"I've been having conference calls until 2 AM every day recently."

The person saying this is a veteran in the traditional brokerage industry, having been in the field for over a decade. As he spoke, he placed his phone face down on the coffee table. The corners of his eyes were slightly red, but his tone remained very casual.

His office in Beijing is located in a siheyuan in Xicheng District, with two large doors that are slightly peeling. The afternoon light slants into the courtyard, and some dust floats in the beams. He sits at an old wooden table, dealing with issues related to regulation, business cooperation, and project scheduling.

Starting in the financial industry over a decade ago, he has experienced the last financial crisis and has rolled through the global markets, managing funds, running products, and leading teams, almost covering all continents. In recent years, he has begun to shift towards a direction that the entire traditional financial industry initially deemed "uncertain"—virtual assets.

The traditional financial sector's attention to Web3 did not start in 2025. If we trace back to the beginning, many people would mention Robinhood.

This platform, known for "zero-commission stock trading," launched Bitcoin and Ethereum trading features as early as 2018. Initially, it was just a supplement to their product line, allowing users to buy cryptocurrencies like they would buy Tesla stocks, without needing a wallet or understanding blockchain. This feature was not heavily promoted at the time but became a breakout point years later.

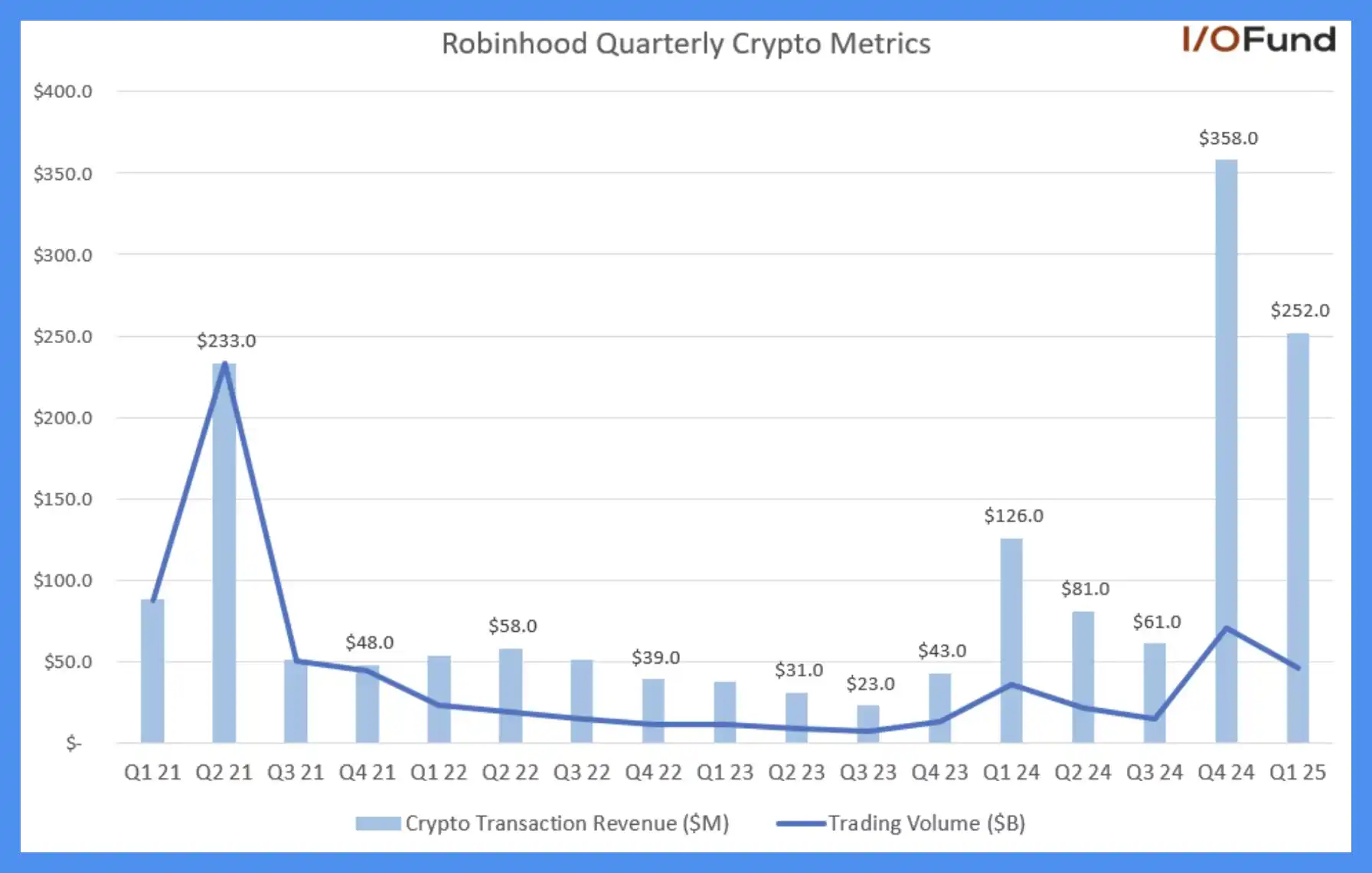

In the fourth quarter of last year, cryptocurrencies contributed over 35% of Robinhood's total net revenue, with trading volume surging by 455%, driving trading revenue up 733% year-on-year to $358 million, making cryptocurrency Robinhood's largest revenue source for the quarter. In the first quarter of 2025, cryptocurrencies contributed over 27% of total revenue, with trading revenue doubling year-on-year to $252 million.

Robinhood quarterly cryptocurrency trends, source: IO.FUND

The driving force behind this change was not technology, but the clicks of thousands of users. Robinhood did not narrate the Web3 story; it simply adapted to users' trading habits and discovered that cryptocurrency trading was no longer a marginal business but had become the core engine of the company's growth.

Subsequently, Robinhood gradually transformed from a centralized brokerage into a digital asset trading platform.

With Robinhood setting the example, traditional finance finally decided to collectively enter the cryptocurrency industry in 2025, no longer just observing. They are not here to experience Web3 or invest in projects; "traditional finance will take over the cryptocurrency industry within 10 years."

We are already in the midst of this reshuffling of traditional brokerages against crypto natives.

In March 2025, one of the world's largest retail brokerages, Charles Schwab, with over $10 trillion in assets under management, announced it would open spot Bitcoin trading services within a year.

In May 2025, Morgan Stanley, one of Wall Street's most influential investment banks, announced plans to officially integrate BTC and ETH into its trading platform E*Trade, providing retail users with direct trading access.

In May 2025, JPMorgan, the largest bank in the U.S. and long critical of cryptocurrencies, announced it would allow clients to purchase Bitcoin.

In July 2025, Standard Chartered, a long-established British bank focusing on the Asian, Middle Eastern, and African markets, announced it would open spot trading services for Bitcoin and Ethereum to institutional clients.

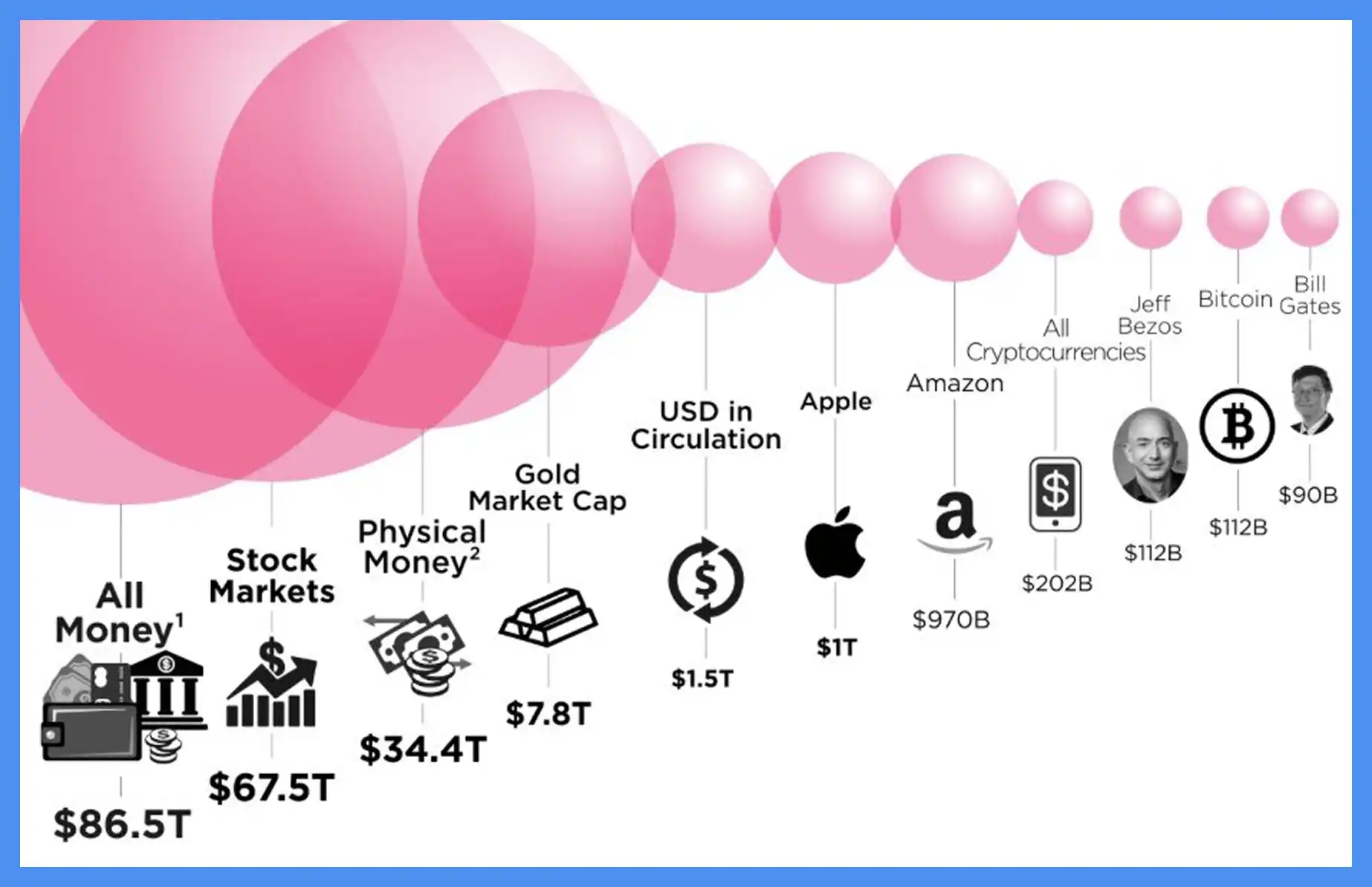

These are colossal entities that dominate the global financial system, controlling the flow of funds, clearing networks, and fiat payment systems worldwide, holding assets worth hundreds of trillions of dollars, while the total market capitalization of the current cryptocurrency market is only around $4 trillion.

Mainstream asset market capitalization rankings, source: Steemit Community

They are gradually completing their layout in the crypto field based on traditional financial compliance frameworks. When an institution possesses compliance trust, user traffic, and clearing capabilities, it has all the elements needed to build a cryptocurrency trading network.

In the traditional financial system, whoever controls the account opening permissions can control the flow of funds, customer relationships, and even the final pricing power. For a long time, cryptocurrency trading platforms defined their narratives by listing coins and controlled liquidity through deposits, but now, the "asset entry" role that has been taken by centralized exchanges for nearly a decade is gradually being reclaimed by traditional finance.

"Those cryptocurrency trading platforms should start to feel anxious."

His tone remains restrained, without a hint of schadenfreude. The source of anxiety may not just be due to the entry of a particular institution or the introduction of a certain policy, but rather a sense of industry awareness that cryptocurrency trading platforms may no longer be the only ones at the financial table who can deal cards.

Methods Remaining at the Table

An insider from a cryptocurrency trading platform told us that he often replies to messages at 5 AM. He discusses cooperation during the day, monitors progress at night, and checks user community feedback late into the night, hardly getting any sleep.

"We can only survive in anxiety."

The anxiety he speaks of is the competition between platforms, the daily struggle to capture users, products, and traffic.

The root of this fierce competition is that the growth space in the industry is nearly exhausted, and the external pressure is too great.

Traditional finance is gradually encroaching on the core capabilities that cryptocurrency trading platforms rely on for survival—from fiat deposits to asset custody, from user account opening to spot matching. They come with regulatory licenses and millions of users, and it seems they do not intend to coexist with crypto-native platforms.

Almost all cryptocurrency trading platforms have immediately launched stock token products. Buying Apple with USDT, leveraging Nvidia, trading Tesla through on-chain contracts. These traditional asset tokenization solutions have been launched across multiple platforms, becoming a collective industry action.

Bybit was the first to take the plunge. They completed the development and launch of U.S. stock token products in just two months, moving quickly from internal project initiation to engaging with the XStocks team and finally launching the product.

In Bybit's view, the core advantages of centralized trading platforms still exist. The real users, strong liquidity, and trading depth accumulated over the years are resources that external brokerages cannot replicate overnight.

The launch of U.S. stock tokens was driven by a clear demand gap, such as trading needs during market closure or geographical and compliance restrictions preventing users from entering traditional stock markets. The 7×24 nature of crypto opens up new liquidity spaces for traditional assets.

Of course, this does not mean this is a guaranteed victory. Emily, the head of spot trading at Bybit, admits that U.S. stock tokens are still in the early stages, with participation and enthusiasm far less than that of high-traffic new coin launches.

However, she remains optimistic about this direction because it represents that crypto is expanding its playbook into the world of traditional finance. DeFi, synthetic assets, on-chain staking—these new derivative scenarios for traditional assets on-chain may represent the true value of this path.

However, these features seem to be actively exploring new markets, but to many, they appear more like a form of passive defense.

When trading platforms no longer hold the dominant position of "asset entry," they begin to try to make themselves appear still connected to the world. Thus, stock tokens have become the most common defensive move at this stage.

Stock tokens are not a new concept.

Going back to 2020, FTX proposed the stock token model at that time. They launched trading pairs like TSLA/BTC and AAPL/USDT, seen as an attempt to challenge traditional financial pricing logic.

That was a time when the crypto space still had an aggressive stance. What FTX wanted to do was to rewrite the trading methods of traditional finance with crypto finance, to price Nasdaq with crypto finance.

Perhaps they had already seen that the biggest future competitor for cryptocurrency trading platforms would be brokerages, so they took the initiative. Looking back now, this model has been picked up again by the industry, but it has already changed in flavor. After FTX's downfall, stock tokens became a band-aid rather than a battering ram.

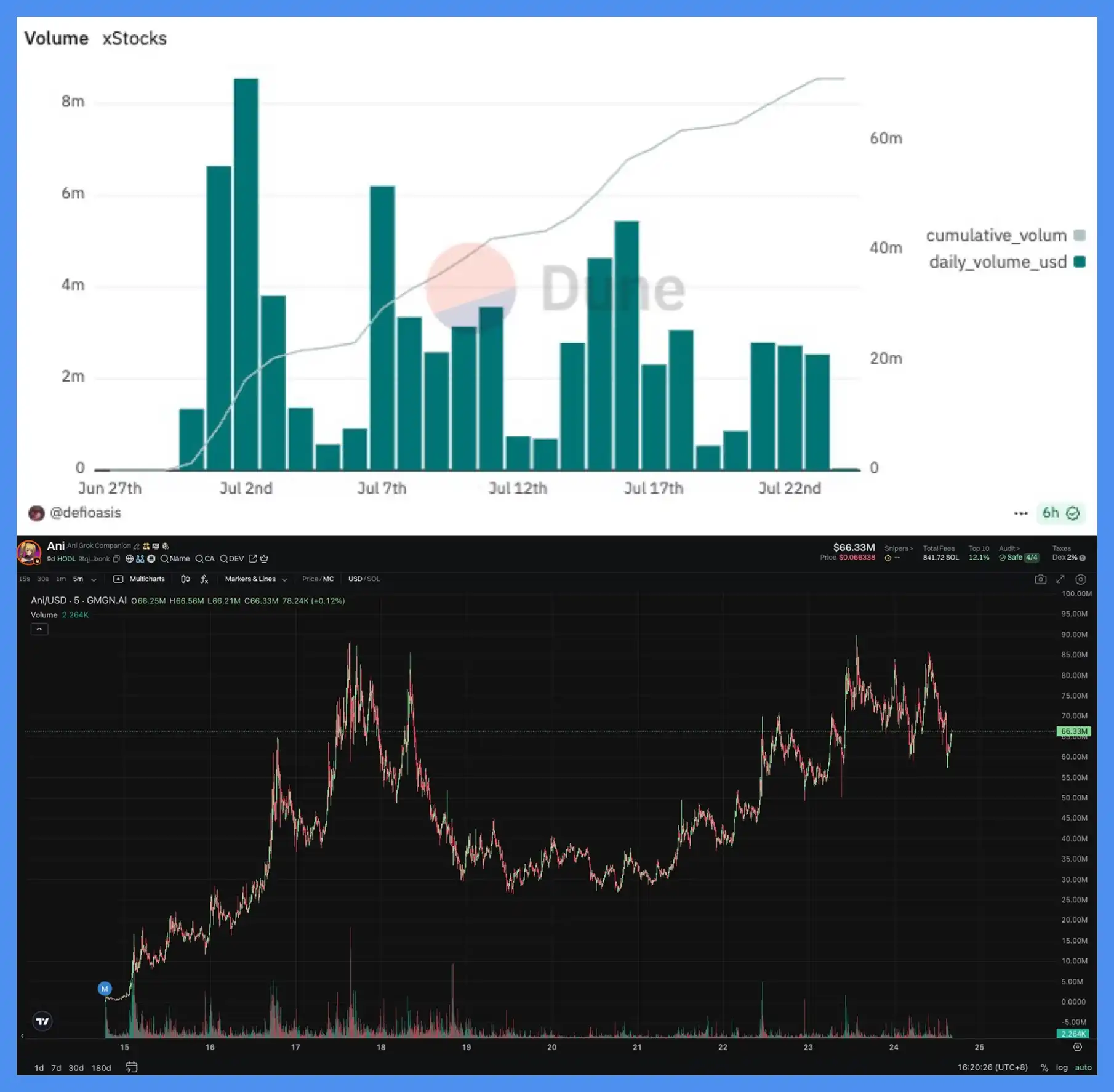

Data also confirms this point.

After the stock token model was launched, it initially gained some community attention, but activity quickly declined, and attempts by various platforms failed to create much of a splash.

On the other hand, in contrast, the memecoin market on Solana during the same period showed a completely different trend. A tweet from Musk could quickly send the market cap of related meme coins soaring to hundreds of millions, with daily trading volumes in the tens of millions of dollars, far exceeding the weekly trading volume of many stock token trading pairs.

Above: XStocks trading volume, source: Dune; Below: meme coin Ani trading volume, source: gmgn

New features, no new users.

At this stage, what features CEX launches no longer matters. What matters is why they are launching these features and whether these features can reclaim the role they are losing.

This wave of stock token enthusiasm is not because the industry has progressed, but because no one dares to do nothing.

Kant said: "Freedom is not doing whatever you want, but being able to refrain from doing what you do not want to do."

Compliance is just an illusion

In recent times, almost all cryptocurrency trading platforms have been discussing compliance. Each is striving to apply for licenses, adjust business structures, and bring in executives with traditional financial backgrounds, trying to prove that they have emerged from the wild era and become more like a financial institution that can be accepted by regulators.

This is a consensus in the industry, as well as a collective anxiety.

However, in the eyes of traditional finance professionals, this understanding of compliance remains too superficial.

"Many trading platforms go to small countries to obtain licenses to prove compliance, but those licenses are hardly considered legitimate; they cannot even get a seat at the table." He said, his tone not sharp, but more like stating an industry common sense.

What he means by "getting a seat at the table" is not whether you have a business license, but whether you can connect to the real financial system—whether you can open accounts with mainstream banks, use clearing networks, and gain the trust of regulatory agencies to truly engage in business cooperation with them.

This implies a reality: in the eyes of traditional finance, the crypto world has never been treated as equals.

The traditional financial system is built on a chain of responsibility and a closed loop of trust, emphasizing a transparent customer structure, risk control, auditing capabilities, and the explainability of fund flows. In contrast, crypto platforms often grow in the gaps of the system, maintaining high profits and growth in the early stages through gray areas, but rarely have the ability to build these compliance foundations.

In fact, these issues are well understood within the crypto community. But previously, no one cared because no one was competing for this territory. Now that traditional financial institutions are entering the scene, they operate according to their own rules, and the "industry practices" of the crypto sector suddenly become significant flaws.

Some platforms are indeed making adjustments, introducing compliance audits, establishing offshore trust structures, and splitting their businesses to appear more legitimate.

But many countries' regulatory agencies simply do not buy it. On the surface, they may cooperate with you in discussing processes, but deep down, they never intended to consider you as part of the formal financial system. No matter how much you try to fit in, it only appears "similar," which does not mean they will actually keep you around.

However, not all trading platforms are just going through the motions. Bybit is one of the few platforms that have truly broken through the regulatory shell. This year, they became one of the first centralized trading platforms to obtain the European MiCA license and established their European headquarters in Vienna, Austria.

Bybit does not deny that this process is difficult, nor do they shy away from acknowledging the regulatory skepticism towards the industry. But as Emily said, regulation is no longer the same as it was five years ago when they did not understand crypto. Now, regulatory agencies are beginning to truly understand the business logic and technical structure of this industry. Their understanding is deepening from technology, models to market promotion, and the foundation for cooperation is becoming more solid.

In addition, Xie Jiayin, the Chinese head of Bitget, told us that Bitget has already obtained virtual asset licenses in multiple countries and has built local compliance structures according to regional regulatory requirements. He revealed that the team is also actively pushing for the MiCA license application, hoping to establish a more stable business channel in the European market and lay the groundwork for future multinational operations under a unified regulatory framework.

Even so, such cases remain the minority. For most platforms, they neither have licenses, networks, and trust endorsements within the traditional financial system, nor are they still benefiting from the high growth dividends brought by the previous institutional vacuum. They find the threshold for transforming through compliance too high; when they want to revert to being crypto-native, they discover another group of competitors is eyeing them.

Thus, everyone can only continue to align with regulators, continue to discuss compliance, apply for licenses, and follow processes. Many times, these actions are not strategic choices but a sense of anxiety that is pushing them forward.

Mid-game Moment

In a community chat at 5 AM, Xie Jiayin is still replying to users' questions one by one. Some ask how to trade stock tokens, some inquire about the platform's recent compliance progress, and others ask about the situation with PUMP subscriptions and how they plan to handle it. He says that he and his colleagues often stay up late; pulling an all-nighter is nothing unusual.

On a hot afternoon in Beijing, in a siheyuan, an executive from a Hong Kong brokerage is having tea and discussing cooperation with several senior executives from listed companies. The meeting room is separated by a carved wooden door, and outside is a courtyard paved with blue bricks, where the sound of insects can be heard in the shade of the trees.

Looking further away, in Vienna, Austria, Bybit's new European headquarters has just completed its ribbon-cutting ceremony and has officially begun operations. This is their European outpost established after obtaining the MiCA license. They are among the first centralized trading platforms to have crossed the river, while they are also aware that the vast majority of their peers are still feeling their way across.

They are in different places, with different emotions and rhythms, but what they say resonates subtly: they all mention "the changes are too fast," they all talk about "taking it slow," and they all ponder how the industry should continue moving forward.

The premise for moving forward has already changed from a few years ago.

Cryptocurrency trading platforms may no longer be the most central role in this world, no longer the starting point for all traffic and narratives. They are standing on the edge of a new order, slowly being pushed out of the core by an invisible set of rules.

More complex systems and larger capital are gradually replacing the original narratives and structures.

Cryptocurrency trading platforms are still present, new product features are being launched as usual, and announcements are being made one after another. Their modes of expression are changing, the rhythm of their voices is changing, and the contexts they want to integrate into are also changing; everything is changing.

Some changes are proactive choices, some are passively accepted, but more often, they are just trying to retain a sense of presence without being eliminated by the times.

However, not everyone is pessimistic. Both Xie Jiayin and Emily believe that the impact of crypto on traditional finance is greater than the latter's pressure on centralized exchanges. They are optimistic about the trend of traditional financial institutions entering the market because every round of evolution in the industry requires new players and new participants. Centralized trading platforms have developed to this point and are continuously expanding their institutional client base, starting to engage in wealth management, asset allocation, and more. The businesses of both sides are intersecting and merging, "the two financial worlds resonate with each other, which is a romantic moment."

But at the same time, everyone is also aware that this advantage does not exempt them from anxiety.

Many questions will not have clear answers. For example, will regulators truly allow these cryptocurrency trading platforms to operate? Are traditional financial institutions really willing to co-build rather than replace?

Also, before the next round of industry themes arrives, do they still have a chance to define themselves?

No one dares to speak too confidently about these questions. Everyone is dealing with their part of the work, holding meetings, modifying products, applying for licenses, waiting for feedback, maintaining the status quo while waiting for opportunities to regain initiative.

They are waiting for the wave of industry reshuffling.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。