Recently, the Ethereum community officially launched the second phase of the treasury governance project "Protocol Guild Pilot": it plans to allocate 20,000 ETH, worth nearly $70 million, to core developers over three years, funded directly from the community treasury. This money essentially serves as a "share-like" incentive for developers from Ethereum.

This is not a one-time event, but a signal: Ethereum's treasury is transitioning from "passive holding" to "strategic allocation."

Where does the money come from? Who will spend it? Who will benefit?

Currently, the annual revenue of the Ethereum protocol layer is about $400 million, most of which comes from the burning of gas fees. Due to EIP-1559, these fees no longer go into the pockets of developers or miners, but directly reduce the total supply of ETH.

The problem is: developers create immense value for Ethereum but have not received any incentive mechanisms from the protocol layer.

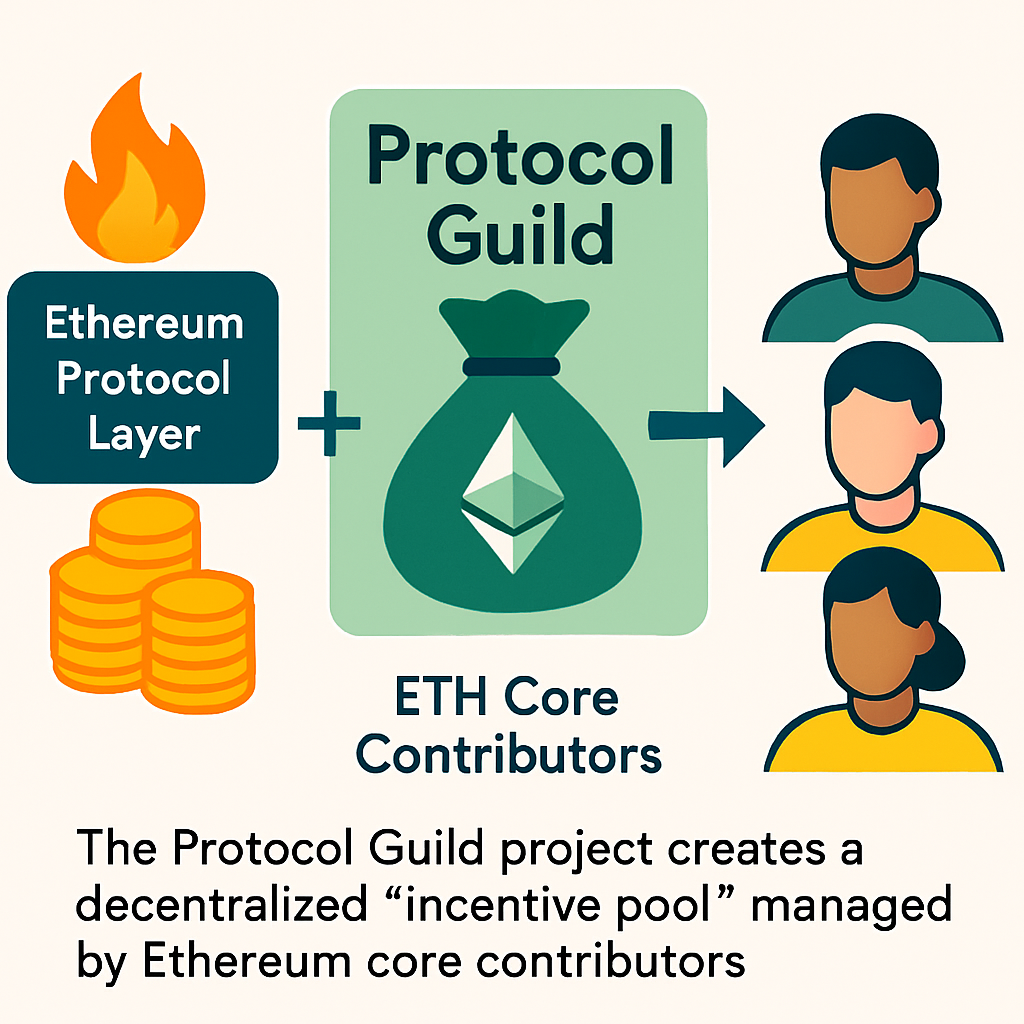

This is the reason for the existence of the Protocol Guild project. It has designed a relatively decentralized "incentive pool," managed by ETH core contributors themselves, with high entry barriers and long lock-up periods (up to 3 years), essentially incentivizing those who contribute over the long term and enhancing their "binding of interests to Ethereum's future."

How much capital does the treasury have available?

According to data from ultrasound.money, currently about 0.5% of the circulating ETH is locked for use by treasury projects like Protocol Guild. While this may not seem like much, it is already sufficient to support the necessary foundational research and development.

Ethereum has not set up a dedicated "DAO treasury" structure, but instead allocates ETH to multiple project parties or special funds, which then distribute it further, such as EF, ENS, Protocol Guild, etc.

This is a "soft treasury" structure, decentralized and non-concentrated custody, but it forms actual support for the ecosystem.

The treasury is not for speculation, but for market protection

It is worth noting that while Ethereum has a large reserve of ETH, it does not engage in any form of active investment or trading. Its strategy is not to "appreciate treasury assets," but to "provide a more robust research and development backing for the network."

In other words, Ethereum's "treasury strategy" is not like Lido or some projects that manage an LP pool or engage in quantitative trading, but rather uses ETH as a dividend-like stock to reward those who "work long-term."

How does the market interpret this?

From a market perspective, this reflects several signals:

- Developers are beginning to be seen as "shareholders" of Ethereum, which strengthens their governance legitimacy and long-term stability.

- In a bear market, projects that can actively deploy capital are the ones with true strategic capability.

- This is a practical implementation of the "value storage logic": ETH as an asset is not earned through speculation, but through work.

Ultimately, this mechanism enhances the Ethereum ecosystem's risk resistance and provides a new narrative framework: ETH is not only currency but also protocol equity.

In summary: not all treasuries can buy stability for the future, but Ethereum is attempting to bind true long-term value with money!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。