Key Information Overview

- By 2025, over 36 million ETH have been staked, locking up more than 30% of Ethereum's total supply, providing stable returns for holders.

- Staking ETH no longer requires a threshold of 32 ETH. Whether through decentralized liquid staking protocols or centralized platforms, you can start earning returns with any amount of ETH at any time.

- XT.com stands out in ETH staking, offering competitive annual yields, high individual limits, instant liquidity, and XT Crazy Wednesday and other XT Earn promotional events, achieving repeatable yield enhancements.

- Re-staking options (like EigenLayer) and hybrid solutions (like EtherFi) can yield returns far exceeding the basic staking rewards of Ethereum.

- The choice between staking, re-staking, or hybrid strategies depends on your priorities regarding yield, liquidity, control, and risk tolerance.

How much ETH income have you missed out on this year?

By 2025, those who acted early to stake have already outpaced the onlookers in terms of returns and Ethereum growth.

Every week you delay is a week of income that will never come back.

Currently, over 36 million Ether are locked up, continuously generating profits for early movers.

Latecomers can only watch opportunities slip away.

Are you still letting your ETH sit idle in your wallet?

This means that over 30% of ETH on the Ethereum network is actively generating returns for its owners, while yours remains stagnant.

From 3% conservative returns to 16%+ high returns, the difference lies in whether you have mastered the right strategies.

EigenLayer's re-staking, EtherFi's hybrid strategies, combined with promotions like XT Earn Crazy Wednesday, present unprecedented opportunities to amplify returns.

The question is no longer "Should I stake?" but rather "How can I stake immediately to earn more ETH, compound faster, and withdraw at any time?"

Keep reading, because the big winners of 2025 will be those who have already taken action.

Table of Contents

2025 Ethereum Staking: How to Maximize ETH Returns

Best DeFi ETH Liquid Staking Platforms

Comparison of CeFi Ethereum Staking Platforms

Advanced Ethereum Yield Strategies: Re-staking, Hybrid Plays, and Synthetic Staking

Quick Guide to Ethereum Staking: Helping You Choose the Right Strategy

Ethereum Staking 2025: How to Maximize Your ETH Returns

Staking Ethereum (ETH) means putting your ETH to work while also contributing to network security.

When you lock up Ether, you are supporting validators in confirming transactions and packaging new blocks, and you can earn rewards for doing so.

Of course, if validators act maliciously or fail to perform their duties, their staked assets may be partially slashed.

Image Credit:Ethereum Foundation’s Official Staking Launchpad

Three Main Ways to Stake ETH

1. Solo Staking

- Run your own validator node, requiring 32 ETH, manage your own hardware and software, and enjoy all rewards.

- Fully autonomous but requires technical skills and stable online time.

2. Pooled Staking

- Multiple stakers combine to form a validator node, breaking the 32 ETH threshold.

- Rewards are distributed proportionally to participants.

3. Liquid Staking

- Stake through a protocol or platform to receive liquid staking tokens (LST), such as stETH or rETH.

- These tokens represent your staked ETH and rewards, allowing you to trade or participate in DeFi while still earning staking rewards.

Understanding Ethereum Staking Yields and Liquidity

- Yield Fluctuations: APY changes with network conditions; higher staking volumes can lead to lower yields, while lower volumes can increase yields.

- Current Levels: As of mid-2025, most platforms offer annual yields of 3–4% (before fees).

- Re-staking Opportunities: Using staked ETH or LST for additional services to earn more yield, but this increases complexity and risk.

Liquidity is equally important

- Solo staking requires going through Ethereum's withdrawal process, which may take days or even weeks depending on the exit queue.

- Liquid staking tokens can be sold or exchanged instantly, but during significant market fluctuations, their prices may be slightly lower than ETH itself.

Best DeFi ETH Liquid Staking Platforms

The emergence of liquid staking has completely "democratized" Ethereum staking.

Now, you no longer need 32 ETH or to set up your own validator node to participate in staking.

You can stake any amount of ETH at any time and receive liquid staking tokens (LST) like stETH or rETH, earning rewards while also using them for DeFi investments.

Below, we categorize the platforms by their main advantages to help you quickly find the one that suits you best.

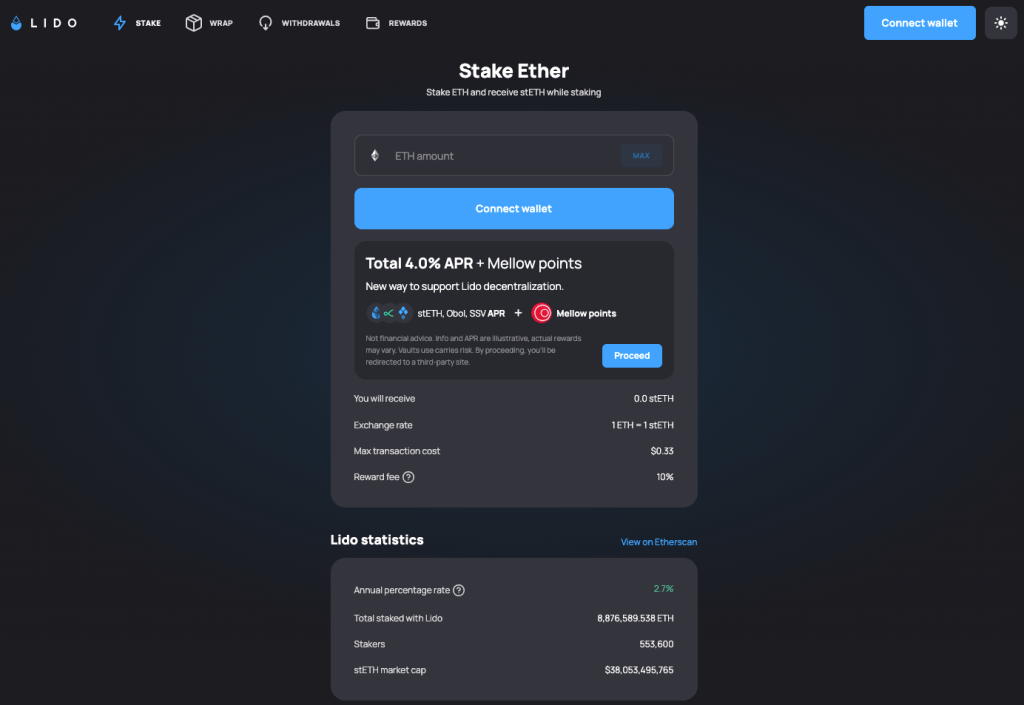

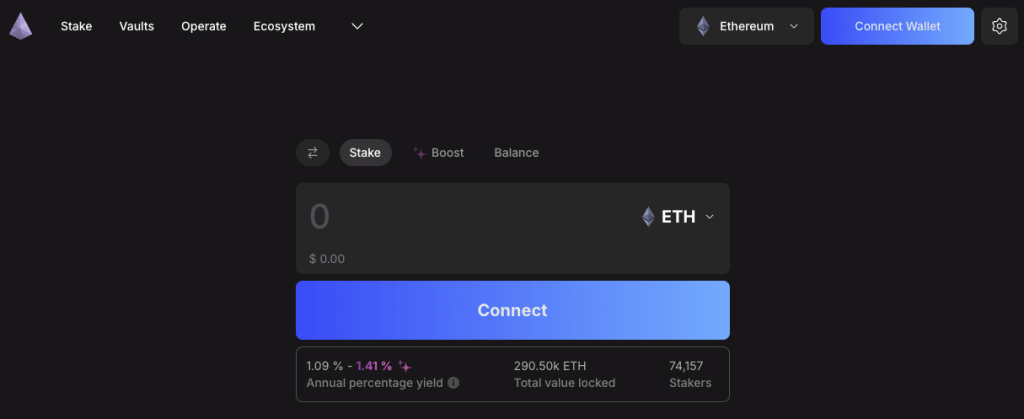

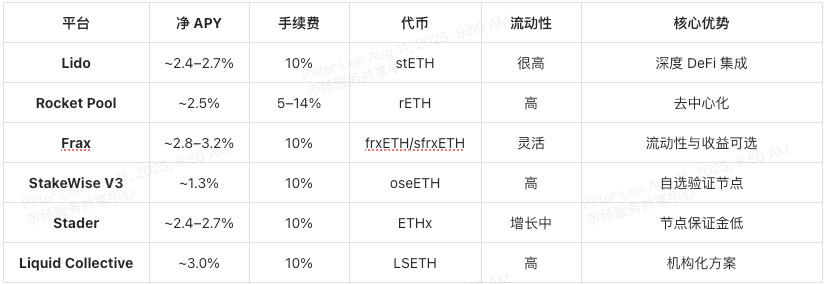

Best Liquidity Options: Lido & Frax

- APY: Approximately 2.43% (after a 10% fee)

- Liquidity: stETH is integrated with over 100 DeFi protocols

- Advantages: Deepest liquidity, stable security record

- Disadvantages: High market share raises concerns about decentralization

- Suitable for: Heavy users who need to exchange at any time and deeply participate in DeFi

Image Credit:Lido.Fi Staking Interface

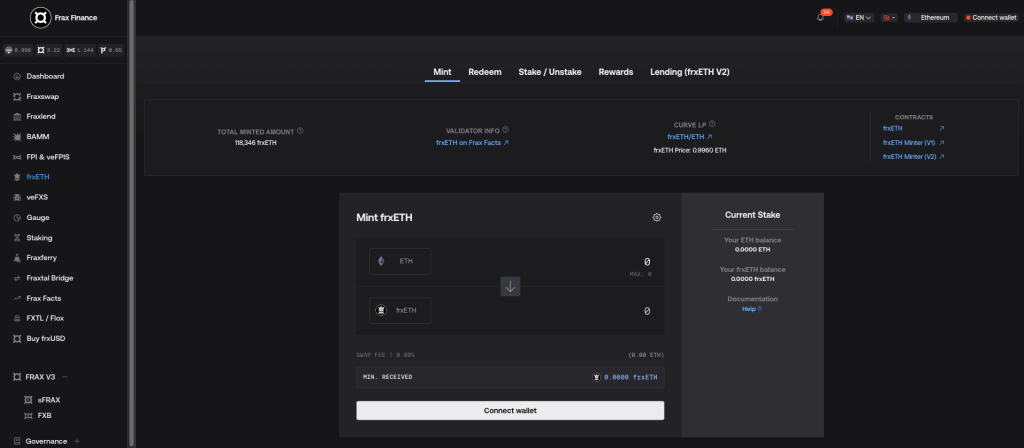

- APY: sfrxETH approximately 2.84% (after a 10% fee)

- Liquidity: frxETH can be traded at any time, sfrxETH is locked but offers higher yields

- Advantages: Flexible dual-token mechanism allows free switching between liquidity and yield

- Disadvantages: Validator nodes require whitelisting, limited decentralization

- Suitable for: Yield optimization players who want to control their liquidity and yield ratio

Image Credit:Frax.Finance frxETH Minting Interface

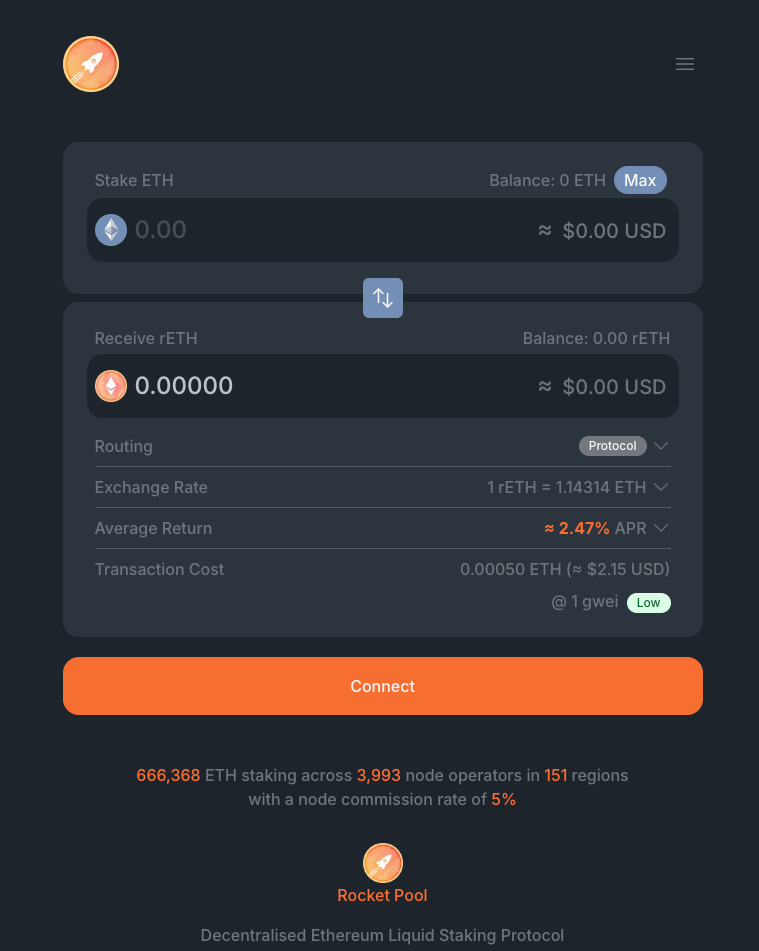

Best Decentralized Options: Rocket Pool & StakeWise

- APY: Approximately 2.5% (after node commission)

- Liquidity: rETH is accepted by many DeFi platforms

- Advantages: Highly decentralized, node operation does not require permission

- Disadvantages: APY is slightly lower than Lido

- Suitable for: Users who prioritize decentralization over maximum yield

Image Credit:Rocket Pool Staking Interface

StakeWiseV 3 (oseETH)

- APY: Approximately 1.3% (after a 10% fee)

- Liquidity: oseETH can be freely traded in DeFi

- Advantages: Open node market, accessible to institutions

- Disadvantages: Total locked value (TVL) is relatively small

- Suitable for: Users who want to choose their own validator nodes

Image Credit:StakeWise Staking Interface

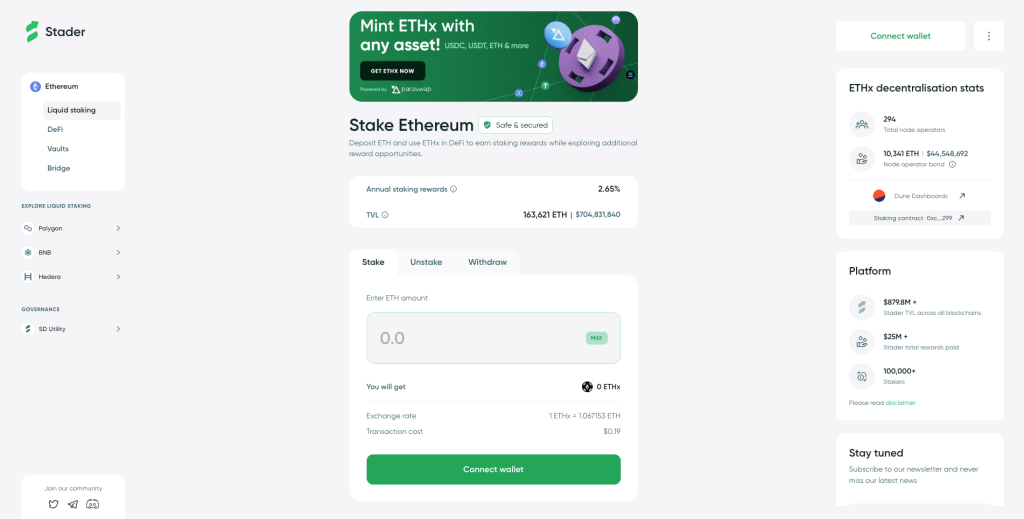

Emerging and Institutional Liquid Staking Options

- APY: Approximately 2.4% (after a 10% fee)

- Liquidity: Adoption of ETHx in DeFi is increasing

- Advantages: Low margin requirements for node operation

- Disadvantages: Entered the ETH staking space relatively late

- Suitable for: Users looking to bet on multi-chain ecosystem growth brands

Image Credit:Stader Labs Staking Interface

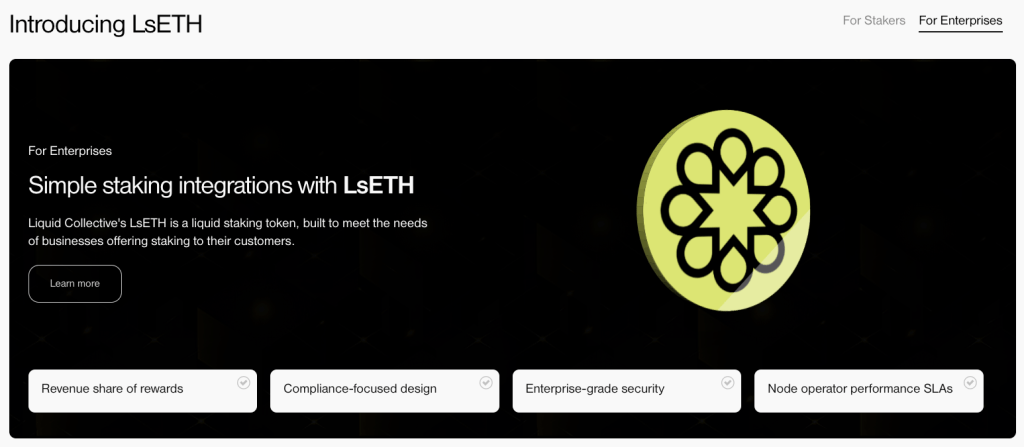

- APY: Approximately 3% (after a 10% fee)

- Liquidity: Requires KYC to use

- Advantages: Enterprise-grade solution supported by major exchanges

- Disadvantages: Lower accessibility for ordinary users

- Suitable for: Institutional investors and regulated entities

ExploreLiquid Collective’s Enterprise ETH Staking Solutions

ETH Liquid Staking Comparison Table (DeFi)

CeFi Ethereum Staking Platform Comparison

Centralized exchanges make Ether staking almost "zero-threshold."

You don't need to set up your own validator node or worry about hardware maintenance; just choose a staking product, deposit ETH, and leave the rest to the platform.

The differences between platforms mainly lie in yield rates, flexibility, and how frequently you can participate in high APY activities.

XT.com has taken this to a new level.

It doesn't just offer you a fixed or flexible option; it has created a complete "yield toolbox" with XT Earn**, allowing you to freely combine flexible, fixed, weekly activities, and even AI smart strategies to customize your ETH yield plan.

The latest highlight is XT Trend Smart Yield — a principal-protected structured yield product that combines ETH price directional strategies with a yield floor mechanism. Users choose a target price and duration; if the price is met, they can enjoy significantly enhanced yields, with some recent products offering annualized returns exceeding 16%; even if the target is not met, a minimum guaranteed yield is still available, achieving a balance of risk and reward.

XT.com ETH Staking Yield Tiers

1. Short-term Quick Returns

- XT Crazy Wednesday: 3 days of ETH staking, 10% annual yield, individual limit of 5 ETH, 100% principal protection. Ideal for making idle ETH work during trading gaps.

2. Medium-term Steady Growth

- XT ETH Exclusive Fixed Investment: 35 days at 4.20% annual yield, 115 days at 5.80% annual yield. Higher returns than short-term products, with a relatively controllable lock-up period.

3. Long-term Compound Strategy

- XT ETH Regular Fixed Investment: 7 days at 1.40% annual yield, up to 6.00% annual yield at 365 days. Suitable for long-term holders seeking stable returns.

4. Anytime Deposit and Withdrawal –XT ETH Flexible Investment:

- 0–0.1 ETH portion: 5.10% annual yield

- 0.1 ETH portion: 1.25% annual yield

- Compounded hourly, no lock-up required, funds can be withdrawn instantly.

5. Structured Yield + Principal Protection Mechanism

- XT Trend Smart Yield: A principal-protected structured yield product, allowing users to set ETH target prices and durations; if the price is met, they enjoy high yields, and if not, there is still a minimum guaranteed annual yield.

Why XT.com Has an Advantage in ETH Staking

High Individual Limits

- The amount you can stake far exceeds most platforms; there are no limits for flexible and XT On-chain Earnings

- Regular fixed investment: Up to 700 ETH can be staked for a maximum of 365 days, enjoying a 6% annual yield

- Exclusive fixed investment: 150 ETH can be staked for 115 days, enjoying a 5.8% annual yield

Stable, Repeatable High Yield Rhythm

- XT is the only platform with a public weekly high-yield calendar, centered around “XT Crazy Wednesday”.

- Most platforms like Binance and Coinbase only conduct one-time events, and the limits are restricted.

Structured Yield + Principal Protection Mechanism:

- –Trend Smart Yield is a principal-protected structured yield product, allowing users to set ETH target prices and durations; if the price is met, they enjoy high yields, and if not, there is still a minimum guaranteed annual yield.

Major CeFi Platforms ETH Staking Comparison

Conclusion: Staking ETH on XT.com is not just about locking up for yield. You can flexibly switch between flexible, fixed, and weekly high-yield activities, and also use structured yield products like Trend Smart Yield to set ETH target prices for higher returns, creating a repeatable personalized yield strategy.

Ethereum Advanced Yield Strategies: Restaking, Hybrid Plays, and Synthetic Staking

In August 2025, after ETH [https://www.xt.com/zh-CN/price/eth] broke $4,000, more and more staking users began to ask the same question:

“How can I raise the ETH yield from 3%–4% to double digits?”

The answer lies in advanced yield strategies — not just staking, but utilizing staked Ether multiple times to earn in various scenarios.

Why Use Advanced ETH Staking Strategies?

The idea is simple:

Instead of letting ETH "lie flat" after staking, why not—

- Restaking: Use the same ETH to provide security for more protocols and earn extra rewards

- Staking + Restaking in One Go: Reduce operational steps and improve efficiency

- Synthetic Yield: Combine staking rewards with market-based yields to amplify profit margins

Of course, complexity and risk will increase, but for experienced ETH holders, these potential returns are enticing enough.

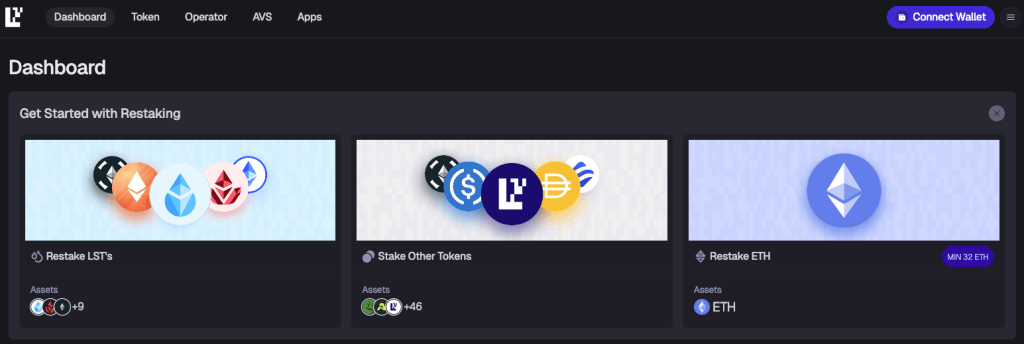

EigenLayer: Boosting Yields Through Restaking

EigenLayer allows you to restake ETH or LST (liquid staking tokens) to provide security for services like data availability layers and oracles.

- Annual Yield Potential: Base ETH staking yield (~3.2%) + module rewards (an additional 4%+)

- Liquidity: Depends on the type of LST you use

- Risk: If the supported service fails, it may trigger slashing, affecting the original stake

- Suitable for: Stakers seeking high returns and willing to accept protocol-level risks

Image Credit:Eigenlayer Restaking dApp Interface

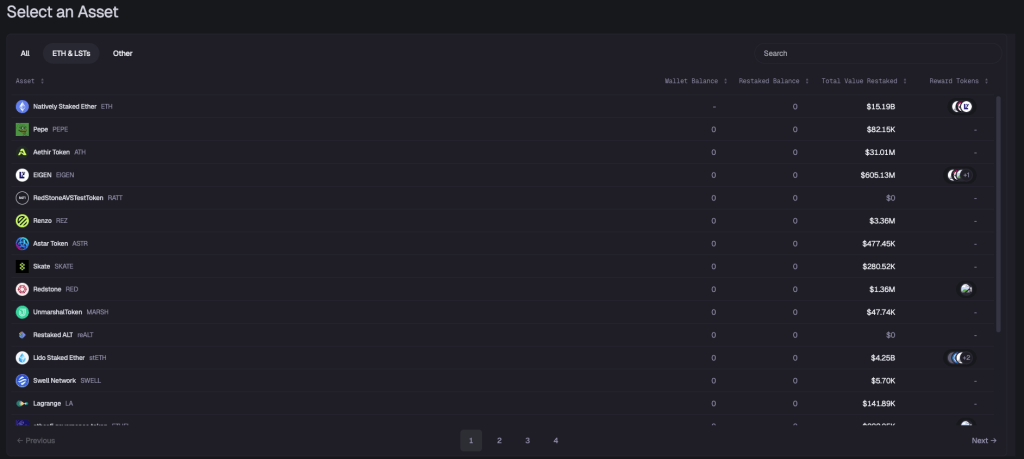

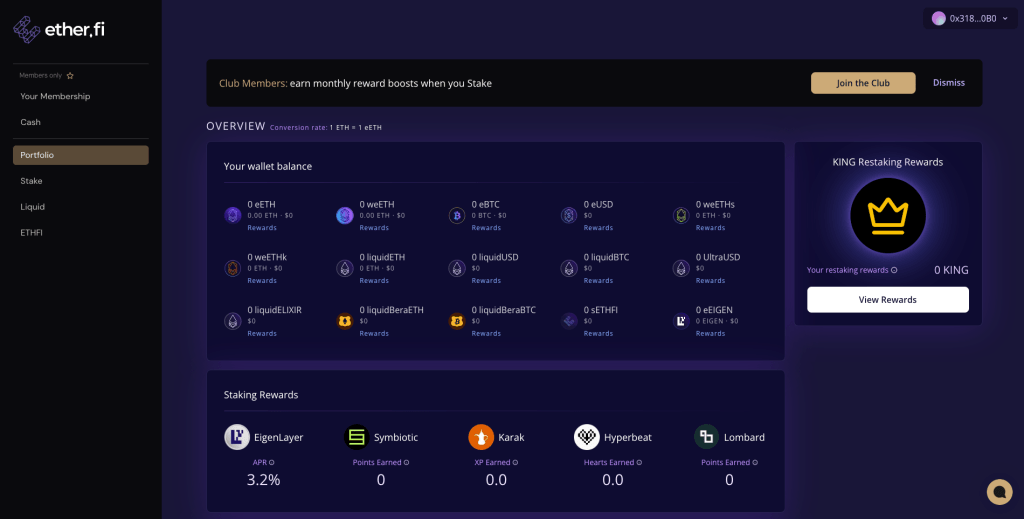

EtherFi: Staking + Restaking in One Go

EtherFi will issue eETH, which allows you to earn ETH staking rewards and directly restake on EigenLayer.

- Annual Yield Potential: Approximately 6.2% (before compounding)

- Liquidity: Integrated with 400+ DeFi and centralized platforms

- Advantages: Staking and restaking are completed in one step, requiring no extra operations

Image Credit:EtherFi Restaking dApp – Portfolio Interface

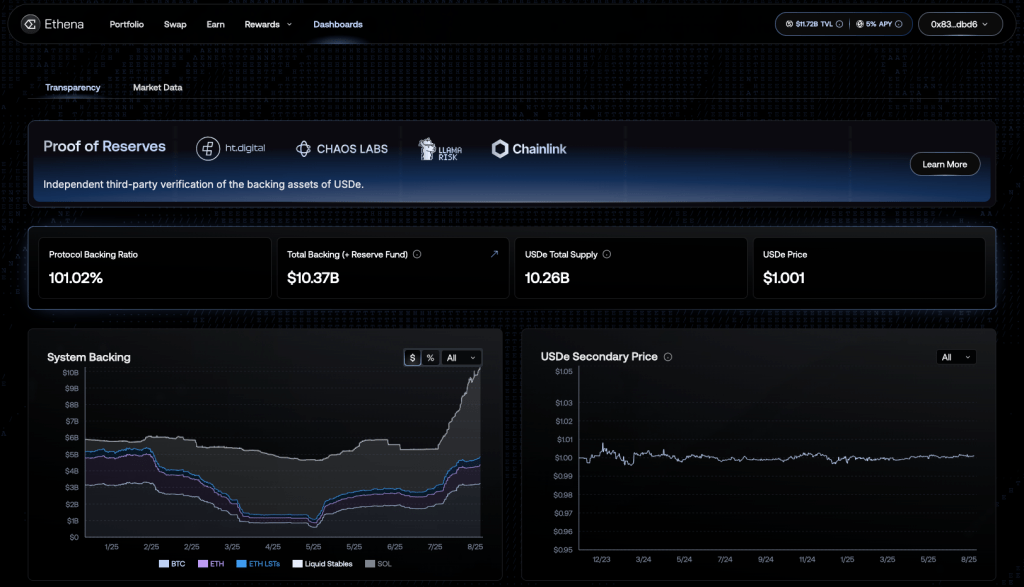

Ethena: Using Staked ETH for Synthetic Yield

Ethena (ENA) has launched USDe, a synthetic dollar asset backed by staked ETH, hedging price fluctuations through short perpetual contracts.

- Annual Yield Potential: Can reach 8%–12%+ in favorable market conditions

- Risk: Changes in funding rates, contract vulnerabilities, and derivatives market volatility

- Suitable for: Holders looking to reduce ETH price volatility while pursuing high yields

Image Credit:Ethena dApp – Transparency Dashboard

ETH Restaking and Hybrid Protocol Comparison Table

Summary: If you are a beginner in ETH staking, it is recommended to start with liquid staking protocols, familiarize yourself with the processes and risks, and then consider advanced plays. Once you adapt, you can combine EigenLayer (EIGEN), EtherFi (ETHFI), and Ethena** ( ENA)** to create a diversified ETH yield portfolio.

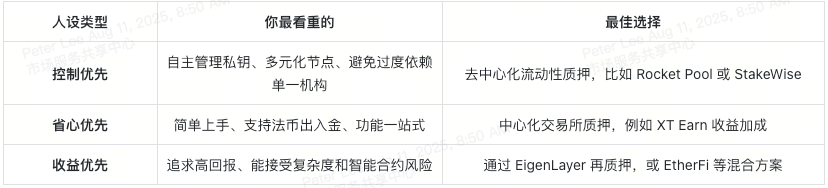

Ethereum Staking Quick Reference Guide: Helping You Choose the Right Strategy

To choose the right Ethereum (ETH) staking method for yourself, the first step is to clarify your priorities. The following table and flowchart will help you quickly find the answer.

Which ETH Staking "Persona" is Most Like You?

ETH Staking Choice Flowchart

- If you care most about control → choose decentralized liquid staking

- If you care most about convenience → choose XT.com or other CeFi staking

- If you care most about maximizing yield → try restaking or hybrid plays

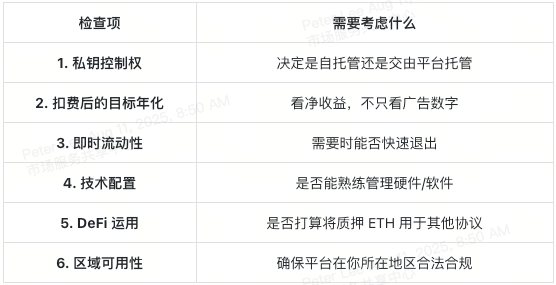

6-Point Self-Check List Before Staking

How to Maintain the True Annual Yield of ETH Staking

High advertised annual yields do not necessarily mean high net returns.

- Fees: If the staking annual yield is 3.5%, but the platform takes 35% of the rewards, your net yield is only about 2.27%. Calculating for 10 ETH held over 5 years, you would earn approximately 0.6 ETH less.

- Liquidity: Staking alone may require waiting for Ethereum withdrawals, which could take days or even weeks. LST (liquid staking tokens) can be traded instantly, but during market fluctuations, the price may drop to 0.98 ETH.

- Security: Prioritize platforms with audits, slashing protection, and node diversification. Centralized staking should also consider compliance and custody security.

Tip: The high personal limits and flexible terms of XT Earn, along with fixed high-interest activities like “XT Crazy Wednesday”, can reduce these "yield losses" and make your actual annual yield closer to the advertised figures.

Common Questions About Ethereum Staking

Q 1: Do I need to start staking with 32 ETH?

No, you do not. Through staking pools, liquid staking protocols, or centralized exchanges, you can stake any amount of ETH.

Q 2: Which unlocks ETH faster, XT Earn or DeFi platforms?

XT Earn supports instant redemption. The unlocking speed in DeFi depends on whether you sell LST (liquid staking tokens) directly on the market or wait for the protocol to redeem according to its process.

Q 3: Is the staking token always 1:1 with ETH?

Most of the time, yes, but during significant market fluctuations, LST may temporarily trade below the price of ETH until the market stabilizes.

Q 4: Is restaking worthwhile for small users?

Restaking does have the potential to enhance yields, but it also brings more complexity and risk, requiring careful consideration.

Q 5: Do fees significantly impact staking yields?

Yes, they do. High fees can reduce your Ethereum staking net annual yield by a third or more, which can greatly diminish the effects of compounding over the long term.

Q 6: Are staking rewards taxable?

In many jurisdictions, the answer is "yes." Ethereum staking rewards are typically considered taxable income at the time they are received.

Q 7: Can I still trade ETH after staking?

If the platform issues liquid staking tokens, you can sell or trade the tokens while continuing to earn staking rewards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。