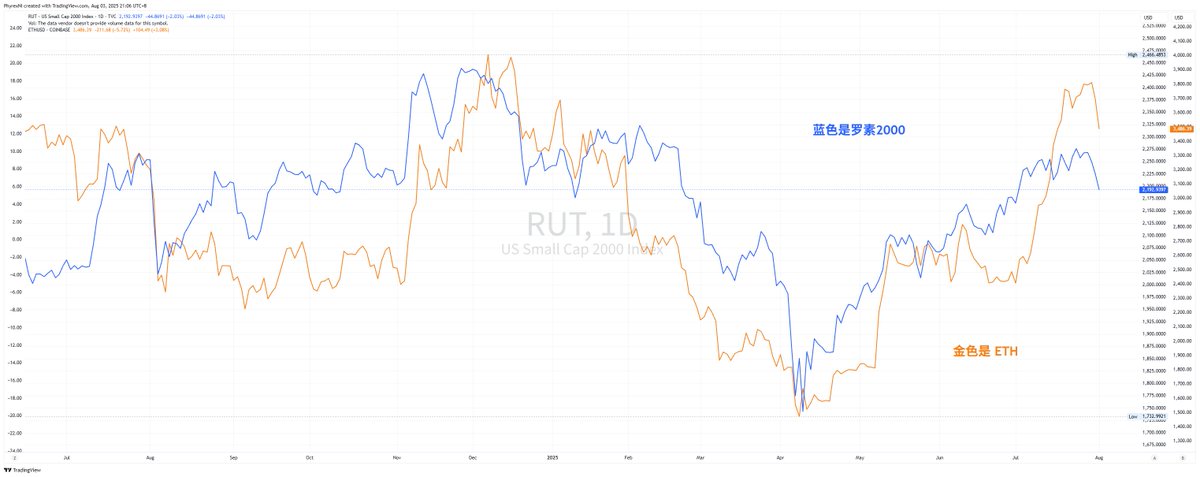

Regarding Kitty's data, I want to say that I did not have high expectations for this altcoin season when discussing it. There are two viewpoints. The first viewpoint is that although $ETH is highly correlated with the Russell 2000, there are no obvious signs of a reversal in the Russell 2000. Moreover, considering the Federal Reserve's monetary policy, the current liquidity is insufficient to support a full-blown altcoin season. An altcoin season will not be independent; if there is an altcoin season in the crypto space, it is highly likely that there will also be an altcoin season in the U.S. stock market.

This is all due to the effects of capital overflow, but in reality, the U.S. stock market does not exhibit strong capital overflow. Therefore, it is quite difficult for the U.S. stock market and the crypto space's altcoins to both experience a surge. I have written about this topic in the weekly report for at least four weeks.

Secondly, regarding the rise of ETH, we have compared various data sources, including exchange inventory, on-chain data, contract data, and ETF data. Compared to $BTC, which is experiencing a sell-off, the rise of ETH is more about the increase in purchasing power and trading volume in the primary and secondary markets of ETFs. However, this part is more inclined towards traditional investors. How much of this overflow capital will actually flow into altcoins?

This is still my personal viewpoint, which may not necessarily be correct, but I believe that without a comprehensive entry into monetary easing, which may not happen until 2026 or later, a full altcoin season is still somewhat difficult. The same goes for the U.S. stock market.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。