Original Source: Biteye

ETH has rebounded from its April low and is currently standing at the $4500 mark.

If 2024 is the beginning of a bull market ignited by Bitcoin ETFs, then 2025 may very well be Ethereum's turn to shine.

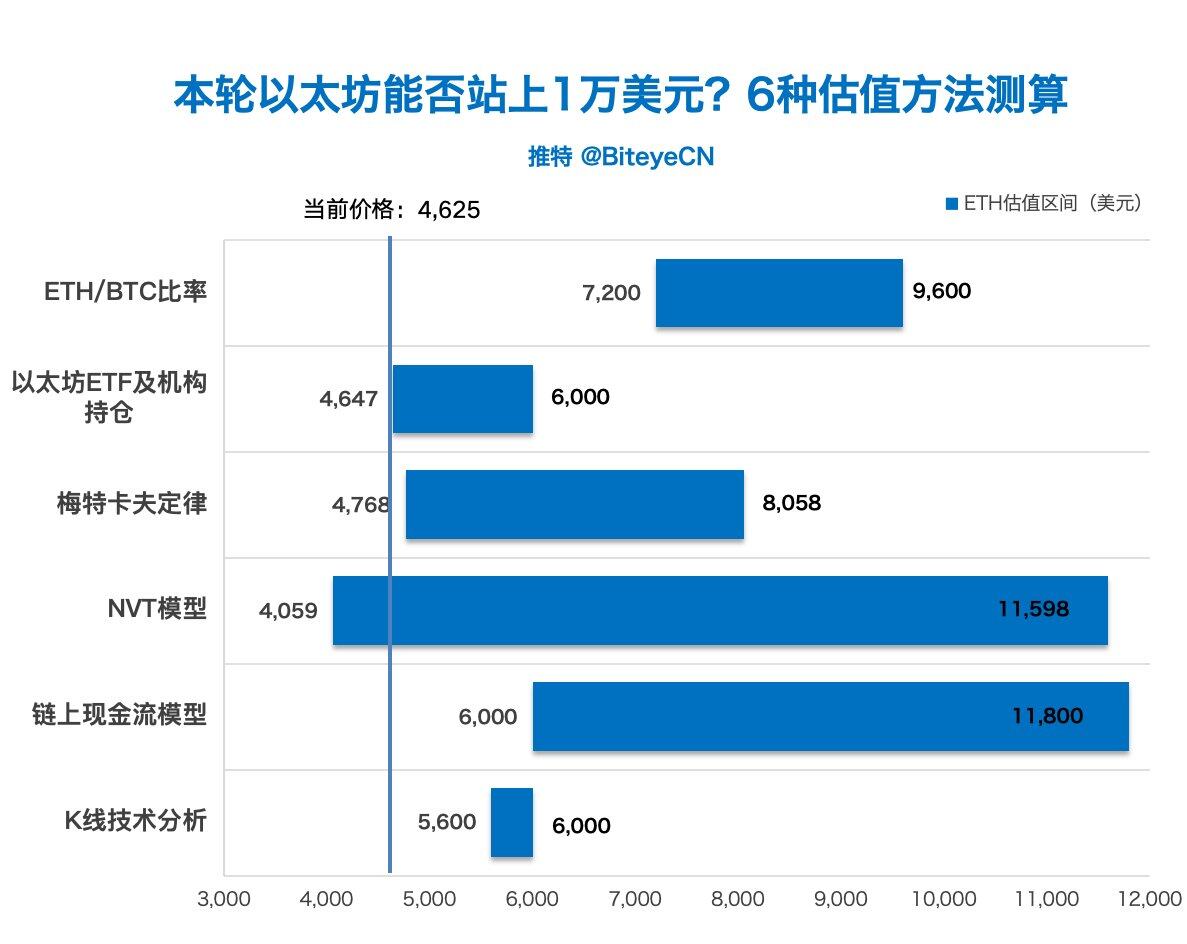

This article uses six valuation methods to analyze whether ETH can break the $10,000 barrier!

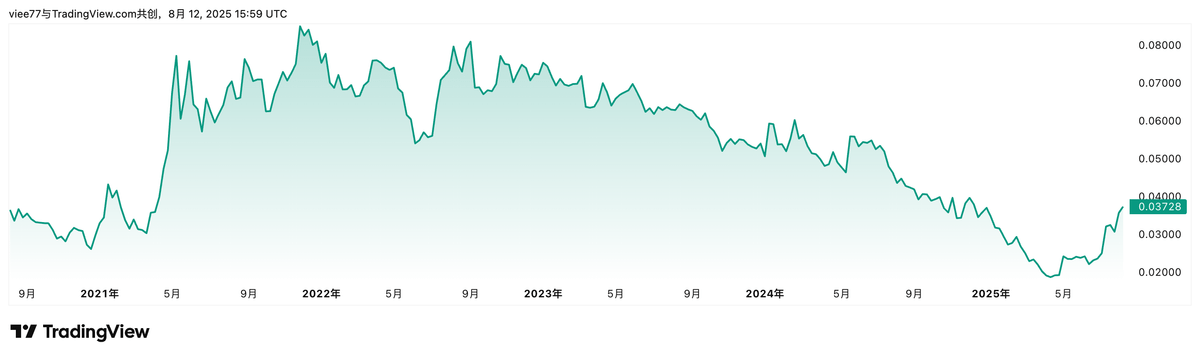

ETH/BTC Ratio

First, we compare the relative valuation of ETH and BTC.

The ETH/BTC ratio has been very stable in the long term, but the current ratio is only 0.0372, which is historically low over the past five years, indicating that ETH may be "undervalued" at present.

Based on the average ETH/BTC ratio of 0.0518 over the past five years, assuming BTC remains around $120,000, the corresponding ETH price would be $6214.

If we refer to the previous bull market's ETH/BTC ratio of 0.06-0.08, still assuming BTC stays around $120,000, the corresponding ETH price would be between $7200 and $9600.

Ethereum ETF and Institutional Holdings

With the surge in ETH prices, significant off-exchange funds have flowed into Ethereum ETFs. Many overlook the actual impact of Ethereum ETFs and institutional buying, which is not only sentimentally positive but also represents a massive buying force.

According to data from @SoSoValueCrypto, Ethereum spot ETFs have reached a new historical high, with a net inflow of $1.019 billion on August 11, Eastern Time. The current total net asset value of Ethereum spot ETFs is $25.712 billion, with a holding of approximately 6 million ETH, accounting for 4.96% of the current circulating supply of ETH, compared to BTC's ETF percentage of 6.48%, indicating room for growth. Additionally, 70 Ethereum reserve entities hold about 3.49 million ETH, accounting for 2.89% of the circulating supply. BMNR has publicly stated its goal of ultimately holding 5% of the global circulating supply of Ethereum. After deducting the staked and locked 36.17 million ETH, only about 7.51 million ETH remains in free circulation.

The following price projections are based on a simple assumption: the reduction in the free circulating supply will proportionally increase the price per unit.

That is, New Price = Current Price × (Target Free Circulating Supply / Current Free Circulating Supply)

If we consider ETFs and institutional reserves as a whole, they currently hold 7.85% of the total supply. Assuming this proportion increases to 10%, and the staking and locking ratio remains relatively stable, the free circulating supply would shrink to about 7.252 million ETH, mechanically pushing the corresponding price to about $4647; if it increases to 15%, it would rise to about $5070; if it increases to 20%, it would approach $6000.

This does not take into account the amplifying effect on the demand side, so the actual increase may be even higher. Furthermore, the incremental funds from ETFs and institutions typically take time to settle, meaning the price center of ETH will be raised long-term and steadily, rather than experiencing a short-term spike.

Metcalfe's Law

Many discussions about ETH valuation focus on price fluctuations and hot narratives, overlooking the long-term support of on-chain activity for network value. Metcalfe's Law states that the value of a network is proportional to the square of its active user count. Applied to Ethereum, this means Network Value ≈ k × (Daily Active Address Count)².

Simply put, "the more users, the more valuable the network," and a square growth in user count can lead to exponential growth in market value.

According to BitInfoCharts data, on August 13, 2025, the number of daily active addresses (DAA) on the Ethereum mainnet was approximately 971,486, with ETH priced around $4500, a total circulating supply of about 120.7 million, and a market cap of approximately $543.1 billion. Plugging this into the formula gives us the current coefficient k ≈ 0.576 (USD/address²).

With this k, we can estimate prices under different activity scenarios:

If DAA increases to 1 million, the price would be approximately $4768 (+6%).

If DAA increases to 1.1 million, the price would be approximately $5769 (+28.2%).

If we are optimistic and reach 1.3 million (close to 90% of the historical high), the price would be approximately $8058 (+79.1%).

This estimation assumes that the staking amount and circulating supply remain relatively stable, and the increase in activity will directly amplify network value, thereby raising the price of each ETH. Unlike ETF and institutional buying, the Metcalfe method reflects the endogenous growth of on-chain usage and economic activity, relying on the compounding effect of network effects rather than external capital inflows.

Note that once activity and capital resonate—on-chain transactions increase, fees rise, and burning rates recover—combined with the ETF and institutional chip contraction effect, ETH's price will be driven by both supply contraction and network expansion, potentially accelerating beyond predictions based on a single factor.

NVT Model

NVT essentially acts like a "crypto version of PE," allowing us to reverse-engineer market cap and price given a reasonable NVT multiple (based on historical ranges) and future daily transaction volumes.

NVT = Market Cap (USD) / Daily On-chain Transaction Amount (USD), which calculates to the current NVT = 518 B / 14 B = 37.

Historically, ETH's NVT has generally been in the range of 60–110, and it is currently at a historically low position. Assuming the NVT multiple remains in a reasonable range of 60/80/90/100/110 over the next 6–12 months; the on-chain transaction amount (USD) is expected to fluctuate in the future range of $7 B–$14 B/day.

6-Month Scenario

- Conservative: NVT 70, Daily Transactions $7 B → Market Cap ≈ $490 B → Price ≈ $4,059

- Benchmark: NVT 80, Daily Transactions $9 B → Market Cap ≈ $720 B → Price ≈ $5,965

- Optimistic: NVT 90, Daily Transactions $12 B → Market Cap ≈ $1080 B → Price ≈ $8,947

12-Month Scenario

- Conservative: NVT 75, Daily Transactions $8 B → Market Cap ≈ $600 T → Price ≈ $4,971

- Benchmark: NVT 90, Daily Transactions $10 B → Market Cap ≈ $900 T → Price ≈ $7,456

- Optimistic: NVT 100, Daily Transactions $14 B → Market Cap ≈ $1400 T → Price ≈ $11,598

In other words, the network effect of ETH is supporting a valuation range of $5000–$12000.

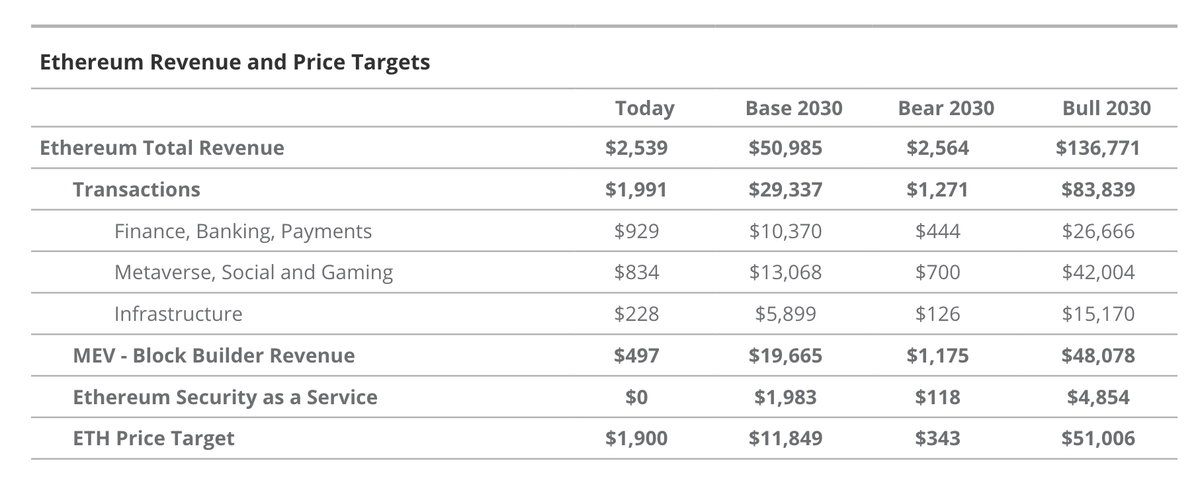

On-chain Cash Flow Model

Viewing the on-chain "revenue" generated by the Ethereum protocol (transaction fees + MEV, etc.) as cash flow helps measure network value. As the Ethereum application ecosystem expands, the growth in network "revenue" can enhance ETH valuation.

Asset management company VanEck predicts that by 2025, with the introduction of ETF benefits and Ethereum staking yields, ETH prices could approach $6000; as early as in their 2023 report, VanEck estimated ETH prices, assuming on-chain fees and usage continue to rise, projecting that by 2030, ETH could reach approximately $11800. Refer to the chart below:

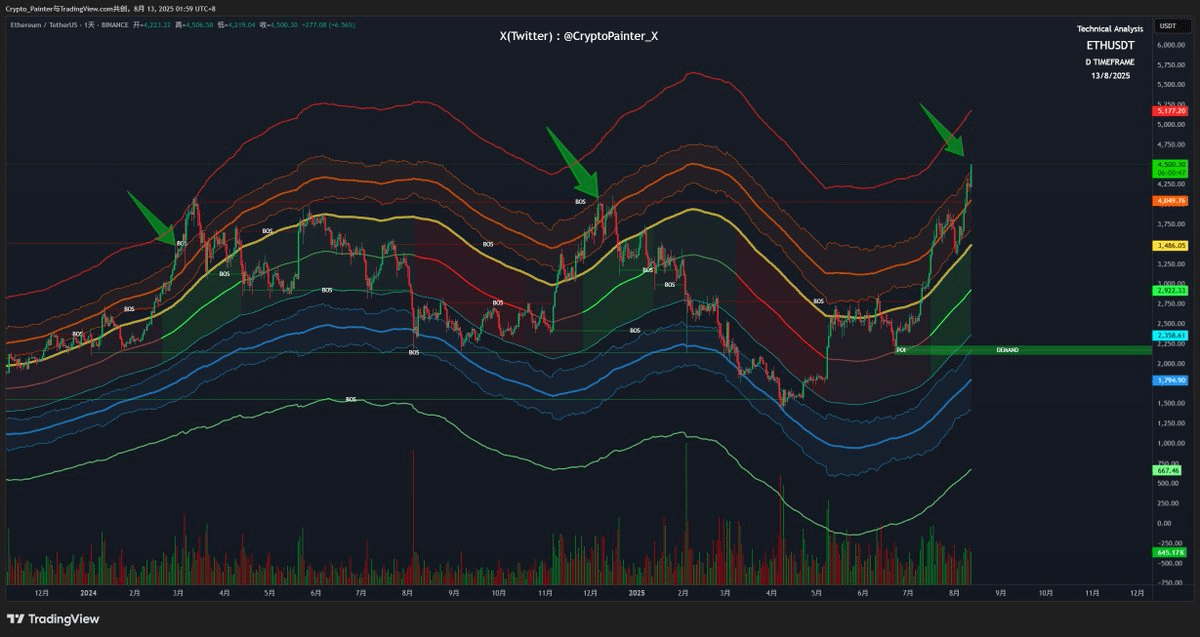

K-Line Technical Analysis

@CryptoPainter_X believes that although ETH currently faces some historical selling pressure from the supply zone of the 2021 highs, the technical structure on the 4-hour level shows that highs and lows are still slowly rising without significant damage.

From the ASR channel perspective, ETH prices are oscillating upward above the orange average resistance band, indicating a strong pattern, suggesting that market demand is gradually digesting the supply near historical highs.

The daily ASR channel shows signs of breaking through the average resistance band. The last similar breakout occurred in early 2024; if this breakout is successful, the daily target could directly reach the daily overbought line (around $5600).

Another possibility is a repeat of the late 2024 trend, where the upper limit of the orange channel encounters extreme resistance.

Overall, the current situation remains positive, and there is a possibility for ETH prices to challenge the $6000 mark in the medium term.

Crypto Analyst Scenario Projections

Some crypto analysts and media L have provided a series of scenario-based predictions for ETH prices:

Crypto analyst @VirtualBacon0x believes ETH has entered a new macro bull market. In the benchmark scenario, ETH is expected to rise to the $6000–$7000 range by the end of 2025, with a long-term target of around $10000 by mid-2026. In an extremely optimistic scenario, if the market becomes fully euphoric, BTC hits $200,000, and ETH outperforms, Virtual Bacon estimates ETH could reach as high as $16000.

Wall Street analyst Tom Lee stated in July on the Bankless podcast that in the short term, ETH should at least rebound to $4000; and before the end of 2025, it is reasonable for ETH to rise to $7000, or even reach $12000 or $15000.

Former BitMEX CEO Arthur Hayes set a target price of around $10000 for ETH by the end of 2025, which is an optimistic bull market scenario. In his July 2025 article, he emphasized that a shift in U.S. policy towards credit expansion would bring a large amount of liquidity, combined with renewed interest from Western institutions in Ethereum, which would be key catalysts for driving ETH prices up.

Crypto media Bankless proposed in their 2025 outlook that ETH could challenge $15000 in an extremely bullish scenario. They stated in their annual forecast that new driving forces such as the AI boom could trigger a new wave of crypto market frenzy, providing Ethereum with the opportunity to rise to the $10,000 level. The underlying assumptions include ample market liquidity, narrative trends (such as AI + Crypto), and the continued consolidation of Ethereum's dominance in the DeFi space.

Summary by the Editor

In summary, based on six valuation methods, there is a significant possibility that ETH will reach the $6000–$8000 range by 2025. If market sentiment remains high and on-chain activity continues to grow, breaking through $10,000 is not impossible, and in extremely optimistic scenarios, it could reach the $12000–$15000 range.

This is not just "market speculation," but a synthesis of on-chain data, capital behavior, and macro liquidity. Regardless of whether it ultimately reaches $10,000, ETH, as the infrastructure of the crypto ecosystem, has already established a foothold in multiple value pricing systems.

Risk Warning:

The content of this article is for informational reference only and does not constitute any investment advice. ETH prices are influenced by multiple factors such as market sentiment, on-chain activity, and policy changes, and are highly volatile. Please make decisions based on your own risk tolerance and bear the investment risks yourself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。