Crypto ETF Sell-Off: Bitcoin and Ether Funds Post $798 Million Combined Outflow

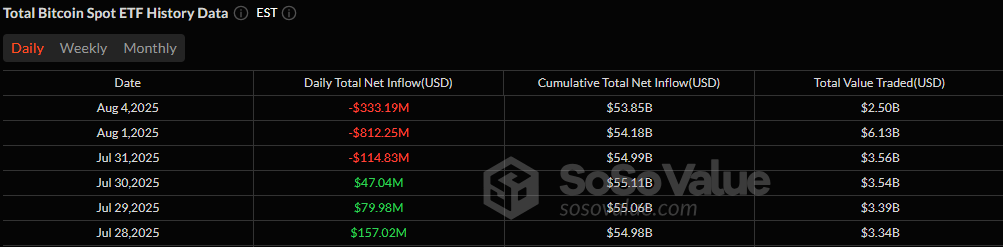

Investors slammed the brakes on crypto ETFs on Monday, August 4, triggering one of the most dramatic sell-offs of the summer. Bitcoin ETFs shed $333.19 million, while ether ETFs posted a record-breaking $465.06 million outflow, their largest single-day exit since inception. The combined $798 million drawdown reflects renewed caution across digital asset markets.

For bitcoin ETFs, outflows were concentrated in a handful of major funds. Blackrock’s IBIT bore the brunt with a massive $292.21 million exit, while Fidelity’s FBTC lost $40.06 million. Grayscale’s GBTC and Valkyrie’s BRRR chipped in with outflows of $9.92 million and $9.74 million, respectively.

Bitcoin ETFs 6-Day Inflow/Outflow. Source: Sosovalue

A modest $18.74 million inflow into Bitwise’s BITB was far too small to offset the wave of redemptions. Total BTC ETF trading volume hit $2.50 billion, leaving net assets at $147.96 billion.

Ether ETFs had an even tougher day. Blackrock’s ETHA led the exodus with a jaw-dropping $374.97 million outflow, followed by Fidelity’s FETH with $55.11 million. Grayscale’s ETHE and Ether Mini Trust rounded out the rout, collectively bleeding $34.98 million. Despite robust trading activity at $1.92 billion, net assets dipped to $20.47 billion.

The staggering outflows mark a sharp reversal after weeks of sustained inflows and raise questions about short-term sentiment in crypto markets. All eyes are now on whether this sell-off signals a deeper correction or a brief pullback before the next rally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。