Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

On the evening of August 11, the Uniswap Foundation released a proposal on the community governance forum, planning to establish a new legal entity for its governance organization—DUNI, under the DUNA framework in Wyoming.

According to the proposal, DUNI will provide a compliant and limited liability "legal shell" for the entire governance organization while maintaining the existing DAO governance mechanism and Uniswap protocol. This will enable it to legally hire service providers, sign contracts, and handle tax matters. To this end, the foundation plans to allocate $16.5 million worth of UNI to the new entity, of which about $10 million will be used to settle historical taxes and potential fines, while the remaining funds will serve as a budget for future legal defenses. Additionally, DUNI will hire Cowrie Law Firm as the management entity, whose co-founders were directly involved in drafting the DUNA legislation.

It is noteworthy that the Uniswap Foundation's General Counsel explicitly stated in the proposal that adopting the DUNA framework not only enhances the legal protection and enforcement capabilities of the DAO but also aims to clear institutional obstacles for the activation of the "protocol fee switch"—once implemented, the DAO can allocate a portion of LP trading fees to the treasury for community decision-making and ecological development.

What is DUNA? When was it enacted?

DUNA, short for Decentralized Unincorporated Nonprofit Association, is a new legal framework signed in March 2024 and officially effective in July of the same year in Wyoming. It aims to provide legal entity status and limited liability protection for DAOs and is considered one of the most "friendly" paths for DAO compliance in the United States.

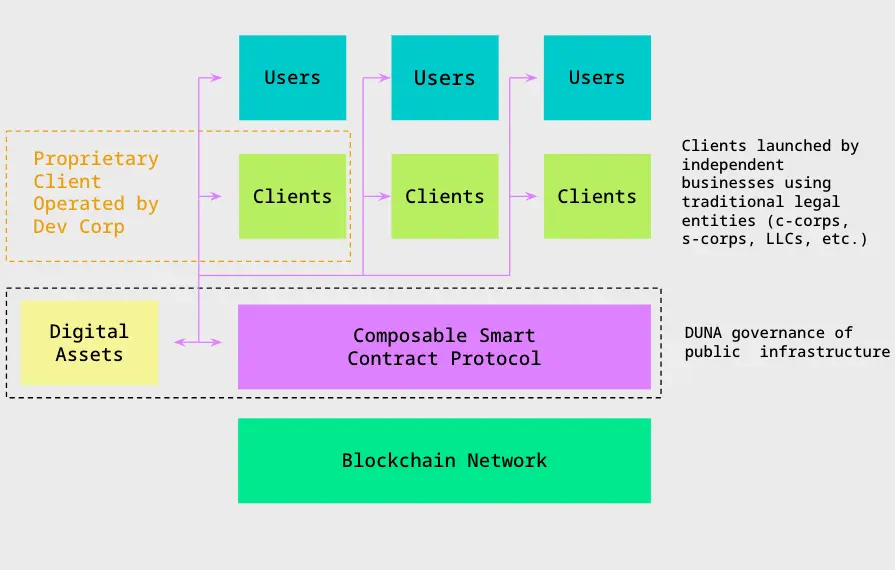

In terms of institutional design, unlike traditional companies or foundations, DUNA is defined as a nonprofit organization that can engage in profit-making activities but must use the income for public nonprofit purposes and cannot distribute dividends to members (reasonable compensation and expense reimbursements are exceptions). Specifically, DUNA allows DAOs to sign contracts, hold assets, open bank accounts, participate in litigation and arbitration, and provide personal limited liability protection for members. This means that participants in the DAO do not have to worry about personal assets being pursued due to collective decisions while the governance mechanism of DUNA can operate directly on the blockchain, executed through smart contracts and consensus algorithms.

In my view, DUNA addresses a key pain point that DAOs have faced for a long time—gaining legal recognition and protection in the real world while maintaining decentralization. However, this "legal shell" is not without controversy. The U.S. SEC and CFTC have consistently emphasized that DAOs cannot evade securities or commodities law obligations simply due to formal decentralization. If DUNA's role becomes too heavy and overly centralized in network operations, it may be viewed as a "centralized management entity" by regulators, triggering stricter compliance requirements.

DAO Governance Path Comparison

The Uniswap Foundation's choice to strengthen decentralized governance with the DUNA framework is just one of the three main paths currently available in the DAO ecosystem. The other two cases—LayerZero and Yuga Labs—represent different degrees of "centralization" trends.

On August 10, the LayerZero Foundation released a draft on the governance forum of its incubated cross-chain bridge Stargate, proposing to acquire Stargate for approximately $110 million and dissolve Stargate DAO. In the proposal, the existing STG tokens will be exchanged for LayerZero's native token ZRO at a ratio of 1 STG : 0.08634 ZRO, with governance and assets all reverting to the foundation. Co-founder and CEO Bryan Pellegrino stated that this is to "bring the cross-chain bridge home," unifying governance and value mediation, and reducing directional discrepancies and value dilution caused by multiple tokens and governance structures. (See: “LayerZero Proposes to Acquire Stargate: Both Tokens Surge Over 20%, but This Group Strongly Opposes”)

In June of this year, Yuga Labs, the company behind Bored Apes, took an even more drastic step. CEO Greg Solano proposed to directly dissolve ApeCoin DAO and have a new entity, ApeCo, take over all governance and resources, completely ending the original DAO system. Solano believes that ApeCoin DAO has become a "slow, inefficient governance theater filled with noise," and the new entity will focus on three core projects: ApeChain, Bored Ape Yacht Club, and Otherside, empowering "real builders" through milestone funding and stronger accountability mechanisms.

These two cases point to the same trend—some leading projects are actively reclaiming governance rights to improve execution efficiency. However, the three also form a stark contrast: Uniswap is taking the path of "retaining decentralization + enhancing compliance capabilities"; LayerZero achieves "centralized integration" through acquisition; and Yuga Labs chooses to "start over and completely restructure."

This reflects the trade-offs that DAOs face between efficiency, compliance, and decentralization—in the context of tightening regulation and increasing market competition, this trend of differentiation may deepen further.

The Significance of Implementing Protocol Fees

For Uniswap, choosing to advance the DUNA framework at this time is largely to prepare for the "protocol fee switch." The protocol fee has been a topic of debate in the Uniswap community for years, centered on extracting a small portion of revenue from LP's trading fees and directly injecting it into the DAO treasury for funding public expenditures such as research and ecological development.

In theory, this is a way to return protocol value to the governance organization, but in practice, the implementation of protocol fees has long been hindered by two obstacles: first, compliance—how the DAO can legally receive and manage these funds; second, tax and legal risks—without a legal entity, the flow of funds may trigger regulatory accountability and even expose individuals participating in governance to joint liability.

The introduction of DUNA provides a systematic solution to these issues. As a legally registered nonprofit entity, DUNI can open bank accounts, sign custodial agreements, hire accounting and legal advisors under compliance, ensuring that protocol fee income is transparent, auditable, and compliant with regulatory requirements. At the same time, limited liability protection allows DAO participants to be shielded from personal asset risks in collective decision-making, which directly helps lower the threshold for governance participation, increase voting rates, and enhance community engagement.

According to OKX market data, buoyed by this news, the price of UNI surged from a low of $10.91 to $11.99, with a short-term increase of nearly 10%, significantly improving market sentiment.

Future Outlook

In the short term, two points need attention: first, the governance voting results of the DUNA proposal, which will directly determine whether Uniswap has the institutional conditions to activate the protocol fee; second, the progress of protocol fee-related proposals—once the legal framework is established, the community may soon welcome a new round of discussions and votes. The outcome remains uncertain.

In the longer term, if DUNA achieves positive results in legal protection, tax compliance, and operational efficiency, this model in Wyoming is likely to be adopted by more DAOs; conversely, it may also be viewed as another governance experiment in contrast to the centralized paths of LayerZero and Yuga Labs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。