Compiled by: Felix, PANews

On Thursday (August 7), U.S. President Donald Trump signed an executive order allowing Americans to invest their 401(k) retirement savings in alternative assets such as cryptocurrencies, private equity, and real estate. The signed executive order instructs:

- The Department of Labor to reassess the guidance on the obligations regarding alternative asset investments in 401(k) plans and other defined contribution plans governed by the Employee Retirement Income Security Act (ERISA) within 180 days.

- The Labor Secretary to clarify the Department of Labor's stance on alternative assets and the appropriate fiduciary processes related to providing asset allocation funds that include alternative asset investments.

- The Labor Secretary to consult with the Treasury Secretary, the U.S. Securities and Exchange Commission (SEC), and other federal regulatory agencies to determine whether similar regulatory reforms should be made at these agencies.

- The U.S. SEC to facilitate access to alternative assets for participant-directed defined contribution retirement savings plans by amending applicable regulations and guidance.

In Trump's executive order, cryptocurrencies are explicitly categorized as alternative assets and included in 401(k) retirement savings investment plans. Previously, the U.S. Department of Labor had issued guidance requiring fiduciaries to "exercise extreme caution before considering adding cryptocurrencies to the investment menu for 401(k) plan participants." This guidance was fully rescinded in May of this year.

As a result of this news, market data shows that Bitcoin has risen nearly 2% in the past 24 hours, while Ethereum has increased over 7%.

Nearly $900 Billion U.S. Retirement Funds to Open Up to Cryptocurrency Exposure

U.S. pensions are divided into three parts: the first part is the national-level Social Security, which guarantees basic retirement living for workers. The second part is corporate pension plans, with the 401(k) plan being an important component, applicable only to employees of private companies, and is the most common retirement plan for U.S. workers. The third part is private annuity plans.

The 401(k) plan is a tax-advantaged retirement savings plan provided by employers. The plan primarily relies on employee contributions, meaning employees withdraw a portion of their pre-tax wages to deposit into their 401(k) accounts, and employers typically provide a matching contribution of a certain percentage. For example, if an employee contributes 6% of their salary, the employer may contribute an additional 3% or 6% (the specific percentage and rules are set by the employer).

In 2025, the IRS set the limit for voluntary employee contributions at $23,500, with an additional $7,500 for those aged 50 and above. Employees can usually choose to invest from a range of investment funds provided by their employer, bearing the investment risk themselves. However, if employees withdraw funds before the age of 59.5, they typically incur a 10% additional penalty tax and must pay income tax.

Currently, the U.S. 401(k) platform provider market is highly concentrated, with estimates suggesting that the top five providers (Fidelity, Empower, Vanguard, Principal, ADP) collectively control over 60% of the 401(k) market assets.

In terms of business models, Fidelity, Empower, Principal, and Voya tend to be comprehensive, offering record-keeping, investment management, and proprietary fund products. Vanguard and BlackRock primarily excel in investment management.

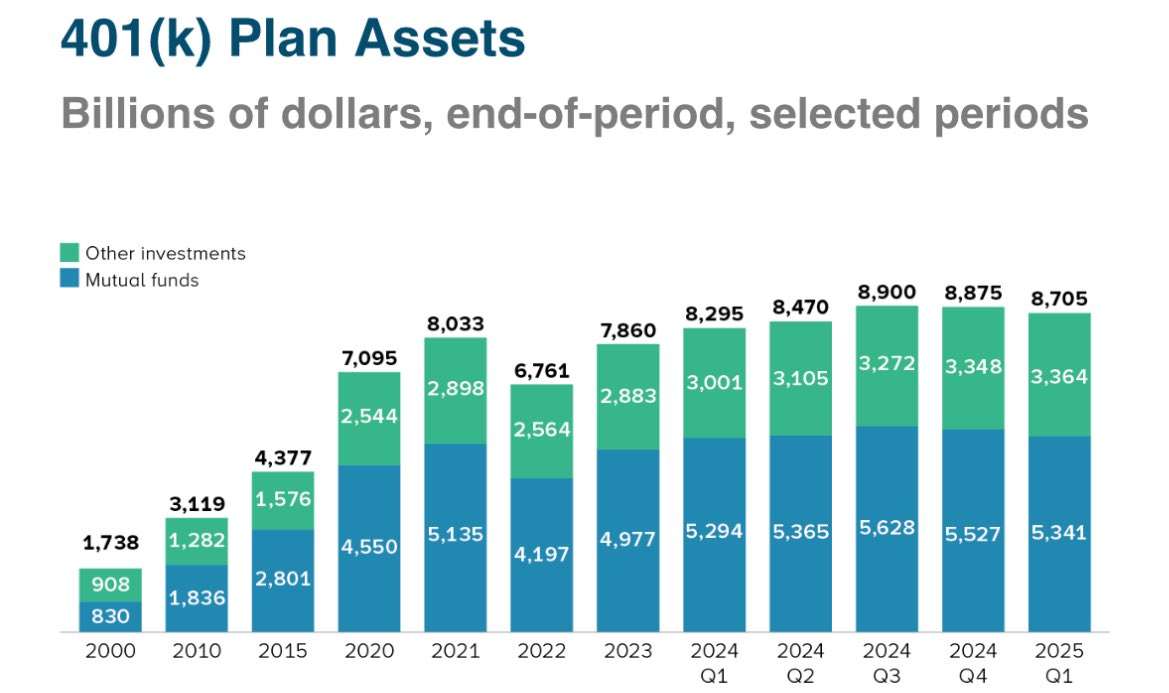

According to a report released by the Investment Company Institute (ICI) in June of this year, 401(k) plans hold $8.7 trillion in assets, with over 90 million Americans participating in employer-sponsored defined contribution plans. In 401(k) plans, mutual funds manage assets totaling $5.3 trillion, accounting for 61%; among these, equity funds total $3.2 trillion, making them the largest category, followed by balanced funds, which hold about $1.4 trillion.

Mixed Reactions to Cryptocurrency Benefits

While introducing crypto assets into 401(k) plans increases the risk for retirement funds, it undoubtedly represents a positive development for the emerging crypto industry.

Analyst Geiger Capital tweeted, "401k pensions hold about $9 trillion in assets. If only 5% of that is allocated to Bitcoin, it would amount to $450 billion. Bitcoin's total market cap is $2 trillion."

Tom Dunleavy, a partner at investment firm Varys Capital, analyzed pointing out, "Most Americans allocate a portion of their paycheck (usually between 1% and 10%) to their 401(k) retirement accounts every two weeks. Typically, stocks account for 60%, and bonds account for 40%. If suddenly the allocation to cryptocurrencies becomes 5%, you will see hundreds of billions of dollars flowing into this asset class in the coming years."

Ryan Rasmussen, head of research at Bitwise, stated: "The short-term impact of Trump's 401(k) executive order is that it sends another message to investors that the regulatory awakening around cryptocurrencies will continue." "This will clearly drive the market up." "In the medium term, the executive order and the responses from 401(k) plan providers will bring hundreds of billions (even trillions) of dollars into crypto assets."

In contrast to the cheers from the crypto community, traditional finance has also raised rational voices, reminding that this move comes with certain risks and challenges.

First, investment fees may erode returns. Private equity funds typically charge investors a 2% management fee annually, plus 20% of the fund's profits. Morningstar analyst Jason Kephart stated that this executive order presents "huge opportunities" for asset management companies but also raises concerns for individual investors. "Due to increased fees, added complexity, and reduced transparency, the situation becomes less clear."

Second, corresponding litigation cases may increase. Stifel's chief Washington policy strategist Brian Gardner expects the Department of Labor to review its guidance on plan fiduciary responsibilities, as losses incurred by 401(k) plan participants in private investments could lead to lawsuits against managers.

Additionally, a lack of liquidity is a significant drawback. 401(k) plans allow investments in private equity, but such assets often lack liquidity, and investors' funds may be locked up for months or even years. This could mean that holders of private equity funds in 401(k) plans may find it difficult to quickly sell shares, whether to raise cash or purchase other investment products.

Lastly, it is worth mentioning that although the executive order has been signed, providers like Fidelity and Vanguard need to develop suitable products, and the popularization of these products may take several years.

Related reading: Will $12.5 Trillion in Retirement Funds Enter the Market? Trump Supports Cryptocurrency in 401(k) Plans?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。