Institutional entry, speculation retreat, value rise.

Author: Kyle

Translation: Deep Tide TechFlow

The term "Internet Capital Markets" has multiple meanings. In today's context, it refers to "alchemical" results that are entirely derived from the advantages of blockchain technology: a form of fintech that transcends geographical boundaries. From collateralized lending with "magical internet currency" to the tokenization of government bonds and private credit, and the application of stablecoins—these are all seen as manifestations of the "Internet Capital Markets" in today's world where traditional finance and digital assets intersect.

Original tweet link: Click here

However, for those of us who have been deeply engaged in this asset class as on-chain traders over the past few years, "Internet Capital Markets" has another layer of meaning. It not only refers to "on-chain government bonds," but also encompasses various speculative tools such as NFTs, decentralized finance (DeFi), initial coin offerings (ICOs), and the token trading derived from these tools. This all began with the deployment of the first smart contract on Ethereum in 2015, which propelled the birth and development of countless innovations over the past decade.

In this article, I hope to delve into this aspect of Internet Capital Markets—focusing on tokens, narratives, 10x or even 100x returns, airdrops, etc., which constitute the initial core concepts of Internet Capital Markets.

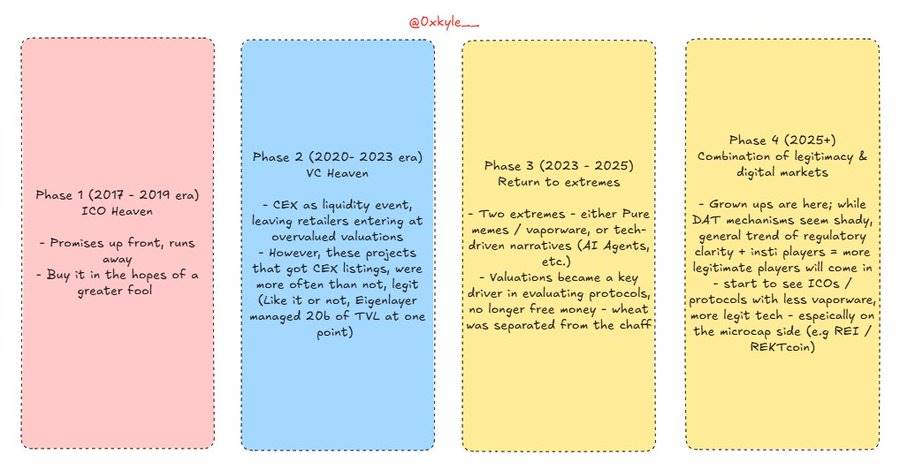

I believe we are on the verge of a new phase that seasoned crypto players might call "a new meta." To explore this further, we must first observe these capital formation mechanisms and the differences that come with them:

If the content looks too small, you can click the image for details!

Over the past few cycles, we have witnessed continuous changes in market financing mechanisms. From initial coin offerings (ICOs) to centralized exchange altcoins (CEX Alts), and then to meme-based tokens, I have broken this down in the chart above, but simply put:

1. Initial Coin Offering (ICO) Era (2017)

A mechanism for investment based on promises, where investors hope to find "greater fools" to take over. The actual implementation of technology is extremely rare; even if the technology exists, it is often difficult to apply practically or create value.

In most cases, this resembles a game of "hot potato." Projects like Bitconnect and Dentacoin are typical examples from this period.

2. Venture Capital Paradise

The bubble of 2021 brought in a large amount of institutional capital, which, in hindsight, caused significant damage to the industry. Extremely high valuations and poor incentive designs (who would continue to work hard after receiving a $100 million advance?) led to frequent issues.

However, this wave also spawned more legitimate and mature products, so we cannot completely dismiss the mainstream model of low liquidity and high fully diluted valuation (FDV). Although these tokens are extremely overvalued, they have also driven the birth and development of some important protocols that are now widely recognized.

Take Ethena as an example—I really like it, but it is undeniable that the simple mechanism of "giving too much too early" weakened its ability to "increase token prices" in the early stages. However, there is no doubt that it is one of the best products in the crypto space. This phenomenon is similar to many other "double-edged sword" projects.

This period also saw the emergence of many projects like Solana and Uniswap. Although there are some controversies surrounding the operational methods of these projects today, the fact is that this era was not entirely negative and cannot be generalized.

Is there a way to avoid these problems? Perhaps. But ultimately, these are the growing pains of the industry—despite the fact that four years have passed, we are still bearing the effects of these aftershocks.

3. Both Sides—Returning to Extremes

After the collapse of FTX, the crypto space fell into an existential crisis, and this sentiment is evident. Many began to agree with the view that "crypto is a scam," believing that most projects are merely tools for quick wealth. I once shared this view, but it is important to understand the nuances.

While the crypto space has a "casino" nature, it does not mean it is entirely a casino. Stablecoins and asset tokenization are proving to have significant real-world applications beyond launching a plethora of memecoins and serving as dollar trading pairs for long-tail assets.

In this era, the nature of projects entering the market is clearly differentiated. On one hand, there are purely meme projects (like Dogwifhat and Pepe), and on the other hand, there are more legitimate narratives, such as AI agents. Although valuations have significantly declined, you might ask yourself, "Is all of this just a meme?" But just because they are seen as memes does not mean they will always be memes.

This field is undergoing a slow maturation process. Some projects have already crossed the threshold from meme to legitimacy—such as REI.

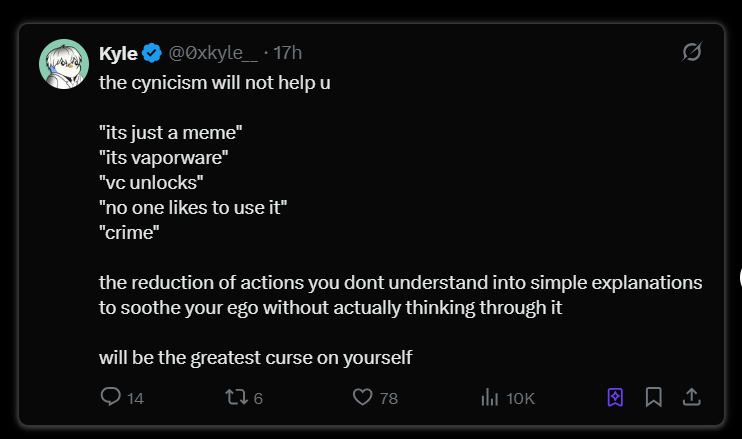

Finally, the mindset of "everything is a meme" could be extremely destructive in the coming years because:

4. The Combination of Legitimacy and Digital Markets

We are entering an "era of maturity." Institutional capital has entered and is showing great interest. However, perhaps because we are too close to the "factory" and understand "how the sausage is made," this has led to many perplexing outcomes. For example, people in the crypto space hold a pessimistic view of Circle's IPO because they are too aware of the potential risks and negative bear market theories.

Knowing too much can be a curse. For this reason, the cynical mindset of "everything is a meme" will ultimately cause great destruction, as hastily dismissing everything will lead you to lose faith.

Take Ethereum as another example. It was the worst-performing asset for two consecutive years, and many large holders chose to cut their losses and exit. It was labeled with various negative tags, even leading us to genuinely believe that decentralization had failed and that Ethereum would never see a bright future again.

Now, look at Ethereum today. Do you think Tom Lee would know (or care) about the awkward video of the Ethereum Foundation leadership singing and dancing on stage? Do you think institutions like BlackRock—who have launched tokenized funds on Ethereum—would care about the so-called "weak mentality" of the Ethereum Foundation?

The answer is no. This is what we must internalize. Today, the crypto space seems to have forgotten how to dream, while traditional finance (Trad-Fi) is relearning how to chase dreams. As digital assets gradually become mainstream, attracting more high-quality developers, this will inevitably bring more opportunities.

This is what I mean by "Internet Capital Markets." We are entering an unprecedented era of potential in the past five years—where regulation, technological strength, and capital perfectly converge. A part of this will inevitably move on-chain. It is not an exaggeration to say that I believe some of the most valuable companies in the coming years will choose to issue tokens on-chain.

In fact, this has already become a reality. Hyperliquid is the pinnacle representative of Internet Capital Markets. They have not accepted any venture capital (VC) funding, and to my knowledge, they have no equity structure—completely an on-chain token, and initially did not list on any exchange.

Let me emphasize again, this is the true meaning of Internet Capital Markets.

Hyperliquid is a company with a market value of $40 billion, with no business plan and no equity burden. It is a purely on-chain giant that has rapidly risen from scratch to dominate the market, now moving towards an annual revenue of $1 billion. This is the purest embodiment of how Internet Capital Markets operate.

But before you think this is just an article to promote Hyperliquid, let me take a step back. I believe this is not just the story of Hyperliquid. In the coming years, we will see more similar cases.

Isn't that exciting? We are about to enter an era full of opportunities—do not let your cynical mindset destroy the dreams of the past. However, what saddens me the most is that all of this is obvious to anyone who truly observes the trends, yet we are busy chasing random altcoins with 50% gains because the market over the past four years has accustomed us to this pattern. It is time to set our sights on bigger dreams—and the blueprint for success is already laid out before us.

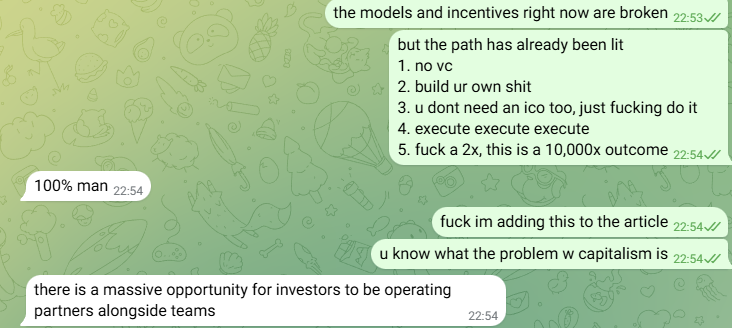

In a chance conversation, I discussed the following with @connorking_ (I am fortunate to call him my good friend):

Huge opportunities are coming: investors can work alongside teams and become operational partners.

Today, the shackles that bound us are gone. For too long, people have been limited by traditional structures, but in the era of "Internet Capital Markets," owning 5%-10% of your own token and building it into a product worth $100 million or $1 billion will yield returns far exceeding most people's expectations.

Yes, financing is still necessary; yes, conducting an ICO is not wrong. But look again at the success path of Hyperliquid—if you are confident in your product, this is the direction worth emulating. Look at the wealth of Hyperliquid's founders today; they did not rely on venture capital but simply held a large portion of their own product and listed it in the Internet Capital Markets. The market, as the ultimate judge of truth, will reward you handsomely if it recognizes your product.

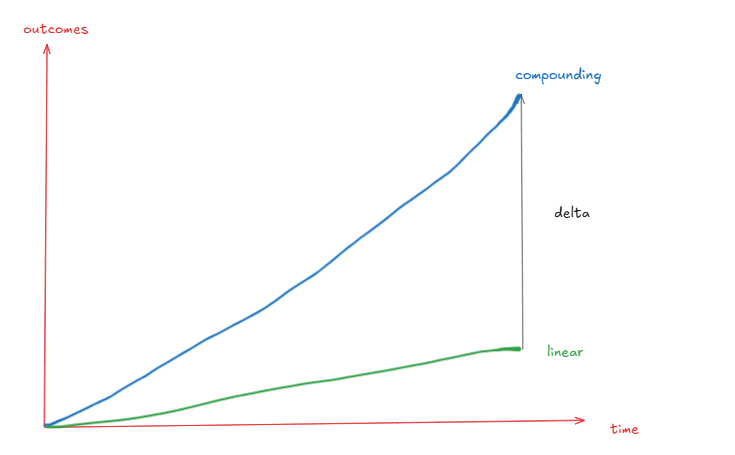

Do you know what the problem with capitalism is? It's that most participants in capitalist markets have a short-sighted view. Capitalism can indeed drive innovation in the right direction, but it cannot push it far enough. People often compromise for quick profits, while if they were willing to stick it out for a few years, they might achieve much greater returns. This is the true manifestation of the mathematical power of compounding.

Long-term thinking often leads to geometric rather than arithmetic changes in results—for example, doubling in two years (2x), growing five times in four years (5x), and growing ten times in five years (10x).

Of course, you can make $10 million by quickly launching a product and then abandoning it, but if you are willing to spend a few more years refining that product, you might earn $300 million.

Finally, I want to talk about the speculative nature of the market. There is no doubt that the market is more like a voting machine in the short term. We will still see many "worthless" assets rise in price, and we may also see "quality" assets priced far above their fundamental value. Phenomena like team sell-offs may still occur.

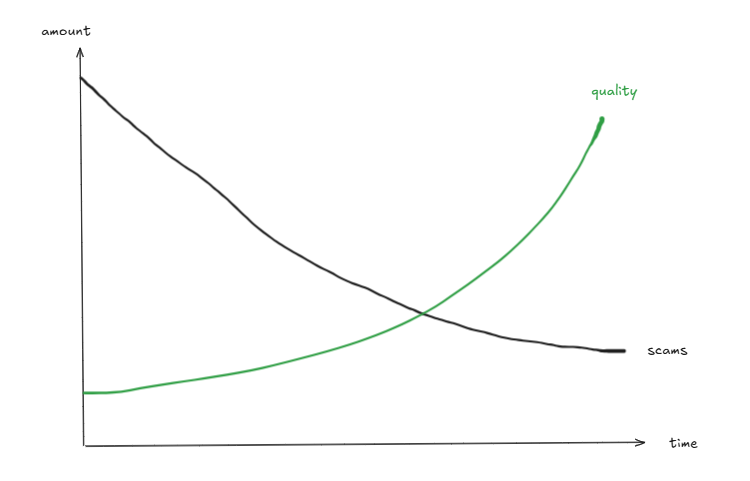

But the key is that the upcoming digital wave will attract more truly outstanding founders to the battlefield—this is the trend shift I believe will drive the creation of many great on-chain products.

More S/A level founders participating = less focus on C-level and below founders = less attention to those "air projects," more focus on quality products that can truly bring compounding growth.

Trends like the above will never go to zero, but they also don't need to go to zero. Look at Hyperliquid, look at Ethena, look at Aave—annual revenue of $1 billion, total value locked (TVL) of $10 billion, net deposits reaching $60 billion. Now look at Pengu and Rekt—total views reaching 197 trillion, 2 million toys sold globally, beverage brands entering the shelves of 7-11 in the U.S., all of which issued tokens through blockchain.

Of course, we can argue whether they are overvalued or undervalued. But I would rather discuss these issues than return to an era where one could only invest in companies that sold empty promises with no real results. I would prefer to own a piece of something real rather than pretend to be playing a game of "hot potato."

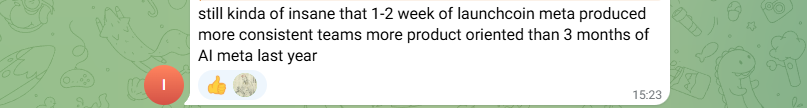

Another perspective interpretation—from @ImmutableSOL

If you always think of every token as a "meme," then this viewpoint is meaningless. Talented individuals like Jeff from Hyperliquid issuing tokens is no longer a fantasy. The next "Steve Jobs" could very well issue tokens on-chain. Some of these assets will ultimately become on-chain giants that define the future of finance, and we all have the opportunity to participate. Simply viewing them as "just a meme project" could lead to missing out on 1000x returns.

This is what I mean by the evolution of speculation. We have evolved from trading worthless air projects to being able to own shares of solid, lasting, and most importantly, on-chain assets—assets that will shape the world.

It's time to believe. Believe in the possibilities of the future, unburdened by the constraints of the past. Break free from the shackles of history and turn the bearish emotions within into ashes. The future is bright, my friends. We cannot let the shadows of the past obscure our optimism for the future.

Ladies and gentlemen, in my view, this is what the future looks like: Internet. Capital. Markets.

Editor's note on long-term results:

Japan is renowned for its exceptional quality, but this quality is not achieved overnight; it is the accumulation of decades of culture, products, and lifestyle. If they had merely "optimized for profit," they likely wouldn't have come this far. But because they have had decades of long-term planning, they are now reaping the rewards. The results of this long-term thinking cannot be fully measured in numbers—clean streets, cool vending machines, while not necessarily directly reflected in "GDP," attract a large high-consumption demographic, bringing income to the country.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。