, Strengthening the Logic of the Stronger Getting Stronger

In a high interest rate environment, while financing becomes more difficult, it is actually a "positive" for large companies:

Apple holds over $130 billion in cash, Alphabet over $90 billion, and Meta nearly $70 billion;

At interest rates of 4%-5%, this cash generates billions of dollars in interest income;

Small and medium-sized enterprises are marginalized in terms of financing costs, further concentrating market share among giants;

High cash flow buybacks drive EPS upward, making the valuation structure more robust.

This not only explains why the "seven major tech stocks" continue to dominate the market capitalization rankings but also illustrates why index-based assets can still reach new highs even in a high interest rate environment.

5. Cryptocurrency Market: Transitioning from Speculative Games to Structural Asset Allocation

Cryptocurrency assets were once seen as "speculative products born from zero interest rates," but in the past two years of high interest rates, the market structure has undergone profound changes:

1) ETH/BTC has become the allocation target for "digital cash flow" and "digital gold"

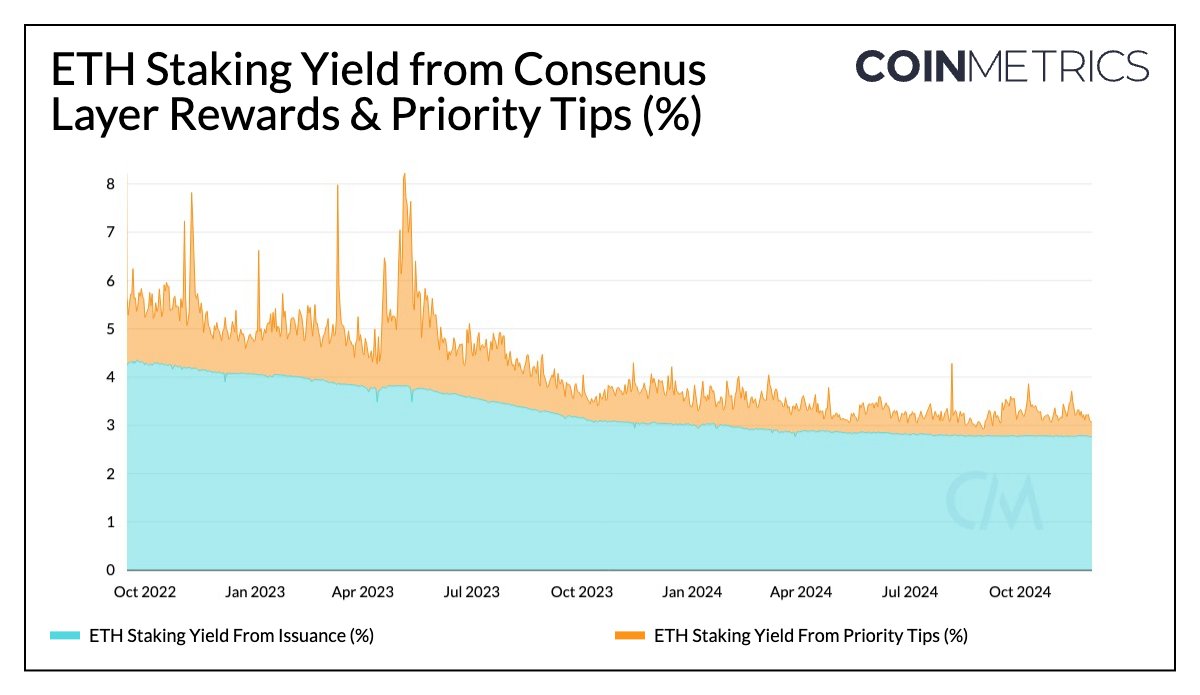

Ethereum ETH Staking Yield Trend (Annualized)

Ethereum's staking annualized yield remains between 3.5%-4.5%, possessing characteristics similar to government bonds;

BTC has become a core reserve asset for several U.S. listed companies (such as MicroStrategy);

The launch of ETFs, re-staking mechanisms, and on-chain governance yield have made ETH present a combination of "stable income + asset scarcity."

2) The "interest margin dividend" of stablecoins has become an invisible profit pool

Circle earned over $1.7 billion in profits in 2024 from U.S. Treasury bond interest;

Tether earned over $4 billion in profits through reserve investments in the past year;

The stablecoin ecosystem has actually enhanced profitability under high interest rates, strengthening the stability of the entire DeFi infrastructure.

3) The survival logic of the cryptocurrency market has shifted towards "cash flow" and "systematic returns"

Speculative altcoins and memes are retreating;

Projects with clear revenue models, such as Uniswap, EigenLayer, and Lido, are gaining funding favor;

The market is beginning to evaluate on-chain assets based on "ROE, cash flow, and inflation resistance."

The cryptocurrency market is completing a transition from "speculating on stories" to "speculating on structures."

6. Conclusion: This is a Re-evaluation of Asset Logic, Not a Cycle of Macro Easing

While interest rate cuts can certainly boost asset prices, if they are not based on real profits and structural optimization, they will ultimately repeat the bubble burst seen after 2021.

This time, the U.S. stock and cryptocurrency markets are following a healthier path:

High interest rates but controlled inflation;

Continuous fiscal stimulus and corporate profit recovery;

Strong companies gaining cash flow advantages;

Cryptocurrency assets returning to competition based on economic models.

A true slow bull market is not driven by money printing but by structural reallocation driven by pricing mechanisms and cash flow.

The current "inaction" of the Federal Reserve is the most critical backdrop for this structural re-evaluation to occur.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。